Value Punks: Year 2 Performance Review

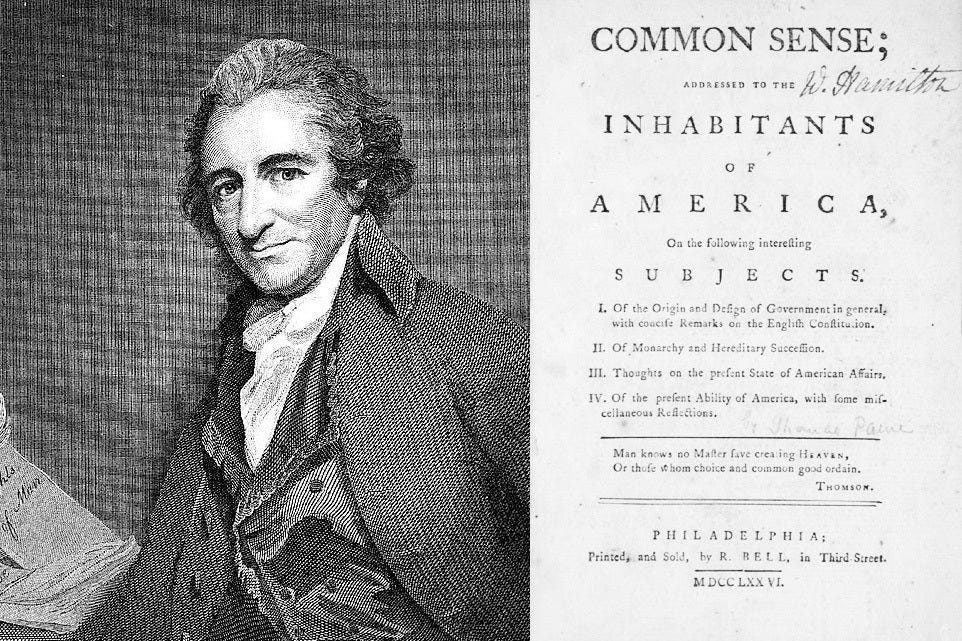

In 1776, as tensions between the American colonies and British rule reached a critical point, Thomas Paine felt a burning desire to contribute to the cause of independence. He penned Common Sense, a pamphlet that would become a literary spark igniting the flames of revolution.

Paine's writing was clear and accessible to the common person. In Common Sense, he argued for the colonies' independence from British rule, advocating for democratic governance and denouncing the monarchy. His persuasive words struck a chord with the American colonists, many of whom were on the fence about breaking ties with Britain.

Thomas Paine's ability to distill complex political ideas into simple, persuasive language stands as a testament to the idea that a well-crafted piece of writing can have an impact.

While we can never imagine to have Paine’s impact, we started Value Punks similarly inspired with the aim to impact our readers - one idea at a time. We strive to:

Distill complex ideas into simple and persuasive language, while cutting out jargon.

Write with clarity of thought so that readers can build conviction in the idea.

Have a ‘common sense’ approach (like Paine) to investing that, we hope, appeals to a broad audience.

Be transparent with our wins as well as losses and engage our readers with good faith.

So far, feedback has been encouraging and this motivates us to keep writing.

However, this is not enough. We work in the realm of financial markets, which is not a simple pursuit of penmanship - we have to hold ourselves accountable for the ideas that we publish.

This post will review our performance both quantitatively and qualitatively. We did the same thing last year, which you can find at: Value Punks: Year 1 Performance Review

Let’s get right into it:

Quantitative performance:

Our methodology remains the same. The questions are:

What if you simply invested $100 in every single one of our ideas that we have written about, on the date we published them?

What if you invested $100 into benchmark indices (MSCI ACWI or S&P500) instead, on those same dates?

To conclude,

You would have invested $3,000 in 30 of our ideas in total. That $3,000 would have turned into $3,557 for 18.6% total return, or ~9% annualized.

