Before we begin, we want to acknowledge Federico Sandler (@FedexSTi), ex-Investor Relations Officer of Nu Holdings who added some invaluable insights and helped us edit this report.

The Nu Holdings thesis has been written by many investment analysts but we believe that none of them have done justice to the opportunity. There is a younger cohort of analysts - likely ones that entered the industry in the last 10 years - who have never analyzed a bank. We don’t blame them as most portfolio managers swore off financials after the great financial crisis (GFC).

We are biased and believe that banks in emerging markets present a very unique opportunity. In January 2022, we wrote a detailed report on HDFC Bank, India’s largest private bank. We also used that report as a primer in analyzing a bank’s balance sheet and income statement. HDFC Bank remains on thesis and has produced alpha when compared to the market. It is down 10% YTD compared to -24% for S&P 500. Importantly, there were many opportunities to use HDFC Bank as a source of cash as it rallied to its previous high’s intra-year.

We now come back to another emerging market bank, this time, in Brazil called Nu Holdings. It helps that Berkshire Hathaway owns ~$1 bn in Nu Holdings at close to IPO price of $9 per share while the shares are now half off!

David Velez

David Velez was born in Colombia, but his family moved to Costa Rica when he was 9 in order to escape the security situation in the country. After graduating as a valedictorian, David went to Stanford for his engineering degree. Thereafter, he worked with Morgan Stanley and then General Atlantic. During this time, David met Nigel Morris, a co-founder of Capital One and got an opportunity to learn about Capital One’s business model.

After General Atlantic, David then went back to Stanford to complete his MBA. After graduating he started working with Sequoia Capital. He moved to Brazil and was tasked with building Sequoia’s Latin American practice. Over time, David and Sequoia both realized that there was not enough talent or opportunity for a thriving tech ecosystem in Brazil and they abandoned their effort.

David describes his experience in opening a bank account in Brazil,

“When I moved to Sao Paulo for the first time, I had to go to a banking branch and it was the most painful experience I ever had in my entire life. I would describe it as almost going to jail because you have to go to these bulletproof doors, you have to leave your wallet and your cell phone and your bag in a locker outside the branch and go through the bulletproof door and wait 60 minutes and then talk to a branch manager that has a horrible attitude that is always thinking I’m doing you a favor, opening your bank account, and it’s not like, oh, let me really serve you. I had to go to the banking branch maybe 10 times in the course of four months to eventually open a bank account that charged me about $30 per month, an interest rate that was over 400% a year.”

-David Velez, founder Nu Bank

While this experience certainly played a part, I believe David’s conversations with Nigel Morris, the co-founder of Capital One, were more consequential. From Morris he likely learned about Capital One’s business model (which we will discuss). Morris would later sit on NU’s board of directors. He also probably saw Oleg Tinkoff adopting this business model to great success in Russia. He realized that this business model, when applied to the highly consolidated, inefficient and underbanked banking sector in Brazil, could pay significant dividends.

Here is David describing the big lessons studying other technology businesses which helped form Nu Bank’s strategy:

Consumer obsession

Building technology in-house

Superior culture

In 2013, after raising a $2M seed round from Sequoia, David was in business. David’s past experience was as an investor. While he could help set strategy and apply his learnings sitting on the other side of the table from entrepreneurs, he still needed co-founders who could help him execute his vision and complement skill sets that were needed to build a durable financial services business. Cristina Junqueira, a management engineer from Universidade de São Paulo with an MBA from Kellogg School of Management came on board as a co-founder. Cristina was Brazilian and was working in one of the biggest banks in Brazil, Itaú Unibanco, handling consumer’s loans and credit card business. To build the technology stack, Edward Wible, a Princeton Computer Science grad with an MBA from INSEAD joined as a co-founder.

In August, 2014, they raised a $15M series A round. They launched Nubank’s beta a month later, with the primary value product being a credit card with no annual fees.

Why? Why launch an unsecured product in a third world country? Don’t they know people will not pay their credit card bills leaving Nu Bank with large losses!

We believe there are a few reasons:

Success of similar business models in other countries offering an app only user experience and no fee credit card

The opportunity in LatAm with a large financial services TAM (50% of population unbanked/underbanked).

Increasing smartphone penetration with a population that has massive demographic tailwinds and increasing consumer technology adoption.

