In the mid-19th century, during the heady days of the California Gold Rush, Levi Strauss found himself in the bustling port city of San Francisco. Levi was a shrewd and enterprising young man, and he recognized the unique opportunity that lay before him as prospectors from around the world flooded into California in search of gold.

One day, Levi overheard a miner lamenting his pants' poor durability in the goldfields' harsh conditions. The miner explained that the typical work trousers of the time were simply not up to the task of withstanding the rigors of gold prospecting. Levi saw an opportunity to address this need and provide prospectors with a more durable and reliable garment.

Drawing on his knowledge of textiles and his understanding of the challenges faced by miners, Levi decided to create a new kind of work pants. He partnered with a tailor named Jacob Davis, and together they developed a pair of sturdy trousers made from a durable fabric called serge de Nîmes, later known as denim. The pants were comfortable, rugged, and stood up to the demanding conditions of prospecting. Levi made a fortune without ever panning an ounce of gold.

"Invest in picks and shovels” is a metaphorical expression and the idea behind this phrase is to invest in the tools, equipment, or services that support an industry, rather than directly in the end product or commodity. Oftentimes, the picks and shovels providers are more consistently profitable than the prospectors - be it the gold mining or pharma and biotech.

We know that the pharmaceutical industry over-earned during Covid. During the subsequent downturn, and as funding dried up, the whole ecosystem saw declining revenues and profitability. The biotech index, as expressed by XBI, is at one of the lowest levels in many years. Interestingly, this is one sector that is truly reflexive. Lower stock prices mean less funding which then leads to cuts in R&D leading to fewer dollars for the picks and shovel providers.

While there are many service providers to the pharmaceutical and biotech industry, the focus of this report is on contract research organizations (CROs). A CRO is a company that provides clinical trial services for the pharmaceutical, biotechnology, and medical device industries. There are different types of CROs, but typical CRO services include regulatory affairs, clinical trial planning, site selection and initiation, recruitment support, clinical monitoring, data management, trial logistics, biostatistics, medical writing, and project management.

Clinical trials have a long history. Generally considered the first controlled clinical trial in modern times, Dr. James Lind sought a viable scurvy treatment. While working on a ship as a surgeon in 1747, he came face-to-face with the condition. Looking for a solution to avoid the high mortality rate of scurvy among sailors, he divided sailors with scurvy into different groups. He had each group follow a particular regimen. During this trial, he determined oranges and lemons (sources of vitamin C) gave the best result, creating a way to keep sailors safe from scurvy in the years to come.

Today, the clinical trial process is complex, convoluted and cumbersome!

Source: James Lind Institute

Here are the major steps:

Preclinical Development:

Objective: Understand the drug's safety profile, metabolism, distribution, risks, and side effects before testing in humans.

Methods: In vitro studies with cell cultures and in vivo studies with animals (rats, mice, dogs, pigs, monkeys).

Outcomes: Identification of potential issues, refinement of the drug candidate, and determination of a plausibly safe dose range for human testing.

Clinical Phases:

Phase I Trials:

Objective: Assess safety, determine an appropriate dosage, and understand the drug's movement within the human body.

Population: Typically involves healthy volunteers.

Focus: Safety and dosage.

Phase II Trials:

Objective: Establish preliminary evidence of efficacy in patients.

Population: Involves patients with the target condition or disease.

Focus: Efficacy and continued safety assessment.

Phase III Trials:

Objective: Confirm efficacy in a larger patient population, collecting robust safety data.

Population: Involves a larger sample of patients.

Focus: Further confirmation of efficacy, extensive safety assessment.

As per the Nature Journal, which reviewed data on clinical trials, the probability of success was 63% in Phase I trials, 31% in Phase II trials, 58% in Phase III trials and 85% during the regulatory review process, for an overall success rate of 9.6% (63% × 31% × 58% × 85% = 9.6%).