If you had done this with MSCI All-country index instead, you would have gotten $3,342 for 11.41% total return, or ~6% annualized. Similarly, S&P500 yielded $3,444, for 14.80% total or ~7% annualized.

But this includes ALL of the ideas we published, which over-penalizes the returns as not every stock we write about is a BUY. In some cases, due to high valuations, we recommended that readers should wait for better entry (e.g. Keyence, Arm) or others where we felt that the business had a large spectrum of outcomes (Warner Bros.)

When we only include names which we communicated were BUYS*, Value Punks returns were 21.4% total or 10% annualized. It’s perhaps worth noting that the outperformance here has been achieved without the “help” from any Magnificent 7 stocks, which we have not written on.

If you’d like to look at the performance in more detail, please refer to the spreadsheet below:

Now let’s turn to a qualitative discussion.

Small caps

Our biggest alpha generation has actually come from two small cap US names - Diversey and Rover (interestingly in a year that’s not been so great for the Russell 2000). Both names were taken out this year at significant premiums, only months after we published on them. The “value” that the acquirers saw in these weren’t distressed value or cheapness in a statistical sense. Rather it was the quality of their business models - dominance of an attractive industry niche, business moat, and improving margins.

If you’re focused on small caps, the one that you might be interested in now is Global Blue, the leader in tourism shopping tax refunds (~70% market share of a duopoly market). In its most recent results, the business has already surpassed pre-Covid peak in sales - this is despite travelers from mainland China remaining at a depressed level. One reason for this is that the business inherits the pricing power of luxury and branded items, benefitting from their inflation - a key attractiveness of their model.

Another development is that Tencent has recently invested in Global Blue. Interestingly, both Alibaba (via Ant Financial) and Tencent are now investors - perhaps a testament to the fact that Global Blue is a true leader with not many competitive alternatives. It’s worth noting that Planet, Global Blue’s much smaller competitor, was sold for €1.8bn in 2021 - twice Global Blue’s current market cap!

Japan

Japan has been good to us. Our posts on the Japanese trading companies are some of the highest visited posts on our site. While Berkshire made a very good investment, these ideas have continued to do very well since we wrote them.

So far we’ve published on Recruit, Keyence, Komatsu, Japanese Trading Companies, and Rakuten. Not only did these ideas do well as a group, but with each of them we explored a different industry and, hopefully, educated our readers on some of the nuances of investing in Japan.

The noticeable blemish for us in that list is Rakuten. In last year’s performance review, we already touched upon the mistake we made. Since then, things have continued to deteriorate. If we were managing a portfolio, we would probably have sold the stock already, but have included it in performance measurements here for the sake of transparency.

A recent writeup - Recruit - has recently received a substantial investment from ValueAct Capital (Do they read Value Punks?) Despite being a very high quality large cap tech name, we feel that Recruit is still under-appreciated by most global fund managers.

Japan is a very deep market of interesting ideas, and going forward, we plan to continue to cover more Japanese companies.

If there are institutional investors reading this post who wants to get to know Japan better, please get in touch with us. We bring 10+ years of experience investing in Japan and can add substantial value to your research.

Xiaomi

Xiaomi has staged a huge rally this year, ending at ~$16 per share which is roughly flat since we wrote about the stock. While there is nothing remarkable about the absolute performance here, it’s worth noting that Hang Seng index (where Xiaomi is the #10th largest constituent) is down 32% over the same period.

What explains the relative outperformance? Xiaomi continues to gain market share. Notably, its smartphone shipment recorded positive growth in the third quarter, even as shipments by Apple dropped 5.5% and Samsung by 8.5% during the same period.

A phenomenon we are seeing more often nowadays in China is consumers “trading down”. This is happening across a variety of categories, and at times favors Chinese domestic products over more expensive foreign ones. But that is not all - there has clearly been much progress in the quality of China’s domestic brands and a change in consumer perception. It’s a topic worth digging deeper.

