In October 2022, we published our analysis on Nu Holdings when its stock was trading at just $4 per share. At that time, it was flying under the radar, with little to no discussion about it on fintwit. Fast forward to today, and the stock has surged to $15 per share, capturing the attention of the broader investment community. Now, it seems like everyone on fintwit has something to say about Nu Holdings!

Nu Bank’s business model serves as a blueprint for how fintech companies can disrupt traditional banking systems and achieve sustained growth. The key lessons from Nu Bank’s rise — entering a market with poor service quality, leveraging a tech-enabled low-cost structure, using data to manage risk, and maximizing customer value through cross-selling — are applicable not only to its current operations but also to its future expansion into other Latin American markets.

Several key lessons emerge from Nu Bank's journey, applicable both to its current trajectory and other similar institutions. The model is highly reliant on certain critical factors: market conditions, a tech-enabled low-cost platform, strong data-based risk management, and an ability to cross-sell various services. Below, these factors are explored in depth, along with their relevance to Nu Bank.

One of the central lessons from Nu Bank’s rise is the importance of market conditions, particularly in regions where incumbent financial institutions offer subpar services. In Brazil, where banking services were dominated by five major institutions — Itaú, Bradesco, Santander Brasil, Banco do Brasil, and Caixa Econômica Federal — there was an inherent opportunity for disruption. These traditional players, while profitable, had outdated infrastructure, high fees, and poor service quality. Nu Bank capitalized on this gap by offering a better alternative, particularly to the underserved segment of the population. n such conditions, Nu Bank's offering of a fee-free, fully digital credit card with lower interest rates was a breath of fresh air for consumers.

This lesson is applicable to Nu Bank’s ongoing expansion in other Latin American markets like Mexico and Colombia, where similar dynamics exist. These regions also have a high percentage of unbanked populations and a financial sector that offers limited innovation. By addressing these gaps with superior services, Nu Bank is poised to replicate its success in Brazil.

Nu Bank's ability to operate at a fraction of the cost of traditional banks was a game-changer. Leveraging a fully digital, cloud-based platform, Nu Bank drastically reduced its operating costs. Unlike incumbents that were burdened with legacy infrastructure, high IT costs, and a large number of physical branches, Nu Bank’s streamlined tech stack allowed it to serve customers more efficiently. This lean operational model meant that the bank could offer competitive products like credit cards with no annual fees, attract new customers at a low acquisition cost, and deliver a seamless user experience.

One of the most significant challenges in consumer lending is managing credit risk, especially in high-risk markets. Nu Bank’s approach to risk management has been meticulous and data-driven. From the outset, Nu Bank hired risk management professionals from established U.S. institutions like Capital One, which has a strong track record of finding mispriced risk in the credit card market. The company adopted a “low and grow” strategy, granting customers lower credit limits initially and increasing these limits based on their usage and repayment behavior. This approach allowed Nu Bank to gather data on millions of users, enabling it to refine its credit models over time. The key lesson here is the importance of using proprietary data to reduce credit risk. By collecting over 11,000 data points per active customer, Nu Bank’s risk engine, NuX, outperformed traditional credit scoring methods and reduced delinquency rates.

Nu Bank's business model isn’t just about offering credit cards; it’s about building a platform that can serve as a financial hub for its customers. After establishing itself with credit cards, Nu Bank expanded into personal loans, payroll loans, debit cards, digital banking accounts, insurance, and investments. The company’s strategy of cross-selling these products has been highly successful, increasing customer lifetime value and maximizing revenue per user.