History has shown that regulation is necessary to protect patients from unscrupulous firms taking advantage of them with unsafe or useless drugs, but there is a delicate balance to be found. Regulators are incentivized to be risk averse, and it’s hard to fight this general tendency, especially when the general public often supports exercising caution. Before the 1950s, regulation focused on preventing the sale of fraudulent, impure, or adulterated goods, or was limited to specific diseases or products. This led to the passing of the 1938 Food and Drug Act in the US, which required that drug developers submit evidence to the FDA demonstrating the safety of their products before they could be marketed. The roots of the current CRO marketplace can be traced back to the 1940s and 1950s, with the foundation of companies like Huntingdon Life Sciences and Charles River Laboratories. They provided animals for clients to experiment on or conducted the tests themselves in a wide range of scientific areas rather than just pharmaceuticals.

In 1962, the US further amended the Food, Drug, and Cosmetics act to require that drug developers demonstrate efficacy in addition to safety - reasoning that every active drug carries risk, and therefore, risk-benefit evaluations are critical. This increased the need for drug companies to test their compounds systematically.

However, the industry only began to emerge in its present form in the late 1970s and early 1980s. Quintiles, today the largest CRO in the world, was founded in 1982 by Denis Gillings to formalize the statistical consulting work he’d been doing for drug companies since the mid-1970s. The 1980s saw the arrival of a stream of blockbuster drugs, with the first statin and the first SSRI, Prozac, both approved in 1987. But costs in the industry were mushrooming too, providing a niche for the CROs to expand. The 1990s saw explosive growth in the market for CRO services, rising from 4% of R&D spend in the early 1990s to 50% in the mid-2000s. Rising costs and falling productivity, among other trends, drove pharmaceutical companies to outsource an increasing range of functions to CROs in search of time and cost savings. This produced strong growth in the sector until the financial crisis resulted in reduced funding available for biotech companies. Then, after 2013, the industry once again began growing revenues and profits.

The transition from preclinical to clinical phases is a critical juncture in drug development. Once a drug candidate has demonstrated safety and promising efficacy in humans, it can progress in the regulatory process. It's important to note that these phases involve increasingly more significant and diverse human populations to ensure the drug's safety and effectiveness across different demographics.

The most important data collected in a trial is the specific clinical objective known as the ‘primary endpoint’ of the trial, such as improvements in survival or pain severity scales. A failed trial is one in which the drug misses the target level of performance on the primary endpoint1.

The gold standard of evidence for new drugs is the randomized double-blind clinical trial. In this trial, new drugs are tested against a control group receiving the ‘standard of care’ - the conventional treatment for the condition in actual practice, or a placebo if no established standard of care exists. Volunteers are randomly assigned to the new drug group or the control group, and the trial is ‘double-blind’ in that neither the patients nor the clinicians know who is in which group.

Trials are planned with a sample size expected to be large enough to detect a statistically significant drug effect on the primary endpoint if it exists. Typically, regulatory agencies require success (statistically significant improvement in a meaningful primary endpoint) in two independent phase III trials for approval. These activities are both computing and expertise-heavy, complementing already existing areas of strength for many CROs with some newer, more technology-oriented data services.

Once the drug has shown its efficacy and safety in clinical trials, and regulators are convinced it can be manufactured consistently and safely at scale, it will be approved and given a marketing authorization for a specific indication.

In 2022, the industry spent around $200 billion on R&D and the bulk of that spending goes towards clinical trials and associated manufacturing costs; roughly 50% of total large pharma R&D spend is apportioned to phase I, II, and III trials compared to 15% for preclinical work. In essence, the growth of the CRO industry is a function of R&D spend of the pharmaceutical industry which then depends on the speed of preclinical work in established companies and funding for new biotechnology companies.

A late-stage flop in a phase III trial hurts far more than an unsuccessful preclinical mouse study. By the time a drug gets into phase III, the work required to bring it to that point may have consumed half a decade, or longer, and tens if not hundreds of millions of dollars. A typical phase I program with 20-80 trial participants can be expected to be around $30m. Phase III programs, involving hundreds of patients, often require outlays of hundreds of millions of dollars. Clinical trials in conditions where large trials with tens of thousands of patients are standard, such as cardiovascular disease or diabetes, can cost as much as $1 billion.

