This report was written by Luke Emerson and edited by Value Punks. Luke is a brilliant analyst. We believe he has written THE deep-dive on Disney. If you or someone you know is looking for an analyst please reach out to Luke at Luke.Emerson.CFA@gmail.com

Not so long ago, Disney's share price was nearing the $200 mark, despite the pandemic's severe impact on its Parks and Resorts business. Fast forward to the present, and even with the parks posting record results, Disney's share price has fallen to levels not seen in a decade, raising the question: what happened?

Several factors are at play, including challenges within the studio arm, the ongoing decline of its legacy media operations, and Big Tech's incursion into sports media. However, the most significant shift has been in the investment community's perception of the streaming business. The consensus has shifted from "Streaming is a good business" to "Streaming is a good business... if you're Netflix."

Investors remain unconvinced that Disney can generate returns approaching those of Netflix. This skepticism stems from two factors: a) every major streaming service, except Netflix, is bleeding money, and b) Disney's streaming narrative has been somewhat opaque.

Bob Iger, now back at the helm, highlights improving margins and has provided a profitability timeline (Q4 FY2024), along with the initiatives Disney is implementing to achieve these goals. But there's been scant detail on those steps, and Disney is yet to outline guideposts for streaming profitability. Until Disney offers a more detailed strategy or demonstrates tangible successes, investors are likely to remain cautious about assigning a significant multiple to the business.

This report uncovers overlooked details necessary to form conviction in the stock. My analysis suggests that the inherent worth of Disney's Parks division, ESPN, and traditional media operations firmly underpins the company's current enterprise value. In this light, Disney's extensive content library, studio operations, and streaming initiatives might be seen as a "free call option," offering an attractive risk-reward proposition for investors.

This report is structured in accordance with Disney's latest segment reclassification, organizing sections by their contribution to revenue. Each section delves into the segment's history, business model, value proposition, plausible futures, and commonly misunderstood or underappreciated aspects of each segment.

Given the extensive due diligence, we had to divide the report in two parts.

Part 1 will cover:

The impact of cord-cutting, why the Charter deal matters, and what's going on with cable re-bundling.

How Disney’s streaming hand is underappreciated, the untapped potential of its bundled offerings, why bringing its platforms together is a big deal and the edge it has with advertising technology.

The challenges Disney's studios are facing (think franchise fatigue, superhero overload) and some possible fixes.

Part 2 will cover:

The unique value of Disney Parks and Resorts, and why the market is likely underappreciating the potential of the $40 billion earmarked for incremental capacity over the next decade.

Whether Disney has a "parks problem," including concerns about pricing strategies.

The future of ESPN and the viability of potential technology or league partnerships.

The impact of Big Tech's foray into sports media and the upcoming renewal of NBA broadcast agreements.

The cultural implications of the “Bob swapping”—Bob Iger's return—and an assessment of the ongoing activist investor situation.

A sum of the parts DCF analysis, catalysts, and risks and mitigants to the investment thesis.

And more.

Executive Summary of Part 1:

Disney Entertainment division’s problems are stabilizing. Management knows where they went wrong and are course correcting.

The decline in the linear segment is concerning, yet the Charter agreement and re-bundling of Disney's services (with other streamers following suit) create a synergy between streaming and linear platforms, expanding the reach of the former while slowing the decline of the latter.

Disney's streaming hand is underappreciated with the (largely) untapped potential of its bundled offerings, ongoing platform integration, and advanced advertising technology.

Disney has yet to fully tap into the potential of live sports, despite possessing an unrivaled portfolio of broadcasting rights, which could significantly boost subscriber growth, engagement, and profitability.

The income statement highlights notable inefficiencies. As Disney continues to scale and streamline its operations, the division's profitability is expected to significantly improve. The anticipated crackdown on password sharing in 2024 is also expected to bolster overall profitability.

Disney Entertainment (46% of Revenue in FY2023)

After returning from the Great War to his hometown of Kansas in October 1919, 17-year-old Walt Disney was determined to do work that he loved. Ever since he was a kid, he had a knack for art and cartooning, but more than anything, as a friend observed, he wanted to “make a name for himself.”

Besides being a natural storyteller, Walt was always looking for new technology to enhance animation. His unique ability to blend creativity with technology led to the birth of a new cinematic art form and this fusion would be the key to his eventual fame and success. Although the first two Mickey Mouse features didn’t quite catch on, it was Walt’s innovative use of synchronized sound in the third attempt, “Steamboat Willie,” that really made waves.

“The crowd at the Colony Theatre was enthralled. People had heard sound in pictures before, but never like this. The music and sound effects were part of the gags. ‘It knocked me out of my seat,’ one New York reporter wrote. A few audiences begged the projectionist to delay the start of the feature and rerun Steamboat Willie … And within months—never mind he was just a cartoon—Mickey Mouse was the newest Hollywood celebrity.”

- American Experience, PBS

Years later, Walt was eager to venture into uncharted territory once more: creating a feature-length animated film. His brother, Roy, was hesitant, worrying that it might not draw in crowds and could potentially lead the company to financial ruin. Nevertheless, Walt pushed forward.

“Walt must have told that story a thousand times. People would always say that he’d collar them in the hallway and tell the story of 'Snow White’ again. He had to repeat it again and again and again to keep them energized and to keep himself energized, and to review the film in his head so that it was always rolling. This was obsession.”

- Neal Gabler (Biographer)

Lines wrapped around theatres all over the United States for “Snow White and the Seven Dwarfs,” (1937) and the film grossed more than any other (sound) film before it. The film’s merchandising campaign was also unprecedented:

“There were Snow White jars, jelly, and scarves. There were Snow White shows going on at department stores. So, the film and the space of commerce were completely one. It was a commercial triumph for Disney, not just because of the film itself, but because of the way merchandise was tied to it.”

— Eric Smoodin, film historian

While the company's business interests and methods of distribution (and monetization) have evolved over time, storytelling remains at the heart of the company. The emotional bonds formed through these stories are deepened with merchandise, interactive games, and immersive theme park experiences. These elements enhance audience engagement with new content in a self-perpetuating cycle: Disney’s commercial flywheel.