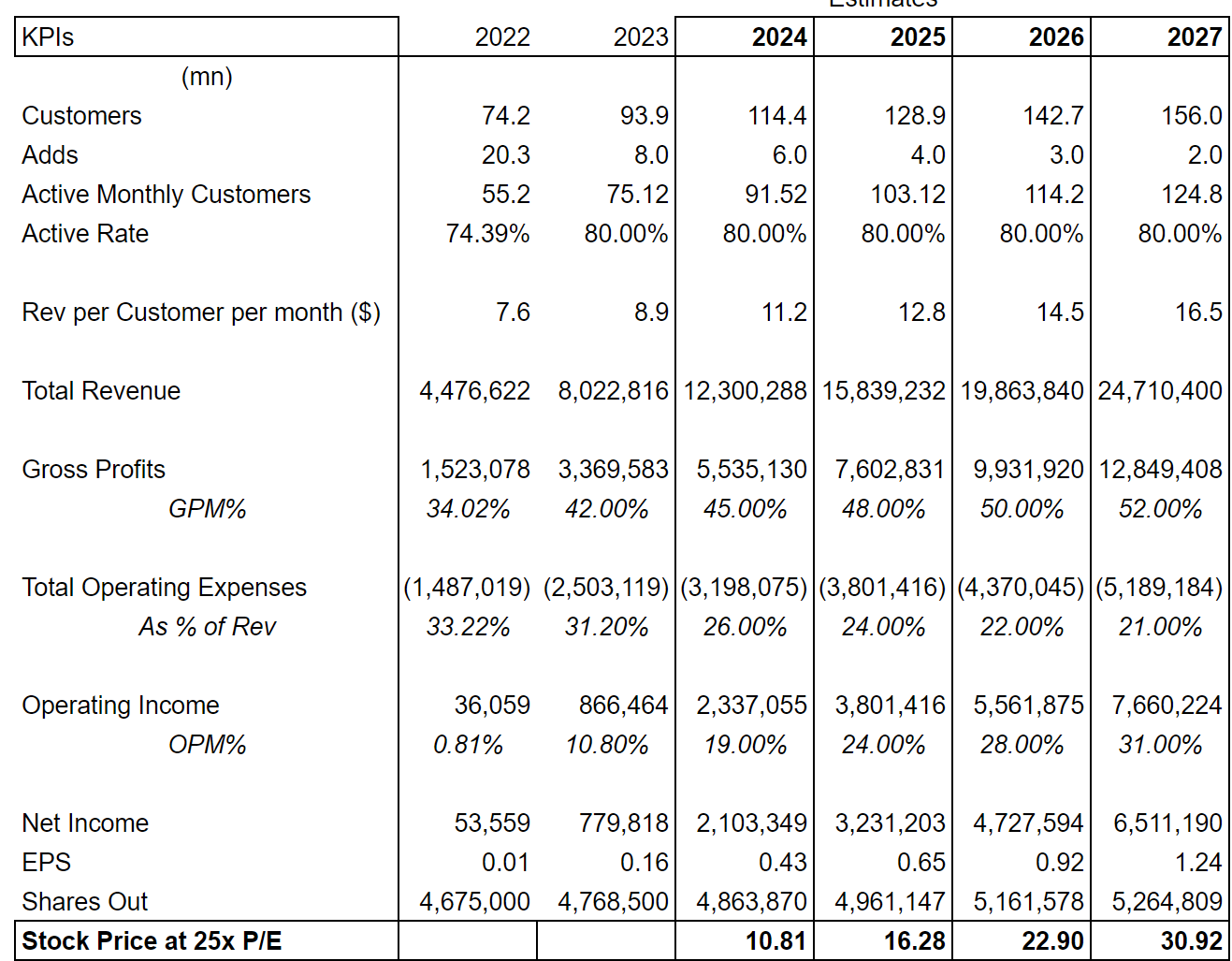

In the report in October 2022, we made the following assumptions about Nu’s future:

It’s truly remarkable what Nu has accomplished, and they’ve gone beyond expectations in many ways. While their strategy was undeniably well-crafted, the real driving force behind their success has been an exceptional management team. This team is constantly looking 6 to 18 months ahead, preparing and executing for the world that will be—not just the one that exists today.

However, everything has a price. The name of this substack is ‘ValuePunks’! While many investors define value investing in more traditional terms—focusing on stocks that appear undervalued based on metrics like the price-to-earnings (P/E) ratio or free cash flow (FCF) yield—our approach takes a slightly different perspective. One of the core principles of our value investing philosophy is to seek out opportunities where the market has yet to fully recognize or price in the future potential of a company. This forward-looking approach allows us to identify value in a way that goes beyond surface-level financial ratios, capturing opportunities that others might overlook.

In Nu’s case, even as the stock has materially appreciated from our initiating report, we believe there is further upside.

Our new simplified estimates for Nu are as follows:

Why 25x P/E? In addition to growth, Nu offers spectacular ROE’s. Given the higher interest rates and Nu’s advantaged working capital cycle (discussed in the original report) Nu is very profitable. In fact, ROE will already be 32% in 2024 based on consensus numbers.

Nu is still overcapitalized and anticipates expanding net interest margins by increasing its loan-to-deposit ratios. A gradual rise in secured lending originations is expected in H2 2024 with the introduction of new features. In fact, Nu is just starting and expanding its payroll loan product which is one of the largest segments in Brazil.

As it uses more of its capital for growth and becomes more efficient, ROE’s will trend higher into the ~35% range. We can even argue for a higher P/E for such growth and profitability.

The bears point to the rise in Nu’s NPLs and competition. The company is intentionally and strategically growing its lending book and expanding down the credit spectrum where it sees relevant opportunities, prioritizing decisions that optimize the long-term net present value of credit cohorts rather than focusing solely on NPL metrics. As we mentioned in our original report, NPL’s cannot be analyzed independently without looking at the NIM’s on the loan book. Also, while there are some new competitors in the space, including Mercado Libre, it is important to remember that financial services is one of the largest TAMs in the world and that legacy competitors still have a lot of the market.

Nu is a rare compounder that can grow intrinsic value and provide a buy and hold investor attractive IRR’s for years to come.

Here is the original report (It is still a good primer on Nu Holdings):

Deep Dive: NU Holdings (NU US)

Before we begin, we want to acknowledge Federico Sandler (@FedexSTi), ex-Investor Relations Officer of Nu Holdings who added some invaluable insights and helped us edit this report.

Disclosure: The author or the accounts managed by the author hold shares in Nu Holdings. This can change without giving a prior notice to the reader. This article is for informational purposes only. We may be wrong in our analysis and encourage all readers to come to their own conclusions.

I linked to your piece in my links post for today: https://emergingmarketskeptic.substack.com/p/emerging-markets-week-october-14-2024 And you are right: EVERYONE (especially Seeking Alpha...) talks and writes about them and other fintechs! But I have heard that the traditional banks in Latin America have also figured out how to do fintech as well - meaning they can give the fintechs a run for their money....

Amazing call on this one!