Deep Dive: Investing in Gold Royalties (FNV, SAND, NSR.TO)

Gold as part of a bottom-up portfolio

As investors, we constantly evolve. When I started my investing journey, I devoured everything written by Buffett and Munger. It all made sense to me because it all made sense to them - and they were my heroes. On gold, Buffett said the following:

“Gold gets dug out of the ground in Africa, or someplace. Then we melt it down, dig another hole, bury it again and pay people to stand around guarding it. It has no utility. Anyone watching from Mars would be scratching their head.”

If you dig deeper, Buffett is really saying that you can exchange your dollars for gold or you can exchange your dollars for a productive asset such as farmland or an operating business. With the latter, you get some yield from the investment with which you can then buy more farmland or operating businesses and thus compound your capital. Snowball. If you buy gold, it provides no income and instead you have to pay someone to store it for you so it, in essence, has a negative yield. Made perfect sense! Hence, I never spent any time thinking about gold or gold linked-investments.

In 2018, I heard this Tony Deden interview on Real Vision. Grant Williams conducts a beautiful long form interview in the Swiss Alps where Tony opens up about his investment philosophy; a large part of which involves owning physical gold as well as gold related equities. When asked about holding gold vs. cash, he said the following:

“This reserve can be in the form of treasury bills, commercial papers, short term bonds or time deposits. The problem with these so-called 'paper assets' is that they are actually debt. So you do not want your liquidity to be somebody else's liability. Physical Gold solves that problem. Gold gives scarcity, permanence and independence from the financial system..no one actually owes you anything when you hold gold. It's not a claim on anything. Has a sense of peace to it as it possesses a financial strength that even some financial institutions can't boast about.”

Reminded me of a JP Morgan quote I had seen a long time ago,

“Gold is money, everything else is credit”

Tony had started buying gold after the GFC. That episode, and the subsequent central bank interventions, shook his faith in the financial system and he wanted an asset that was outside the system. I think it shook everyone’s faith but as soon as the markets normalized and we saw our accounts get back to par, we forgot about the fact that none of the problems which led to the GFC were fixed. The opposite, in fact, occurred. The Fed was now ever so powerful and intervened in the economy on a regular basis to keep its wheels greased.

We have had recurring crises since 1987. In each and every subsequent crisis the Fed has increased its role and interfered to stabilize the system. The consequence of this policy has been that debt in the system has increased and increased and increased some more. Since 1982, bond yields have been declining with a trend of lower highs and lower lows. Every time these yields perk up, there is an ‘accident’ which forces the Fed to intervene with even more easing. In 2019, there was a repo crisis, and the Fed had to fix it with “not QE”. In March 2020, along with the market melt-down, the credit markets came to a halt. Stopped. It was not until the Fed directly intervened in the corporate bond market that these companies could start rolling their paper again.

Lets Invert. Imagine for a moment that the Fed could not get the credit markets to open. Imagine that, American corporations, big and small, could not roll their paper. A lot of astute investors bought these wonderful stocks on dips because they were cheap based on the calculations of earnings power. A question one might ask oneself is - what is this earnings power in a world where you cannot issue or roll over debt? What is the ‘bear case earnings power’ in that situation? Even if you do a well placed purchase of a good quality company with a net-cash balance sheet - what about their customers, their suppliers, their employees? It's all connected! One has to be intellectually honest to admit, no matter how ‘bottom up’ your analysis, that at the end of the day, your whole investment operation is dependent on the Fed!

There is a ‘myth’ out there that gold is speculative or that gold is only for ‘gold bugs’ or people who are waiting for the end of the world. This is not true! We believe gold is an asset that helps hedge a bottom up portfolio against these risks. Gold is not a new addition to a value investor’s portfolio. Jean-Marie Eveillard (and his firm First Eagle) always had an allocation to gold in their portfolios. Here is Jean-Marie in his own words:

“If for whatever reason, things become extremely difficult, I may be running more risk than I thought in my funds. So gold is a nice insurance policy. The 5%-7% weighting would partially offset the hit we would take on equities. Because we know we have partial insurance policy, we feel comfortable when we come up with a security we like. We'll think, "Boy, it's attractive, but we should have some cash." But we don't need to, because our insurance policy is gold.”