Case study #1 Capital One

Capital One has long been known as a north star for neo-banks. Established in 1994, the core idea behind the company’s formation was “information-based strategy” - that important operational and financial decisions should be made on the basis of data and analytics.

“One of our key advantages is having a mindset focused on technology and innovation from the outset. Yes we have branches and yes we have pieces of plastic that you put in your wallet today, although some people just carry it in their phone as digital versions of that. Our products though are intangible products, and so at the core of our business is the important role that technology plays and it is about software and it is about data and analytics and it is about how to bring all of that together to create a great experience for the customers”

-Robert Alexander, CIO of Capital One

Richard Fairbank and Nigel Morris, saw that most large banks were focused on traditional products and the credit card market was underserved. Furthermore, the sub-price subsector was totally a whitespace for the credit card market. They came up with a plan to fine-tune card product and pricing strategies for individual customers through a decision-making structure blending together marketing, credit, risk, operations, and technology functions.

“Credit Cards aren't banking - they’re information”

- Richard Fairbank, Co-founder of Capital One

Capital One was one of the pioneers in using data analytics to build a customer profile for its credit card business. Once it had built the credit card business, it used its knowledge and customer database insights to enter into auto financing and then into other products. The bank proved to be a great success.

Case Study #2 Tinkoff Bank

Oleg Tinkoff was inspired by Capital One’s success and launched a neo-bank in Russia in 2006. It was based on the same principles as Capital One but took the business model one step further. It started off with credit cards but then built a whole ecosystem with the mobile app.

“Our approach is that there’s no difference between consumer business and the banks’ business. Getting a credit card must be as thrilling as buying an iPhone, or Coca-Cola – or beer.”

- Oleg Tinkoff

Studies of mobile app usage show that people use only a handful of apps regularly, and one of them is typically their mobile banking app. Frequent customer transactions gives the banks owning those apps the ability to cross-sell other products. Frequent customer contact also gives them the ability to provide targeted offerings based on the customer’s profile, which increases conversions. Also, unlike Capital One, Tinkoff did not want a big balance sheet, it wanted fee revenues. So when it introduced other products, it asked other financial institutions to provide these products to Tinkoff’s customers with Tinkoff taking a substantial cut.

As one can imagine, Russia is not the easiest place to do business. Tinkoff, however, grew to become Russia’s second largest credit card issuer. Building on its success in credit cards, Tinkoff then expanded into SME accounts and debit cards. Tinkoff had massive cost advantages over other banks because it was a digital only bank with no physical branches. It married its digital first philosophy with its cost advantages to provide better and cheaper financial services for Russian citizens. The results can be seen below:

Through cycles, Tinkoff grew on a net profit basis and averaged ROE’s in the 40%+ which is remarkable for a financial institution.

Case study# 3 Bajaj Finance

Bajaj Finance, unlike Capital One or Tinkoff, did not start with credit cards. Its initial customer acquisition and data strategy was to pull customers with the buy now pay later (BNPL) product. I first met Rajiv Jain, the CEO of Bajaj Finance in 2015. At that time, Rajiv explained the problem of customer acquisition in the financial services industry. The big banks attract customers with their branches or by getting corporate accounts which are often followed by employee accounts. Bajaj Finance - a branchless and tech enabled business - acquired customers cheaply with their BNPL product. As customers used the product and join the platform they are then funneled with the help of data and offered other financial products that are higher margin. These customers will buy other products if and only if they are offered a superior product and a superior service and Bajaj endeavored to provide it.

Bajaj Finance was different from Tinkoff in that they grew their balance sheet in order to provide other financial products to their customers and the share of fee revenue was relatively low.

“Franchises with distribution, obsession with frictionless and risk management will get a disproportionate share of profit pool in the financial services industry as profit pool is linked directly to market share”

- Rajeev Jain, CEO Bajaj Finance

I wish I had understood the power of the business model in 2015! The stock is up 4,000% or 40x since my first interaction with the Company!

What is the lesson from these cases and how is it applicable to Nu Bank?

This is a powerful business model and works when the following criteria are met:

A market with low quality financial services and credit card penetration

A product that can get customers on the platform with low customer acquisition costs

Low costs enabled by technology

Data based risk management where profits can be made on an unsecured product

A strong platform for cross-sell

We believe that Nu Bank meets all the above criteria and is well positioned to compound at high rates over many years. Let us talk about each of the above in some detail.

