A lot has happened since we published our Disney thesis back in February. On the corporate front, Disney emerged victorious from its proxy battle with Nelson Peltz and managed to patch things up with Florida Governor Ron DeSantis. In media, Disney posted its first streaming profit—ahead of schedule—and secured the NBA’s coveted “A Package,” though it came with a hefty price tag.

Creatively, Disney’s content engine is revving again, with a much stronger film slate compared to last year’s and a record-setting run at the Emmys. But perhaps most importantly, Disney finally pulled back the curtain on its $60 billion plan to “turbocharge growth” in its Experiences division, nearly a year after announcing it. This provides a much clearer view of its growth potential.

With these developments and the stock back to where it was when we first published, it’s time to revisit our thesis. We’ll assess its strength and offer new insights on areas we covered before. Let’s start with Disney’s cash cow: Experiences, which has driven 64% of OI year-to-date.

Experiences

Disney’s Experiences division has had a solid year in 2024, though momentum is starting to cool. This isn’t surprising—record-breaking performance can’t go on forever. Last quarter, revenue growth slowed to 2%, bringing YTD growth to 6%, while the division posted its first Y/Y decline in OI since 2022, down 3%. Management has framed this as “normalization” following the peak in post-COVID travel demand and expects similar trends for the next few quarters.

International performance, however, remains a bright spot. The debut of new themed lands—including the first Frozen and Zootopia areas in Hong Kong and Shanghai—have been a hit. And come they did—attendance at Shanghai Disney surged 164% Y/Y in 2023, far outpacing Universal Beijing’s 109%. Meanwhile, Universal’s Experiences revenue fell 11% last quarter, highlighting Disney’s relative strength.

Looking at the bigger picture, let’s dive into that record $60 billion investment plan.

“Turbocharging” Growth

“It’s a 25-plus margin business and has been for an extended period,” CFO Hugh Johnston noted in Q2, “with terrifically high guest satisfaction scores, which create layers of advantage. With a business profile like this, you invest in it.”

Our thesis emphasized one of Disney’s most enduring and overlooked differentiators: its Imagineering team. For the uninitiated, Disney Imagineers are the architects of the magic, tasked with “making make-believe believable.” Imagineering’s ambitions and unwavering commitment to excellence routinely propel the team into uncharted territory, demanding new technologies or innovative adaptations of existing ones. The result is rides and attractions that consistently surpass those from a decade earlier. And that’s why we see immense potential in Disney’s Experiences division. As one Imagineer put it, “I think it’s going to be truly revolutionary in what we’re able to deliver to the parks.”

This constant evolution has been a critical driver of the Experiences division’s strong returns, particularly over the last decade. According to our analysis, Disney has achieved an inflation-adjusted ~$0.30 boost in operating earnings for every $1 of net CapEx over the last ten years. While this wasn’t the sole growth driver (more on that later), it suggests that Disney could add over $8 billion in normalized real operating earnings—or more than $11 billion nominally—if the trend holds.

