Value Punks: Year 1 Performance Review

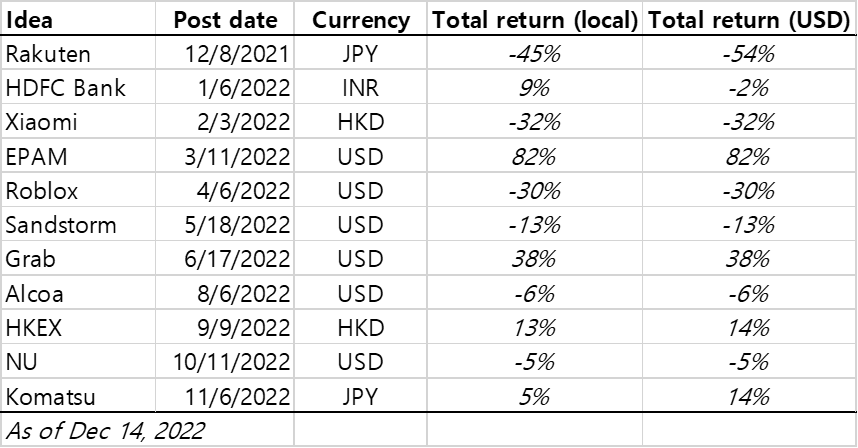

How would you have done if you put $100 into all of our ideas?

We started Value Punks a year ago. Since then, we have written up on 11 ideas. In the spirit of holding ourselves accountable to our writings, in this post we examine our own performance and discuss mistakes and surprises in our first year.

What if you simply invested $100 in every single idea we published during the year? Then you would have invested $1,100 total in 11 ideas throughout the year, (one per month), ending up with $1,106 (0.6% return) as of the date of this writing (December 14). This is an all-in return with dividend and effects of currency included.

Now, if you replicated this strategy with the S&P500 index instead, your total return would have been about -1.6%. That is, if you said “hey screw Value Punks!” and put $100 into the S&P500 index rather than our ideas, every time we released a new idea. Alternatively, if you were fully invested in S&P500 from the very beginning of the calculation period, the returns would have been about -12%. Either way you look at it, we seem to have done okay relative to what we regard as our benchmark.

It should be noted that the focus at Value Punks is always on the long-term compounding of capital - not optimizing for short-term gains. Having said this, we are also believers that the long-term is simply a compilation of short-terms. Our philosophy is to hold ourselves accountable to performance across ‘all’ time periods. While we recognize this may sound even a bit crazy, we believe:

This is the best way to have intellectually honest conversations;

This is still preferable to giving investors the free rein to craft whatever excuses or narratives to justify underperformance (the ‘art’ part of investing refers to investor creativity in wriggling their way out of underperformance); and

We believe eventually investors are better off with this mindset

While our relative performance has been okay so far, this doesn’t mean there weren’t a fair share of mistakes and surprises on the way. So let’s talk about them here.

The biggest detractor to returns was Rakuten, down 45% in yen and 54% in USD. We should spend the most time reflecting on our biggest mistake. The gist of our initial write-up was that we 1) believed strongly in its core of e-commerce and financial services, 2) thought investors were being too pessimistic on the new mobile (telecom) business, and 3) believed Rakuten was significantly undervalued as one of the (if not THE) cheapest established e-commerce company anywhere in the world.

#1 is still true but we were wrong about #2 and #3. The problem is that telecom losses haven’t narrowed as fast as we expected. When it comes to Symphony, there seems to be a lot more self-congratulatory narratives happening compared to tangible growth to show for. But perhaps the bigger issue is funding - Rakuten is more cash strapped than we thought, given sluggish improvements to losses, and they now have to sell parts of their crown jewels (financial services) to keep the business running.

We were too optimistic on the timeline on a new unproven business. We also gave management too much benefit of the doubt, when we shouldn’t have. Mikitani has good intentions and the strategic thinking behind all of this is commendable but we should have discounted management’s execution here more. After all, this should have been clear when looking at their past track record in trying to develop businesses outside of their core.

