Mohnish Pabrai, a legendary investor, who recently took a big position in Warrior, commented

‘Let us say there is a company that will produce a billion dollars a year for 50 years and then it goes out of business. It is going to exist for 50 years and it is going to pump out 1 billion a year.

What would you pay for that business? The market was asking me to pay less than 2 billion…. We loaded up on these coal companies. We were buying a billion of cash flow for 2 billion’

Pabrai may be exaggerating here when he says that the coal company will produce 1 billion every year for next 50 years. Further, us investors are not getting the deal today that Mohnish got when he entered the trade last year. But still, we can easily get an average of $0.5B-$0.8B of cash flows for next 10 years, even with an average metallurgical coal price. This equates to approximately $5B-$8B of cash flow in the next 10 years, enabling the company to buy itself out in 6-7 years at the current market cap and investors get years of future production for free.

Of Pabrai's four coal investments, Alpha Metallurgical Resources, ARCH Resources, and Warrior Met Coal primarily focus on metallurgical coal production, while CONSOL Energy produces a substantial amount of thermal coal. Among these, Warrior Met Coal stands out as the only pure-play metallurgical coal company.

Metallurgical coal plays a crucial role in steel production, as it is a key input in the creation of coke, which is essential for the steelmaking process. Steel is essential for economic growth, specially for the less developed economies. Steel is the backbone of manufacturing, construction, infrastructure, transportation and the energy sector. Global Middle class is expected to grow by 2-3 billion people by 2050, mostly in India and South East Asia (SEA). Rural communities are moving to cities driving infrastructure build.

Some may find it counter-intuitive, but if the world were to move to a Low-Carbon World, steel would be a key ingredient for that for its usage in electric vehicles and renewable infrastructure. Crude steel production is expected to grow at ~ 2.5% per year through 2030 as per IEA estimates1.

Coal production can be divided into two types:

a) Thermal coal is used for power generation i.e. to run turbines to generate electricity either to public electricity grids or directly by industry consuming electrical power (such as chemical industries, paper manufacturers, cement industry and brickworks). During power generation, the coal is ground to a powder and fired into a boiler to produce steam to drive turbines to produce electricity.

b) Metallurgical coal or coking coal is used in the process of creating coke necessary for iron and steel-making. Coke is a porous, hard black rock of concentrated carbon that is created by heating bituminous coal without air to extremely high temperatures.

Use of metallurgical coal to make steel

Metallurgical coal plays a crucial role in steel production, as it is a key input in the creation of coke, which is essential for the steelmaking process.

Coke making is effectively the carbonization of coal at high temperatures. Production normally takes place in a coke battery located near an integrated steel mill. In the battery, coke ovens are stacked in rows. Metallurgical Coal is loaded into the ovens and heated in the absence of oxygen up to temperatures around 1,100 degrees Celsius (2,000 degrees Fahrenheit).

In the absence of oxygen, the coal does not combust but instead starts to melt. The extreme temperatures cause unwanted impurities like hydrogen, oxygen, nitrogen, and sulfur to vaporize. These gases can either be captured and recovered as by-products or burned off for heat. Once cooled, the coke solidifies into lumps of porous, crystalline carbon, which are then suitable for use in blast furnace. Properties inherent in the initial input coal heavily influence the ultimate quality of the coke produced. A lack of a reliable supply of individual coal grades means that coke makers today often use blends of up to 20 different coals to offer steelmakers a consistent product.

Approximately 1.5 metric tons of metallurgical coal are required to produce one metric ton (1,000 kilograms) of coke. Now that coke has been made, there are a few methods to get it converted to steel

Making steel with Basic oxygen furnace (BOF)

Basic oxygen furnaces (BOF), which account for 70-75% of steel production worldwide, require iron ore, coke, and fluxes as feed material in steel production.

After the blast furnace is fed with these materials, hot air is blown into the mixture. The air causes the coke to burn, raising temperatures to 1,700 degrees Celsius, which oxidizes impurities. The process reduces the carbon content by 90% and results in a molten iron known as hot metal.

The hot metal is then drained from the blast furnace and sent to the BOF, where scrap/recycled steel (up to 30%) and limestone are added to make new steel. Other elements, such as molybdenum, chromium, or vanadium, can be added to produce different steel grades cand could be cast into semi-finished products such as billets or slabs. This remains cheapest means of steelmaking, with average production cost of $390/tonne2.

