This report was written by Luke Emerson and edited by Value Punks. Luke is a brilliant analyst. We believe he has written THE deep-dive on Disney. If you or someone you know is looking for an analyst please reach out to Luke at Luke.Emerson.CFA@gmail.com

We hope you enjoyed the first part. Following its release, Disney's stock surged by approximately 15% (a correlation that's hard to ignore!), though it has since seen a slight pullback. We attribute this rise partly to the double-digit profitability guidance for its streaming operations provided in the quarter, along with the blockbuster announcement of a sports streaming joint venture between Disney, Fox, and Warner Bros. Discovery. Despite the recent uptick, we remain confident in Disney's potential for long-term outperformance.

A quick recap of our conclusions from Part 1:

The Disney Entertainment division is showing signs of stabilization, with management acknowledging past errors and actively implementing corrective measures.

The decline in the linear segment is concerning, yet the Charter agreement and re-bundling of Disney's services (with other streamers following suit) create a synergy between streaming and linear platforms, expanding the reach of the former while slowing the decline of the latter.

Disney's streaming hand is underappreciated with the (largely) untapped potential of its bundled offerings, ongoing platform integration, and advanced advertising technology.

Disney has yet to fully leverage its unparalleled portfolio of broadcasting rights for live sports in streaming, which could significantly enhance subscriber growth, engagement, and profitability.

The income statement highlights notable inefficiencies. As Disney continues to scale and streamline its operations, the division's profitability is expected to significantly improve. The anticipated crackdown on password sharing in 2024 is also expected to bolster overall profitability.

This report, Part 2, will cover:

The unique value of Disney Parks and Resorts, and why the market is likely underappreciating the potential of the $40 billion earmarked for incremental capacity over the next decade.

The issue of whether Disney has a "parks problem," including concerns about its pricing strategies.

The future of ESPN and the potential for technology or league partnerships.

The impact of Big Tech's entry into sports media and the upcoming renewal of NBA broadcast agreements.

The cultural implications of the "Bob swapping"—Bob Iger's return—and an analysis of the ongoing activist investor situation.

A sum-of-the-parts DCF analysis, outlining key drivers, risks, and mitigants to the investment thesis.

And more.

Parks, Experiences, and Products (37% of FY2023 Revenue)

“Disneyland is an experience involving many moving parts in harmony, like an orchestra. Everything has to be tuned, what you hear, what you smell, what you see, how you see it, the speed at which you assimilate all of that, just like a film, is choreographed.”

– Marty Sklar, the late creative executive, from “The Imagineering Story” (2019)

While watching his daughters enjoy a merry-go-round at Griffith Park, Walt Disney conceived of a place where adults and children could have fun together. While the company excelled at storytelling, venturing into the design and operation of a theme park was unchartered territory. Nonetheless, the project broke ground in 1954, with a hefty investment of $17 million (equivalent to about $155 million today) — a gamble that would have led the company to bankruptcy had it failed.

Disneyland's opening day on July 17, 1955, was broadcast by none other than ABC, which deployed 29 cameras to document the historic occasion — far surpassing the previous record of seven cameras for a live event. The broadcast drew an audience of 90 million across the U.S., setting yet another record.

More than 28,000 people attended the event, nearly triple the park’s official capacity, due to ticket counterfeiting and fence-jumpers. This, coupled with many operational mishaps, prompted the media to crown the event “Black Sunday.” Yet, the public could see that Disneyland was unlike any other place on earth.

"Average working-class people were able to experience a cruise through the exotic jungles of the world, take a romantic journey aboard an authentic stern-wheeled stream riverboat, fly over London as Peter Pan, or even hear the sharp cry of a steam whistle as an 1800s locomotive hauled happy visitors around the magic kingdom."

– The Imagineering Story

Within 90 days, the park’s one millionth passed through the turnstiles, and after a few years, was attracting five million guests annually. Walt, reflecting on the park's conception, said:

“A picture is a thing that once you wrap it up and turn it over to Technicolor — you’re through. Snow White is a dead issue with me. I wanted something live, something that could grow. The park is that. Not only can I add things, but even the trees will keep growing. The thing will get more beautiful every year. That’s why I wanted that park.”

Walt Disney passed away before the opening of his ultimate project, Walt Disney World Resort in Orlando, in 1971. In the years after his death, the Imagineers continued to add new attractions, refresh old ones, and spread the magic around the world with new resorts in Tokyo (1983), Paris (1992), Hong Kong (2005), and Shanghai (2016).

Overview

Disney's Parks, Experiences, and Products (DPEP) division stands as a cornerstone in the company’s asset portfolio. The division encompasses theme parks, resort hotels, a cruise line, guided tours, merchandise, gaming, and publishing.

These assets both augment the returns and lower the break-even on content investments. Their record financial performance is particularly noteworthy against the backdrop of a challenged studio arm and unprofitable streaming operations.

The crown jewel of the division is, of course, the theme parks. Needless to say, the value of these properties transcends their financial contribution: how does one assign a value to a child's awe upon encountering their favorite Avenger, or the thrill of piloting the Millennium Falcon? For adults, they offer a retreat from the mundane, reigniting a sense of youth and wonder — a rare occurrence under any circumstances, let alone at such scale.

Disney’s Magic

“What we love as storytellers is not showing you everything at once. We prefer to give you just a taste — a moment where you’re like, 'Oh my god, look at this building — this is the droid shop, it’s incredible!' Then, as you turn the corner, we present this amazing view — almost like a cinematic reveal. We’re excited because this isn’t the only one. Every time you turn a corner, we paint another reveal for you. We’re always leading you through the scene towards a destination you haven’t seen yet.”

- Chris Beatty, Imagineer

What sets Disney's theme parks apart is their exceptional level of immersion, a result of three key elements: storytelling, meticulous attention to detail, and innovative technology. While the storytelling is universally appreciated, the investment community can often overlook the importance of the latter two.

Attention to Detail

Disney's Imagineers obsess over every detail, considering every component down to the smallest bolt or screw. “If you wouldn’t see something in a film, it shouldn’t be in this land,” one Imagineer stated. However, achieving full immersion goes beyond visual fidelity. While lands like Galaxy’s Edge and Avatar - The World of Pandora are visually striking, the experience also extends to sensory authenticity.

For instance, guests expect the alien flora in Pandora to feel artificial, like plastic. Accordingly, it comes as a great surprise when they feel realistic — and strikingly unfamiliar. Similarly, the unique scents in places like Pandora or Galaxy’s Edge add another layer of immersion.

“They will be able to smell the fragrances that we are going to create. They are going to be able to touch the materials and fabrics. They are going to be able to live this place as if it is real — because it is real,”

-Doug Chiang, creative executive at Lucasfilm.

The believability of these imagined worlds is further enhanced by the interactions with Disney’s cast members. Renowned for their dedication to staying in character, they play a vital role in maintaining the integrity of these fantastical realms.

Technology

At the heart of Disney's strategy lies a commitment to technological innovation. This often involves developing new technologies or combining existing ones in innovative ways. Scott Trowbridge, an Imagineer, illustrates this with the development of the immensely popular Millennium Falcon ride:

“We knew we needed this to be near cinematic quality imagery, rendered at a high frame rate in real-time. That technology didn't exist then. We started down that path, expecting that by the time we were ready to open, it would all work — we didn't know for sure. Months before opening, it didn’t work; it almost worked. It almost worked for a very long time as we fixed bugs, connected one piece of technology with another, and figured out why there was an impediment... But that's what life is like on the cutting edge of technology: you're treading in territory where no one's been before. Yet, we're counting on everything working flawlessly on opening day. That can keep you up at night.”

Moreover, it's crucial that the technology behind the magic remains invisible to guests. As one Imagineer put it, "You have to build the best technology you’ve ever built, and then make it invisible." A standout example is the animatronic Spider-Man at Avengers Campus, performing acrobatic stunts 65 feet in the air, unbeknownst to guests that it's a robot.

Disney's Imagineers have mastered the art of infusing robots with emotion, as seen in the droids that now wander the parks, designed to move and express like a small child. The technology is impressive, but the artistry is so excellent that people don't even notice it.