Market

The banking sector in Brazil is highly concentrated and controlled by a small number of incumbent financial institutions. The five giants that tower over the country’s financial system - Itaú, Bradesco, Santander Brasil, Banco do Brasil and Caixa Econômica Federal - have over 85% market share in the country. Caixa and Banco do Brasil are controlled by the government. Majority of Brazil’s poor are customers of these banks as the government uses these banks for social security and subsidy payments. Itau, Bradesco and Santander are private banks that have consolidated the market and have strong presence amongst businesses as well as middle and upper middle class parts of the population. Each of the five incumbents in Brazil has between 2,000 and 5,000 branches and around 50,000 – 80,000 employees each.

We believe this legacy infrastructure has translated into a higher cost to serve, incentivizing incumbents to sell high-margin products while excluding a large segment of the population from the financial system. It is estimated that there are 45 mn unbanked individuals in Brazil while at the same time the ROE’s in Brazil are some of the highest in the world due to the highly concentrated nature of the industry. These ROE’s are a direct result of high fees as well as very high interest rates charged to consumers for credit. Brazilian credit cards had interests running 200% to 400% a year!

“Management (of Brazilian banks)described to me a banking sector that was one of the most profitable in the world. A history of hyperinflation kept interest rates high. Simply buying and holding government bonds was a profitable enterprise. Most private lending was reserved for large corporations, and these relationships fuelled banks’ consumer business – employees typically maintained a bank account with whichever bank their employer used. Interest rates on consumer loans were justifiably high because charging overdraft fees was prohibited and a lopsided credit scoring regime made it difficult to underwrite credit”

- Marc Rubenstein of Net Interest

The above collaborates David’s experience when he first decided to open a bank account in Brazil – high fees, high interest rates and poor service.

Product

Nubank launched its first product in 2014. “Roxinho” is a credit card with no annual fee or maintenance fees and is fully digital. This was a purple Mastercard-branded credit card in Brazil.

This card grew like wildfire, we believe due to two factors:

It was 10x better than anything in the market

Nu created scarcity which was a clever marketing move

First, this card was better than anything else on the market – it was free, it had lower interest rates, and it was all digital. To apply for a card, prospective clients had to download an app and enter some details. They would then receive a preliminary decision within two minutes. Second, a referral program was built into the app, where someone had to refer you in order to get a card – not everybody could have it! Hundreds of thousands joined the company’s waitlist – eager to get a hold of one of the purple cards.

Nu Bank’s strategy was to start with a single product to ensure they delivered a great user experience but also to gain insights about these customers to refine and improve data models. Again, it is important to remember that customers use their credit cards frequently, making it relatively simple to launch a new product.

Nu Bank followed this initial launch with a rewards program that was again revolutionary in the county for its radical transparency and cost.

According to Nu, their Customer Acquisition Cost (CAC) was US$5.0 per customer in 2021 and they have acquired approximately 80%-90% of customers organically via word of mouth on average per year since inception. This has been a key competitive advantage of Nu Bank. They will make money from these customers on credit cards but also when they sell them other services due to which unit economics here are very very good.

Since they focused so much on the user experience and customer service, people got excited and were compelled to tell friends and family. So, Nu’s customers became their biggest ambassadors and ultimately that was great because they grow with very little marketing spend. This is also how you build a very valuable consumer brand!

“They got a lot of customers, a lot of good feedback, and the people here in Brazil love Nubank. I don't know if you know, but "N-U" means "naked" in Brazil. This is why they called Nubank, because they want to be transparent with their customers.”

- C6 Chief Digital Officer (Stream Transcript)

Nu makes money with interchange fees and net interest income on revolving balances.

Every transaction made in Brazil has a 5% interchange fee shared by the company that produced the card machine (called acquirer), the credit card network (in Nubank’s case is MasterCard) and the issuer banks - Nubank. In addition, Brazil's credit system gives issuers like Nubank thirty days to pay a merchant for a consumer purchase. This is very different from the US, where merchants receive funds in just two days. This dynamic served Nubank well — the average consumer paid Nubank back in 26 days, meaning the company had a positive cash flow cycle, with four days of float. This essentially means that ROEs in this business are exceptionally high.