Clinical trials are expensive because they are complex, bureaucratic, and reliant on highly skilled labor. Clinical trial planning and study start-up include the process of creating the clinical plan and clinical protocol and obtaining the necessary approvals from regulatory authorities and ethics committees. The protocol development process and the clinical study protocol need to maintain compliance with all applicable regulatory requirements.

The more important reason for the decline in R&D efficiency, however, is that it is not enough for drugs to simply be novel and safe, they must also improve meaningfully over the available standard of care, which may include a large number of effective and cheap older drugs.

Increasing sample sizes across the board also means a limited supply of trial volunteers. To get enough patients to fill up large trials, CROs need to conduct trials at multiple sites. The more sites involved in a trial, the greater the logistical complexities involved in coordinating that the protocol is executed appropriately across sites, the data is collected to a good standard, and the drug is distributed to all sites as needed. This all increases costs.

Due to all this, the medical industry has come up with a term called ‘Eroom’s law which is the opposite of ‘Moore’s’ law where productivity declines over time:

Source: Tom Pike MIT Lecture

All this is an opportunity for CRO’s and a key reason they have thrived over the last few decades.

The CRO is hired to plan, coordinate, execute, and manage the lifecycle of the clinical trial, safely and efficiently. With more complexity, the CRO can sell more or differentiated or higher priced services to their clients. With data and technology becoming increasingly important, many CROs are building in-house technology, analytics and data teams to help their clients further.

In some cases, the CRO is hired as a Functional Service Provider (FSP) where the pharma company is dictating how the protocol gets written, how the regulatory documents get submitted to FDA, the whole strategy of how the trial is going to be operationalized - all they need are bodies. They don't necessarily need a lot of strategy and high-level medical scientific thinking, but they need bodies trained in their specific roles. FSP’s are a lower margin business and are big with larger pharma clients who, as I said, are very cash-rich and don't mind spending money on their clinical development programs.

The CRO sector has a lot of similarities with the IT services sector which we have written about extensively (EPAM). Instead of hiring engineers and technologists, CRO’s hire doctors and PhD’s; and instead of offshore delivery centers, CRO’s open sites in various locations in the world both to manage their cost base as well as to satisfy client needs such as recruitment of volunteers and marketability of results in various geographies.

The growth of IT service companies is a function of client IT budgets, while the growth of CRO is a function of industry R&D budgets and R&D funding.

Working with a CRO gives hiring companies access to the most advanced technology and systems for data management, product development, research analysis, and other clinical research services. Clinical research is a rapidly changing industry. It is essential that software and hardware IT capabilities are up to par to facilitate the acceleration of clinical trials while maintaining comprehensive quality control. These are not core areas for a pharmaceutical company and they find it difficult to stay abreast of all the changes constantly. This is no different than an IT services provider that has to help clients with the cloud, or analytics or security or whatever it is that the client needs either to cut costs or to further their business.

Moreover, like the IT services industry which is divided into various verticals, the CRO industry is also verticalized where some CRO’s are known for oncology trials and others are more famous for medical device trials. If a CRO gets business or not can depend on if they have done a similar trial in the past and their relative success. It is difficult for upstarts to enter the industry without a portfolio of proven projects.

While price is always important the other critical requirements for a client are:

Team experience, team chemistry, therapeutic experience, in this area, and relationship to investigators. Can you show that you have done a similar study a short time ago that you have a network of investigators? How familiar are you with the counties, regulations, contract management in these countries for the investigation, contact management and then price?

We’ll go as far as to say that the IT and CRO industries are converging in many ways - traditional CRO’s such as IQVIA and ICON provide data, analytics and technology capabilities to their clients, that was an undertaking of the IT services companies.