Operations

Disney's flagship resorts, Walt Disney World in Florida and Disneyland in California, boast the equally distinguished titles of the world's "most visited" and "most Instagrammed" destinations. The company's international operations includes Disneyland Paris (Europe’s leading vacation destination), as well as Hong Kong Disneyland and Shanghai Disney Resort, with Disney holding 48% and 43% ownership stakes in these locations, respectively. Furthermore, Disney licenses its intellectual property to a third-party operator for Tokyo Disney Resort. Disney also operates a beachside resort hotel in Hawaii, “Aulani,” with hundreds of hotel rooms and time-share villas.

In 2023, international operations represented 19% of Parks and Resorts revenue (excluding Consumer Products). There was a 6% year-over-year increase in theme park attendance, with around 126 million visitors globally, though this figure was still below the peak of 142 million in 2019. Hotel occupancy showed a gradual recovery trend: domestically, occupancy rose to 85%, and internationally to 74%, improvements from 82% and 56% in 2022, respectively, yet still trailing behind the pre-pandemic averages of 89% and 82% from 2018-19.

In response to the pandemic, Disney introduced a variety of measures to regulate park capacity, notably an online reservation system. While many competitors have since removed these restrictions, Disney has chosen to maintain operations at approximately 80% of its pre-COVID attendance levels. This decision stems from addressing guest feedback regarding overcrowding before the pandemic and recognizing a decreased post-pandemic tolerance for such conditions.

“It’s tempting to let more and more people in, but if the guest satisfaction levels are going down because of crowding then that doesn’t work. We have to figure out how we reduce crowding but maintain our profitability. And we did that well.”

-Bob Iger

Recent changes, effective from January, include the elimination of reservation requirements on less crowded days and the removal of “park-hopping” restrictions for guests with access to multiple parks. However, the reservation system remains in place to regulate the daily attendance of annual pass holders, who tend to spend less.

Disney Cruise Line

Disney operates an expanding fleet, currently comprising five cruise ships with plans for three more. The line stands out by appealing to a demographic beyond the typical cruise-goer. Josh D’Amaro, Chairman of Disney Parks, Experiences, and Products, highlights that about 40% of Disney Cruise Line passengers wouldn't consider cruising if not for Disney's unique offering. Despite its premium pricing and infrequent promotions, the line achieved an impressive 98% occupancy rate in the fourth quarter. As a result, even though it represents less than 2% of the global number of cruise ships, its share of industry profits is disproportionately larger.

Consumer Products

Disney's Consumer Products division stands as a global leader, holding the title of the world's top licensor and dominating the children's publishing industry. While typically contributing less than 20% to the division's revenue, Consumer Products stands out for its exceptional profitability and economic resilience. This segment encompasses all products sold outside of Parks and Resorts.

Economics

Despite attendance and hotel occupancy rates not reaching pre-pandemic levels, DPEP reported record financial performance in 2023. The division achieved over $9 billion in operating income from $32.5 billion in revenue, yielding a margin exceeding 28%, excluding unusual items.

While admissions are the main revenue stream for Disney Parks, they are unparalleled in their ability to generate microtransactions. Each themed area is replete with a diverse range of merchandise and themed food and beverages, all seamlessly woven into the experience. For instance, Galaxy’s Edge offers guests numerous spending opportunities, from crafting custom lightsabers at Savi’s Workshop to assembling unique droid units at the Droid Depot, as well as themed souvenir drinks like the iconic blue milk from “Star Wars: A New Hope.”

Despite the discretionary nature of theme park visits and significant fixed costs, Disney Parks and Resorts exhibit impressive economic resilience. The only instance of faltering occurred during the pandemic when almost everything was affected. For instance, during and immediately after the Global Financial Crisis, the division maintained an average margin of around 13%, excluding Consumer Products. From 2018 to 2023, excluding the pandemic years (2020-21), domestic Parks and Resorts had an average operating margin of 25.7%, while international operations had an average of 14.4%, climbing to 20.2% in 2023.

Highlighting Disney's robust economic moat, per capita guest spending has surged by 103% domestically and 98% internationally over the last decade, more than doubling the respective Consumer Price Index increases. In 2023, international guest spending increased by 21%, following a 23% rise in 2022 (constant currency), compared to the 3% and 13% growth seen domestically.

Competition

Comcast's Universal Studios stands as Disney's principal competitor in the theme park industry. Similar to Disney, Universal operates parks in Florida, California, Japan (Osaka), and China (Beijing), with an additional park in Singapore. Unlike Disney, however, Universal has not ventured into the cruise line business. Predictably, there is a constant rivalry between the two, with each striving to surpass the other’s latest attraction.

Universal raised the stakes with "The Wizarding World of Harry Potter," prompting Disney to unveil attractions like "Pandora: The World of Avatar" and "Star Wars: Galaxy's Edge." Most industry observers agree that these attractions were better than anything that had come before. While Universal's parks are known for their thrilling and exciting experiences, Disney's parks are celebrated for their enchanting and magical atmosphere.

Domestic Parks and Resorts

In California, both companies’ resorts span approximately 500 acres. However, Disneyland usually attracts double the attendance of Universal's counterpart.

Disney World stands out in terms of size and attendance, covering around 25,000 acres (half of which is utilized), dwarfing Universal Orlando’s 540 acres and drawing nearly six times more visitors.

International Parks and Resorts

In China, both companies have similarly sized resorts at about 1,000 acres each. Universal's other international parks in Osaka and Singapore are considerably smaller at 130 and 50 acres, respectively.

Disney’s international resorts collectively cover approximately 6,600 acres, significantly more than Universal's international presence.

Financials

In 2023, Universal Parks and Resorts saw revenues of approximately $9 billion, an increase from $7.6 billion in 2022. In comparison, Disney Parks and Resorts reported revenues of $28.2 billion and $23.4 billion, respectively, in the same years.

Both divisions exhibit similar operating margins: Universal recorded margins of 25.1% in 2023 and 21.5% in 2022, while Disney posted margins of 24.8% and 21.7%, respectively.

It's important to note that this comparison isn't directly equivalent due to two main factors: Disney’s revenue figures include its cruise line operations, and Universal’s figures encompass consumer products sold outside its parks and resorts.

Growth

“Since the returns have been so strong, why not invest more?”

– Bob Iger, interview with CNBC on Nov 8th

In September, Disney unveiled a substantial investment plan of $60 billion for Parks and Resorts over the next decade. This represents a significant increase in funding, almost doubling the investment of the previous decade in nominal terms and climbing by approximately 45% in real terms (weighted average). Iger has specified that around $40 billion is earmarked for incremental capacity.

Over half of this investment is designated for international parks, with the majority of the expenditure anticipated in the latter half of the decade. Notable recent and upcoming developments at international locations include:

Shanghai Disneyland unveiled its second expansion and Disney's first Zootopia-themed land on December 20th. Exceeding the high expectations set by the movie's popularity in China, this addition concluded the resort's highest year of attendance, with over 13 million guests.

Hong Kong Disneyland is rebounding post-pandemic with a refurbished castle and the new "World of Frozen." While it may not match the scale of lands like Pandora or Galaxy's Edge, the positive reception is promising for future expansions themed around Frozen.

Disneyland Paris underwent a comprehensive refresh and recently opened the Avengers Campus to enthusiastic reviews. Josh D'Amaro, Chairman of Disney Parks, Experiences and Products, has emphasized the significant potential for further expansion in Paris, stating, "We are not even close to being done in Paris."

The investment plan also includes three additional cruise ships by 2025 and 2026, effectively doubling the fleet's capacity. A new port in Singapore, designated as the home port for the Disney “Adventure,” is part of this expansion. “These cruise ships have been very productive for us from an investment perspective, commanding double-digit returns,” D’Amaro revealed.

“There should always be a new reason for people to come and new things to experience,” Walt Disney emphasized. The impact of these investments is significant and often self-promoting, requiring minimal marketing due to inherent media attention.

Adding attractions increases guest capacity and enables more efficient management of visitor flow, enhancing overall visitor capacity beyond the individual capacity of new attractions. Next, we will explore the historical link between capital expenditures and earnings growth to derive a plausible forecast considering these record investments.

While refreshing old attractions and building new ones are key drivers of long-term earnings growth, they are not the only factors. Nonetheless, examining this historical relationship provides valuable insights.