Credit cards are priced at an interest rate of 12% per month which is in-line within the industry. Personal loans, however, is where their data comes into play and rates vary based on the quality of credit. They average 5.6% per month in personal loans while peers charge much higher (between 25-30% higher). It is important to emphasize that credit cards are a high risk/high reward business – while delinquencies can be high – the high interest rates on the remaining portfolio can buttress overall profitability and result in good ROE’s – which is what matters at the end of the day.

In 2017, Nu launched a fully digital banking account solution which offered customers the ability to make deposits, peer-to-peer transfers, payments, and cash withdrawals. The bank also started paying interest on customers’ balances in order to attract deposits and further increase customer’s business with Nu Bank. Unlike competitors, these accounts had no fees or transaction costs which customers appreciated.

In 2018, this was followed up with the launch of a debit card. It is important to note that the customers who join by acquiring only a NuAccount typically generate lower initial revenue than customers who start off with multiple products, such as a credit card and a NuAccount. However, these NuAccount-only customers are highly attractive and strategic as Nu become their primary banking account provider and captures a greater share wallet. NuAccount is also how they began to build more data points about users they did not have enough information initially to offer a credit card.

In 2019, Nu launched a personal loan product for people with larger credit needs. Also in 2019, Nu also launched a Nu business checking account in order to target SME businesses.