Recent History and Current Backdrop

“I fundamentally believe that storytelling is what fuels this company, and it belongs at the center of how we organize our businesses.”

- Bob Iger

After raking in almost $1.3 billion at the box office, “Frozen” (2013), the modern analogue to Snow White, propelled the commercial flywheel into high gear. The film’s success led to staggering merchandise sales, games, theme park attractions, and a sequel, with anticipation building for a third installment in 2025.

But Frozen wasn't a one-hit-wonder. Over the last decade, Disney has churned out a slew of blockbusters across genres, including nine animated or live-action reboots and four Star Wars films, each crossing the $1 billion mark at the box office. However, Disney's most significant cinematic achievements came from an unexpected corner.

Enter Kevin Feige, who took over production at Marvel Studios in 2007, just as “Iron Man” began production. Feige had a bold idea, first hinted at a year earlier at Comic-Con: a “cinematic universe” where each movie was part of a shared narrative. This concept proved to be a goldmine with the release of “The Avengers” in 2012, which earned over $1.5 billion and became the third highest-grossing film of all time. The Avengers series alone has brought in nearly $7.8 billion. While Iron Man was a hit at the box office, no one could have imagined it would be the springboard from which the Marvel Cinematic Universe (MCU) would eventually amass about $30 billion in box office revenue in just 15 years.

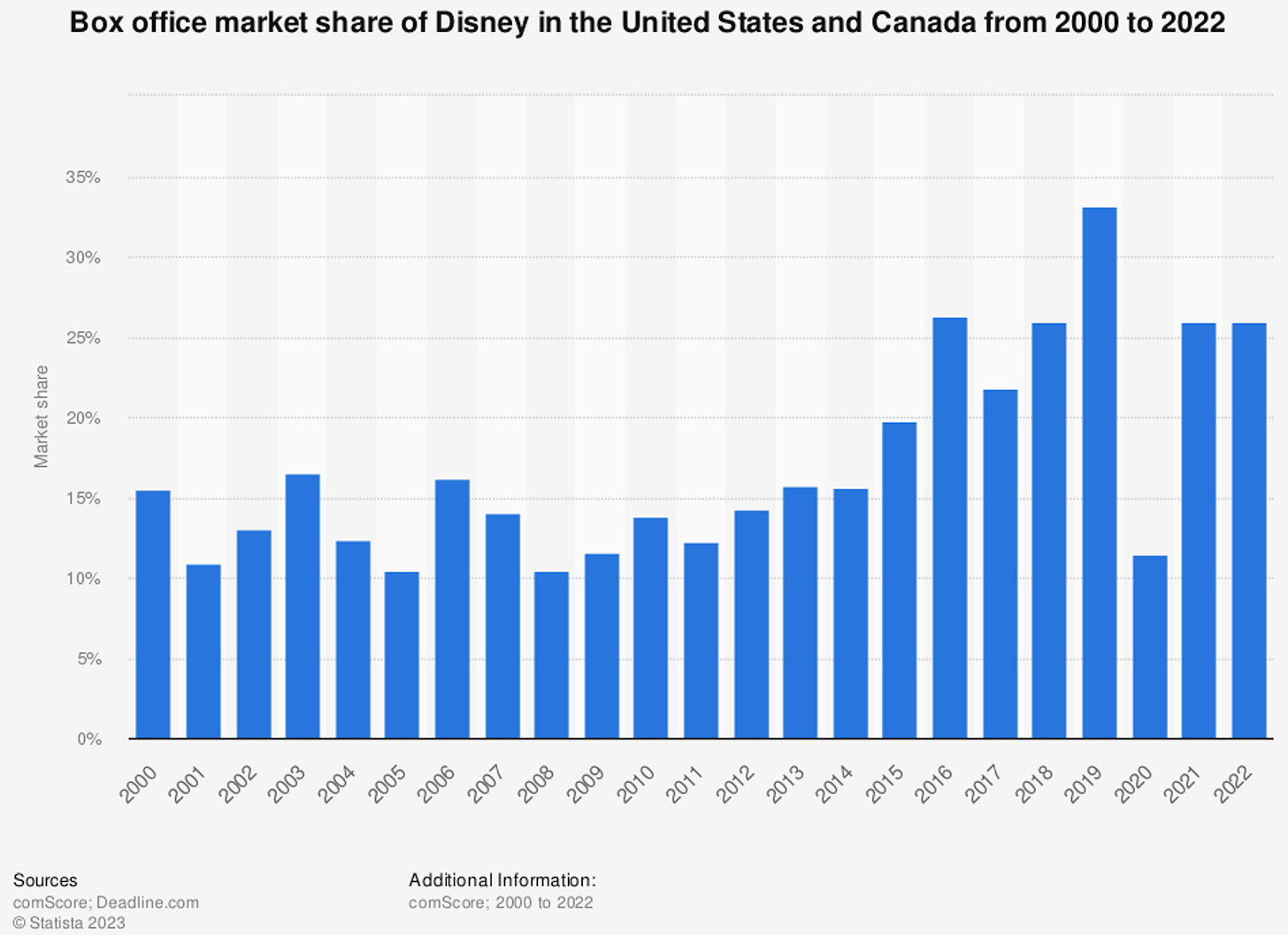

Marvel’s extraordinary studio run culminated with "Avengers: Endgame" (2019), which held the title of the highest-grossing film (unadjusted for inflation) for two years until "Avatar" (2009) snagged it back after a re-release. Disney Entertainment, bolstered by this and six more billion-dollar films, grabbed a whopping 40% of the U.S. box office market share in 2019, including Fox, doubling the average needed to lead the market in the previous decade.

However, for the first time in 15 years, in 2023, Disney didn't have a movie in the top three. The MCU, usually a surefire hit-maker, saw "The Marvels" fall flat, with an opening weekend of just $47 million—the lowest for any MCU film. Following that, Disney's "Wish" also had a tepid reception. These films add to a growing list of what the company internally dubs "creative misses," unprecedented in their frequency and magnitude. This became a focal point during Bob Iger's discussion at the New York Times DealBook Summit on November 29th, where the loss of Disney's "creative magic" was questioned.