From 2013 to 2022, Parks and Resorts' net capex was approximately $12.3 billion, or $14.7 billion when adjusted for inflation. During this period, normalized operating earnings rose by about $4.2 billion in real terms, yielding a ratio of roughly 3.5:1. Assuming this trend continues, the projected increase in normalized (real) operating earnings could exceed $8.5 billion, more than doubling the earnings generated in 2023.

“The same people who dreamed this up are still dreaming. And that just goes on and on. The next decade is going to be pretty amazing. I think it’s going to be truly revolutionary in what we’re able to deliver to the parks.”

– Jon Snoddy, Imagineer

Over-Earning Concerns

Rising ticket prices at Disney Parks have led to concerns of price-gouging, raising questions about the possibility of over-earning. A Wall Street Journal report in November 2022 highlighted Bob Iger's apprehensions regarding price hikes initiated during Bob Chapek's tenure, which he feared were "killing the soul of the company," as shared with a confidant. On reassuming leadership, Iger reinstated several guest-friendly measures and significantly expanded the availability of Disneyland's most affordable tickets.

In the Q1 2023 earnings call, Iger highlighted the extraordinary demand for the parks, but expressed reservations about trying to exploit it to the fullest, “We could lean into that demand easily by letting more people in and by aggressively pricing. But we don't think either would be smart.”

While Disney implemented price hikes in October 2023, they were not discordant with inflation. These increases affected select admission categories and parking across its domestic parks, most notably hiking prices by over 8% for Disneyland's top-tier tickets. Disney World's hike was modest and only affected annual passes.

Industry expert Don Munsil reflected on the price adjustments, suggesting they aim to manage crowds by incentivizing visits on typically less busy days. Speaking to CNN Travel, he said, “The broader message for the past several years is that Disney is trying to optimize park attendance to get a better experience for people paying full prices and to maximize revenue.”

Clarifying the varied ticket pricing, Munsil observed, “They’d love to get more people in the low season and don’t need more in the high season… I would expect more of this going forward.”

Munsil also highlighted the cost dynamics of operating Disneyland, pointing out that operating costs are nearly the same on both low and high-attendance days. Balancing attendance to enhance profitability is a goal he described as "the holy grail for theme park businesses."

Despite Disneyland's headline-grabbing price increases, Kevin Lansberry, then interim CFO, emphasized the park's continued strong demand during the fourth quarter earnings call, indicating no signs of sensitivity to interest rates or economic factors.

However, while demand remains strong, it's logical to conclude that the record financial performance, despite operating at 80% of pre-pandemic capacity, must be due (mostly) to price increases. My analysis suggests that a typical day at Disney World for the average (middle-income) guest costs about 50% more today than it did in 2017, which is roughly double the rate of inflation.

While guests who are less sensitive to price may appreciate the trade-off of reduced crowding for higher costs, this strategic shift has consistently led to a less enjoyable experience for more price-sensitive guests. Although the financial performance of the parks clearly shows that guests are currently willing to absorb the increases, this could have longer-term implications for Disney's brand perception.

Sports (19% of FY2023 Revenue)

"We were thinking we had the greatest idea in the history of the world, and we've got to guard it really carefully because people are going to want to steal it from us. It took us a little while to realize that most people were going to laugh at us when they heard it, so eventually, we got over that initial paranoia."

– Bill Rasmussen, co-founder of ESPN, from “Those Guys Have All the Fun” (2011) by James Andrew Miller

In 1978, Bill Rasmussen, a 46-year-old former communications manager for the Hartford Whalers, saw his dismissal as an opportunity to pursue a dream. Teaming up with his son, Scott, and friend, Ed Eagan, the trio embarked on creating a local sports cable channel in Connecticut despite their unfamiliarity with the cable TV industry.

Their initial pitches were met with skepticism and ridicule, primarily due to high costs. Undeterred, they decided to explore satellite communication as a possible solution, following a friend’s suggestion. This led them to the RCA Corporation and Al Parinello. The Rasmussens, knowing nothing about this new technology, were stunned when Parinello informed them that they could send a satellite signal around the country at less cost than sending those same signals around Connecticut via landlines.

Fortuitously, the Rasmussens were able to secure the transponder at a bargain rate, as Parinello had struggled to sell this mysterious new technology.

“RCA had launched a satellite called SATCOM 1, but no one understood that this thing was real, that it actually existed. Think about it: you couldn’t see it, you couldn’t touch it, and there was no way to demonstrate that it was really up there, 22,300 miles above the equator,”

-Parinello

The Connecticut-centric approach was promptly replaced by a more ambitious plan: broadcasting sports 24/7 around the country, a concept that many, including HBO’s CEO Gerald Levin, found absurd. Equally groundbreaking was their idea of a nightly half-hour sports news show, given that sports had only ever been a minor component of news coverage.

Another stroke of luck brought tentative financial backing from the Getty Oil Company, boosting the network's credibility. As Miller observed, “Fortunately, the name Getty carried clout, and it helped them get taken seriously by the NCAA, at the bargaining table, and elsewhere. Rasmussen was, in fact, cleverly playing both sides against the middle: he convinced the NCAA of the network’s importance by dropping the name Getty every chance he could and the Getty hierarchy to be more generous every time by dangling the prestigious acronym NCAA in front of them.”

The NCAA agreement was crucial for the network's initial launch and its eventual success. The 1979 tournament was particularly thrilling, climaxing in a final showdown between Indiana State’s Larry Bird and Michigan State’s Magic Johnson — drawing an audience of over 24 million. This event significantly boosted college basketball's popularity and heralded the start of professional basketball's golden era.

The half-hour sports news program previously mentioned was also vital. Chet Simmons, former ESPN president, often reminded his staff, "We don't have the NBA, the NHL, MLB, and so on, but someday we will — someday we'll be on par with NBC, ABC, CBS. But what we do have is something they don't — and that's SportsCenter." The show swiftly emerged as the destination for sports fans every evening at 6:30.

SportsCenter was cost-effective to produce, appealing to advertisers, and perfect for filling gaps between live sports events (replayed throughout the day). This approach also increased the visibility of various sports leagues, which feared being left out of the program. This, in turn, afforded ESPN significant negotiating leverage, enabling the acquisition of sports broadcasting rights at below-market rates. That freed up more resources for reinvestment in programming and talent, creating a virtuous, self-reinforcing cycle that created one of the most successful media enterprises in history.

ESPN Today

ESPN had a near-perfect mousetrap in its initial decades, so much so that, up until the 2010s, the network produced more cash flow than the parks and studio businesses combined, according to former network president John Skipper (2012-2018).