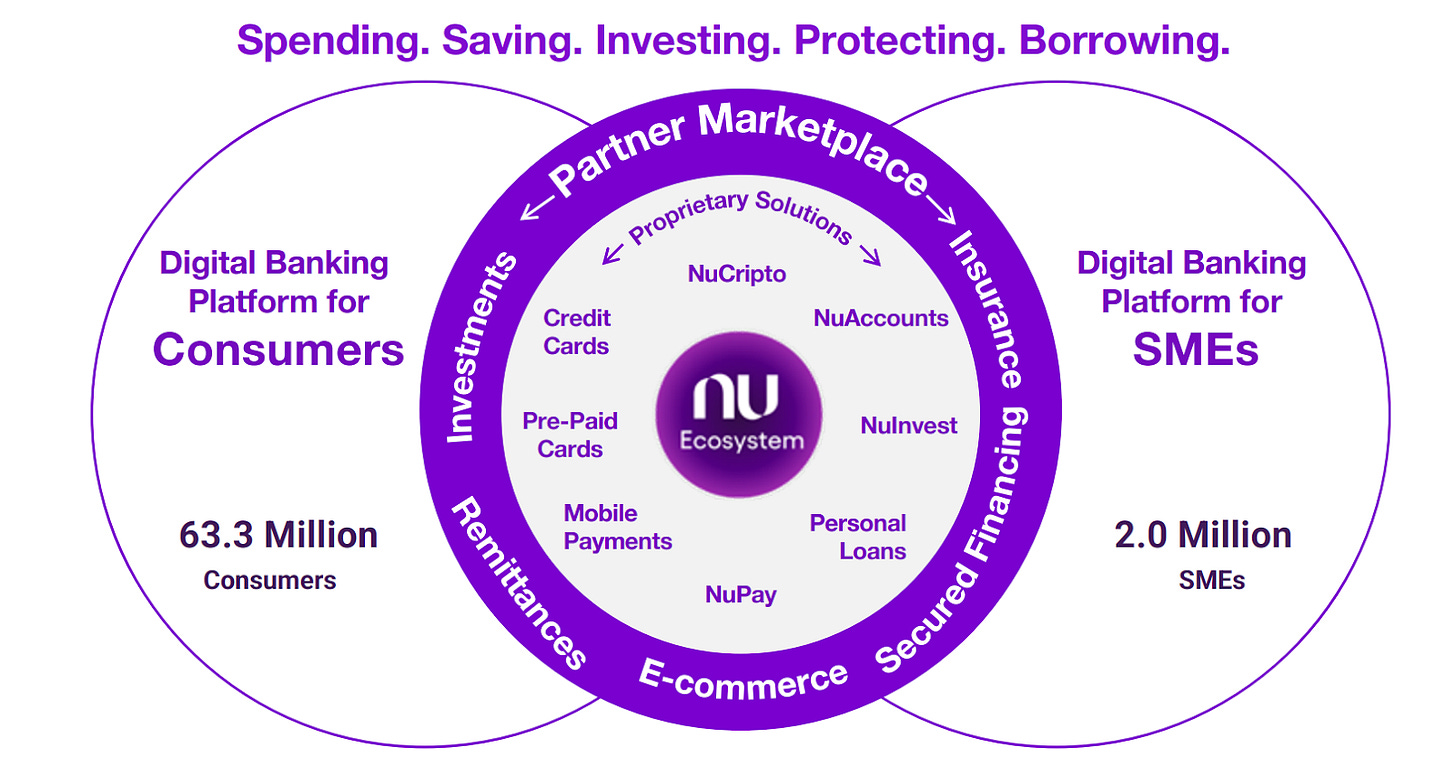

In 2020, Nu launched insurance brokerage services and investments, following the acquisition of Easynvest, a retail investment platform. More recently, Nu has opened its customer base to allow third party providers of financial services and non-financial services to open their products to their customers. Nu has partnered with a number of ecommerce providers in Brazil where they are enabling their customers to consume ecommerce products within its app, but they have also gone beyond to allow its customers to get home equity loans, auto loans and remittance products.

The results have been remarkable:

Nu is now the largest issuer of credit cards in Brazil, Mexico and Columbia with 62 mn, 2.7 mn, and 313K clients, respectively. Nu skews towards younger and less affluent clientele. One can see it as a negative or a positive. We take it as a positive as it helps with both the sustainability and longevity of growth.

Technology

Nu Bank’s competitors in Brazil have a lot of branches and a lot of employees - both of which are expensive! In addition, all legacy banks have large and increasing IT expenses - some to maintain the legacy systems and some to enable banks to ‘pretend’ to be digital.

In contrast, Nu’s all-digital, cloud-based platform is low cost, highly efficient and scalable. Nu estimates that their cost to serve and general and administrative expense per active customer is approximately 85% lower than incumbent financial institutions in Brazil. Unlike many other ‘fintechs’, Nu does not use third party software in their technology stack and is vertically integrated.

It is important to expand on the technology aspect.

I was parsing through Nu Bank’s acquisitions and saw things that made sense - an AI startup, an investing platform, a payments company but then I saw a company called Cognitech which promotes an open source programing language called Clojure - what?

Then it occurred to me that I am still looking at Nu Bank as a bank. It is, at its core, a technology company that happens to be in the financial services business. Further, a part of Nu’s mission is to ‘fight complexity’. Importantly, Nu Bank has to solve for scale. As mentioned before, financial services is a scale business. Nu Bank’s technology needs to perform - without complexity - at scale.

It is important to remind readers that Nu Bank has built all of its technology stack from scratch using the Clojure programming language. Then, they got control of the technology that they used to build this technology stack! There are software companies with billions of dollars in market capitalization (Temenos, for example) that sell banking software to other companies. I have looked at these banking software providers and analyzed IT services businesses that get a large portion of their revenues from financial services. Financial services typically have very complicated tech stacks and they are very very difficult to change. Imagine doing a software change and losing customer data or customer account balances in the process!

As an engineer myself, I had to understand this a bit better:

“Most things in Clojure can be found in other languages. However, Clojure has an especially stable and coherent design story, and is quite a bit better thought out than the other languages I've programmed in professionally. The pieces just work together really well, and there isn't a lot of "extra stuff" that only a die-hard specialist would know, or need to. It is the nature of the problem space (financial services) which requires you to produce high quality code. If you have a small error in your program, the financial market participants will use it against you to profit. In banking you have to keep track of every transaction, see "double accounting". You never delete a transaction, you only retract! Clojure and datomic solves this through immutability. Datomic linerialies transactions thus this problem does not occur on database level.”

- Y Combinator forums

This acquisition also solves the talent problem as Nu has all Clojure engineers - based anywhere in the world - to help work on their technology.

In addition to technology and administrative costs, the other cost that a financial institution has to contend with is cost of funding. In a bank, capital is your basic raw material - you borrow it at a lower level to lend it at a higher level and make a margin. Since the introduction of NuAccount in 2017, Nu Bank has been accumulating deposits which have reduced the cost of funds. Currently Nu is paying the full interbank rate on deposits. The longer-term strategy is to offer customers saving products where they can invest their balances in fixed income products and this should further lower the cost of funds. Management believes that their cost of funds can come down to 70-80% of interbank rate which is not that much higher than legacy players whose cost of deposits are ~65% of interbank rate.