Iger, who had already acknowledged the studio's setbacks and expressed his commitment to a creative turnaround since reassuming leadership, conveyed added resolve at the summit. Despite his own role in these issues (more on this later), most industry observers believe he is the right leader to help steer the studio arm back on track.

Linear Networks (29% of Entertainment Revenue in FY2023)

Disney's foray into television began in earnest with "The Mickey Mouse Club" in 1955, quickly gaining popularity and broadening the audience for Disney characters. Throughout the '60s and '70s, the company continued to produce both animated and live-action programs. Its linear presence expanded significantly after launching the Disney Channel, a premium cable channel, in 1983.

However, it wasn’t until Disney acquired Capital Cities/ABC (which included ESPN) in 1995 that linear became its core business. Though it was never more than half of total revenue, it had a disproportionate impact on the company’s earnings. For example, from 2010 to 2018, linear networks represented 43% of Disney's revenue but contributed 58% to its operating income, boasting an average margin of approximately 33%. Such economics highlight the golden goose that was the cable bundle and Disney's pivotal role within it.

Disney further solidified its position in the industry by acquiring Fox's general entertainment assets (closed in 2019), including the Fox, FX, and National Geographic channels. In 2023, Disney estimated that its general entertainment and family channels reached 270 million and 225 million unique subscribers globally, compared to 320 million and 220 million in 2022, respectively.

Financials

Due to the reclassifications, the recast financials for the linear segment, excluding ESPN, are as follows:

The domestic business contributes approximately 80% of the linear segment's revenue, a slight increase from 2022. Advertising revenue saw a decline, with domestic and international impressions decreasing by 12% and 6% respectively, attributed to lower average viewership and reduced advertising rates (2% and 1% decreases).

Cord-cutting

Value Punks readers are undoubtedly familiar with the significant evolution in media consumption trends. Nevertheless, some brief historical context will be provided. Beginning in the 1970s, household pay TV saw a consistent increase, reaching its pinnacle between 2009 and 2010. The appeal of the traditional TV bundle lay in its diverse channel offerings, catering to various interests and age groups. Coupled with the fact that these services were generally bound to long-term, hard-to-cancel contracts, subscriber turnover remained at a negligible rate.

Although 2009 marked the peak of pay TV penetration, the bundle continued to improve in the subsequent years, adding more programming and regional sports networks (RSNs). This era, heralded by acclaimed shows such as “Game of Thrones” and “Breaking Bad,” is often referred to as the golden era of pay TV. However, it was also during this time that the cost of the TV bundle accelerated above the trend.

Bundle inflation coincided with the proliferation of high-speed internet and smart TVs, facilitating the swift adoption of streaming services. Netflix, as the primary beneficiary of this trend, was awarded a notably higher price-to-earnings multiple by the market, a development keenly observed by traditional media companies.

Content suppliers, seeking to leverage their extensive libraries and bypass intermediaries, became distributors of their own content. Thus commenced “the great unbundling,” as dubbed by industry observer Ben Thompson at Stratechery. Yet, churn remained surprisingly low until the late 2010s and then suddenly spiked.

“We had been talking about this for a decade, saying, ‘These competitors are going to catch up with us at some point, and they are going to be all in on streaming.’ And it took way longer than we expected, but then it all happened in an 18-month period, it seems.”

-Netflix co-CEO Greg Peters

As costs climbed and the array of original streaming content expanded rapidly, the value proposition of the pay TV bundle weakened, leading to a surge in cancellations:

While higher prices initially cushioned the impact of the surge in cord-cutting, by the end of 2022, the trend accelerated past these increases. MoffettNathanson's third-quarter 2023 report shows a significant 11.7% drop in U.S. pay TV subscribers, now down to approximately 72 million. This sharp decline is a notable shift from the gentler reductions of 6.3% and 5.2% recorded in the third quarters of 2022 and 2021, respectively. We believe it has become more and more important for linear players to show profitability in their streaming businesses.

Linear Asset Mix

This trend contextualizes Bob Iger's infamous CNBC interview in July, in which he broached the subject of potentially selling legacy networks like ABC and FX, stating that they “may not be” core to Disney’s business. The company has since conducted a strategic review, revealing, as Iger stated, "significant long-term cost opportunities, which we’re implementing while continuing to deliver high-quality content." The review identified ABC, Disney Channel, and FX as key assets due (largely) to their role in producing content for the streaming platforms.

Having both streaming and linear networks enables content monetization across audience demographics, as exemplified by 'Abbott Elementary.' When this show airs on ABC at 9 pm, it primarily attracts an older audience, averaging around 60 years of age. However, once made available on Hulu the following day, it appeals to a younger demographic, with the average age being closer to 30. Additionally, the concept of “appointment viewing,” where viewers are drawn to watch broadcasts at specific times, especially for primetime shows on major networks, can enhance the perceived value of a show when it is later added to a streaming platform (though much less so than following a cinematic release).

Discussions within Disney's leadership have considered integrating some channels into the existing joint venture with Hearst, which includes A&E, History, Lifetime, and FYI. This move, contemplated before Iger's return and now revisited, indicates a strong likelihood of implementation. Furthermore, the Disney-Charter deal announced in September points to further channel consolidation. However, Iger asserts, “We are not going to abandon the linear or the traditional platforms while they can still benefit us and our shareholders.”

MoffettNathanson had previously projected the “pay TV floor” to be 50 to 60 million homes. However, the firm wrote in its Q1 2023 report, “As things stand, we expect cord-cutting to grow even worse and the long-theorized ‘floor’ to be breached.”

Despite the ongoing challenges, linear TV continues to generate significant cash flow for Disney. The Charter deal, along with the potential re-bundling it may encourage, hold the potential to bolster Disney’s earnings beyond consensus expectations and to significantly expand the company’s advertising video-on-demand (AVOD) platform. The increasing importance of this platform will be further explored later in the discussion.

The Charter Deal

“The significance of the just-announced deal between Disney and Charter is that The Great Re-bundling has begun.”

– Ben Thompson, Stratechery.