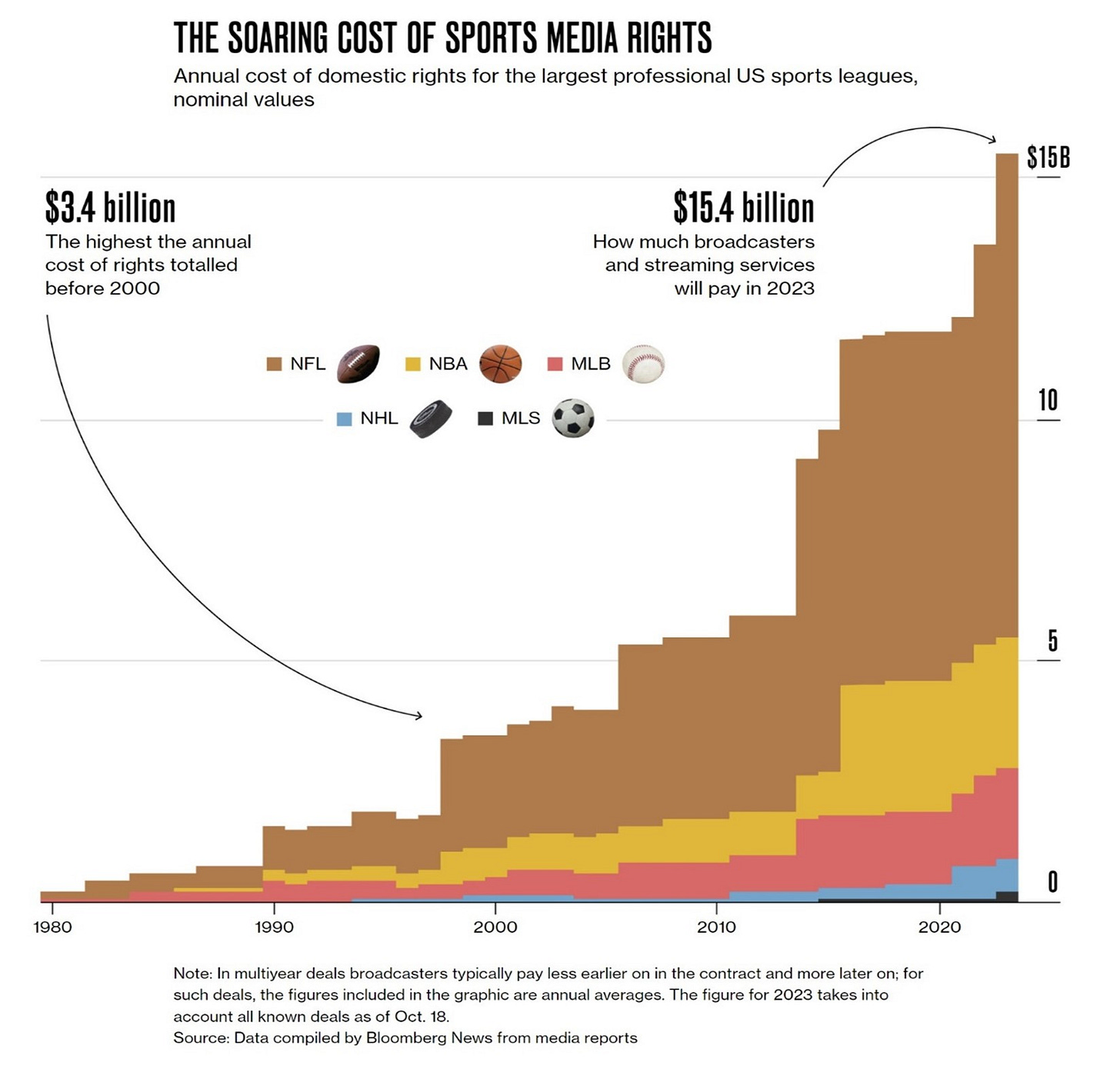

However, times have changed. With (nearly) everyone carrying a smartphone, we don't need to turn on the TV or radio for the latest sports news anymore. Furthermore, with social media overflowing with game highlights, highlight-based programming like SportsCenter doesn't hold the same significance as it once did. Given these factors, along with rising sports media rights costs and the trend of cord-cutting, it's understandable why some speculate that the network is facing its twilight.

So, what's keeping ESPN in the game even as the old business model is under seige? It boils down to a few key reasons, all rooted in the network’s scrappy beginnings.

"ESPN was a funky little seat-of-the-pants operation when it started in 1979, in a town so dull [Bristol, Connecticut] that people worked 18-hour days to avoid dying of boredom outside… Those people spend their days and nights talking and thinking about sports."

- James Andrew Miller

This ingrained cultural work ethic, highlighted by both insiders and observers, continues to be a defining feature of the network. Jimmy Pitaro, who took over as ESPN’s president in 2018, reaffirms this: "I'm really fortunate that I inherited a culture at ESPN where people work really hard. Really hard."

ESPN's marketing engine is another vital component of its continued success. As Pitaro points out, “It’s the megaphone, our studio programming, how we’re 24/7 getting behind a league to drive awareness and affinity, what we’re doing on socials, [online], and the app, the quality of our production.” It's like oxygen – its absence is deeply felt, as some leagues, such as the NHL, have discovered the hard way.

Moreover, ESPN has adeptly navigated the very disruptions that have challenged traditional media. Today, ESPN is the top-followed brand on TikTok with around 45 million followers, surpassing the NBA, NFL, MLB, and NHL combined.

"We can't just expect that sports fans are going to visit our owned and operated properties, meaning our website and app. We need to treat these [social media] platforms like entertainment, not marketing. We should create content and experiences that exist organically and natively on these platforms. The idea is this rising tide: you get them in, you introduce, you create awareness, you build affinity, and ultimately, they're going to spend more time on your owned and operated properties, and that seems to be working."

- Pitaro

Foray Into Streaming

In response to the decline in cable subscriptions and consequent advertising revenue dip, the network launched ESPN+ in 2018, marking its foray into streaming. With subscribers reaching over 26 million by 2023, the venture has exceeded management’s initial forecasts. Pitaro has noted the skew towards a younger demographic among ESPN+ users, in contrast to the traditional linear audience.

ESPN+ distinguishes itself by offering an extensive array of live coverage, exclusive to the service and not broadcast on the main network (except for some simulcasts), as well as original programming. It also includes the entirety of ESPN's content archive and access to pay-per-view events. While the service is priced at $11 per month, company reports indicate that approximately 80% of subscribers access ESPN+ through bundled packages.

Looking ahead, ESPN is gearing up for a major project, internally named “Flagship,” aimed at streaming its core networks by 2025. Media insiders speculate Flagship’s price could reach as high as $30 per month (more on this later). Planned features include advanced statistics, fantasy sports integration, and innovative concepts like “watch and buy” for merchandise and “watch and bet” for live betting.

These advancements are intended to transition the platform from a traditional, passive viewing experience to a more engaging, interactive one. To support Flagship’s launch, the company is actively pursuing strategic partnerships that may include an equity stake (see “Bonus Content” for additional commentary).

With Disney holding an 80% stake in ESPN and Hearst Communications the remaining 20%, Disney is positioned to sell up to half of its share while maintaining control, a strategy it plans to pursue.

Financials

“We feel that leaning into it [ESPN] is the smart thing to do because of its unique quality, how popular it is, and how profitable it is.”

– Bob Iger

I have omitted Star (India) from the financial breakdown to simplify the analysis. While part of the Sports segment, it represents a minor and diminishing portion, accounting for about 4% of FY23 revenue.

In 2023, ESPN saw its revenue climb to $16.38 billion, marking an increase from $16.07 billion in 2022. International operations contributed around 9% to this total. While ESPN's domestic business remains robustly profitable, its international segment has been treading close to the break-even point in recent years. The operating margin for international operations stood at -2.7% in 2023, compared to 5.4% in 2022.

Focusing on domestic operations, ESPN's ARPU, excluding ESPN+, stood at roughly $14.60 in 2023. This figure comprises $10.65 from affiliate fees and $3.95 from advertising revenue. In comparison, the 2022 ARPU was about $14.30, with $10.50 from affiliate fees and $3.80 from advertising, based on average subscribers of 72.5 million and 75 million, respectively.

However, these figures might not fully encapsulate the potential ARPU from DTC channels. This is due to a) the dilution of affiliate fees across multiple channels, with some potentially receiving inflated fees due to ESPN's influence, and b) a portion of advertising revenue being shared with pay TV providers.

The Intersection of Technology Giants and Sports Broadcasting

In the fast-evolving world of sports broadcasting, tech giants such as Amazon, Apple, and Google have made notable strides by securing high-profile media rights. Amazon's acquisition of Thursday Night Football, YouTube's grab of the NFL Sunday Ticket, and Apple's exclusive rights to MLS games and "Friday Night Baseball" have brought these platforms to the forefront of sports programming. Predictably, this has sparked intense discussions about the future of traditional sports media.

There’s a prevailing notion that Big Tech is less concerned with return on investment (direct or indirect) compared to traditional media operators. However, this view oversimplifies the reality. Consider Amazon, often perceived as the foremost threat due to its vast subscriber base and aggressive pursuit of various sports rights; a closer examination reveals a different picture.

Amazon Studios faced budgetary scrutiny in early 2023 under the direction of CEO Andy Jassy, followed by layoffs later in the year, challenging the notion of unchecked spending. Amazon's Prime Video seeks not to surpass Netflix in streaming dominance but to enhance the value of the Prime membership. This strategy is reflected in Amazon's measured content budget, which is approximately one-third of Netflix's spending.

High-profile sports properties like the NFL and NBA are attractive due to their ability to attract large audiences and increase engagement within these platforms. But as with any other form of content investment, they are subject to diminishing returns.

The Reach vs. Revenue Dilemma

The decision-making process for leagues involves a delicate balance between maximizing reach and optimizing revenue. These objectives can sometimes be at odds, especially since traditional broadcasting continues to dominate sports viewership. A "prime" example is the Big Ten's 2022 deal, which chose to partner with traditional media partners over a higher financial offer from Amazon, as noted by sportswriter Richard Deitsch. In short, leagues cannot afford to prioritize the highest bidder if it compromises audience size (reach) or production quality.