“IQVIA, which is IMS and Quintiles together, and remake IQVIA, they sell their data which is international data, so fully global. They are very, very successful at selling that datastory as a reason why clients, both pharma and biotech, hire IQVIA. If you ask me, again, it lacks substance, because ask them to demonstrate with empirical evidence how that data has actually sped up the completion of their trials relative to the standard timelines that exist in ClinicalTrials.gov. then they cannot do it, because it hasn't accelerated them. Regardless, their marketing tool and their marketing team, has been very successful at selling that angle.”

- Former Covance Vice President (AlphaSense Expert Insights)

However, unlike the IT services industry where we see the big becoming bigger without an upper limit for the number of employees, CRO’s have certain limitations. While there are economies of scale and we see the likes of IQV become very big over time, there are limits due client dynamics. While every business in every vertical is a potential client for IT services firms, CROs have a small number of large pharma companies on one side and a large tail of biotech companies on the other side. The large pharma companies may require scale, but the biotech companies may look for service, an attribute that becomes difficult as you scale.

“They'd either specialize in a therapeutic area, they would specialize perhaps in a geographic area, they might specialize in a specific type of service like biometrics or regulatory, those types of things. The mid-sized and certainly the niche CROs, the smaller ones have a degree of specialization that the big generalist CROs don't have, but the big generalist CROs get their money by being huge and being able to execute huge studies.”

- Former Covance Vice-President (AlphaSense Expert Insights)

“On the one hand, you don't need the global footprint, because if you're going to be doing a phase II and a study, depending on the therapeutic area, if it's something like dermatology or something like that, then you can go to a bigger company just fine. A lot of the mid-tiers, though, are really capitalizing on the complexities in the biotech market to really start growing and stealing share from the bigger players because the bigger CROs really can't support the overall complexity and the relationship requirements with the biotech in order to make that really work well.”

- Former Syneos Health SVP (AlphaSense Expert Insights)

An interesting case study of a company that is executing really well on the smaller CRO/Service angle is Medpace (MEDP). Medpace is one of the smaller CRO’s but its margins are 23-24%. They've positioned themselves as the cheaper alternative to the biotech companies. Medpace’s pitch is that they are less expensive than the big six and provide better, more personalized service. Importantly, their footprint is big enough to get phase I and II studies done for most biotech companies. We suspect Medpace’s success also has to do with its strong leadership team and especially its CEO, who owns a large part of the business and cherry-picks the best prospects.

Due to all the reasons we have discussed in this report - increasing R&D spends and declining productivity - the CRO industry is a secularly growing industry.

In the chart below, the industry is reasonably consolidated, where the top 7 companies have close to an 80% market share.

We also see that most of these companies have more than doubled revenues over the last 10 years. Some of that has been due to M&A, but the organic growth in the industry has been at that 5-7% level - R&D growth plus penetration plus inflation. Fortrea has increased revenues from $1.25 bn in 2013 to $2.82 bn in 2023.

Source: TD Cowen

In 2015, Labcorp completed its $6 billion purchase of Covance, a CRO, and predecessor to Fortrea (forward trials with ease). In addition to this, over the last decade Labcorp has made a further series of acquisitions including: LipoScience, Inc., Bode Technology Group, Sequenom, MNG Laboratories, and Personal Genome Diagnostics (PGDx), which has strengthened their position in the market. In 2022, Labcorp announced its plans to spin off its CRO segment, Fortrea. Covanance never thrived within Labcorp due to the very different and cultural dynamics.

“To be completely honest, Labcorp has a very U.S.-centric, very diagnostic lab, very facility analytical equipment focused organization with a low paid workforce, never [understood] the clinical CRO business. Never understood the international piece, never understood the client demands, never understood the high paid salary requirements and the different HR practices that have to be implemented to retain them, never understood or frankly, was not interested in addressing international issues of either its workforce or its clients”

- Former Covance VP (AlphaSense Expert Insights)

It is important to note that even as LabCorp spun off Fortrea, the latter has access to Lapcorp’s data which makes it competitive against someone like IQVIA which prides itself on its data and analytics capabilities.