Perhaps a broader lesson is to use much more caution when management decides to make a “bet the ship” type of investment in a new business area. Rakuten is one, but Meta is also another example this year. Public market investors might be better off by just sitting out of these types of situations. It takes a lot of brainpower to get these right. If you are right, the returns better justify the brainpower spent. And let’s hope that you are right - because if you are wrong, they end up being costly.

The one silver lining is that Rakuten has announced in October that it will sell 20% stake in its brokerage (Rakuten Securities) business for ¥80 bn to Mizuho. This is a terrific valuation (4.4x trailing revenue and 22x EBIT) which underscores the strength and value of the company’s core. If management takes a bigger axe to stem losses or scale back the mobile business, there is a good chance the stock will re-rate. For this reason, the author has not sold the shares, but will not be adding more until the company proves it can be self-sustaining.

Our biggest winner this year was EPAM Systems, which is up 82% since we wrote about the stock back in March. The thesis played out better than the ‘base case’ mentioned in the report. EPAM has executed wonderfully despite a very difficult geopolitical backdrop. EPAM now has about 40% of its employees in Ukraine, Belarus, and Russia - down from 60% and with plans to get to 30% by year-end. This significantly de-risks the thesis and puts EPAM on a sustainable path to grow earnings in the mid-teens for the foreseeable future.

There were also some notable surprises this year. First, we wrote about HDFC Bank earlier in the year, when it was very much against the consensus to be bullish an EM bank (“EM is done”). Since January HDFC Bank has returned 9% in Rupee and -2% in USD, beating the S&P500 even with the USD headwind. Since our writeup, HDFC Bank has merged with HDFC Ltd, its parent company. HDFC’s mortgage book provides stability at the cost of margins. Subsequent earnings reports have validated our thesis that earnings and NPL’s were not at risk.

Another surprise came after we published Hong Kong Exchange (HKEX) in September. When we published, shares were at HK$311 (we made a note of $250 as a potential entry price for investors). A month later, China’s 20th Party Congress dealt an unprecedented blow to investor sentiment. Nobody had predicted a “clean sweep” by Xi! Shares of HKEX immediately dropped to a low of HK$209, and with it China was banished to the realm of being “totally uninvestable” by many investors.

But just as the results of the Congress weren’t predictable, the flipping of narrative came even more unpredictably as investor focus turned to Covid re-opening, policy stimulus, and economic recovery. And with it, HKEX’s share price recovered to $350 as of the date of this writing. The experience here goes to show just how difficult the job of a top-down allocator is, and is one example of why we believe it’s never a bad idea to just maintain a globally diversified portfolio at all times.

Grab being up 38% was also another surprise, although it’s a volatile name and frankly there is still a long way to go in terms of the company proving to investors. But one thing we can say so far is Grab and some of its peers have proved serious about attaining financial sustainability. Grab has delivered its profit target three quarters ahead of schedule, and this is despite a big cash buffer still remaining (more than $5 bn net cash which is 43% of market cap). Management paranoia here is commendable (and much needed).

Reader survey

We would like to ask for your kind help in completing a short reader survey (for both free and paid subscribers). It will take less than a minute, and can be accessed by clicking here

To reward our survey participants, we are giving away two complimentary annual subscriptions for next year in a lucky draw!

The survey really helps us to better understand how we are doing and how we can continue to improve our service.

Conclusion

As we head into our second year, we would like to thank all of our subscribers. Without your support none of this is possible. The quality of our subscriber list humbles us and pushes us to become better ourselves. In our second year, we will strive to add more value and hope to continue to earn your readerships.

If you know of someone who will benefit from our work, any recommendations are highly appreciated!

Best wishes for you and your family next year. Safe and happy Holidays!

Value Punks

Hi, I also bought Rakuten but sold it after a couple of months. The problem with their telco service is that the network quality is so low that many users who got lured by their free first year fee, changed to other providers again after using rakuten for awhile. I’m using rakuten mobile too, and to be honest I would have changed it to Softbank if it’s not because of the ecosystem created by the credit card point system. Unless they could increase the retention rate of the telco users, it would be difficult to expand the business in my opinion.