Further, we showcase a superior way to get exposure to gold where an investor can obtain the benefits of a hedge while not leaking capital over the cycle.

The Macro Picture

Gold has been money for millennia. It’s malleable, durable, has appealing physical properties, and is long-lasting. Notably, it is one of the most historically consistent assets a person can own. The USD, in its current fiat form, only started in 1971 when President Nixon severed its gold backing. In a Gold standard, a country that is more competitive in trade would sell goods for gold and accumulate more gold (this would then increase the value of its currency thereby bringing the trade balances back into balance over time). The USD was chosen at Bretton Woods in 1944 as it was the strongest economy with the most gold after profiting handsomely in WW2. Until 1971, USD was pegged to an ounce of gold at $35 and all other currencies were pegged to USD.

Governments have always found a way to run deficits and raise debt. Once over-indebted there are only three ways out: austerity, productivity, and inflation. Ray Dalio in his seminal work Principles for Dealing with the Changing World Order observes that the boom and bust of long-term debt cycles has been one of the most distinguishing and constant features of our monetary history, predating centuries and across all societies and governments. The way government’s have been dealing with debts for millennia is the same way they are dealing with debt at present - inflating it away.

When all faith is lost in a fiat, something hard and tangible is needed in order to issue a new currency. This is illustrated below, showing that historically, monetary systems have cycled between three types of money: type 1 (hard money - gold), 2 (claims on hard money), and 3 (fiat). When they fail, history has shown that monetary systems invariably revert back to hard money. For example, China since the Tang dynasty has reverted back to hard money based systems on three separate occasions following regime changes. Another interesting example is Germany, which tried to issue a currency backed by its farmland after WW1 when it had depleted all its gold holdings.

For most people today who have never lived outside of the current financial system, it’s hard to fathom an alternative one. For what it’s worth, history tells us that every single one that existed before us has broken down at some point. The overwhelming point here is that gold is money and it is outside the financial system (and it seems wise to not assume that the current one would last perpetually…although the bet here is not of its demise).

Gold Fundamentals

But, how do you value Gold? What is its intrinsic value? Without these, is it not just speculation?

The simple answer is that gold is a currency and should be valued as such. We can hold the USD as reserves or gold; but why would we pick one over the other?

The characteristics of USD are:

The USD has unlimited supply (the Fed just prints). In fact, 80% of all USD in existence was printed in the last two years.

The USD has a yield. We can invest for 5 years or 10 years in US treasuries at a certain yield that compensates for the time value of my money. Many times, this yield is less than the prevailing rate of inflation leading to what some call financial repression.

We can keep this USD at a bank where it is my asset but their liability. With the US's sanctioning of Russia’s reserves or the Canadian government’s freezing of trucker’s bank accounts means this liability does not have to be honored (First they came for the…..)

The characteristics of Gold are:

Gold has limited supply increase of about 1.5-2% per year on average. There is constant demand for gold from jewelry and central bank purchases.

Gold does not have a yield and in fact demands some costs for safe keeping. For simplicity, let's assume that the carrying costs are zero.

There is no counterparty here. The whole world can go bankrupt or the financial institutions can refuse to pay their claims but one’s claim to the gold is not threatened.