Here is the history and makeup of Fortrea:

Source: Fortrea presentation

The central thesis at Fortrea is,

Revenue: It should grow revenues with the industry at 5-7%. We do not expect it to gain market share and do acrobatics with its topline.

Margin: Its margins are depressed. While Fortea made a margin of 9% in 2023, most of its competitors made 15-20% margins. Over time, Fortrea should increase its margin

Deleveraging: Fortrea comes with debt. Due to its depressed EBITDA, leverage currently stands 6x - which is very high. All CRO’s produce good amounts of FCF due to which Fortrea should be able to de-leverage over time, turning debt repayment into equity.

The combination of some revenue growth, some deleveraging and a lot of margin growth is very potent where we see 100% plus upside in the stock over a 2-3 years time horizon.

Business & Margin

Fortrea is very well-reputed in the industry for oncology, which is one of the fastest-growing therapeutic areas in medicine (~40% of pipeline). In addition, they are one of the leaders in medical device trials. Furthermore, they have a sizable FSP business with many big Pharma clients. Per our conversations with the company, they are trying to penetrate other areas, such as CNS and diabetes. This is both due to diversification and to balance the ‘burn’ meaning how slow or fast a project rolls over.

Source: SEC filing

“Now that the spin is complete, we are actively assessing our cost base, both for direct costs as well as SG&A and have begun to form our margin optimization plan. With 1 month of actual expenses available, we are continuing our SG&A benchmarking and exploring technology productivity initiatives. We are identifying improvements through sourcing and procurement and are finalizing our TSA exit strategies to replace them with more fit-for-purpose infrastructure. We are prioritizing margin improvement efforts and continue to expect to move towards peer margin levels over time. Turning to customer concentration.”

- Jill McConnell, CFO at Q2 2023 Earnings Call

We know that Labcorp did not invest in Fortrea. Due to this and other factors, Fortrea lost a really big FSP client just before the spin-off. This was a significant setback for Fortrea as it had invested in this project and hired personnel but could not monetize them. This imbalance can only be corrected with time. Operating leverage as revenue grows much faster than costs will help the business increase margins.

This lack of investment is also applicable to other areas of the business such as technology. Now, this is both a positive and a negative. Negative because Fortrea benchmarks poorly in capabilities when compared to its competitors and positive because this gives Fortrea a clean slate on which they can architect their technology. In fact they just hired Cognizant and said the following in the press release; "We're looking forward to bringing Cognizant expertise from across our service portfolio to support Fortrea's goal of providing a seamless digital experience for their customers. We expect this work will help Fortrea achieve a step-change from the legacy systems common across the industry, to a fully digital ecosystem leveraging the latest technology, which should result in better customer experiences and greater efficiency,"

There is a third reason: geographical mix. Labcorp was a US centric company and Fortrea’s asset base is more skewed towards higher-cost developed nations.

These are all significant factors for the underperformance in margins. We do not think it will be easy but we do think it can be done. Management’s job is clear: bring down cost structure, invest in technology and win clients. If they can do all these things then there is no structural reason for why the margins have to be lower than peers.

Source: Starboard Value

“First, we are laser-focused on selling a mix of work that brings higher value to our customers and therefore, higher margins for Fortrea. The combination of increased volumes and better mix will improve operating and overall margins over time. Second, we will need to make further investments to optimize productivity. Third, as previously discussed, we recognize the tremendous opportunity in front of us to reduce our SG&A costs and bring EBITDA margins closer to peer levels, having been launched as a lift and shift spin-off.”

- Jill McConnell, CFO at Q3 2023 Earnings Call

In order to have confidence in the margin improvement thesis, one needs confidence in a couple of factors;: (1) the business which, as we described above, is a secularly growing business, (2) Fortrea’s position in the industry which is solid, and (3) management as this is a very people-centric business and execution is of paramount importance.

Management

Tom Pike ran Quintiles which was a predecessor to IQVIA. He had retired in 2016 and came out of retirement to run Fortrea. Tom started his career with Arther Anderson and then went to McKinsey for a few years. He came back to Arthur Anderson when it was called Accenture and rose to be a member of the executive committee. He was part of the healthcare practice at Accenture.