Following a deadlock that led to a week-long blackout, Disney and Charter reached a pivotal agreement, reinstating Disney's popular channels to Charter's 15 million cable subscribers. David Zaslav, CEO of Warner Bros. Discovery (WBD), said, “There was a lot of noise around the Charter deal with Disney, but to Bob’s credit [Iger], that deal was structured in a way that’s really favorable for both parties and for the ecosystem.” He further praised the deal’s innovative approach. The main points of the deal are as follows:

Charter agreeing to higher affiliate fees ($1.50+ for each remaining network).

Inclusion of the ad-supported tier of Disney+ in Spectrum TV’s video packages.

Inclusion of ESPN+ to sports tier subscribers.

Charter dropping various channels, notably Freeform, Disney XD, and FXX.

Charter marketing Disney’s streaming services to its broadband-only customers, sharing in the revenue generated.

Availability of the anticipated direct-to-consumer (DTC) ESPN networks to Charter customers upon its release.

For an in-depth analysis of the deal and its preceding events, I recommend reading “Disney, Charter End Dispute, Restoring ESPN, ABC to 15 Million Households” from the Wall Street Journal.

Iger judged that this deal is in line with Disney’s strategic shift towards streaming, and that consolidating channels is beneficial at this juncture. The deal is significant because it creates a synergy between streaming and linear platforms, broadening the reach of the former while slowing the decline of the latter. S&P Global provided a forecast for the financial impact of the deal as follows:

The re-bundling structure established by the Charter-Disney deal is poised to set a trend in the industry. Following this deal, Verizon introduced a $10 bundle for the ad-supported plans of Netflix and WBD, offering a significant 40% discount.

“Cable companies are uniquely positioned to effectively rebundle. Imagine a ‘streaming bundle’ including Netflix, HBO Max, Disney+, Paramount+, Peacock, etc., offered at a cost lower than the combined individual services … Having a larger customer base may outweigh the need for direct customer ownership, especially if it leads to reduced churn. The strength of a bundle lies in its collective appeal, not requiring individual services to constantly produce compelling content, but rather working together to retain customers within the bundle.”

-Ben Thompson

Streaming (49% of Entertainment Revenue in FY2023)

Disney’s much-anticipated streaming video on demand (SVOD) service, Disney+, launched in November 2019, two years after it was announced. For $7/month, it offered approximately 500 movies and 7,500 TV episodes, including exclusive originals like "The Mandalorian." Demand for the service exceeded management’s most optimistic projections—amassing 10 million sign-ups in the first 24 hours alone.

Its traction continued to surprise, surpassing 50 million subscribers within six months. Management’s initial target of hitting 60 to 90 million subscribers within five years quickly proved conservative. This success, even with Disney's vast content library and experience with Hulu and ESPN+, astonished industry experts.

“If you’d asked us a year ago, ‘What are the odds that they’re going to get to 60 million subscribers in the first year?’ I’d be like 0. I mean, how can that happen? It’s been super impressive execution.”

-Reed Hastings

In a move likely without precedent amongst Fortune 500 companies, Disney's new CEO, Bob Chapek, tripled the subscriber forecast only ten months into the original five-year plan:

This stirred immense enthusiasm in a market fixated on subscriber growth. Adding to the excitement, Chapek indicated it could reach this elevated target by merely doubling its content investment. Despite the pandemic battering its Parks business, Disney’s stock soared to new heights.

However, as industry losses deepened, the mood turned sharply. This was exacerbated by Netflix missing its subscriber target, precipitating the so-called “Netflix Correction,” in which its shares dropped by about 60%.

Although losses were expected, their scale was startling. Take Comcast as an example: in 2020, it predicted that its streaming service, Peacock, would not see cumulative losses exceeding $2 billion. Fast forward to 2023, and the service lost $2.8 billion in a single year—bringing the cumulative operating loss to over $7 billion. Disney’s burgeoning deficit caught the market off guard, ultimately leading to Chapek’s ousting. The company’s quarterly loss reached a peak of almost $1.5 billion in Q4 2022.

So, how did Disney manage to snatch defeat from the jaws of victory? Answering this question requires some context.

Mistakes and Lessons

The streaming wars emerged largely from a prevailing belief that the market could sustain only a few major players. (Note: this still rings true—it is difficult to imagine Paramount+, Peacock, and Max each remaining independent platforms through 2025). This fight for market leadership prompted a strategic emphasis on growing subscribers first and monetizing later. Such an approach had a logical appeal—a larger subscriber pool would mean that the content costs per subscriber would decrease, offering a significant long-term competitive edge.

To this end, operators significantly ramped up content spending and, seeing or anticipating their competitors doing the same, doubled down. This conjured a costly and unsustainable feedback loop in which the benefits of content spending were substantially diluted—requiring even more spending to achieve the same results. Whether due to unwillingness or inability, no other operator took this to Disney’s extreme—whose firehose approach to content production was captured in the book “MCU: The Reign of Marvel Studios”:

“They [Disney’s leadership] expected Feige to increase the studio’s output dramatically, providing a steady flow of content for the Disney+ streaming service. In the era of peak TV, Disney+ needed Marvel shows fast, and to stay competitive, it wanted a lot of them… Feige essentially had a blank cheque for television programming, so long as he could deliver volume.”

Lamentably for shareholders (and Chapek), Disney’s swelling content investment didn’t translate to the subscriber growth it had projected. Compounding the issue, the company spent a lot of money on local content and marketing in low Average Revenue Per User (ARPU) international markets.

“One thing we also know is that our films, those that are released theatrically, big tentpole movies in particular, are great sub drivers. But we were spreading our marketing costs so thin that we were not allocating enough money to even market them when they came on the service, as witnessed by the ones that are coming up, including Avatar, Little Mermaid, Guardians of the Galaxy, Indiana Jones, Elemental, etc.”

-Bob Iger

Emphasizing the need for a refined approach, Iger states that Disney will be “much more surgical" in greenlighting production and intends to curb investment in “those markets where the revenue potential just isn't there." However, while Disney has undoubtedly backed a few too many unpromising projects with substantial budgets—whether second-rate screenplays or those with excessive execution risk—its batting average remains commendable or, at the very least, respectable.

