HDFC Bank: An Update

....and a few lessons from ITC (and other compounders)

HDFC Bank reported earnings last week. The next day the stock fell 8% followed by another 4% the day after. HDFC Bank is one of India’s bluest blue chip stocks with a reputation for being a high quality compounder.

What happened and where do we go from here?

First, some lessons from another life.

Many moons ago, I had coverage of ITC, another Indian blue chip stock, which is India’s largest tobacco (cigarette) company with 80% volume and 90%+ revenue market share - a monopoly in an addictive product. As you can imagine, this is a very profitable business. While most of its profit’s were derived from the tobacco business, ITC also had strong positions in FMCG, packaging, hotels, and agriculture businesses. The management had a reasonably good reputation for capital allocation.

This was a compounder stock that had CAGR’d at 20% plus, but, of course, all those returns came before - and after - I covered the stock!

Fundamentally, I knew the company really well. I knew their operations, I knew their competitors, I knew the informal beedi industry, I had talked to the management and visited their headquarters in Kolkata, and importantly, I was increasingly comfortable with regulations and taxation.

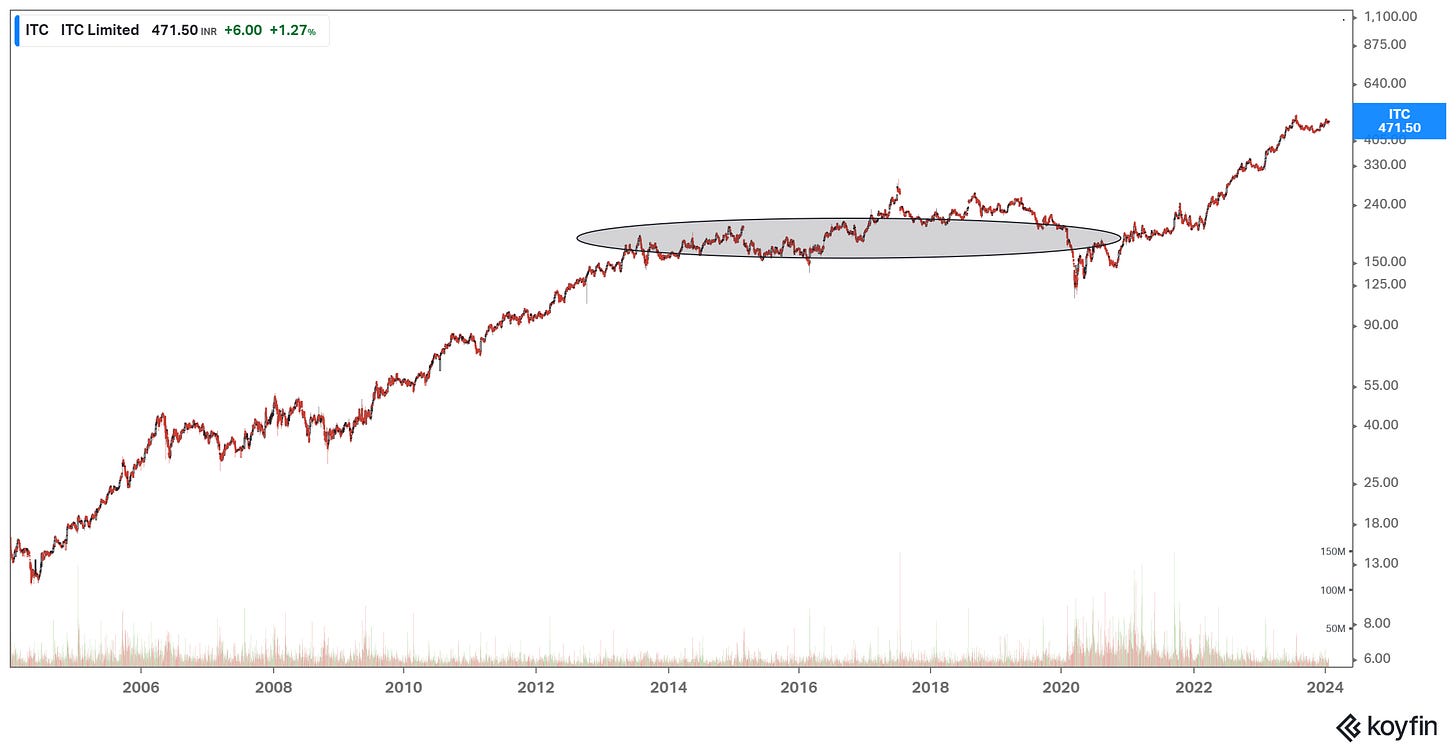

ITC is up 56x (22.3% CAGR) over the last 20 years (my coverage period is circled):

As an analyst who believed that fundamentals are the end all and be all, my recommendation throughout that whole period was to BUY MORE. It fell another 15%? No problem, just add. It fell again - check the model - add - talk to the management - add, add, add.

As we can see in the chart, in the long term, I was not wrong, but in the short term I was very very wrong.