China, the world’s #1 steel producer, accounts for >50% world output and uses BOF for 90% of steel production. On average, this method emits 2.32 tonnes of CO2 per ton of crude steel2 – the highest amount of the three conventional steel routes

2. Making steel with Electric arc furnace & Scrap (EAF)

The other alternative process (which accounts for ~20-25% of global steel production) is through an electric arc furnace (EAF). To start the electric arc furnace process, scrap/recycled steel (up to 100%) and/or other iron-rich raw materials are charged into the furnace along with slag forming materials. Next, large graphite electrodes send high-powered electric arcs through the scrap generating temperatures up to 3,000° F. At this temperature, the iron-rich, raw materials melt into liquid steel. The Electric arc furnace is smaller, more efficient and does not require a constant coke supply as it uses electricity as a source of energy. It is the cleanest conventional route, emitting 0.67 tonnes of CO2 per ton of steel. Scrap EAF average cost of production of $415/ton – but cost fluctuates based on scrap and electricity prices2.

While it has lower emissions, its environmental benefits depend on the electricity coming from clean renewable sources. While the EAF process is predominant in U.S. steel production, it remains less common globally. Many international steel producers face challenges such as insufficient scrap steel supplies or a lack of infrastructure to efficiently transport scrap to EAF facilities, making widespread adoption impractical.

3. Making steel with Electric arc furnace & Natural Gas/ Hydrogen (DRI-EAF)

Around 5% of global steel production comes from Direct Reduced Iron (DRI) methods, which are based on direct reduction of iron ore into iron by a reducing gas which contains elemental carbon, produced from natural gas and/or hydrogen. DRI processes are more energy-efficient as they operate at lower temperatures, and have lower operating costs, especially in regions where natural gas is affordable and plentiful. On average, it emits 1.65 tons of CO2 per tonne of crude steel. DRI-EAF is the most expensive conventional production route at $455/ton2.

When DRI utilizes green hydrogen, it offers the lowest emissions among all steelmaking methods. However, the overall carbon footprint depends on the carbon intensity of the electricity used, both for hydrogen production and for running the electric arc furnace. Currently, producing green hydrogen is neither cost-effective nor easily scalable. Additionally, the availability and quality of scrap steel can be a limiting factor, and the process is not suitable for all types of steel.

Types of Metallurgical Coal

Metallurgical coal is classified into different grades based on its quality and characteristics, such as its strength when converted to coke, moisture content, carbon content, volatile matter, and ash levels. The main grades of metallurgical coal include

Hard Coking Coal (HCC)

HCC has the highest rank/quality among metallurgical coals and is characterized by its strong coking properties, high carbon content, and low volatile matter.

Semi-Hard Coking Coal (SHCC)

SHCC (Semi-Hard Coking Coal) has somewhat lower coking properties compared to hard coking coal, with moderate levels of volatile matter and slightly higher ash content. It is commonly blended with hard coking coal to create coke, offering a balance between cost and quality.

Semi-Soft Coking Coal (SSCC)

Also referred to as weak coking coal, it has lower coking properties, along with higher volatile matter and ash content compared to hard coking coal. It is typically blended with hard coking coal to help lower costs in coke production.

Pulverized Coal Injection (PCI) Coal

This is a type of non-coking coal with moderate to high carbon content and low volatile matter. PCI coal is injected directly into blast furnaces to provide additional carbon for the reduction process, helping to reduce the amount of coke needed.

Metallurgical coal can further be classified by volatile matter (VM). VM in coal refers to the components of coal, except for moisture, which are liberated at high temperature in the absence of air. If the VM is too high (mid to high 30’s), its not favorable for use in steel production. Typically, there are three main varieties: low vol coal (0-22% VM) - mid vol coal (22 to 28% VM) and high vol coal (28-34% VM). In addition, metallurgical coals for steel production must be very low in ash (generally less than 10 percent) and sulfur (less than 1 percent).

Global metallurgical coal market

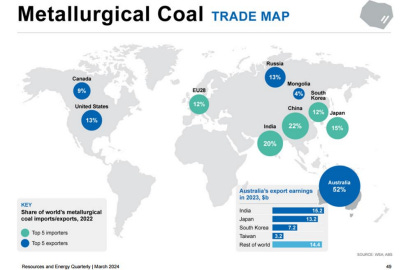

Australia is by far the largest exporter of met coal, accounting for about 50% of the export market in 2022, followed by Russia (16%), the United States (13%) and Canada (9%)3. These four countries supplied over 88% of exports in the highly concentrated met coal market. On the import side, Asian stalwarts dominate the picture with China, India, Japan and South Korea accounting for ~ 70% of the global imports.