Disney surprised Wall Street in the fourth quarter by gaining 6.9 million new Disney+ subscribers, more than double the consensus estimate. Now, Disney+ stands at 112.6 million subscribers globally, marking a significant year-over-year increase of approximately 10 million. Notably, this growth was driven by international markets, as the domestic subscriber count (U.S. and Canada) remained constant at 46.5 million.

This plateau, however, must be contextualized. During this period, Disney’s ARPU climbed $1.40, or 23% YoY, to $7.50, primarily due to the price hike in December 2022. Disney recently implemented another round of price increases, starting in early October. Except for the “Trio Basic” bundle (unique to the domestic market), the price increases affected ad-free tiers. Concurrently, Disney+ rolled out ad-supported plans in Canada and internationally starting November.

Hulu has 48.5 million paid subscribers, with 4.6 million opting for its Live TV tier. This tier provides a cable-like experience, offering live and on-demand access to various channels, including news, sports, entertainment, Disney+, and ESPN+. Hulu’s ARPU evolution:

In 2023, the platform generated approximately $11.4 billion in revenue, compared to $8.6 billion for core Disney+. Live TV's contribution was significant, accounting for 44% of total revenue, up from 41.5% in 2022, despite representing just 9.5% of total subscribers.

Market Position

According to Nielsen data, as of November 2023, Disney+ and Hulu collectively held about 5.2% of the U.S. market share in total TV viewing minutes (monthly average) and nearly 15% in total streaming minutes. This contrasts with Netflix, Amazon, and Max, which captured 7.6%, 3.1%, and 1.3%, respectively.

While the “Netflix Correction” cast doubt about its long-term supremacy, the consensus is now that its market leadership is deeply entrenched. The renewed wave of (unreciprocated) licensing from its competitors, notably Max and Disney, clearly illustrates this.

So, where does this leave Disney?

Netflix, excluding YouTube, is the primary streaming service in most households. However, notable exceptions include fans of major franchises and parents with young children, for whom Disney+ is either the primary or secondary service. Disney+ excels in the children, family, and fantasy genres with its flagship franchises like Pixar, Marvel, and Lucasfilm. While it could improve its general entertainment offerings, matching Netflix in this domain is not crucial for its success in streaming.

Hulu, known for its strong drama, comedy, romance, and reality TV catalogue, complements Disney+'s library well. Despite some skepticism about the value of the Hulu acquisition, the combined strength of Disney+ and Hulu's portfolios is formidable.

A key differentiator for Disney+ is its success with "Pay-One" window films, a term denoting exclusive rights to broadcast or stream a film following its theatrical release, particularly significant for big-budget "tentpole" films. In contrast, Netflix’s big-budget storytelling primarily focuses on scripted series, having produced only four films with budgets exceeding $150 million.

On the other hand, since 2013 (when Netflix began releasing original content), Disney and its acquired studios have produced over 40 films with approximate budgets of $200 million or more, and more than 70 with budgets exceeding $150 million. Disney’s prowess with big-budget filmmaking and its prolific output have resulted in unmatched box office success:

The success of tentpole films on Disney+ means that it need not spend as much on programming. The similarity in churn rates between Disney+ and Hulu underscores this differentiator, even though Hulu invests more in content, offers a wider range of programming, and has higher engagement (minutes viewed).

Despite having a smaller subscriber base and lower levels of platform engagement relative to Netflix (46.5 million versus Netflix's over 70 million domestic subscribers), Disney consistently tops the streaming charts with movies:

Ultimately, Disney+, together with Hulu, stands as a formidable competitor to Netflix in terms of quality and market positioning. While there have been some setbacks, these issues are being addressed. We predict that the narrative surrounding Disney's streaming services will shift dramatically in the coming years.

The Power of the Bundle

“As we transition ESPN to a streaming future, and more fully integrate general entertainment content into Disney+, we will have a DTC offering unlike any other in the industry.”

– Bob Iger, Q4 2023 earnings call

Bob Iger’s statement, while seemingly promotional, may downplay Disney's advantageous position. Noteworthy in his quote—and generally in Disney's broader communications—is the omission of integrating live news into their streaming offerings. The value of adding live content to an otherwise static platform was highlighted by David Zaslav during WBD’s Q2 earnings call: “News and sports are important, they’re differentiators, they’re compelling, and they make these platforms come alive.”

The availability of quality news coverage on a streaming service will both increase engagement for regular consumers of news but also for occasional news consumers during “breaking news” events, making platform use increasingly habit-forming. Despite challenges in primetime ratings, ABC continues to lead in news broadcasting, with “Good Morning America” and “ABC World News Tonight” topping morning and evening newscasts for 11 and 7 seasons, respectively. The eventual integration of ABC News into the basic offerings seems like a natural progression.

By leveraging its substantial annual investment of over $10 billion in sports and news content, Disney can enhance engagement without additional programming costs as its streaming ecosystem becomes more integrated. Combining Disney+ content with Hulu's general entertainment, ESPN, and ABC News would offer a diverse range of content for every household member throughout the year. This comprehensive bundle would not only enhance existing offerings but also, despite a higher cost, likely further reduce churn rates. Disney's current bundles already show significantly lower churn rates than its standalone services, at around 2%, and are even lower than Netflix, the standout leader in churn among standalone services.

In the domestic market, the uptake of Disney’s bundles has significantly increased over the past two years, with approximately 90% of bundle subscribers opting for the ‘Trio’. Internationally, the growth in multi-product offerings, especially the “Combo+ Bundle” that pairs Disney+ with “Star” (akin to a compact version of Hulu), has substantially outpaced the growth of standalone subscriptions.

The chart above indicates that despite the growing penetration of bundles, around 70% (equivalent to 55 million) of domestic subscribers have not subscribed to more than one Disney streaming service. Indeed, the majority of Hulu and Disney+ subscribers, approximately 26 and 24 million respectively, do not subscribe to the other platform or ESPN+. Disney aims to change this dynamic by transitioning to a one-app experience. To this end, Disney+ has recently introduced a beta version of the Hulu “tile” for bundle subscribers. Disney anticipates that deeper exposure to the full range of content available on the other platform will encourage more subscribers to opt for the bundle upgrade.