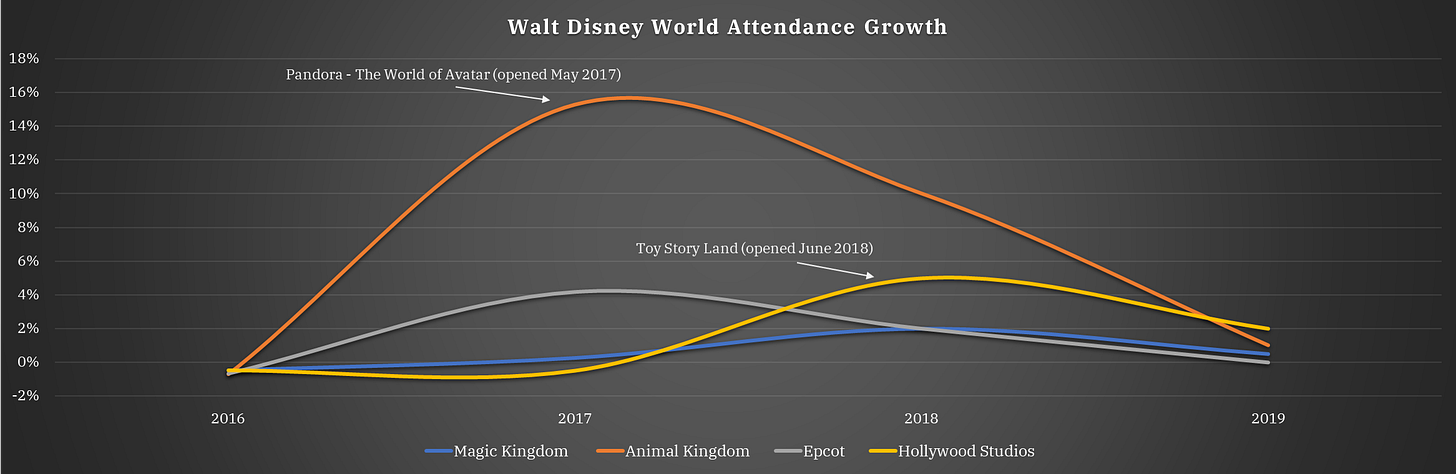

Disney’s ambitious plans include new lands and attractions worldwide, featuring beloved IPs making their theme park debuts, like Monsters, Inc. and The Lion King. Notably, a large portion of this investment remains stateside, where the U.S. generates about 60% of Experiences OI, including Disney Cruise Line. Disneyland, for example, is set for its largest expansion since California Adventure’s 2001 opening, nearly doubling Avengers Campus and introducing the much-anticipated Avatar land. At Walt Disney World, Pandora—The World of Avatar ranks #1 in guest satisfaction, and we expect Disney to replicate that success on the West Coast.

Our thesis discussed the looming threat from Universal Orlando’s Epic Universe (set to debut in 2025). Disney’s response, in our view, has exceeded expectations. But the real showstopper? The announcement of an entire land dedicated to Disney villains—a daring first for the company and an instant hit with fans.

It’s easy to envision these new lands driving attendance spikes that could even surpass those seen with Pandora – The World of Avatar:

Disney’s investment push extends beyond theme parks and onto the high seas, with plans for three additional cruise ships on top of the three expected by November 2025, bringing the fleet to 13 by 2031. This includes expanding into Asia, with one ship based in Japan and a massive 7,000-passenger vessel stationed in Singapore.

As suggested earlier, Disney’s newest lands and attractions far surpass those of a decade ago, and we expect this trend to continue—with each new land (or ship) offering fans an even richer, more immersive experience than the last.

Disney Debt

A valid concern for Disney’s Experiences division, as laid out in our thesis, is the risk of “over-earning.” With operating margins hovering near 30%—well above the 2010-2019 average of 21%—it’s a trend worth watching. Once a rite of passage for American families, Disney Parks are increasingly out of reach for the middle class.

While Disney has kept its lowest ticket prices steady at $109 for Walt Disney World and $104 for Disneyland (with kids’ tickets under $50) since 2019, the average ticket price has surged by about 56% over the past decade, far outpacing inflation’s 32% rise. Food and accommodations have followed similar patterns. Universal, for its part, has raised prices alongside Disney, with a four-night stay at Universal Orlando now costing about as much as five nights at Disney World. Management insists that guest satisfaction, intent to return, and intent to visit remain “terrific,” but there are signs Disney may have pushed the pricing lever too far.

A recent LendingTree survey of 2,000 people found that 45% of parents with children under 18 who visited a Disney park went into debt to do so, averaging nearly $2,000. Only 59% of those who incurred debt felt it was worth it, down from 71% in 2022. For many families, the added cost is simply too much.

Disney must strike a balance between maximizing short-term profit and playing the generational long game of creating as many lifetime superfans as possible. With the declining linear business and streaming yet to generate meaningful profits, it’s understandable that management feels pressure to test the limits of park pricing. However, this strategy risks inflicting real—and possibly irreversible—damage to the Disney brand. Presumably, Disney will ease up if demand continues to soften, but as a long-term shareholder (and soon-to-be visitor), I’d feel a lot better if they dialed it back a bit before that point.

Media

When we published our thesis in February, doubts loomed over Disney’s content machine. We highlighted how quality had slipped as Disney rushed to establish itself as Netflix’s main rival, putting creative teams under pressure to churn out content. The result? For the first time in 15 years, Disney missed the top three at the box office in 2023—a telling sign of the strain.

But with Bob Iger back in charge, Disney seems to have found its rhythm again. Iger’s taken a “much more surgical” approach to greenlighting projects, even shelving several that didn’t make the cut—a tough move in an industry where sunk costs and relationships can weigh heavily.

Inside Out 2 and Deadpool & Wolverine shattered records on the film side, becoming the highest-grossing animated and R-rated films ever, respectively.