Production Quality

Apple TV’s Friday Night Baseball and Netflix’s inaugural live sports broadcast, “The Netflix Cup,” showcase the challenges in producing live sports, a task not as straightforward as it seems for incumbents. Contrary to popular belief, broadcasting a live sports event is a sophisticated entertainment production, not just a simple documentation of the game. Indeed, a journalist observed that the elaborate productions of high-profile live broadcasts, such as NBC's Sunday Night Football, are akin to producing a blockbuster Hollywood film, but with the added challenge of post-production editing in real-time. For more details, see "Bonus Content."

The complexity of sports production is why tech giants approach it with caution, as seen in the collapse of Apple's bid for Pac-12 college football rights. Furthermore, while Amazon has made significant investments in producing Thursday Night Football, it's less commonly known that the production is primarily managed by NBC staff, indicating more collaboration than disruption.

In summary, the intricacies of live sports production suggest that the perceived threat from Big Tech to traditional sports media enterprises may be somewhat overestimated.

Recent Rights Acquisitions

ESPN's recent spending spree on college sports (SEC, CFP, NCAA) has reinforced its status as the premier destination for college sports, a move widely regarded as astute by industry observers. Furthermore, the network has secured rights in several cases without being the highest bidder.

Importantly, the renewed contract for "Monday Night Football" (MNF) between ESPN and the NFL marks a notable enhancement from the previous arrangement. ESPN is set to pay $2.7 billion annually through 2033, which constitutes roughly a quarter of its total sports programming rights expenditure in 2023. This agreement boosts the number of regular-season games from 17 to 23, including some double-headers, with 19 of these games being simulcasts or exclusive to ABC. Moreover, the deal introduces an annual divisional game and grants ESPN the rights to broadcast two Super Bowls, in 2026 and 2030, marking a first since ABC's last broadcast in 2006 and a debut for ESPN.

This NFL deal is pivotal for Disney. The resurgence of MNF and ESPN's inclusion in the Super Bowl rotation is timely for Disney's billion-dollar NBA media rights negotiations and ABC's exclusive NBA Finals coverage. "Disney can now tout a one-two programming punch of ESPN (cable) and ABC (broadcast), which could be too good for any league to refuse." Adding Flagship to the mix, expected by the fall of 2025, means that no other media partner will be able to match ESPN's reach.

NBA Rights

The renewal of the NBA's broadcasting rights is a hot topic in sports media. The league is aiming for a significant increase in its next rights cycle, starting in the 2025-26 season, with reports suggesting a target of $50 billion to $75 billion. This is a big jump from its nine-year, $24 billion deal with ESPN and Warner Bros. Discovery's (WBD) TNT in 2014. Insiders say the NBA might spread its rights across three to five media partners. ESPN and TNT, which currently air around 165 games, have an exclusive negotiating window until April.

There's a general belief that the NBA could, or is even likely to, hit the lower end of its target, but there's a lot of skepticism about reaching the higher end. Taking this at face value, ESPN's earnings could see a roughly $1 billion impact if it keeps a similar package over an expected 11-year term. This assumes no significant increase in NBA viewership or ESPN's ability to monetize that viewership by the 2025-2026 season.

The deal is expected to involve three or four partners, as expanding beyond this would lead to excessive distribution fragmentation. (Consumers' tolerance for not knowing where to find a game appears to be reaching a tipping point.)

Moreover, Comcast's NFL investment doesn't necessarily predict similar aggressive bidding on the NBA or other sports media properties, given a) the experimental nature of the deal, and b) the viewership disparity between the leagues.

ESPN seems almost certain, and Amazon very likely, to be part of the mix. However, if the NBA opts for three partners, it's unclear whether the third will be WBD or Comcast. The arrangement most likely to bring the NBA closest to its target would include all four. But how realistic is this target?

When comparing total viewership between the NBA and the NFL, adjusted for the number of games, the NBA's target seems attainable. However, historical trends from the last six rights cycles (since the 1980s) suggest that even the lower end of the NBA's target may be optimistic, considering the average annual value (AAV) of the NFL's domestic rights. For a more detailed analysis of this topic, please refer to the “Bonus Content” section.

ESPN BET

Disney, with its family-friendly brand, had long been hesitant to enter the sports betting market through ESPN. However, in August, practicality prevailed when the company announced a decade-long partnership with Penn Entertainment. This deal involves licensing Disney's brand for “ESPN Bet,” an app operated by Penn. Throughout the deal, Disney will receive $1.5 billion in cash and $500 million in warrants for Penn stock.

Industry consultant Eilers & Krejcik Gaming estimates that the sports betting market will expand to $11.8 billion by next year, up from $7.6 billion in 2022. This growth represents over a third of sports media rights payments, according to S&P Global Intelligence.

Though the financial component is relatively modest, the partnership positions ESPN to engage a younger demographic. Also, the agreement includes a provision where, if "ESPN Bet" doesn't secure about 10% of the market share within three years, both Disney and Penn have the option to withdraw.

Flagship Pricing Strategy

Two key reference points for Flagship's pricing strategy are Netflix's Premium tier at $23/month and "NFL Premium" and "NBA League Pass" at $15/month. This is because a) many subscribers, particularly casual sports fans, might not see greater value in standalone Flagship, especially during the off-season, compared to Netflix Premium, and b) pricing below the direct league offerings could undermine ESPN's perceived value.

Therefore, a middle-ground approach appears most pragmatic. A standalone Flagship subscription could be priced around $20, while a Trio bundle including Disney+ and Hulu could be set at approximately $30. The initial pricing for the bundle might be lower to attract a broader audience, but Disney is likely to avoid setting the price too low.

There is a strong likelihood that ESPN+ will be incorporated into Flagship. If it remains separate, it will probably be rebranded as "ESPN Basic," acting as a lower-tier subscription within the same app.

ESPN’s Post-Flagship Revenue Scenarios

Under the following assumptions, ESPN’s potential revenue post-Flagship launch is outlined:

A bundled offering of Flagship, Disney+, and Hulu priced between $25 and $35/month.

Higher ad revenue for Flagship compared to linear, due to more valuable personalized ads and no revenue sharing with pay TV distributors.

A slower rate of cord-cutting, approximately 7-10%, assuming a significant conversion of pay TV cancellations into DTC subscriptions. (Note: most pay TV subscribers are sports fans.)

An increase in ESPN+ ARPU from the current $6.10 to $6.50, driven by price hikes and higher ad revenue.

At least 70% of ESPN+ subscribers transitioning to Flagship, with an estimated ARPU of $14 to $20.

Flagship attracting at least five million subscribers who are neither current pay TV nor ESPN+ subscribers, within its first two years of launch. (For now, think of Flagship as a placeholder for ESPN's DTC services, which will also include subscribers from the recently announced joint venture – more on this to follow).

The prospect of considerable revenue growth for ESPN appears likely, provided that the outlined assumptions are reasonable. However, the uncertainty surrounding the direct-to-consumer (DTC) cost structure and other factors add complexity to projecting its margin profile. In this context, the performance of ESPN+ provides valuable insights.

In 2023, ESPN+ achieved a significant milestone by reporting quarterly operating profitability for the first time. An analysis of the reported average revenue per user (ARPU) and subscriber data indicates that ESPN+ reached an operating margin of around 8% in the fourth quarter. This represents a considerable improvement from the -19% margin seen in the fourth quarter of 2022. While quarterly profitability can vary significantly due to the timing of sports rights payments, ESPN+'s operating margin demonstrated a remarkable improvement from -45% in 2022 to -7% in the last year.

Drawing from this positive trend, Flagship could achieve profitability more swiftly and significantly than what might be inferred from the financial performance of Disney+ and other streaming services.

Super Sports App

Following the first part of this deep dive, Disney, Fox Corp., and Warner Bros. Discovery announced a groundbreaking streaming joint venture. This initiative combines their sports programming—most nationally televised major league games and an estimated 55% of all U.S. sports rights—into a single platform, set to launch this fall, with potential bundling options with their other services.

The partnership aims to bring back bundle economics to streaming, offering more value and simplicity to consumers while achieving larger scale and higher revenues than the broadcasters could on their own. The venture could significantly impact pay TV distributors and rights holders, potentially cooling the bidding wars for premium sports rights due to reduced competitive dynamics.