This integration is significant as it streamlines the user experience by eliminating the need to toggle between multiple apps, thereby fostering greater user engagement. Additionally, it consolidates user data, facilitating more in-depth analytical insights. These improvements in engagement and data analysis are pivotal for advancing Disney's advertising business.

Given this increased awareness and the ease of access, along with the nominal $2 per month cost for adding the other platform through the basic bundle, a significant boost in bundle adoption is anticipated in 2024. Early indicators of cross-platform engagement are promising.

“Since our beta launch began rolling out seamlessly a month ago, engagement with Hulu content in the Disney+ app is beating even our own expectations and continues to grow week-over-week. Consumers are watching more, both in terms of hours and they’re watching a wider variety of programming.”

-Joe Earley, Disney’s President of Direct-to-Consumer (DTC) Streaming

AVOD

“The truth is we have only just begun to scratch the surface of what we can do with advertising on Disney+.”

– Bob Iger, Q2 2023 earnings call

As many of you are surely aware, advertising has become the hot topic in streaming. Matthew Belloni from “The Town” podcast remarked, "Ad-free streaming, which was once for everyone at a pretty low price, is now going to be for a pretty small group of people who can, and will, pay a lot for it. Everyone else will accept the annoying ads and pay about seven bucks for Netflix, and about the same for the others."

The appeal of AVOD lies in two primary aspects: First, it maximizes revenue from those willing to pay for an ad-free experience by widening the price gap between premium and ad-supported tiers. Second, it aims to attract price-sensitive consumers with a more affordable entry point, thereby expanding the total addressable market. This strategy becomes particularly relevant as Disney plans to address password sharing in 2024, making the affordable option crucial for converting shared-account users into paying subscribers.

Furthermore, unlike fixed subscriptions, advertising revenue scales with user engagement: the more a user engages, the more advertising opportunities arise. The AVOD model is especially efficient in monetizing the behavior of “serial cancelers” who systematically binge-watch and then switch between platforms. Typically, the revenue from ads exceeds the amount users would pay to avoid them, leading to higher ARPU in ad-supported tiers.

Another benefit of AVOD is its accessibility to small and medium-sized businesses, in contrast to linear TV’s ad dominance by Fortune 500 companies. This accessibility is facilitated by programmatic and self-service advertising tools. Incorporating a diverse range of advertisers not only has the potential to increase revenue but also improves the viewer experience by providing a variety of ads and aiding in the management of frequency caps.

Automation in advertising simplifies the ad tech supply chain, reducing costs for advertisers who no longer need to rely on ad tech vendors for campaign management. Looking ahead to 2024, “Disney Campaign Manager” is set to launch internationally, offering advertisers a “buy once, deliver everywhere” solution. This tool ensures optimal ad placement across Disney's streaming ecosystem. Additionally, Disney+ and ESPN+ will make their inventory available domestically, further expanding automated advertising opportunities.

Tech Stack

“In order to deliver the very best viewer experience, having your ad technology deeply integrated into the service is really important,”

-Jeremy Helfand, executive VP of ads and data platforms at Disney.

Unlike before, when Disney relied on third-party platforms like Google to serve ads, it now uses its own technology, which it began developing around four years ago. Despite the high cost and time investment in building the Disney Ad Server (DAS), Helfand believes its competitive edge over others, including Netflix, is worth the expense.

Disney's tech stack allows greater control over ad decisioning mechanics. This, in turn, increases relevance for viewers, CPMs for advertisers, and revenue by selecting the highest value ad, sold either directly or programmatically. The algorithmic engine that decides when to serve ads to viewers is aptly named YODA (referring to Yield Optimized Delivery Allocation, not the venerable Jedi master).

Disney+ introduced ads in 2022, but its targeting capabilities were limited until Hulu’s full suite was integrated last summer (which has been developing its advertising infrastructure for over a decade). This integration offers advertisers access to Disney’s Audience Graph of first-party data, which includes 2,000 audience segments (like “females aged 18-24 with a college degree”), spanning over 230 million monthly unique U.S. visitors to its media properties and over 100 million household-level IDs.

During the Q4 earnings call, Iger asserted, “We have the best advertiser technology in the streaming business, and we’ve just introduced new tools that will make this an even more attractive platform.” Among these tools is “Disney’s Magic Words,” a first-to-market contextual advertising format using advanced data.

Disney+ now has around 5.2 million AVOD subscribers (excluding Charter), with about half of the new subscribers in the fourth quarter opting for an ad-supported plan. In contrast, likely over half of Hulu’s 48.5 million U.S. subscribers are on ad-supported plans, with two-thirds choosing the ad tier in the last quarter.

Disney's considerable and expanding footprint, technological advantages, high-value intellectual property with strong brand appeal, coupled with its unparalleled portfolio of sports broadcasting rights, position advertising as a crucial yet underappreciated contributor to the company's streaming revenue and profit growth for years to come.

The Path to Streaming Profitability

Bob Iger outlined several strategies to enhance the company’s streaming margins during Disney’s Q3 2023 earnings call. These include refining pricing, addressing password sharing, AVOD, and boosting engagement through improved recommendation technology. Focusing on the factors not previously discussed:

Recommendation Engine

Netflix has the most sophisticated recommendation technology, while Disney’s significantly lags. Echoing this sentiment, the former head of Global Data and AI at Warner Bros. Discovery believes that Disney could reduce content marketing costs by an additional 20-30% through further optimization.

Password Sharing

Disney plans to start addressing password sharing in 2024, aiming for completion by 2025. This initiative is similar to Netflix's approach, which contributed to their substantial subscriber growth, as noted in their third-quarter report.

Non-programming Costs

Disney’s direct-to-consumer (DTC) non-programming expenses, including SG&A, technology support, and distribution costs, have experienced a notable decrease from about 50% of revenue in 2022 to 40% in 2023. This reduction marks a positive development, yet Disney’s figures still remain considerably behind Netflix’s highly efficient 21%. Specifically, Disney’s SG&A margin fell to 21% from 30%, a decline primarily attributed to reduced marketing costs. However, this figure still exceeds Netflix’s lean 13%.