Global demand for metallurgical coal reached 317 million tonnes in 2023, growing by 8% from 2022, with India and China drove the majority of this growth. World metallurgical coal demand is projected to rise from 317 million tonnes in 2023 to 331 million tonnes by 2029.

Australia, however, has seen its exports steadily declining since 2019, largely due to major premium hard coking coal producers—BMA, Anglo, and South32—either reducing their production targets or operating at the lower end of their capacity. See figure below3

How does the supply and demand look?

First, let’s discuss supply. Production levels have remained relatively flat over the years. In contrast, global crude steel production, has exhibited slow but steady growth. While steel output dipped during the COVID-19 pandemic, it rebounded significantly afterward, only to decline again recently due to challenging macroeconomic conditions.

This provides a key insight: the metallurgical coal market has been relatively stable in terms of supply, with little indication of significant new capacity being added. This stability can largely be attributed to ESG pressures and hesitancy from financial institutions to back new metallurgical coal projects, both of which have constrained the development of additional supply. We'll explore these factors in more detail later.

If we dive further into global supply, we notice that close to 88% of world production comes from just four countries, and the chart5 below shows that Australia is the only country that is projected to increase its export volumes.

However, Australian companies have been struggling to develop met coal mines due to reasons such as inadequate financing, ESG pressures and increasing coal royalties. The industry recognizes that and has stated that metallurgical and thermal coal producers face growing constraints on availability of finance. However, Australian banks have increasingly sought to pivot away from all forms of coal in favour of renewables and related commodities. Hopes among some producers that metallurgical coal would be unaffected have not been entirely borne out. This is likely to place some further constraint on metallurgical coal investment over coming years.

As financial institutions increasingly move away from coal in favor of renewable energy, a larger portion of funding for coal mine acquisitions and expansions in Australia is now coming from private debt, leading to higher financing costs6.

This in turn reduces the return profile of the met coal projects. Further, in Australia, metallurgical coal producers are subject to royalties, which are payments made to state governments for extracting resources. Royalty rates vary by state but are typically calculated as a percentage of the free-on-board (FOB) sales value or per tonne of coal mined. For example, in Queensland, the rates are progressive, ranging from 7% to over 40% depending on coal prices, with higher rates applying during periods of elevated prices. These royalties represent a significant cost for producers, impacting their profitability, especially when market conditions fluctuate.

The United States, the third-largest exporter of metallurgical coal, is unlikely to see any significant increase in supply in the coming years. Current estimates indicate that only three new met coal projects are in development. The largest of these, the Blue Creek mine, is expected to produce approximately 5 million tons annually. While much of Blue Creek's output is anticipated to be exported, this represents less than 2% of global seaborne export volumes, making a negligible impact on overall supply.

Canada is expected to bring approximately 15 million tons of incremental coal supply online in the coming years7. However, a significant portion of this, around 10 million tons per year, comes from the Fording River expansion, which primarily serves to extend the lifespan of the existing mine rather than adding entirely new capacity.

To summarize, Teck Resources featured a quote8in their investor presentation that effectively highlights the supply situation.

‘Without the addition of confirmed and unconfirmed greenfield and brownfield projects, there will be a significant gap to steelmaking coal demand between 2025 and 2030’

Now lets talk about demand. First off, lets analyze the charts below9.

The chart on the left demonstrates a nearly linear relationship between global steel stock and global GDP. As steel stock (measured in million metric tons) increases, global GDP (in billions of US dollars) rises proportionally. This suggests that economic growth is strongly tied to the accumulation of steel as a physical capital resource, underpinning industrial and infrastructure development.

The chart on the right shows a positive relationship between steel stock per capita (kg/capita) and GDP per capita (real PPP$). Wealthier nations tend to have higher steel stocks per capita, reflecting their advanced industrialization and infrastructure development.

So, it can be positively argued that steel and economic growth grow in tandem. Going forward, with all of the infrastructure spending in developing countries, met coal will find itself to be in demand. Even in the developed countries, all of the spending regarding renewable growth to arrive at net zero by 2050 requires steel, which in turn requires met coal. As discussed in a section later, the alternatives for met coal are simply not there yet.