At this juncture, it is important to recall Nick Sleep’s lessons. Sleep coined the term “scale economics shared” in reference to Costco’s business model where he found that their strategy of passing the advantages of expanding scale on to customers in further reduced prices, instead of taking profits themselves, gave the business a long-term compounding power unlike its competitors. Nu is no different! It passes the benefits of its advantaged cost structure to customers with no fee and low interest credit cards. With further scale and better data, Nu retains an ability to accelerate this flywheel and pass on lowering of unit costs to customers in either superior products with lower interest rates or better services.

Risk Management

From its early days, Nubank management has hired former employees of US credit card lender Capital One into risk management roles. Capital One has consistently been good at finding mispriced risk in the card market. It then takes a slow and deliberate approach to raising limits, using payment history to identify “good” credits and grow with the customer.

In their own words, Nu pursues a “low and grow” strategy with credit limits - grant lower limits to new customers who Nu assess as higher risk and then increase those limits selectively based on a positive usage and repayment track record.

Importantly, Nu generates proprietary data on millions of individual consumers and SMEs. Nu has an internally developed credit engine called NuX which collects more than 11,000 data points per monthly active customer. One such datapoint is how an applicant came to Nubank – the model shows that someone recommended by a well-performing cardholder is likely to be a better credit risk. They use this data to improve underwriting and lower risks. As an example, Nu had a 90-day credit card delinquency rate that is consistently 25-30% better than the competitors. This is because not only they rely on income data, but also on behavioral data such as where you activated your card, what are your spending patterns, and who do you pay and receive payments from, amongst other data they collect from users.

While investors worry about a recession and its effect on Nu’s credit quality, it is important to remember that Nubank’s credit card business has weathered a period of volatile macro in Brazil, including the 2014-2016 recession (which was one of the worst in 100 years and also included an impeachment). Nu’s algorithms have also gone through the COVID 19 pandemic which also likely strengthened Nu’s credit models.

The proof is in the pudding. Nu has lower NPL ratios when compared to peers. Now, most peers don’t report NPLs specifically on their credit card portfolios due to which the market is perennially confused on this point. Might we suggest that market participants look at actual write-offs? These have been 2-4% of total loans which is very low for an unsecured portfolio. Even more important is that due to accounting regulations Nu has extra provisions.

During bad times, bank managements used to have the option for when and how much provisions to take against the oncoming wave of delinquencies. However, accounting regulations (specifically IFRS 9) require Nu to take provisions against credit risk up front. So while Nu generates revenue and credit losses from these credit card and personal loan customers over time, the impact of upfront provisioning means that gross profits are artificially depressed especially when growth is high. Here is this dynamic in charts:

Nu has been growing its share of personal loans. These have a high interest rate but almost no fee income. Due to accounting, high growth in these loans will have the effect of depressing margins as Nu will have to take all all provisions upfront.

Cross-sell

As mentioned before, Nu’s strategy is to use its data and CAC advantages to onboard third party providers onto their platform. These third party financial institutions will sell insurance or home loans or any number of other products and Nu will take a fee - which is a high margin transaction for Nu. Nu, for its part, will focus on credit cards, personal loans and investments.

“So in just a few years we were able to go from a credit card monoliner to achieving leadership positions in the verticals we entered - deposit accounts, personal loans, SMEs, life Insurance and investments - while reaching over one third of the adult population in Brazil. This, to us, represents significant progress in advancing a product diversification and cross-sell strategy.”

- Nu Conference Call

Above we observe three things:

Left chart: 55% of active customers use NuAccount which means that Nu Bank is slowly becoming their primary bank.

Middle chart: With this, Nu is able to sell more products and services to their customers. In 2Q 2022, they had 3.7 products per customer which is one of the best ratios in the world.

Right Chart: More primary customers and more products per customer means that Revenue per user is increasing. In 2Q 2022, this revenue was $7.8 per customer per month (ARPAC) but some mature cohorts are doing $18-20. This metric is very important as we believe that most of Nu’s future growth will come from ARPAC growth. Nu’s competitors in Brazil have ARPACs of greater than $35 per customer per month.

This cross-sell flywheel is in full motion and we expect Nu to increase its ARPAC per customer per month slowly to $15 in 2025.

Bringing it all together with Financials

The financials are fairly simple,

Nu has 70 mn clients and makes about $7.8 mn per client per month. These revenues comes from the interest income on loans as well as fee income from credit cards as well as selling third party products.

Expenses consist of interest expense as well as the expenses related to fee income.

Nu reports its results a little differently from other banks in that it reports its loan loss provisions before gross profit.