Disney's ongoing efforts to integrate its platforms and promote bundle adoption are likely to yield significant savings in marketing expenses. Additionally, replacing the lesser-known Star brand with Hulu in international markets presents a promising yet underestimated opportunity.

A critical area for improvement lies in technology support and distribution costs, where Disney spends up to 20% compared to Netflix's 8%. Despite the complexities of operating multiple platforms, Disney has made commendable progress towards efficiency, particularly in integrating Hulu and Disney+.

“While the launch of this will be a simple Hulu button in the [Disney Plus] app, the complexity underneath to deliver that to you has [required] a lot of work. For example, the content libraries between Hulu and Disney Plus—over 70,000 pieces of content—were encoded differently. The playback output had different specifications. The metadata attached to each of those assets was different.”

-Aaron LaBerge, the president and CTO of Disney Entertainment & ESPN

Despite Disney+'s modernity, its rapid growth focus initially sidelined longer-term operational considerations. Michael Cupo, SVP of business operations for Disney Entertainment & ESPN Technology, reflected: “Any platform decisions that would have been made to stabilize or standardize or operationalize things, it was like, ‘We need to grow as quickly as possible.' Now, we’re fixing those things.”

However, the focus hasn't solely been on rectifying existing issues, significant as they may have been, as conveyed by Disney’s advancements in its advertising capabilities. The company has been developing the technological foundations which can be applied to all its platforms, including the upcoming ESPN DTC platform.

Despite these challenges, Hulu has been operationally profitable since at least 2021, as indicated in Disney’s financial disclosures. This positions it alongside Netflix as one of the few profitable major streamers. Disney's 2023 10-K states: “Operating loss from Direct-to-Consumer decreased … due to a lower loss at Disney+ and, to a lesser extent, higher operating income at Hulu.” Moreover, ESPN+ achieved profitability in 2023.

Content Sales and Licensing (CSLO)

Netflix's latest quarterly letter confidently declared its dominance in the streaming industry. The company stated, "Success in streaming starts with engagement... The variety and quality of our programming, along with our global reach, superior recommendations, and intense fandom, enable us to generate higher engagement than our competitors."

One media executive already sold on this proposition is David Zaslav, who notably opened the vault to HBO’s library last summer for the first time in nearly a decade. The company redoubled its licensing endeavors with its DC portfolio, which commenced streaming on Netflix in December. Both agreements were on a nonexclusive basis. Zaslav explained:

“Someone might have it for three months or six months. We always have those movies and we have the complete set of all those movies,” he said. “And candidly, we have found that we won’t do it unless the economics are significant. But in many cases, it really helps us. People come back and then they want to see the full bouquet of DC movies and the only place to do that is with us.”

When inquired about Disney's licensing strategy, Bob Iger struck a more cautious tone:

“We've actually been licensing content to Netflix and are going to continue to. We're actually in discussions with them now about some opportunities. But I wouldn't expect that we will license our core brands to them. Those are real, obviously, competitive advantages for us and differentiators. Disney, Pixar, Marvel, Star Wars, for instance, all doing very, very well on our platform. And I don't see why just to basically chase bucks, we should do that when they are really, really important building blocks to the current and future of our streaming business.”

For Disney, last year marked the smallest contribution to overall revenue from content licensing since at least 2016:

Following the discussions mentioned earlier, Disney licensed 14 popular TV series to Netflix for 18 months on a non-exclusive basis. This lineup includes notable shows like "Lost," "This Is Us," "Prison Break," "How I Met Your Mother," and "ESPN 30 for 30." These series will be released periodically throughout the year.

We view this as a decidedly positive development. However, the challenge with these titles is that, for the most part, people don’t automatically associate them with Disney as the IP owner, unlike Pixar, Marvel, or Star Wars. As such, the advantage is primarily monetary, rather than promoting cross-platform awareness.

Accordingly, while I understand Iger's reservations, I anticipate a slight, if not significant, shift in his approach to licensing in 2024-25, with content that more readily triggers an association with Disney.

Studio Challenges

This section focuses on Marvel Studios, given its disproportionate contribution to the studio business and the conspicuous challenges it faces. While there have been some setbacks in animation and live-action reboots, it may be too early to raise major concerns. Indeed, though "Wish," "Strange World," "Pinocchio," and, to a lesser extent, "Lightyear" were misfires, most releases in the Disney+ years have not been.

Disney Motion Pictures and the animation studios deserve the benefit of the doubt, attributing the shortcomings, as Iger does, to stretched resources rather than to a talent or process-related problem:

“In our zeal to grow our content significantly, to serve our streaming offerings, we ended up taxing our people way beyond where they had been in terms of their time and focus... And frankly, it diluted focus and attention. I think that is more the cause than anything else.”

The insights presented here are primarily sourced from the book "MCU: The Reign of Marvel Studios," with certain quotes modified for better clarity and relevance. The following excerpts, unless stated otherwise, are from this book, hereafter referred to as “the book.”

The “Marvel Method”

When asked about other studios failing to replicate Marvel's success, Joe Russo, director of the final two Avengers and Captain America films, stated, “Simple—they don’t have a Kevin [Feige].” The book discloses:

"The open secret of Marvel Studios was that Kevin Feige was a shadow director for all its movies. His deep involvement in every MCU installment far exceeded that of a typical studio executive and even most producers."

Feige's presence during filming is rare, but his crucial role is apparent pre- and post-production. “The pieces come home [to Marvel HQ], where Feige would meticulously review footage and rough cuts to add the special touch that makes a Marvel movie sing.”

The book also examines several reasons for the studio’s recent struggles, potential solutions, and its prospects of a successful turnaround.

“Marvel Method” Scalability

Marvel expanded production significantly at Bob Iger’s urging. Under Bob Chapek, the pressure increased, leading Marvel to, as Joanna Robinson, the book's lead author, notes in a podcast, “Announce things they weren’t ready for and push productions prematurely.” Feige, known for his prodigious output, found himself stretched thin. “Producing three movies a year was already a full-time job. Adding oversight of multiple divisions and a full streaming TV slate was overwhelming even for him.”