Disney’s programming also excelled, with a record-breaking 183 Emmy nominations. Shōgun and The Bear raised the bar, winning 18 and 11 awards, respectively—the most ever for a series and comedy series in one year. Meanwhile, ESPN delivered a standout performance, helping Disney capture an average of 11% of all U.S. TV viewership over the past ten months—eclipsing YouTube and NBC, both at around 9.5% (with NBC getting a boost from the Olympics) and leaving Netflix trailing at 7.9%.

Linear TV Decline

Cord-cutting continues its relentless march, with the U.S. pay-TV industry shedding four million subscribers in the first half of 2024, according to MoffettNathanson’s Q2 Cord-Cutting Monitor. This brings the total subscriber base to a record low of roughly 69 million, including about 19 million virtual MVPD subscribers, such as YouTube TV and Hulu Live TV. Yet, there are hints of a slowdown: Q2 saw the first deceleration in five quarters, with a Y/Y decline of 6.9%, only slightly down from 6.8% last year.

Disney’s linear revenue and OI slid about 7%, tracking the industry’s broader contraction. Recently, Warner Bros. Discovery and Paramount Global recognized impairments of $9.1 billion and $6.2 billion on their linear TV assets. While Comcast and Disney have yet to record write-downs, it’s increasingly plausible they will follow suit as the value of traditional TV assets continues to decline.

Streaming’s Steady Ascent

In Q3, Disney hit a major milestone: profitability in streaming—a remarkable turnaround from the deep losses just two years ago:

As highlighted in our thesis, bundling is still a largely untapped opportunity for Disney. Multi-product subscribers comprise only around 30% of Disney’s domestic base as of FY2023, leaving an estimated 40-50 million Disney+ or Hulu subscribers without a bundle. For just $2 extra per month, Disney offers an ad-supported bundle, and earlier this year, they added a Hulu tile within Disney+, contributing to Hulu’s impressive 2.8 million Y/Y subscriber growth in Q3. Engagement and retention are, unsurprisingly, much stronger among bundle subscribers.

Demand for Hulu exclusives surged to an all-time high in Q2, driven by hits like Shōgun and season three of The Bear, while churn hit a record low. Both shows are returning for new seasons, and it’s worth noting that viewership for ongoing series often grows with each season. Game of Thrones, for example, drew an average of 9.3 million viewers by the end of its first season, which more than doubled to 18.6 million by season four.

Disney’s other streaming developments include a password-sharing crackdown, launched in September—a strategy that’s worked well for Netflix. Disney+ also recently introduced ABC News, with an ESPN tile set to follow in December, both free for subscribers. This will be a slimmed-down version of ESPN ahead of the full DTC rollout planned for 2025.

As noted in our thesis, Disney’s recommendation engine has room for improvement, a shortcoming that management has openly acknowledged. I’ve often stumbled upon hidden gems buried deep within Disney+’s vast library, only to wonder why they weren’t flagged based on my watch history. If you’re a subscriber, you’ve probably experienced this frustration—or maybe you’ll be pleasantly surprised to find there’s more to watch than you thought.

We expect Disney’s significant investments in improving content discovery to start paying off soon.

Disney’s Film Slate

We’re feeling much more optimistic about Disney’s upcoming film lineup than we were earlier this year. Our outlook is based on a project-by-project analysis rather than simply riding recent successes. This includes factors like cast, directors, behind-the-scenes intel, and early audience reactions for those with trailers.

The final stretch of 2024 features three promising releases from Searchlight Pictures, including a Bob Dylan biopic starring Timothée Chalamet. Like him or not, Chalamet’s portrayal captures Dylan’s essence remarkably well. Then there’s Moana 2, set for a November release, with the biggest animated trailer debut ever. The original was the top-streamed movie in 2023, and this sequel could very well snatch Inside Out 2’s newly-set box office record. Then there’s Mufasa: The Lion King, scheduled for release just before Christmas—a time slot reserved for films with broad appeal and strong staying power. The 2019 remake of The Lion King earned nearly $1.7 billion despite mixed reviews, so it would take a significant misstep for Disney to fall short of the $1 billion mark this time.

Meanwhile, Marvel seems to be finding its footing again for 2025, moving away from the multiverse madness that left many fans weary. The reset begins in February with Captain America: Brave New World. I had my doubts at first, especially after early test screenings underwhelmed. But Marvel regrouped, trimmed major scenes, and brought in Giancarlo Esposito as the new villain—a brilliant casting move, if you ask me. Early fan reactions on YouTube have been glowing, and Thunderbolts*, set for a May release, is generating similar buzz.