"We believe there are numerous sports fans out there who want to watch sports on television but didn't want to sign up for the big cable and satellite bundle. We think this will be accretive to us. We also believe that consumers have either left the bundle because it wasn't serving them well or may leave the bundle, and we want to make sure that we capture them, too. So, we view this whole initiative as being a favorable proposition for sports fans due to the cost and certainly being positive for us given the current marketplace dynamics."

-Bob Iger

Lachlan Murdoch, quantifying the addressable market, said the target is the roughly 60 million households not currently in the pay TV ecosystem, out of approximately 125 million households in America.

Opinions differ on how the sports media landscape will be affected by the introduction of the so-called "skinny bundle" priced between $35 and $55 per month. Some view this as a significant shift, while others doubt the demand for such a service. Most anticipate the price will be set at the mid-point or higher of that range to prevent widespread cord-cutting. Since cable TV packages typically include home broadband, all nationally televised (major league) games, and other entertainment options, the launch of this new app is unlikely to compel consumers to cut the cord.

The product seems to target younger individuals who are passionate about sports and willing to spend over $50 per month when (presumably) combined with other streaming services, and who do not currently have pay TV. One media analyst suggests that the joint venture needs six million subscribers to break even.

Suffice it to say, the companies wouldn't do this if they thought it was going to be a money-losing endeavor or that it would be blocked by regulators due to anti-trust concerns. The JV doesn’t hurt consumers (providing an additional choice) and will not engage in joint bidding for sports rights; rather, each partner will contribute its pre-existing rights. However, to the extent it can cool aggressive bidding for sports rights, the partners will surely contend, that should translate to lower prices for consumers (who ultimately pick up the bill for rising sports rights fees).

The joint venture is, in essence, a vMVPD (like YouTube TV). Accordingly, the partners will receive distribution, affiliate, or carriage fees (call it whatever you like), proportionate to the value of the sports rights each contributes, with an estimated allocation of 50% for ESPN, 30% for Fox, and 20% for Warner Bros. Discovery. The operating costs (including management fees to the unnamed independent operator) and earnings of the enterprise will be shared equally.

Although the joint venture is expected to capture some of Flagship's target market, the latter will differentiate itself by offering a more interactive experience, as opposed to a purely viewing one. While Disney may prefer consumers to subscribe to Flagship, the choice between the two is not crucial. According to Iger, the JV will allow ESPN to "command per unit economics in line with established market rates for our sports content."

Reorganization and Culture

Bob Iger, upon reassuming his role as Disney's CEO, promptly embarked on a significant restructuring process. His first step was the dismissal of Kareem Daniel, the head of Disney Media and Entertainment Distribution (DMED) and Chapek’s foremost ally. Although this move was well received within the company, it did not elicit the same level of reaction as the removal of Chapek himself just a day earlier.

Chapek's exit followed what was Disney's largest earnings shortfall in more than a decade, a critical juncture that saw the company's division heads break from corporate custom to directly voice their loss of confidence in Chapek to the board. Their concerns were rooted not in the results themselves but in Chapek’s leadership during these challenging times.

Christine McCarthy, the then CFO, criticized Chapek for his failure to grasp the seriousness of the company's predicament, remarking he “waxed on about the promising ticket sales for Disney’s Halloween event,” instead of addressing key investor concerns.

“Coming out of the meetings, Schake and Quadrani told Chapek the reaction to the quarter could be devastating. Chapek began referring to Schake, Quadrani and McCarthy as “the mean girls,” a reference to the 2004 Lindsay Lohan movie, because he felt they were ganging up on him. Those who took a gloomy view of Disney’s prospects he referred to as “Eeyores,” a reference to Winnie the Pooh’s perpetually glum donkey friend, according to people familiar with the conversations between Chapek and his staff.”

-Alex Sherman (CNBC)

McCarthy observed that Chapek's restructuring of Disney's streaming operations led to overstaffing and redundancy. Sherman further emphasized that Chapek's management style introduced additional bureaucratic layers, which left executives such as Pitaro and D’Amaro feeling demoralized and contemplating their departure from the company.

Restructuring Initiatives

Reversing some of Chapek’s changes was a significant component of the cost-cutting measures announced upon Iger’s return. The company announced its aim to reduce its costs by $5.5 billion annually, which included $2.5 billion in non-content expenses. These reductions would be achieved through cuts in marketing (50%), labor (30%), and technology (20%).

At the heart of Iger's restructuring efforts was the consolidation of Disney's streaming operations into a single, globally managed unit, under the leadership of Dana Walden and Alan Bergman, moving away from the previously fragmented organizational structure. Additionally, Iger announced the formation of “an entirely new senior management team across the globe to manage these assets.”

The initial results of these efforts are encouraging. As highlighted in the company's Q4 earnings call, Disney is on track to achieve approximately $7.5 billion in cost reductions, significantly surpassing the initial target of $5.5 billion. In May, Christine McCarthy noted that the investment community might be underestimating the impact of this reorganization.

McCarthy drew a parallel to the structure of Disney’s parks, whose success she attributes in part to its cohesive global operations: “When we look at investing in new attractions, it’s not done park by park,” but rather, “where is the best use of that marginal dollar,” she explained.

As the reorganization nears completion, Iger emphasized during the Q4 earnings call that the company was poised to “move beyond fixing and start building.”

Cultural Implications of Iger's Return

Iger's first tenure as CEO is celebrated for its remarkable successes, including the acquisitions of Pixar, Marvel, and Star Wars. These achievements are particularly impressive, considering that the vast majority of mergers and acquisitions do not increase the value of the acquirer. Notably, the decisions to acquire Pixar and Marvel initially faced skepticism and limited support from Disney’s board and senior management. Iger's memoir offers a detailed, albeit somewhat romanticized, account of these pivotal moments in Disney’s history.

After postponing his retirement four times, Iger shared with CNBC that his decision to retire was partly influenced by a growing dismissiveness towards others’ opinions. “Over time, I started listening less and maybe with a little less tolerance of other people’s opinions, maybe because of getting a little bit more overconfident in my own, which is sometimes what happens when you get built up,” he explained.

Iger's candidness about his overconfidence and dismissiveness towards others' opinions not only showcases his character but also highlights the complexity of leadership. His assertiveness undoubtedly played a role in Disney's bold acquisitions, which may not have transpired had he been more yielding to his advisors. This independent thinking, as Sherman detailed, likely influenced both his choice of successor and Disney's acquisition of Fox's general entertainment assets, a move viewed by many as an overpayment by Disney.

Iger's regret over appointing Chapek as his successor and his subsequent return to correct this mistake underscores the ongoing challenge of succession. With Iger's contract extended until 2026, the search for a suitable successor is in full swing, reflecting the board's determination to get it right this time.

The significance of Iger’s return is that, in contrast to Chapek, he is a leader whom people genuinely want to work for. "Bob is the best leader I have ever been around,” Jimmy Pitaro reflected. “He doesn't get too high; he doesn't get too low, which is exactly what you want. He's calm, he's collected.” A former Disney VP echoed this sentiment, “Bob has such respect from all the leaders in the company, which he earned, by the way, over the last 20 or 30 years.” He observed that when Iger disagrees with members of his team, “no one ever takes that personally,” and “you don’t get this feeling that he’s out to get you.”

Activist Commentary

The activist saga surrounding Disney has, predictably, been widely covered by the media. However, I don't anticipate the outcome to have a significant impact on Disney's operational or share price performance, so my comments will be brief.

Nelson Peltz has criticized Disney for underperforming the S&P 500 on “every measure.” This underperformance, however, appears to be a common theme among streaming services, with Netflix being the notable exception. Despite Peltz's frequent media appearances, he has not provided any detailed strategies or justifications beyond a general promise to enhance management accountability. As such, it's challenging to see how his presence on the board would significantly enhance Disney's chances of a successful turnaround.

Given Bob Iger's proactive measures to address the company's challenges and Disney's nomination of eminently qualified directors (which has garnered support from ValueAct), it seems implausible that Peltz will persuade major shareholders like Blackrock and Fidelity that adding him or Trian's other nominee, former Disney CFO Jay Rasulo, to the board would be beneficial.