There are some important lessons that come out of this;

One, compounder and good quality stocks can go through long periods of consolidation. It is often during these long periods of consolidations that otherwise intelligent analysts start questioning the quality of the business. It is also often towards the end of these consolidations that new negative ‘narratives’ start propagating and all the ‘weak hands’ exit causing reflexivity. Weak hands just means investors who jumped on the bandwagon because the stock price was going up without fully understanding the fundamentals. It is very important then to bring your best analytical skills to the fore and have conviction in your thesis. An investor also needs to make sure that the quality of the business is not deteriorating between the ‘short term’ and the ‘long term’. You have to be somewhat stubborn in this business…..but how stubborn?

Two, fundamentals matter but only in the long term. As a Buffett and Munger disciple, I believed in the power of fundamentals and looking at things from a longer term perspective. However, one needs to keep in mind that the long term is made of many short term time-periods. In the short term, what matters is things like sentiment, technicals and flows and one should increasingly incorporating these into their investment decisions. In the context of ITC, being a tobacco stock, it faced the challenges of the ESG wave. The stock had to weather several years of selling as funds gradually sold off their holding in ITC.

Three, the marginal investor does not invest until they see momentum in the business and the stock. Most investors want to see a positive catalyst before they invest. In fact, most investors do not want to invest if they know the next few quarters can be tough. Buffett said, ‘You pay a very high price in the stock market for a cheery consensus.” As a value investor it is sometimes difficult to understand but most investors are satisfied in doing just that! However, as value investors the lesson is that sometimes the higher IRR activity is to average up than to average down.

Four, value investing in good quality companies works. This one is obvious but needs to be said. ITC’s earnings were rising even as the stock had flatlined. With this, the stock had become incredibly cheap in 2019/2020/2021. As value investors, our focus shouldn’t solely be on 52-week lows; at times, opportunities arise in stocks that have undergone prolonged periods of consolidation. With this approach, investors can uncover hidden gems that may be poised for inflection.

For the truly long term investor with a lot of conviction in the thesis, these consolidations provide a wonderful opportunity to accumulate stock (HODL?). Then, when the stock experiences an upswing, you have the potential to generate significant returns on a much bigger position.

Why am I talking about ITC in a post about HDFC Bank?

Simply because I see many parallels between the two situations.

We wrote about HDFC Bank in December 2021. We described its natural competitive advantages via its dominating and entrenched position and excellent culture. At that time, HDFC Bank was trading at $65/share. It has since gyrated around that number but, after reporting earnings last week, its share price fell to $55 per share!

HDFC Bank is up 82x (24.6% CAGR) in INR and 50x (and 21.6% CAGR) in USD over the last 20 years:

(for those wondering, yes, India has produced a lot of compounders over the last 20 years!)

However, investors have made no money in HDFC Bank stock since 2019. At the same time, in the last 5 years, its Revenue and Earnings have compounded at 15% and 19%, respectively. Due to this, a bank that used to trade at 25-30x P/E and 3x+ BV/S is now trading at 15x P/E and 2x BV/S.

Is HDFC Bank still a compounder stock?

I encourage readers to delve into our Deep-dive on HDFC Bank (its free for all readers) to grasp the full context of the discussion below.

Since we wrote our deep-dive, the big news to hit HDFC Bank was the merger between HDFC Bank and HDFC Ltd. On July 1, 2023, this merger was consummated. Why this merger happened only after the departure of Aditya Puri? We’ll never know. Also, the merger was announced when Deepak Parekh was still at the helm, but, he too has left the organization! This is….not ideal.

HDFC Ltd. is one of the oldest companies in the mortgage market with a 16-17% market share in India. The business makes low Net Interest Margin (NIM) as the mortgage market is very competitive and HDFC Ltd. is mostly funded with higher cost wholesale funds. However, the business makes a healthy ROA and ROE due to its very low delinquencies and operating costs. HDFC Ltd. prides itself on its sub 10% efficiency ratio which is far better than its competitors.

Overall, we reckon HDFC Ltd. had more to gain from the merger than HDFC Bank as: (a) the mortgage market in India was getting competitive, (b) its loan book was getting very large and the management had to get more and more creative on the funding side, and (c) HDFC Ltd. did not have a deep bench for succession.

HDFC Bank, on the other hand, was making good money from its relationship with HDFC Ltd. It was originating mortgages for HDFC Ltd. (~27% of HDFC Ltd.'s mortgages) and then selecting what it kept on its books. It was also making fee income selling HDFC Ltd. subsidiaries products such as insurance and asset management. Importantly, it was doing all this in a capital-efficient manner. Over time, the bargaining power of HDFC Bank (vs. HDFC Ltd.) on how these economics are shared was increasing.

With HDFC Ltd.’s mortgage book now on HDFC Bank’s balance sheet, HDFC Bank needs to raise lower cost deposits in order to maintain margins (HDFC Ltd. was mostly wholesale funded). Due to this, HDFC Bank’s loan to deposit ratio (LDR) has shot up, its CASA (low cost deposit) proportion is down (38% from 44%) and its liquidity ratios are stretched.