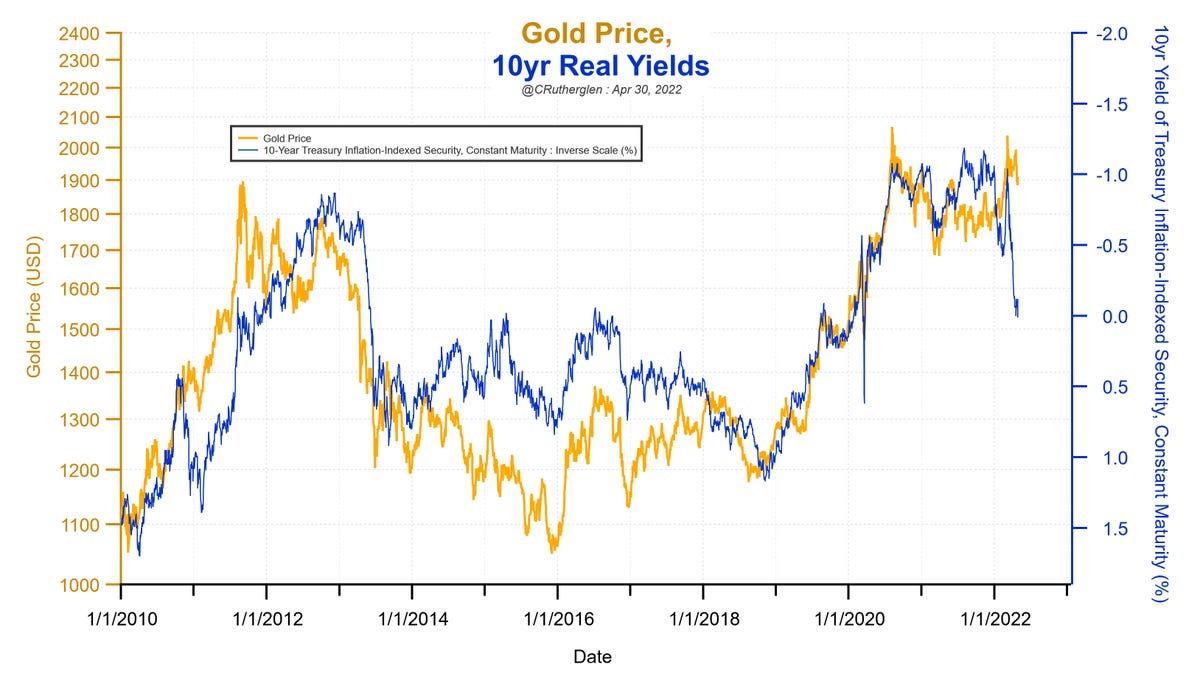

Like any currency, gold moves up and down based on the relative real yield difference. If real yields - yields on a currency’s bonds after factoring in inflation - are positive then there is no need to own gold and one should own that currency instead. However, if the real yield on the currency’s bond is negative, owning gold makes a lot of sense. In this sense, gold can be seen as a zero coupon bond in its own special currency whos supply can only increase 1.5-2% per year. There is a myth that gold is an inflation hedge. It is not! Gold is a financial repression hedge.

Christopher Cole, a hedge fund manager, has written a wonderful paper called the Allegory of the Hawk and Serpent. In this paper, Chris argues that different portfolios are appropriate for different market regimes. The last 40 years have been some of the best for equity and fixed income investors. We have been on a supercycle fueled by demographics, ever declining interest rates, borrowings and spending by both households and corporates, China’s accession to the WTO, cheap commodities, favorable regulations for businesses, and a relative decline in bargaining power of labor. In fact, I would go as far as saying that the Fed’s free money policy was responsible for an industrial revolution led by technology companies. A lot of business models that are taken for granted today would not have been possible if money was not this cheap. What if the last 40 years is an anomaly? What if the market regime shifts again? Is a 100% equity allocation the best path forward?

In fact, Warren Buffett wrote the following in his 1979 letter:

“One friendly but sharp-eyed commentator on Berkshire has pointed out that our book value at the end of 1964 would have bought about one-half ounce of gold and, fifteen years later, after we have plowed back all earnings along with much blood, sweat and tears, the book value produced will buy about the same half ounce. A similar comparison could be drawn with Middle Eastern oil. The rub has been that the government has been exceptionally able in printing money and creating promises, but is unable to print gold or create oil.”

For 15 years - the best capital allocator in the world only just kept up with gold! A barbarous relic that has no utility.