In my opinion, Peltz's proxy fight is unlikely to succeed (particularly with the market's response to the quarter). If his campaign continues as is, the best he can hope for is likely a concession, with Rasulo being a more probable choice than Peltz himself.

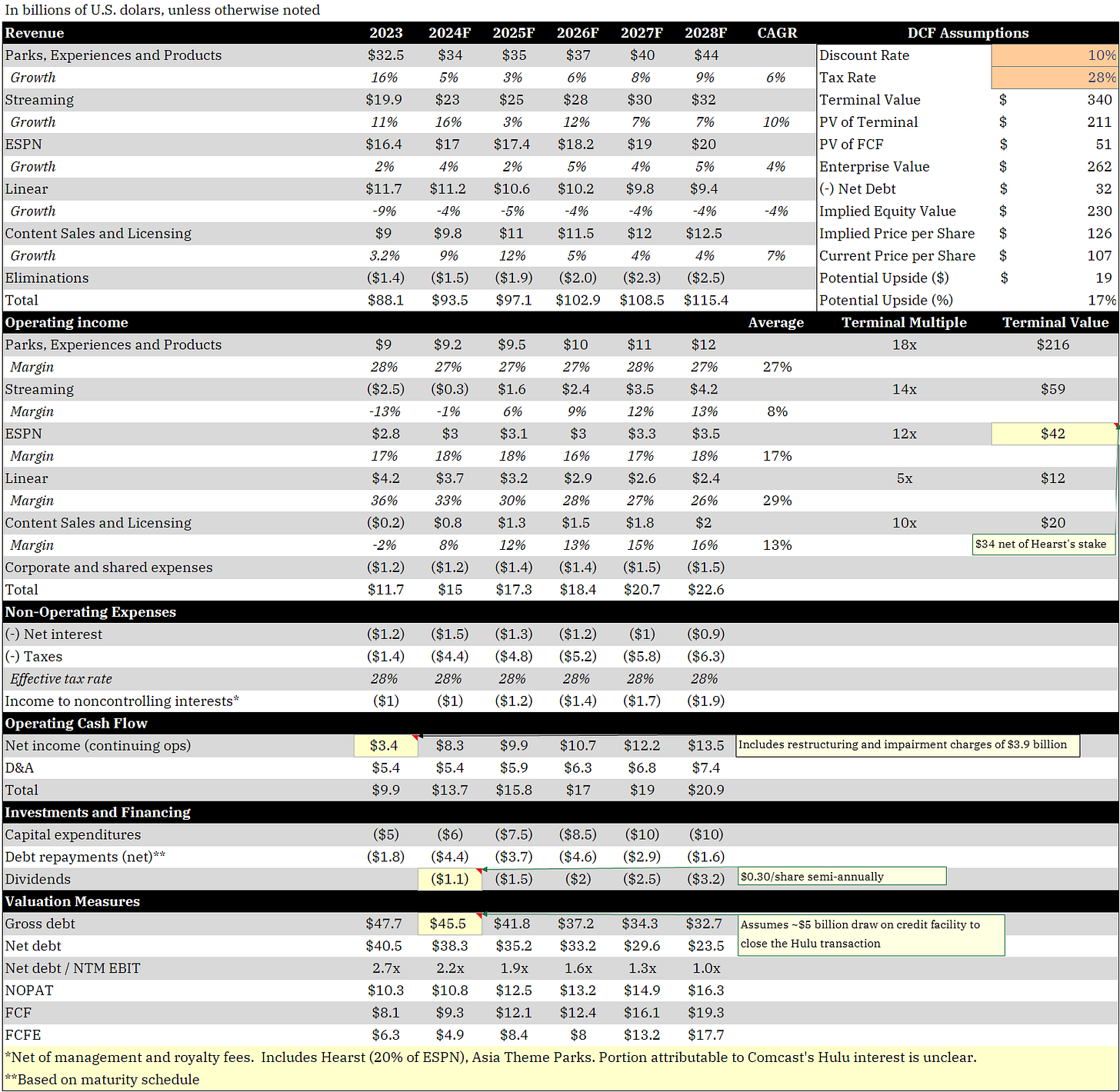

Valuation

If the assumptions hold true, Disney is poised to significantly boost its cash flow and substantially reduce its debt by the end of the forecast period.

Notes to the DCF

Parks, Experiences, and Products: Expected moderate growth in the near term, driven by strong international performance (boosted by new attractions), the launch of three new cruise ships from F2024 to F2026, and increased merchandise sales from a robust theatrical and programming lineup. These cruise ships are projected to add over $2 billion in annual revenue. However, growth may be moderated by the reintroduction of guest-friendly perks and the opening of Epic Universe in 2025. Growth is expected to accelerate towards the end of the forecast period with increased investments.

Streaming: Significant subscriber growth is anticipated, driven by enhanced programming, a more extensive theatrical lineup, and greater bundle penetration through continuous app integration. This includes the introduction of the super sports app joint venture in 2024 and Flagship in 2025.

ESPN: Projections do not account for potential league or tech partnerships. Should these materialize, they could solidify ESPN's foundation and enhance its earnings and valuation, though this may be partially offset by reduced ownership if such partnerships involve equity stakes. Revenue increases from the reported joint venture and Flagship in the short term are partially offset by step-ups in rights payments (e.g., NBA, SEC, CFP, NCAA).

Linear: AVOD is expected to increase its share of video advertising due to its targeting capabilities. Despite this, a modest recovery in the linear ad market might occur, as the shift towards AVOD could unfold more gradually than anticipated. The ongoing trends of cord-cutting and channel consolidation are likely to be mitigated by higher affiliate fees.

Content Sales and Licensing: A steady increase is expected, driven by a stronger film lineup and more licensing deals.

Other: This analysis does not account for the recent $1.5 billion investment in Epic Games or the newly authorized $3 billion share buyback plan.

Risks and Mitigants

Parks: The launch of Epic Universe is expected to ignite significant interest as Orlando's first major theme park expansion in years, boosting local tourism. However, Disney World is likely to face a temporary decline in market share as a result. Most importantly, Disney might consider moderating its price increases or even lowering prices (domestically) to prioritize long-term brand loyalty over short-term profits.

Streaming: The success of app integration could be undermined if new high-budget scripted series like Shōgun or the Star Wars projects fail to connect with audiences. Moreover, initiatives to reduce password sharing and enhance app integration might not achieve anticipated subscriber growth and bundle penetration.

Studio: Short-term disappointments in animation, live-action, Marvel, and to a lesser extent, Star Wars, could have significant consequences. Disney must regain its stride in these areas.

Linear: The projected "pay TV floor" of 50 million subscribers might be overly optimistic. If recent quarterly trends persist, the actual figure could fall to as low as 35 million by 2030.

ESPN: Risks include securing a less advantageous NBA package (cost-adjusted), particularly if competition from tech giants escalates, and if Flagship (or the JV) fails to attract significant numbers of cord-cutters and “cord-nevers.”

Final Thoughts

Parks

Market behavior often leads to the undervaluation of outcomes projected five or more years into the future, which appears to be the case with the $40 billion earmarked for incremental park capacity. My general impression is that the investor community is far less convinced about how productive these investments will be than Bob Iger.

Outlining a clear vision for these investments could elevate investor sentiment. This is particularly salient for Disney World's 1,000 acres of available land (equivalent to seven Disneyland parks), which could alleviate concerns about the impact of Universal’s Epic Universe.

Streaming

I hope I don't offend any Force Followers, but many of the Star Wars originals on Disney+ have felt like nostalgia bait, such as "Obi-Wan Kenobi" and "The Book of Boba Fett." Streaming services thrive on hype, and both "Skeleton Crew" (mentioned in part one) and "The Acolyte," with their unique tones and subject matter, have the best shot at generating it since "The Mandalorian" in 2019.

The Acolyte has been hailed by Ringer Podcaster Mallory Rubin as "one of the most anticipated things in the Star Wars-verse and the wider nerd-verse." Joanna Robinson, referenced in the discussion on Marvel in Part 1, stated, "I have heard from people who have seen a couple of episodes of 'The Acolyte' that it is tremendously good — I am unreasonably excited." Similarly, Hulu's Shōgun, also mentioned in Part 1, is garnering fantastic reviews from media outlets based on early screenings, currently holding a 100% Tomatometer score.