Operating expenses consist of all personal expenses as well as all technology expenses as well as support services to run the business.

The key takeaway from looking at the financials is that Nu’s income statement has a lot of slack. It is underearning on revenues as cohorts are not mature, it is underearning on gross margins due to IFRS 9 and paying for deposits and it is underearning on operating margins due to investments in new segments and geographies. It is important to remember that as all these normalize, there is tremendous operating leverage in the business!

Here are the assumptions:

Nu already has a large part of Brazil’s population and is now starting to grow in Mexico and Columbia. We assume that customer adds slow down.

This is conservative. Mexico and Columbia have a combined adult population of 120 mn and if Nu is to get 20% of the adult population then this is a potential of 24 mn clients.

However, with slowing customer adds in Brazil, ARPAC goes up as cohorts mature.

Management believes that their gross profit margins can be in the 60% level. We believe this is a very long term goal. In the next 3 years, while Nu will expand its gross margins, it will not be steep as the loan growth and resulting provisions for personal loans keep a lid on gross margins. When topline growth slows in 2026 and 2027, we can see rapid gross margin expansion.

Management has mentioned that 40% of Nu’s employees are doing work that is still pre-revenue. There is a significant operating leverage in this part of the business and operating expenses should grow much more slowly than gross profits. It is important to note that Nu is profitable in Brazil but has negative net income due to investments in Mexico and Columbia.

With all this, we get a significant acceleration in earnings with an EPS of $0.38 in 2025. At the current share price of $4.4 this is a P/E of 11.6x. Given growth and quality, we should expect this business to trade at 25x earnings at a minimum; giving a value of $9.5 in 3 years - more than double from the current stock price or > 25% IRR.

We can triangulate this by looking at Book Value per share. Nu has a BV/S of $1.2 at present and will have BV/S close to $1.9 in 2025E. On that basis, it is trading at a BV/S of 3.6x at present and 2.3x in 2025E. What should a normalized multiple be on book for a bank like Nu? It is likely to have growth > 20% and ROEs > 20% for the next decade which means that a 5-7x multiple is justified.

David Velez’s compensation award kicks in at $18.69 in 5 years and we have a value (above chart) which is just shy of that number. Perhaps, David has a similar model?

Governance

Nu has two classes of shares. The Class A ordinary shares are entitled to one vote per share, whereas the Class B ordinary shares are entitled to 20 votes per share. David owns a 21% stake in Nu Holdings through class B shares. There is significant skin in the game.

Nu came to the market with an IPO in November 2021 and raised $2.6 bn in class A shares at $9 per share. No class B shares were offered. With this capital, Nu is heavily capitalized and does not need to raise capital to grow.

Contingent share awards - Nu granted an entity controlled by David Velez a share award where he gets 1% of the firm if the shares, over the next 5 years, are higher than $18.69 per share and another 1% if shares are higher than $35.50 per share. This is somewhat controversial in Brazilian business circles which are not used to seeing such awards. David, for his part, has pledged to donate proceeds from this award to his family’s philanthropic platform. He is also a signatory to the giving pledge.

David’s compensation is designed to ensure that it motivates and rewards David and other executives to think long-term with regard to achieving its strategic goals to maximize shareholder value. Executive compensation is also consistent with Nu’s risk management policy and is designed in a way that does not encourage behaviors that elevate risk exposure above the levels deemed prudent in short-, medium- and long-term strategies adopted by Nubank.

The other controversy at Nu was the appointment of Anitta, a pop singer, to the board of directors. She only lasted one year and resigned her position. I am not sure if this was a big marketing tactic or an error in judgment.

“For me, it was a major change. First of all, Nubank didn't limit itself to Brazilian people. They were hiring people everywhere. People at those times, they were not home working. People needed to come to Nubank, to come to Brazil. Since the early days, we had international people in the company. We were having international talent, international minds, sometimes not as biased as Brazilians with our banking systems.”

- Nubank, Ex-Product Marketing Manager (Stream Transcript)

For its part, Nu Bank is the most ‘international’ of Brazilian financial institutions with talent from all parts of the world working in Brazil. This is unlike other Brazilian companies such as Stone or Pag Seguro. Also unlike the latter institutions, stock is distributed much more widely at Nu Bank.

Competition

Early in its life, Nubank represented disruption against the big five banks in Brazil. Now Nubank is effectively the sixth, as part of the big six.