Our hunch is that some of the top tier multinationals (e.g. Apple, Nike) will continue to do well, while at the same time, many others find that things will not be so easy for them in China. Not because of the usual laundry list of things that management likes to blame (weak economy, geopolitics) - but rather, having to face local competitors that are closing their gap or in some cases even surpassing their foreign counterparts in consumer value proposition.

Nu Holdings

Nu has been one of the more successful ideas we presented. We pride ourselves not only on the writeup itself (which was one of our most popular ones) but we were incredibly lucky to have had Fede Sandler, who was a former IR officer at NU, to review our work. This is a luxury we wish we had for all of our reports!

Since our post, the business has performed better than our expectations. The strategy here is very simple - customer obsession. This customer obsession leads them to use technology, data, and scale to build really good products. By the end of Q3'23, over 50% of Brazil's adult population was part of their customer base. Here, they are introducing new lending products such as payroll lending, insurance, and investments. They have also now entered Mexico and Columbia where they are steadily gaining client accounts.

We believe Nu is still not property understood by investors and at 15x 2025E earnings, the stock is cheap even after doubling from our initial post.

EPAM

The market is slowly coming around to our view on EPAM. In markets, investors sometimes confuse the cyclical with the structural. EPAM as well as other IT services companies are going through a cyclical slowdown as they ‘over-earned’ in the aftermath of Covid. However, with the advent of AI, some investors believed that EPAM and its peers are structurally challenged. We wrote a post when the stock was less than $220 per share refuting the claim that EPAM is an AI loser. In fact, we believe that EPAM is an AI winner! EPAM will keep providing value to clients by acting as a toll road between them and technology - including enabling clients to be AI ready or otherwise helping them with AI/ML.

Resources and commodities

We wrote a primer for oil and gas investing. Initially this post was behind a paywall but it was opened up to all readers recently. As generalists, we went deep into the supply and demand dynamics of oil and gas and wrote a balanced piece on the industry. Oil and Gas is and will always be a cyclical sector and while oil price is flat since our post, our stock ideas have done well.

The other commodity we touched in our writings were precious metals and, specifically, gold and silver royalty companies. The returns here have been essentially flat, but have underperformed the market. We believe they remain cheap and should do well over time.

Guest Reports

We had excellent guest posts this year by Conor O’Kelly on Dollar Tree, Icemancapital on Publicis, and Panoramic Capital on AI.

While most investors were focused on Dollar General, we believe we could provide differentiated insights with a deep dive on Dollar Tree. Conor explores the business model, history, unit economics, management incentives as well as valuation in our two part series. Importantly, he explains the preference for Dollar Tree over Dollar General. It’s one of our deepest of deep dives, and Part 1 is free for all to read!

Publicis is a contrarian idea at the intersection of advertisement and IT. Icemancapital writes eloquently and makes a solid case for an investment where the business quality is improving but where valuation is still very depressed.

Conclusion

As we head into our third year, we would like to thank all of our subscribers. Our subscriber list continues to grow rapidly, and the quality of our readers pushes us to improve and create better work.

If you know of someone who will benefit from our work, please feel free to share this post or any other post that you like.

Best wishes for you and your family next year. Safe and happy Holidays!

Reader survey

We would like to ask for your kind help in completing a short reader survey. It will take less than a minute, is anonymous, and can be accessed by clicking here.

To reward our survey participants, we are giving away a complimentary annual subscription for next year in a lucky draw!

The survey really helps us to better understand how we are doing and how we can continue to improve our service.

*Represents only the authors’ personal opinions and should not be interpreted as investment recommendation.

AlphaSense Expert Insights is an expert transcript library that helps investment analysts maximize returns with access to tens of thousands of high-quality, searchable, proprietary expert transcripts covering multiple perspectives, industries, and markets. Unlike costly and time-consuming traditional expert network calls, AlphaSense drives faster time to insight, improves ROI, and ensures critical information isn’t missed in the research process. You can sign up for a free trial by clicking here.