Overconfidence

Marvel chose to make TV shows as if they were films, a bold departure from traditional methods. “It was arrogant to think they didn’t need to follow established practices of an artform,” says Joanna Robinson. “They didn’t have showrunners, like normal TV. They had a position called head writer, and the head writer would often get put out to pasture at a certain point in the process, handing the scripts over to the director. That’s not how TV is traditionally made, but that’s how they tried to do it initially. And then they were like, ‘Oh, oops—maybe the system that was in place was there for a reason, so let's do it differently.’”

Creative Direction Issues

Before Disney+, viewers could enjoy an Avengers movie without having seen the Iron Man or Captain America films. However, the growing interconnectivity of shows and films started to feel overwhelming, leading to alienation among casual fans. Additionally, Marvel seemed to have misread its core audience's expectations. Robinson pointed out that Marvel was aware some releases were not entirely solid, mentioning the “Falcon and the Winter Soldier” miniseries as an example.

Identifying Solutions

The studio recognizes the necessity of slowing down production to pinpoint and rectify narrative shortcomings. “Before Disney+, Marvel didn’t do things until they were ready,” Robinson remarks. Kevin Feige has pledged to a new (or rather, a return to the old) approach:

“We want Marvel Studios and the MCU projects to really stand out and stand above. People will see that as we get further into phase five and six, the pace at which we're putting out Disney+ shows will change, so they can each get a chance to shine.”

The Next Chapter

Disney's acquisition of Fox was a pivotal moment for Marvel Studios, as it brought the film rights to the X-Men and Fantastic Four franchises back home, after being licensed out in the 80s and 90s. “I think that something you can really respect about Feige is he did not rush to do X-Men or Fantastic Four,” noted Robinson.

The potential for an X-Men revival under Marvel Studios is widely acknowledged, but the anticipation for the Fantastic Four's comeback is notably more cautious. As we assess the studio's chances for a successful revival, it's crucial to examine relevant precedents (see "Bonus Content").

"Deadpool 3," slated for release in July, will mark the first Deadpool film (and R-rated movie) under the Marvel Studios banner, serving as a crucial bridge between the X-Men franchise and the MCU. The success of this movie is vital, and the trailer indicates a promising execution. One top comment (60,000 likes) hails "Deadpool & Wolverine" as the needed step forward for the MCU.

Summary

The postponement of "Stranger Things" to 2025 presents a prime opportunity for Hulu and Disney+ to highlight their scripted series, especially if either or both of Netflix's next highly anticipated shows, such as "Three Body Problem" and "Avatar: The Last Airbender," fail to captivate audiences. Additionally, the anticipated delays of HBO's heavy hitters, "The Last of Us" and "The White Lotus," to 2025, further create an opportunity for the Disney bundle to stand out.

Armed with a roster of eagerly awaited shows and movies, along with enhanced cross-platform synergy, Disney is strategically positioned to amplify its streaming footprint in 2024. Moving into a new content cycle, together with the various factors previously discussed, it's more probable that Disney's streaming economics will exceed expectations rather than fall short.

Bonus Content

Star Wars

It has been recently announced that the first Star Wars film since “The Rise of Skywalker” (2019) will enter production in 2024. “The Force remains strong with the Star Wars franchise,” observes Sarah Whitten of CNBC. Despite a hiatus from film releases in recent years, Star Wars secured the top spot as the leading film franchise of 2023.

In a contrast to Marvel’s “always-on” proposition, Star Wars has opted for producing fewer shows, leading to better performance in terms of both hits and misses:

The forthcoming Star Wars series, "Skeleton Crew," is generating considerable anticipation. This series is a coming-of-age tale (the first of its kind for the franchise) influenced by the 1985 film "The Goonies." Jon Watts, the acclaimed director behind the last three Spider-Man movies, including the hugely successful "Spider-Man: No Way Home" (2021), serves as the showrunner.

Shogun

In an era dominated by prequels, sequels, and reboots, Shogun stands out with its distinct tone and subject matter. While Shogun is likely to resonate with the large and growing audience intrigued by Japanese culture, it also holds the potential to engage a mainstream audience, much like Game of Thrones captured viewers beyond the typical medieval or fantasy enthusiasts.

Franchise Revival Precedent

After "The Amazing Spider-Man 2" (2014) failed to resonate with audiences, Kevin Feige proposed to Sony, the rights holder, that Marvel Studios produce the next Spider-Man films. Sony agreed, retaining the rights and funding production. Tom Holland was cast as Spider-Man, debuting in the MCU in 2016 and starring in three solo films, beginning with "Spider-Man: Homecoming" (2017). The most recent, "Spider-Man: No Way Home" (2021), grossed $1.922 billion, becoming the 7th highest-grossing film of all time. Under Feige's direction, the rebooted series averaged $1.3 billion per solo film, nearly doubling the average of its predecessor.

Course-correction Precedent

Following the tepid reception of "Thor: The Dark World" (2013) and Thor's limited role in "Avengers: Age of Ultron" (2015), Thor was perceived as losing relevance. Marvel executives decided to make bold changes, including altering Thor's iconic long hair and hammer and adopting a less Shakespearean tone. This shift was validated with "Thor: Ragnarok" (2017), the most successful Thor film both commercially and critically. The movie's humor and freshness appealed to a wide audience. Mark Ruffalo commented, "We don't have to force the tone from movie to movie. All we have to do is carry those characters forward with some semblance of the last story in mind."

"Deadpool 3," set for a 2024 release, will be the first Deadpool film (and R-rated movie) produced by Marvel Studios, bridging the gap between X-Men and the MCU.

We hope you enjoyed Disney (DIS): Part 1. We will release Part 2 in a week!

Disclosure: The author, editor or the accounts advised by the editor do not own shares in Disney (DIS). This post is for informational purposes only and we may be wrong in our assumptions and estimates. We encourage all readers to come to their own conclusions.