Diving further into demand distribution (see table below)10, India is projected to be the key driver of metallurgical coal demand, largely due to its reliance on steel production via the blast furnace method. Recent trends support this outlook, with India’s metallurgical coal imports reaching a six-year high of 31.7 million tonnes in the first half of 2024, a 9% increase year-over-year. This follows imports of 27.7 million tonnes in 2022 and 28.8 million tonnes in 202311.

The projections also indicate that India’s rising steel production will roughly compensate for the decrease in steel demand from China over the coming decades.

Cost curve

The cost curve is essential for understanding competitiveness in any commodity based industry like coal because a company’s position on the curve determines its resilience in fluctuating markets. Companies on the lower side of the cost curve benefit from lower production costs, allowing them to remain profitable even when coal prices decline. During such periods, high cost producers may find it unprofitable to continue production and are often forced to reduce output or exit the market entirely. This creates an opportunity for more cost-efficient producers, who can continue to operate profitably, to fill the supply gap and potentially gain a larger share of the market. In contrast, producers on the higher-cost side of the curve are more vulnerable to price drops, as their breakeven points are higher, making their operations uneconomic during prolonged periods of low prices. Looking at the global cost curve for met. coal in the chart below12, we see that Australian companies occupy a significant portion of the low-cost end of the curve. Other countries, such as Russia, the US, Canada, Mozambique, and Mongolia, also contribute to the global supply, but their costs vary widely.

Hence, it is expected that companies with breakeven or cash costs lie below $150/ton stand to make money. This is because the Australian Premium Low Volatile (PLV) coking coal index, generally considered the benchmark index, while exhibiting significant volatility has averaged around $150/ton for much of the previous decade13. Current price is around $200/ton, so most premium coal producers are still in the money.

Are there alternatives present for replacing met coal

If we were to replace metallurgical coal, that means we’d have to start making steel with EAF process. There are a few major reasons as to why its hard to replace metallurgical coal.

1) Scrap availability and quality

Scrap steel refers to steel that has either reached the end of its useful life (known as 'post consumer scrap') or has been produced as waste during the manufacture of steel products (known as 'pre-consumer scrap'). Despite the term "scrap" suggesting waste, it is actually a valuable raw material used in steelmaking. Each year, around 65015 million tons of scrap are used in steel production, compared to approximately 1.9 billion tons of crude steel produced annually14.

Using scrap steel has benefits, including waste reduction and lower energy consumption. However, it also presents challenges, such as impurities like copper and lead, inconsistent quality, and contamination from oils or coatings, which complicate processing and increase costs. Additionally, high-quality scrap steel may be limited in some areas, and the energy required for sorting and melting can diminish energy savings.

While theoretically all new steel could be produced from recycled scrap, this is not currently feasible due to the limited availability of scrap. Steel products have long service lives, ranging from a few weeks for packaging to up to 100 years for infrastructure, with an average lifespan of 40 years. This delay between steel production and recycling, combined with increasing steel demand, makes a complete shift to scrap-based production unlikely in the near future. The current increase in steel demand outpaces the rate at which scrap becomes available, with all collected scrap already being recycled and future increases in availability depending on future post-consumer scrap. India is currently the world's second-largest producer of crude steel and is projected to be the fastest-growing steel manufacturer through 2050. The Indian government is looking to double steel production capacity to 300 million tonnes by 2030 with nearly all of its existing and future steel production capacity is based on basic oxygen furnace (BOF) technology. Since metallurgical coal is the cornerstone of BOF process, its demand is expected to remain resilient in the long term.

As discussed above, environmental concerns are the primary criticism of metallurgical coal use, as the steel sector accounts for around 7-10% of global GHG emissions and is considered a difficult sector to decarbonize. In addition to using Direct Reduced Iron (DRI) with renewable hydrogen, Carbon Capture, Utilization, and Storage (CCUS) is another technology gaining interest for reducing emissions. While not a direct substitute for metallurgical coal, CCUS technologies capture carbon emissions from conventional steelmaking and either store them underground or use them in other industrial processes.

2) Limited scale of EAF

The second factor is the importance of scale. Large blast furnaces can produce up to 4 million tonnes of steel annually, whereas the average output of an EAF is around 1.5 million tonnes per year2.

During a country’s development phase, a steel industry centered around BOF technology enables higher production volumes and economies of scale to meet growing demand, as seen in China. Transitioning from blast furnaces to EAFs would inherently result in a reduction of local steel production capacity.