The Disney bundle's programming slate is, in my view, the strongest it has ever been. The streaming landscape is also more favorable for one or more of these shows to become a cultural hit, as television continues to move away from the "peak TV" era of 600 shows a year to a more manageable range of 300-450.

This expected increase in engagement will coincide with Hulu's app integration and continued bundle penetration, creating ideal conditions for the Disney bundle to shine. Moreover, Disney has yet to fully tap into the potential of live sports, despite possessing an unrivaled portfolio of broadcasting rights, which could significantly boost subscriber growth, engagement, and profitability. The addition of the (potential) joint venture in 2024 and Flagship in 2025 is poised to further enhance Disney's streaming prospects.

The Disney bundle arguably possesses the deepest content library out there, but this can only be deployed to maximum advantage with a sufficient “refresh rate” of compelling new content. Disney+'s market share, as measured by total viewership minutes, has remained stagnant over the last few years, and the aforementioned factors are well-positioned to rectify that.

Demonstrating success in AVOD migration and advertising revenue per user will further solidify confidence, building on the momentum from the previous quarter. In summary, the market appears to be, in the words of George W. Bush, "misunderestimating" Disney's potential as it navigates the digital transition. The value attributed to its streaming operations does not fully capture the strength of its bundle or its near-term prospects for outperformance.

Studio

The slow start to the 2024 box office, marked by high-budget failures like "Argylle" and "Madame Web," creates an opportunity for Disney's theatrical slate to shine in a lighter theatrical calendar due to last year's strikes. Success with titles such as "Deadpool & Wolverine," "Kingdom of the Planet of the Apes," "Moana 2," and "Mufasa: The Lion King" would reinvigorate confidence in Disney's major franchises.

If one or more of these films achieve success by Disney's pre-pandemic standards or avoid being box office bombs, the implicit "show me" discount currently affecting the studio arm is likely to dissipate. The anticipation for these films is evident in their trailer comment sections, with one top comment (60,000 likes) hailing "Deadpool & Wolverine" as the needed step forward for the MCU.

ESPN

Years ago, industry observers suggested that for Netflix to dominate the streaming landscape, it "had to become HBO before HBO could become Netflix." While that didn't happen exactly, the sentiment was on point. Similarly, for ESPN, it needs to "become YouTube" before YouTube "becomes ESPN."

To this end, ESPN must make Flagship interactive and engaging, moving beyond the traditional passive viewing experience. The enhancements include adding social commentary to foster a sense of community, integrating advanced statistics, fantasy sports, and interactive features like betting and e-commerce — enabling the purchase of your team’s merchandise mid-game. If executed well, the company has a great chance of “becoming YouTube" before it “becomes ESPN."

Earlier, I highlighted ESPN's commendable navigation of the digital transition, citing its TikTok subscriber count, which exceeds that of the major leagues combined. Yet, most industry observers seem unenthused about Flagship, questioning the significance of these features responsible for the protracted development. However, by the end of 2025, I suspect we'll understand why the company was working so tirelessly to incorporate these features before launching Flagship.

In addition to Flagship exceeding expectations (which seem low), other catalysts include finalizing a strategic partnership (league or tech) and securing a favorable NBA package (cost-adjusted). These factors would help dispel concerns around Big Tech's incursion into sports media. Furthermore, if the joint venture shows early signs of traction and the partners demonstrate they can navigate competing agendas, this would boost investor confidence.

In summary, the wariness surrounding ESPN’s future seems out of sync with reality. As the market's view of Netflix shifted following "The Great Netflix Correction," we anticipate a similar scenario unfolding with ESPN.

Content Sales and Licensing

Following the discussions mentioned in Part 1, Disney licensed 14 popular TV series to Netflix for 18 months on a non-exclusive basis. This lineup includes notable shows like "Lost," "This Is Us," "Prison Break," "How I Met Your Mother," and "ESPN 30 for 30." These series will be released periodically throughout the year.

We consider this to be a highly positive development. However, the issue with these titles is that, unlike Pixar, Marvel, or Star Wars, they are not automatically associated with Disney as the intellectual property owner. Therefore, the benefit is mainly financial rather than enhancing cross-platform awareness.

Accordingly, while I understand Iger's reservations, I anticipate a slight, if not significant, shift in his approach to licensing in 2024-25, with content that more readily triggers an association with Disney.

Linear

Lastly, efforts to re-bundle could slow the decline of linear TV more than expected, acting as a metaphorical bucket to better capture the leak from cord-cutting. This would help to stabilize cash flow and reduce the need for leverage in funding Disney's growth businesses.

Overall, we believe Disney is poised to restore its magic and reward shareholders.

Bonus Content

Comping Media Rights: How Realistic is the NBA's Target?

Based on the perspectives of various industry observers (journalists, podcasters), the consensus on the upcoming renewal is that the NBA could, or is even likely to, achieve the lower end of its $50 to $75 billion target (up from the current $24 billion). If we take this at face value, ESPN's earnings could see an impact of $1 billion if it retains a similar package over an expected 11-year term. This assumes no significant increase in NBA viewership or ESPN's ability to monetize that viewership by the 2025-2026 season.

Over the last six rights cycles, the NFL's AAV has consistently exceeded the NBA's by more than 3x, except for the most recent cycle, which was around 2.8x.

This significant gap, wider than what viewership comparisons alone would indicate, raises the question of why. The answer lies in the monetization of that viewership.

When looking at advertising revenue, a more direct indicator of “viewership value” than affiliate (carriage) fees, the disparity becomes clear. In the 2021-22 season, the NFL generated $4.4 billion in advertising revenue for its media partners, compared to the NBA's $1.3 billion (or 3.4x). While these figures can fluctuate (4.3x in the previous season), the longer-term trends align with the disparity in the AAV of media rights.

Even though the era of high bandwidth media consumption could potentially narrow the monetization gap, there's no strong evidence to suggest that this will be enough to support even the lower end of the NBA's target. Given the NFL's AAV of $12.4 billion, historical trends point to an AAV of just over $4 billion for the NBA as more feasible than the targeted $4.6 to $6.8 billion under the expected 11-year term.

Furthermore, while the NFL's viewership continues to rise, even with a shrinking linear audience, the opposite is happening for the NBA. Notably, when the NBA last renewed its broadcast deal with ESPN and TNT its viewership was higher than the average of the previous decade.

These factors suggest that the gap between the NBA and the NFL's media rights could easily widen, contrary to the narrowing suggested by the league's target (and affirmed by most industry observers).

The Complexity of Live Sports Broadcasting

Journalist Jody Rosen's insights into NBC's broadcast of the NFL's 2023 season opener reveal the logistical and technical intricacies involved.

Logistics

"An NBC Sports workforce of 200 traveled to Kansas City, bringing along a convoy of ten trucks. This ensemble included mobile production units, an office truck, a backup generator, a truck for the 'Football Night in America' pre-game show, and several haulers loaded with broadcasting sets, cranes, and dozens of cameras."

Production Complexity

"Producers and directors are confronted with a wall of 200 video feeds, making split-second decisions on which images to broadcast while coordinating with instant replay directors, camera operators, statisticians, researchers, and announcers."

Rosen marveled at the seamless integration of this multitude of images and sounds in real time, amidst ongoing communications, describing it as "mind-blowing." For more insight, I recommend reading his detailed piece.

ESPN/Flagship Potential Partnerships

As Iger has mentioned, the goal is to partner with organizations that can offer technological support, marketing assistance, or additional content. For Flagship, the ideal partners would provide extensive distribution networks to broaden reach and lower customer acquisition costs.

Apple stands out as a potential partner, especially with the launch of the Apple Vision Pro, where live sports are apt to be a major use case. While some might see a partnership with Apple as unlikely, it becomes more plausible when considering Apple's (presumed) interest in getting a return on investment in sports media rights.

Moreover, ESPN is looking into partnerships with major sports leagues, particularly the NFL and NBA. A recent report by Variety indicates ongoing negotiations between Walt Disney Co. and the NFL, which could lead to the NFL acquiring a stake in ESPN and integrating NFL Media into Disney's portfolio.

Disclosure: The author, editor or the accounts advised by the editor do not own shares in Disney (DIS). This post is for informational purposes only and we may be wrong in our assumptions and estimates. We encourage all readers to come to their own conclusions.