Tom says that McKinsey taught him how to think and Accenture taught him how to do. In fact, he was one of the key executives that helped take Accenture public in 2001. At that time, he was head of strategy and worked with banks to plan the IPO. It was due to his IPO experience that Quintiles hired him and he eventually took Quintiles public in 2013. Here he did all the things that are now required to be done at Fortrea - executive to win clients and increase margins. Importantly, with his positions at Accenture and then Quintiles, one can only imagine the network he has built in the healthcare industry.

In addition to Tom, other people in management are also very competent:

“He sold Quintiles to IMS, and that's when it became IQVIA, so that's Tom Pike, and then he retired, and he then has come out of retirement to be the new CEO of Fortrea. Other key players at Fortrea are Mark Morais, who's chief operating officer, Jill McConnell, who's the chief financial officer. I do know Mark Morais and Jill McConnell, and they're both very intelligent, very smart, very experienced, very capable, and I have every confidence that they will be able to turn Fortrea into a profitable organization again, at least more profitable”

- Former Covance VP (AlphaSense Expert Insights)

In addition to observing their competence, we also observe that Tom and team got most of their stock after the spin when they had ‘kitchen sinked’ numbers and guidance. Tom Pike received a sign on equity grant of $4 million and then $20 million at spin-off comprised of 30% RSUs and 70% stock options (vesting over three years). After the spin, Tom bought more stock in the open market as the stock sold off.

We believe that the reason for this is:

“My guess and again, complete speculation, but my guess is Tom Pike has, as you said, been brought out of retirement because he was out of the business for a few years, he's been brought out of retirement and told, "You've got from July 2023 to July 2025 to get the EBITDA up as high as you can get it," and at that point, we are going to divest and then a company like Syneos, which is also in enormous trouble , could perhaps merge or part sell. I think that's my complete speculation, that Tom and the executive team has been given those two years to get it as profitable as possible, and then Labcorp will divest and recoup as much of its money as it can.”

- Former Covance VP (AlphaSense Expert Insights)

If true, that would be an awesome outcome!

Numbers

Fortrea has $2.8 bn in market capitalization, $1.6 bn in net debt and $4.5 bn in EV. With TTM EBITDA of $262 mn, Fortrea trades at 17x LTM EBITDA and 6x Debt/EBITDA. While the leverage looks scary, it is important to remember that the EBITDA is temporarily depressed and that Fortrea made a much higher $370 mn in EBITDA in 2022.

Fortrea’s debt is termed out but it is not cheap!

$570 of 7.50% senior notes due 2030

$469 mn in Term Loan A due 2028 (at SOFR plus margin and currently at 7.6%)

$562 mn in Term Loan B due 2030 (at SOFR plus margin and currently at 9.1%)

At the current level of SOFR, this debt will have an annual cost of $125-130 mn which is substantial! If rates do come down as the market is projecting then that will be a mild tailwind to FCF generation.