As seen from the above discussion, metallurgical coal will be hard to replace. Now, we need to find companies that have the highest current and future leverage to high grade metallurgical coal i.e. hard coking coal. And this is where Warrior Met Coal comes into play!

Warrior Met Coal

Warrior Met Coal (NYSE: HCC) is headquartered in Alabama, where it operates two underground mines. Warrior is a major producer and exporter of hard-coking coal (HCC). It operates highly efficient longwall systems in its underground mines located in Alabama. The HCC extracted from Warrior's Blue Creek coal layers is characterized by very low sulfur content and excellent coking qualities. These premium attributes make Warrior’s HCC an ideal base feed coal for steel manufacturers.

Warrior’s advantages

Warrior has lots of things going for them.

a) Warrior processes its coal at their own facilities, with both mines, including Blue Creek, located just 300 miles from their export terminal in Mobile, Alabama. The company has a cost advantage for deliveries to Europe based on a two-week transport time vs five weeks from Australia, which is the world’s largest coal exporter. This close proximity, paired with flexible logistics (railroad + river transport), gives them a significant cost edge compared to other U.S. competitors.

b) Coal quality directly affects how closely the realized price per ton matches the underlying index. Warrior’s coal, characterized by low sulfur, low-to-medium ash, a range from Low Vol to High Vol A, and strong coking properties, is of high quality, allowing them to achieve price realizations that are typically about 98% of the index price.

c) Warrior has adopted a variable cost structure, where royalties are based on a percentage of the realized price, adjusting with price fluctuations. This approach significantly reduces the cash cost of sales when prices decline, while effectively capping costs in higher price scenarios. Consequently, HCC was able to maintain positive free cash flow even during the COVID-19 downturn, when prices dropped to $113/ton in 2020.

d) Warrior’s coal is mined with a process called ‘longwall mining’. Longwall mining is an efficient underground coal extraction method that removes large sections of coal in a single slice, offering higher productivity and safety by eliminating blasting. It recovers more coal than other techniques but requires significant upfront investment, with delayed revenue. While not all coalbeds are suitable, the higher productivity of longwall mining is crucial in managing the cyclical nature of coal as a commodity.

Production and Reserves

As of year end 2023, Mine No. 4 and Mine No. 7, the two operating mines, had approximately 82.9 million metric tons of recoverable reserves and the undeveloped Blue Creek mine contained 67.6 million metric tons of recoverable reserves. Based on last years production rate i.e. ~7 million metric tons per year (2021 and 2022 production numbers were affected from COVID related demand disruptions), we can see that Warrior has approximately 25 years of recoverable reserves remaining. In addition, Warrior owns and leases another 150 million metric tons of potential reserves that can be explored and developed in the future.

Revenue Breakdown

More than 99% of the revenue is generated through sales to international customers. Revenue has also been shifting from Europe to Asia and South America in the recent years as seen in the picture below. This is expected with most of the future steel growth to come from developing nations like India and China. While this trend has changed, margins have stayed relatively stable, so there is no erosion in terms of the market pricing due to changing customers.

Financial Performance

While metallurgical prices have been volatile through the last few years, Warrior has always been free cash flow positive. This speaks to the operational acumen of the management, low-cost mines and financial discipline which is rarely seen in commodity producers. In the despairs of COVID, Warrior was still able to produce free cash flow and payout dividends to shareholders. With the on-going development of Blue Creek, the free cash flow has been temporarily suppressed due to capital expenditures. If the company were not to spend discretionary capital on Blue Creek development, the underlying cash flow in 2023 and 2024 would have been much higher.

In addition, Warrior has plenty of cash on its balance sheet. With a substantial cash buffer ($746 million as of Oct’24), enough to finance the Blue Creek development, the company remains in a strong position to withstand any short-term downfalls in metallurgical coal pricing.

Near term catalyst in the making- Blue Creek Development

Blue Creek is one of the last large scale premium high vol A mines left in the US with a mine life of 40 or more years. A new single longwall mine at Blue Creek will have the capacity to produce an average of 4.8 million metric tons per annum of premium High Vol A met coal over the first ten years of production, thereby increasing the annual production capacity by approximately 60% with further potential of going up to 98% reaching name plate capacity of 17.6M metric tons from 8M metric tons today. Another advantage will be the lowering of the company’s cash costs. Blue Creek’s expected cash cost is $70 per ton, lower than the company’s $80 average per ton. While Warrior already sits in the 1st quartile of low-cost producers, Blue Creek will further push it up among the lowest cost producers globally.