Also, while Berkshire has handsomely beaten gold over its lifetime (and especially since 1980), the last 20 years have also been similar to the 1964-1980 period:

Back to the chart of declining yields for the last 40 years. Currently, market pundits have determined that Fed fund rates need to go above 3%. If the yield curve does not invert and is upward sloping then the yields on 10 year and 30 year bonds will go over their previous highs. This has NOT happened in the last 40 years as each time yields looked up, something broke. If the fed persists in raising rates, then the most likely scenario is - > Fed raises rates - > something will break - > long term yields turn down - > real yields will become more negative. On the other hand, if the Fed does not tighten enough and absolute levels of inflation remain high then too, we’ll also have deeply negative real rates.

We would argue that gold is in a sweet spot and benefits no matter what the Fed does!

Chris Rutherglen (@crutherglen) has done some modeling and finds strong correlations with the growth of M2 (deval of USD) and Real rates (financial repression).

You can pick the starting point that you want but gold has done well in preserving wealth. As per research from Christopher Cole, Gold has outperformed the US equity markets since it was de-pegged by President Nixon in 1971. Gold has also beaten the S&P since 2000. Now, we can use another starting date but that is not the point. The price action of commodities leads to sharp tops and rounded bottoms unlike equities which have sharp bottoms. The panic in commodities (be it Gold in 1980/2011 or Oil in 2007) is on the upside. This means that a patient accumulator of gold has a greater time period over which he/she can accumulate a position at satisfactory prices. A dollar cost averaging approach towards gold would have produced very decent returns compared to the S&P over any time-period.

Further to this, the core characteristics of gold are particularly highlighted during a market event. Gold is seen as a ‘safe haven’ asset. Gold does sometimes go down initially in order to meet margin calls but is one of the first assets to rebound. Here is a chart showing Gold’s performance compared to the S&P during major market events:

Investing in Gold

In 2020, I was in the process of setting up my investment management practice. My background is in bottom up security selection - picking one stock at a time without macro analysis. As argued above, this is a macro heavy environment. There are a lot of things that I do not understand and too many things remain difficult to forecast. Should I not have some ‘schmuck’ insurance in the portfolio? What better way than to own some gold!

My seed capital would come from friends and family. I had to not just think about growing this capital but also preserving it against risks such as fiat devaluation, systemic risks from Fed interventions, or a regime change in the market where equities do not protect purchasing power. A small allocation of gold in the portfolio, I figured, would help hedge against these risks.

Buying physical gold bullion and storing it at a trusted location is the best hedge. I do it at a personal level but as a portfolio manager that manages separate accounts, I cannot do it for clients. The alternative is an ETF such as GLD that issues units based on physical gold in its vault. I personally do not trust GLD and am worried that it may not adequately perform its role when push comes to shove (see LME/Nickel).

Gold miners provide the same upside capture during/after stressed events but are horrible businesses to hold for a majority of the cycle. They are also difficult businesses to analyze. Having said that, it is important to mention that gold mining executives have learned from their mistakes over the last cycle and have significantly cleaned up their balance sheets. These executives are prioritizing capital returns over new capex just like the oil and gas sector. Importantly, high grade ores are in short supply and any incremental capacity that is coming online is of lower grade and higher cost further contributing to the inflationary environment.

My preferred vehicle is precious metal royalty and streaming companies. Interestingly, they also meet my Buffett-esq yearn for yield (and compounding)!

Precious metals royalties companies are businesses that lend capital to a mine in return for a royalty or stream on the precious metals produced from that mine.

There are three arbitrages here:

Mining is a tough business. It takes years to explore for minerals, conduct feasibility studies, and finally build a mine. All these activities require cash with the aspiration that one day the mine will enter production and generate free cash flow. There is a cash flow mismatch. Equity or debt capital are not suitable due to which a royalty or stream is initiated which provides the mine operator capital to explore and build the mine while incurring no cash flow mismatches.

A lot of gold and silver produced is actually a by-product of base metal production. A base metals miner can ‘sell’ its gold and silver to royalty companies in exchange for cash upfront which helps lower their risk and cost of capital on their core business. No extra points for a copper company producing gold.

Investors value royalty cash flows at a much higher multiple compared to operators which has led mining companies to spin-out or sell their royalty portfolios to independent companies.