Founded just in 2019, C6 already has 7 million clients just 2 years after founding. JPMorgan acquired a 40% stake in the company. Banco Inter is another challenger and has been making moves to become a super app.

Mercado Libre is a prominent player in the space via its Pago division. Historically, Pago has focused on businesses rather than consumers although it seems to be only a matter of time before it more directly encroaches on Nubank's turf. Meli can boast robust IT architecture, a relative abundance of engineering talent, and top-tier leadership.

Our take on competition is that financial services have a large TAM and can support multiple players. HDFC Bank also grew when Bajaj Finance came into force; Sberbank grew even as Tinkoff had become a big part of the market. These firms sometimes help to expand the market itself and financial services is not a zero sum game. While this is something to keep in mind, we do not worry about competition at least for the next 5 years. Like government owned banks in India, the legacy banks in Brazil have a lot of market share to shed!

Risks

Macro

We believe the biggest risk here is an economic cycle. If Brazil is to go through a recession then Nu would be affected. A credit card book is fairly low duration and can contract significantly in a downturn. We believe the opportunity in Nu exists due to this fear. We believe the macro-environment in Brazil is good and getting better. The country has come a long way from the downturn of 2014-16 and then Covid. It is important to remember that Brazil is a commodity producing nation which are facing supply shocks. Due to this, we believe that Brazil will be relatively better off even in a global downturn.

Peers

Nu is often compared to Stone Co as an example of perils of lending in Brazil. Our only response is that Stone was not a risk aware financial institution (i.e. it was a payments Co at its core and not a lender) while Nu’s bread and butter are its data and risk management processes.

Regulation

Some subtle points:

LatAm banks have historically used regulation as one of the biggest barriers to entry for foreigners.

In Brazil, for example, foreigners are prohibited from controlling financial institutions without a formal Executive Order issued by the President.

It took Nu almost 4 years to get a financial institution license and, when it finally got it, Nu was asked to operate with ~40% more capital than local banks (i.e Nu's min capital ratio until 2022 is 14.0% vs 10.5% of local banks.

The local banks, for example, lobbied the central bank to reduce the time credit cards had to pay merchants. This would have taken away Nu’s float and forced it to come up with a lot of capital. Thankfully, the central bank did not oblige.

Nu operates largely as (i) a Payment Institution - for the issuance of CC, and (ii) a Financial Institution - for deposits and credit. In both cases, subject to regulatory capital and compliance requirements equal to or greater than those of local banks.

Payment Institutions do have lower capital requirements than Financial Institutions - they do not take deposits and only put their own equity at risk.

For illustrative purposes, if its Payment Institution and Financial Institution were merged and the resulting entity treated just as a local bank, Nu has ample capital to cover the incremental regulatory base, especially after the IPO.

Pix

Pix is a new government favored payment system that is taking tremendous share in Brazil. It is growing even faster than UPI in India! While this will be somewhat negative for fee revenues on the debit side, it will mean that competition will find it increasing difficult to differentiate itself.

There will always be regulatory changes in Brazil as in any country. Our conviction here is based on the fact that Nu is on the right side of the government and is promoting financial inclusion as well as lowering of interest rates in the country. Nu also has the right cultural attitude to navigate these changes.

Conclusion

Both Vélez and Oleg Tinkov, founder of Tinkoff, found inspiration in Capital One, which had achieved success as a new entrant in the US financial services market in the 1990s. In each of their respective countries, credit cards were an underpenetrated market, with significant potential for growth.

Today, Nu is the 6th largest bank in Brazil and expanding just as fast in Mexico and Colombia as it was in Brazil. Nu has created a moated business in a very difficult market. We believe that we are being very conservative in our estimates and Nu is likely to surprise us to the upside.

Disclosure: The author and his firm has a position in Nu Bank. We may be wrong in our assumptions so we encourage all readers to come to their own conclusions.

If you are looking for an expert network to get up to speed on industries and companies, then we highly recommend Stream by Alphasense.

Stream by Alphasense is an expert interview transcript library that has been integral to our research process. They are a fast growing expert network with over 15,000 transcripts on a wide variety of industries (TMT, consumers, industrials, real estate and more). We recommend Stream for its high quality transcript library (70% of experts are found exclusively on Stream) and easy-to-use interface. You can sign up for a free trial by clicking here.