The project cost estimate for Blue Creek ranges from $995 million to $1.075 billion. Around 59% of the CAPEX has already been spent and the remaining will be spent with the significant cash buffer of Warrior. As the plant comes into full operation in 2026, approximately 70% of the remaining spend will happen in 2025 and 30% in 2026, so we will start to see free cash flow substantially increasing from 2026 onwards.

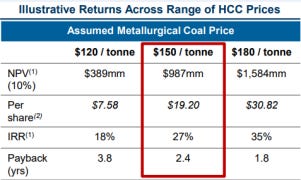

And the projected returns look amazing to say the least! Even at the low end of historical average metallurgical coal price of ~$120/t, last seen during COVID, the project is firmly in the money. An IRR of 18%16 at an extremely low metallurgical coal price is impressive and highly attractive for investors that can remain patient for the next few years.

Commentary on the recent met coal market

Over the recent past, the metallurgical coal markets have experienced significant turbulence, driven by disruptions stemming from the war in Ukraine and economic slowdown in China. Global macro pressures due to high interest rates have played their role in manufacturing slowdown as well which has impacted the price of metallurgical coal. As seen in the past 3-4 years, because the supply of metallurgical coal is so tight, any disruption in supply or demand will cause a sharp surge in metallurgical coal prices.

As the old adage goes, ‘the cure of low prices are low prices’. If prices remain too low for an extended period, higher-cost producers will cease selling, reducing supply and driving prices back up. No one will continue selling coal at a loss for long, specially when most producers have reduced their debts to a very manageable level that they can service it easily. If we look 10 years out, the risks to supply outweigh the risks to demand. ESG considerations with new projects with hesitancy to finance these projects are the prime reason. Further prohibitive regulatory policies and restricted labor availability are a major risk to supply as well. On the demand side, there is very little supply left of premium HCC, most of which is expected to be exhausted by 2030s.

Valuation

Rather than running a complicated DCF, we prefer investments that appear attractive with simple back of the envelope calculations. So, if we do a reverse DCF on Warrior by assuming an annual FCF of $300M, discount rate of 12% and terminal growth rate of 0%, the market is assuming that Warrior’s FCF will decline by ~5% over the next 10 years. However, we established above that Warrior’s cash flow will increase substantially with Blue Creek coming online.

What’s the best way to allocate capital once all the capex spending slows down? As seen in the case of similar companies like Alpha Metallurgical Resources and Arch Resources in the recent past, buybacks can help the share price immensely. Other option is that the management can increase the regular/special dividend drastically. Assuming a modest 70% payout on $0.5B annual cash flow with share count remaining constant, the company can increase its dividend yield from 0.51% today to ~11%. We have seen this before in 2018-2019 when it returned over 50% of its annual free cash flow, primarily through special dividends.

Or, perhaps M&A picks up,

I do think M&A activity on that front is going to heat up over the next year, year and a half, and consolidation, of course, will come naturally with it. You're already seeing that, just look at what Glencore did with Teck in Canada and what you're seeing with Whitehaven in Australia. You haven't seen much of that in the United States other than the CONSOL-Arch coal merger but I do see more of that coming.

- Ex mining Consultant (Alphasense transcript)

On the potential risks to the investment case and the biggest risk is the completion of the Blue Creek project. If the project is delayed or experiences excessive cost over runs, the returns may suffer. Another risk is the sudden adoption of EAF method, either due to carbon taxes on BOF process or a technological breakthrough. Both these risks are less material in the near future as discussed previously.

Conclusion

While metallurgical coal prices could be anywhere in the short run, long term supply/demand balance will drive the thesis As Buffett said ‘Charlie Munger and I always have preferred a lumpy 15% return to a smooth 12%’. To me, this is exactly what an asymmetric bet looks like! A stock at low PE (~8), with FCF catalysts around the corner, and in an industry which either people don’t understand or hate or are bound by ESG pressures. I am reminded of another quote by Mohnish Pabrai, which is quite applicable for Warrior today.

‘Heads, I win! Tails, I don’t lose that much’

Disclosure: The author or the accounts managed by the author do not hold shares in Warrior Met Coal. This can change without giving a prior notice to the reader. This article is for informational purposes only. We may be wrong in our analysis and encourage all readers to come to their own conclusions.