The precious metal royalty sector is synonymous with Franco Nevada. It is worth highlighting Franco and its origin story in order to understand the sector.

Franco Nevada was founded by Pierre Lassonde and Seymour Schulich in 1982. Seymour had some oil and gas experience and had seen royalty arrangements in that sector. Pierre was a portfolio manager of a precious metals fund in Toronto. The young partners had an interest in Nevada where the last major lode-type gold discoveries had been made some 80 years prior. In 1985, through happenstance, they came across a royalty on 3,416 acres of ground in Nevada. The owner wanted out for $2 mn. The project was eventually taken over by Barrick Gold (then known as American Barrick) which began an exploration program, ultimately delineating what has become one of North America’s largest gold deposits. Franco-Nevada was sold to Newmont in 2003 for $3 billion. It is important to remember that gold prices peaked in 1980 and declined until 2000 and during this time, Franco Nevada was able to build significant value starting with an initial investment of $2 mn. In 2008, Newmont IPO’d Franco Nevada and it became a listed company for the first time. Since its IPO at C$15.20 per share the stock has been a compounder, recently closing at C$180 per share. Even from the gold peak in 2012, FNV stock price is up 3.5x. That original Nevada mine has since produced over $2 bn in cash flow for Franco Nevada - a 1000x return.

A hedge that compounds!

Some basics,

A royalty is usually structured at a percentage of annual production where the royalty company has no other obligation but to deposit the cheque every year

A stream is a contract where the mine operator contracts to sell the precious metal output at a certain price (or a certain discount to spot) to the royalty company

The attractive part of a royalty deal is that it is usually perpetual. This means that if the mining company spends capex to increase supplies from the mine, the original royalty holder gets paid on this additional output! Due to this, there is tremendous optionality to a mining royalty. Importantly, a royalty company is a better inflation hedge compared to a mining company which will have inflation in its labor and equipment.

A royalty company is no different than an asset management company. Long term success of the venture depends on the capital allocation prowess of the management. With loose monetary policy, royalty deals have been written at very low IRR’s or with unfavorable clauses such as buyout provisions. We would argue that there are too many listed royalty companies at present and there is a cycle of consolidation underway.

The mining sector values projects and mining companies on a NAV basis. This makes no sense to us. The NAV is calculated at a discount rate of 5%! The royalty companies are essentially a 10 people operation with a core team that is underwriting investments with the capital they have at their disposal. Due to this operational structure, royalty companies have very high gross and EBITDA margins. Over time, this deployed capital should return cash flow and that is the only way of (a) judging management, and (b) valuing these businesses.

Needless to say, larger companies can write larger checks due to which there is limited competition in that space compared to smaller royalty cheques where IRR’s have compressed to the mid single-digits.

While Franco remains the gold standard (pun intended), there are other companies such as Wheaton Precious Metals, Royal Gold, Triple Flag (sponsored by Elliott) among others that also hold high quality royalties and streams on various mines around the world. These companies that can be owned as a hedge in the portfolio or to outright take advantage of higher precious metals prices with lower downside than gold or miners. For those of who want more torque, something like Nomad/Sandstorm can be considered.

To be clear, all these companies will initially go down with the stock market. The saving grace is that they will come roaring back before everything else.

Nomad/Sandstorm

Nomad Royalty Company (NSR) is a US $400 mn market cap royalty company co-founded by Vincent Metcalfe, Joseph de la Plante and Elif Levesque in 2020. Orion Mine Finance, a large private equity-esq company that is a big operator in the mining sector sold royalties from its portfolio to Nomad and put the management team in charge of growing the portfolio. Over the last two years, the management team at Nomad bought more royalties while at the same time slowly diluting Orion. The Nomad portfolio had a heavy African, and particularly South African exposure due to which it received a large discount compared to peers.

It currently sells about 17,000 GEOs (Gold equivalent ounces) per year but has new mines coming online in the 2024-2026 timeframe where its number of GEO’s sold will go up by 100%. In essence, even if gold price does not go up, Nomad’s revenues should go up by at least 100% in the next 3-5 years and its earnings will grow a little higher as its fixed costs get absorbed with a bigger asset base.