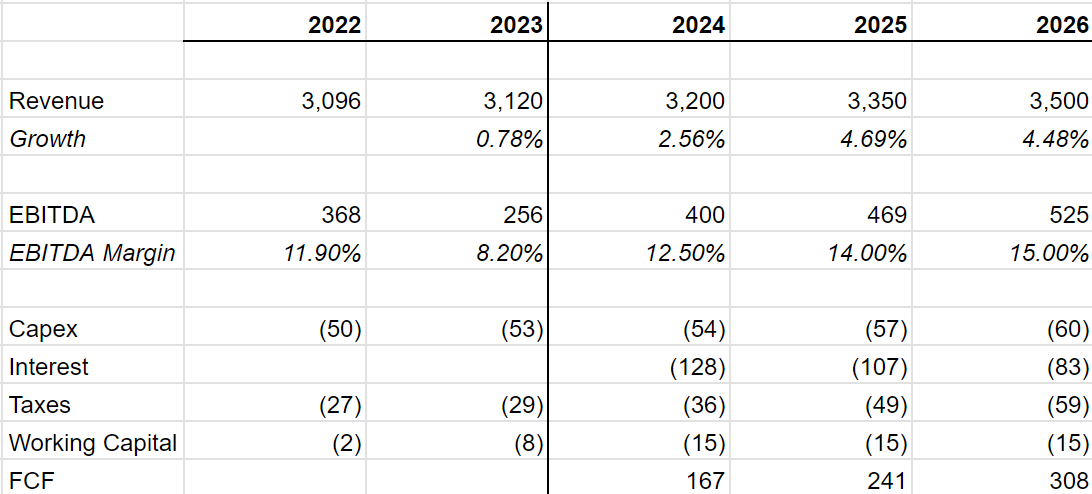

Management has given a guidance of 13% EBITDA margins exiting 2024. Fortrea should increase its margins to 14% in 2025 and 15% in 2025. It is possible that the margins are even higher but we can change our estimates later if need be. For now, we’ll stick to the more conservative estimates.

If our estimates are roughly right then Fortrea will be able to use a lot of its FCF in order to pay down debt and, by our estimates, Fortrea will be left with about $900 mn in debt in 2026. At that time, this business significantly cheapens and will trade at 8x EV/EBITDA.

Peers trade at 12-15x EBITDA. Medpace trades at 18-20x EBITDA. If we assume that Fortrea will trade at 12x 2026E EBITDA then we get an EV of $6.3 bn and equity value of $5.4 bn. Assuming some dilution due to options and 100 mn in shares outstanding in 2026 (from 89 mn in 2023) equity value comes to $54 per share. Compared to the current price of $31.5 - this is a 70% upside.

It is important to note that this valuation is derived from conservative estimates. It is more likely than not that Fortrea’s margin approaches 17% by 2026. If that is the case then the per share equity value with the above assumptions is close to $64 per share - more than double the current market price in about 3 years.

Conclusion

There are cyclical and secular forces due to which growth in the CRO sector should be robust going forward. AI is transforming R&D by applying data science and machine learning to massive data sets, enabling rapid discovery of new molecules. All these molecules will have to go through clinical trials in order to commercialize. We believe Fortrea will see its fair share of this growth.

The thesis, however, rests on margin expansion. In any margin expansion story, the management and their execution capabilities take center stage. The margin thesis take the following form, (1) Operating Leverage as revenues increase faster than costs, (2) further cost cysts as the management team benchmarks their cost base to peers, (3) a brand new technology infrastructure that will help both on the revenue and cost side, and (4) Geographical alignment of cost structure so that more of the cost base is in developing countries.

We believe Fortrea has all the ingredients to turn around the business and position it as one of the premier CRO’s in the industry.

However, it is important to mention that Fortrea is not without risk. For the upside, we are taking on both operating and financial leverage. These are double edged swords! As an example, if margins decline for any reason, be it temporary or accidental, Fortrea may have a hard time with the financial leverage. We have also observed in the past that situations such as these are never straight lines to the end goal.

With Fortrea it is prudent to start with a small weight and, if there are bumps along the way, then add to the position as long as one still has conviction in the business and management.

Disclosure: The author and accounts advised by the author own shares in Fortrea. This post is for informational purposes only and we may be wrong in our assumptions and estimates. We encourage all readers to come to their own conclusions.

AlphaSense Expert Insights is an expert transcript library that helps investment analysts maximize returns with access to tens of thousands of high-quality, searchable, proprietary expert transcripts covering multiple perspectives, industries, and markets. Unlike costly and time-consuming traditional expert network calls, AlphaSense drives faster time to insight, improves ROI, and ensures critical information isn’t missed in the research process. You can sign up for a free trial by clicking here.

Alex’s Blog: The pharma industry from Paul Janssen to today: why drugs got harder to develop and what we can do about it (https://atelfo.github.io/2023/12/23/biopharma-from-janssen-to-today.html)