HDFC Bank now needs to raise deposits at a much faster pace than loans and the market is worried. We believe there are fundamental reasons to be cautious:

Deposit growth in India has slowed down. Due to changes in tax policy, Indians are now subject to lower taxes on their stock market investments compared to their deposits. As a result, many households are opting for Systematic Investment Plans (SIP). In this approach, individuals allocate their excess savings to purchase mutual funds on a monthly basis, diverting funds from away traditional banking savings.

In a higher interest rate environment with tight liquidity, most banks find it hard to retain customers in the everyday chequing and saving accounts. This problem is not specific to HDFC Bank but is a problem nonetheless.

Competitors - private banks such as ICICI and public banks such as SBI - have sorted their technology, service, NPL, and management issues over the last 5 years. The free rein that HDFC had in the last two decades is over and, from hereon, competition will be fierce. In fact, recent technology-related challenges faced by HDFC Bank may mean that its systems are now perhaps older compared to its competitors.

Deposit growth for HDFC Bank is somewhat proportional to branch growth. HDFC Bank has 8,100 branches and guided to open 1,000 branches - more than many banks have in total - which is about 12% growth. Also, the newer branches are disproportionally in semi-urban and rural areas. The law of large numbers dictates that, on a percentage basis, the new branches will not be enough to satisfy the beast which has an insatiable need for capital/deposits.

In terms of market share, HDFC Bank is now 11% of India’s loans and 10% of India’s deposits. These numbers are up from ~5% in 2014. In addition to the law of large numbers one also has to question the nimbleness of the institution - not just in terms of mobilizing deposits but also in term of risk management.

The exit of a ‘larger than life’ CEO is always a source of concern. For every Apple, there is a GE! Aditya was a visionary and a task-master - does Shahi have what it takes? It remains an open question. We believe Aditya has left enough for the current management to execute on for the next few years. In addition, they have the huge task of integrating HDFC Ltd.

With the above information, one can comfortably conclude that HDFC Bank’s NIMs will indeed decline.

However, NIM’s are not the most important metric when analyzing a bank - the key is ROE. It is important to recall:

Net Interest Margin (Lending Yield – Borrowing Yield)

+Other Income (Fee income plus gains/losses on balance sheet investments)

-Expenses (people, technology, infrastructure)

-Provisions (loans go bad)

-Tax (government’s share)

=Net Income

ROE = Net Income/Equity

While HDFC Ltd. may reduce HDFC Bank’s NIM, it will likely be ROE neutral in the long term as,

(a) HDFC Ltd. has much lower operating costs,

(b) HDFC Ltd. mortgage book is very stable and requires lower provisions and lower capital,

(c) Merger synergies - both on the revenue (cross-sell + more unsecured) and costs (technology + people) - will help increase revenues and profits.

The key term in the paragraph above is ‘long term.’ The process of HDFC Bank raising deposits, realizing synergies, and integrating systems and processes will take time.

In the ‘short term’, we anticipate volatility, as evidenced by the most recent quarter. This short term, as shown by the ITC case study, can be a difficult time for most stock holders. If this short term is longer then 2-3 quarters then expect new narratives and constant selling by weak hands. Given HDFC Bank’s increasing market share and, therefore, its sensitivity to the economy, long term holders also have to pray for no hard landing between the ‘short term’ and the ‘long term’.

Overall, we do believe HDFC Bank will come out of its current rut. It will likely take longer than most bulls hope but it will likely be not as bad as more bears expect. We base our assessment on India’s growth and HDFC Bank’s advantaged position and strong competitive advantages that we discussed in our HDFC Bank Deep-dive - it a top-tier institution experiencing a transient setback.

In conclusion, HDFC Bank’s future is likely to be 16-18% growth with 17-18% ROE along with some cyclicality. Said another way - where else do you find a business that can grow at 16-18% per year with 17-18% ROE and can do so for a long long time!

Once the current issues are resolved, one can expect some multiple expansion but the real returns over the long term will come from the compounding of earnings.

—

What have I missed? What other lessons have you guys learned investing in compounders?

Disclosure: The author and accounts advised by the author do not own shares in HDFC Bank. This can change at any time. This post is for informational purposes only and we may be wrong in our assumptions and estimates. We encourage all readers to come to their own conclusions.

AlphaSense Expert Insights is an expert transcript library that helps investment analysts maximize returns with access to tens of thousands of high-quality, searchable, proprietary expert transcripts covering multiple perspectives, industries, and markets. Unlike costly and time-consuming traditional expert network calls, AlphaSense drives faster time to insight, improves ROI, and ensures critical information isn’t missed in the research process. You can sign up for a free trial by clicking here.

Having used both HDFC / ICICI as well as SBI for number of years i can vouch that private banks will still keep taking marketshare from public banks. It's not just about upgrading the tech but also customer experience. - no one wants to go to SBI in case they want to transfer the loans from SBI to HDFC

Thank you for the post! Very interesting read!