A recurring problem in the sector is liquidity. Generalist investors only buy Franco, or Wheaton, or Royal Gold when they want exposure to gold. Nomad and its smaller peers do not have a lot of liquidity so unless a gold bull market is in its 8th innings, generalist investors are not likely to deploy capital to these lower liquidity securities and this valuation discount persists.

Last month, a mid-tier gold royalty company called Sandstorm Gold (SAND) offered to buy Nomad for shares. In addition to Nomad, Sandstorm is also buying a portfolio of royalties from BaseCore Royalties which is an entity funded and supported by Glencore and Ontario Teachers. You see, everyone has been in the royalty game in the last 10 years.

Sandstorm, a $1.19 bn market capitalization precious metals royalty company was founded in 2008 by Nolan Watson and owns a portfolio of precious royalties. Nolan was previously the CFO of Wheaton precious metals. Sandstorm has gone through a few fund raises as well as a few spin-offs (base metals) to get to its present structure where it is majority focused on precious metals.

After the combination of Nomad, plus Basecore, plus Sandstorm, the combined entity will have a portfolio of royalties on ~300 mines and no mine will present more than 15% of NAV. The combined entity will receive some base metals royalties from Basecore but will spin off these royalties to a sister company and will only keep precious metals royalties.

Nomad shareholders will receive upfront consideration of 1.21 Sandstorm Shares for each Nomad Share held, which implies consideration of C$11.57 per Nomad Share based on the closing price of Sandstorm Shares on April 29, 2022. In total, Sandstorm will have 285 mn shares outstanding after the two transactions (vs. 192 mn at present). As part of the two transactions, we estimate that Sandstorm will have about ~$550 mn in debt on the balance sheet (some directly backed by specific royalties).

The transactions increase Sandstorm’s 2022 production guidance by 22% from 65,000–70,000 gold equivalent ounces to 80,000–85,000 GEOs and increase long-term production guidance by 55% from 100,000 GEO to 155,000 GEOs in 2025.

In a bear, base, and bull scenario the investment can produce the following EBITDA:

Here are the three valuation scenarios:

In our base case scenario, an EV/EBITDA of 20x yields an EV of $4 bn and a target stock price of $12.32 per share

In our bull case scenario, an EV/EBITDA of 22x yields an EV of $5.8 bn and a target stock price of $18.5 per share

In a bear case scenario, an EV/EBITDA of 15x yields an EV of $2.4 bn and a target stock price of $6.22 per share

At the current stock price of $6.35, Sandstorm is a double in the next three years if gold prices hang around. This ‘alpha’ comes from a few sources,

Illiquidity risk - Currently, both Nomad and Sandstorm trade at a significant discount to not only Franco and Wheaton but also mid tiers such as Royal Gold and Triple Flag. This gap should narrow with a bigger Sandstorm. Margins should increase as the same cost structure is now supporting a much bigger business.

Sandstorm plus Nomad have the best near term growth profile of any listed royalty company. The larger peers only grow GEOs by low single digits (FNV just went through a step up in GEOs). With others, there is more of a dependency on gold price increases.

One can of course, buy the entity cheaper by buying shares of Nomad at the expense of liquidity.

Or, forget all this and just buy shares in Franco-Nevada. It is the the most expensive option but has some of the best assets and the best management team in the industry.

Disclosure: The author and his clients have positions in the securities mentioned in this article.

If you are looking for an expert network to get up to speed on industries and companies, then we highly recommend Stream by Alphasense.

Stream by Alphasense is an expert interview transcript library that has been integral to our research process. They are a fast growing expert network with over 12,000 transcripts on a wide variety of industries (TMT, consumers, industrials, real estate and more). We recommend Stream for its high quality transcript library (70% of experts are found exclusively on Stream) and easy-to-use interface. You can sign up for a free trial by clicking here.

I enjoy reading this post so much.

Incredible post, thank you very much