Successful box office runs have a way of building momentum, with each hit boosting anticipation for the next one. With these films, plus Snow White, Elio, Fantastic Four, and sequels to Zootopia and Avatar, we expect Disney to surpass $7 billion at the box office in 2025—a milestone it hasn’t reached since 2019. And with more titles yet to be announced, plus Tron and Blade as intriguing wild cards, that total could climb even higher.

These tentpole films have proven to be powerhouses when added to streaming platforms, boosting engagement with related content. If Disney keeps up momentum with scripted series and ESPN stays strong, 2025 should be a standout year for overall engagement.

ESPN’s Enduring Edge

In our analysis, we traced ESPN’s massive and enduring advantages back to its humble beginnings in Connecticut in 1978. For decades, ESPN was a cash machine; up until the 2010s, it generated more cash flow than Disney’s parks and studios combined, as former network president John Skipper once noted.

Though the digital age has eroded some of its earlier structural advantages, ESPN has adapted impressively. Today, it commands a formidable digital presence, boasting nearly 50 million followers on TikTok—more than all the major sports leagues combined. Reaching younger audiences has become increasingly tricky amid media fragmentation and shifting consumption habits. Its record performance in the crucial 18-49 demographic in Q3 is particularly impressive in this light.

ESPN paid top dollar to retain the NBA’s “A” package, but we believe it’s getting more bang for its buck than other media partners—a credit to ESPN’s formidable moat. Paired with an extensive acquisition of college football rights, ESPN has solidified its role as the essential home for sports fans. By securing these key deals, ESPN has effectively locked in market leadership for the next decade, preserving the economic and ecosystem advantages that make it such a valuable asset.

The upcoming DTC launch, dubbed “Flagship,” aims to be more than just a digital extension of ESPN’s broadcast content—it’s designed to be a dynamic, interactive experience. Right now, when viewers watch sports in an app, they tend to tune out the moment the game ends—a huge missed opportunity for Disney. We think the market is underestimating just how much Flagship’s integration into Disney’s streaming ecosystem could boost engagement.

We used an analogy in our thesis: just as Netflix had to “become HBO before HBO became Netflix” to succeed in streaming, ESPN now needs to “become YouTube before it becomes ESPN” to solidify its dominance in sports. For all the reasons mentioned, we believe it’s on track to do so.

Hulu Arbitration with Comcast

Disney and Comcast are currently in arbitration over Hulu’s valuation, with Disney aiming to acquire Comcast’s 33% stake in the streaming service. Disney has already paid $8.6 billion, reflecting one-third of the $27.5 billion minimum valuation set back in 2019. As expected, appraisers from both companies came in more than 10% apart, so a third-party appraiser will now make the final call. Depending on the outcome, Disney could owe Comcast up to $5 billion more if the valuation swings in Comcast’s favor.

Conclusion

Regardless of the labels we use—Value, Growth, or otherwise—our goal as equity investors is fundamentally the same: buying stocks that others will later decide are worth a lot more. So, what will prompt investors to rethink Disney’s current ~$95 per share price?

Sure, there are potential hurdles—like possible write-downs of linear assets or a higher-than-expected payout for Hulu—but these are merely bumps in the road. We expect the market to brush them off after an initial reaction, and we believe the current stock price already incorporates a meaningful margin of safety against such risks.

Disney’s long-term outlook for both its Media and Experiences divisions is significantly brighter than it was a year or two ago. Yet the stock still trades around its 2Y average of ~$95. The pivotal factor that would sway investor sentiment in the near term is streaming Operating Income surpassing declines in the linear business. This narrative has far more appeal than the status quo, and we expect it to play out in FY2025.

The real catalyst here is an earnings surprise. Consensus estimates peg OI at ~$16.5 billion for FY25, reflecting a ~$1 billion increase. Barring major economic disruptions, our base case has Disney exceeding this estimate by about $1 billion—especially if our $7+ billion box office forecast materializes. We anticipate a similar beat in FY26.

With this in mind, we see a potential upside to $120+ over the next 12 months, with strong support in the low $90s. As Disney’s ambitious developments in Experiences start rolling out over the next two to three years—assuming even decent performance in Media—the stock could reach $130+ per share.

If this analysis was helpful, a thumbs-up would mean a lot. Have thoughts or questions? Drop them below!

Here is the original report:

Disclosure: The author or accounts managed by the author hold shares in Disney. This can change without giving a prior notice to the reader. This article is for informational purposes only. We may be wrong in our analysis and encourage all readers to come to their own conclusions. Some quotes were lightly edited for clarity and flow.

really an amazing review

Love this review. I’m telling you visiting the parks definitely justifies being a shareholder. Seeing everything in person, whether you go to DL or WDW, really encapsulates the experience.