Rentokil Initial PLC

A compounder for sale

Rentokil was established in 1925 by Harold Maxwell-Lefroy, a professor of entomology at Imperial College London. Lefroy had been researching methods to eradicate death watch beetles infesting Westminster Hall at the Palace of Westminster. He and his assistant developed an anti-woodworm fluid called Ento-Kill Fluids. In that same year, he attempted to trademark the name Entokill but, due to existing trademarks, he opted for Rentokil instead, which became the name of his company, Rentokil Ltd.

Rentokil Group plc was listed on the London Stock Exchange in 1969. The company acquired the "Initial" laundry and washroom services business, which was established in 1903. Rentokil Initial now offers a range of services, from laundry to washroom hygiene products. The name "Initial" comes from the practice of marking every towel with the customer's initials to ensure that each customer received their own towels.

In 2006, Rentokil expanded its presence in the US residential pest control market by acquiring J.C. Ehrlich Co, Inc., based in Reading, Pennsylvania. J.C. Ehrlich was the fourth-largest pest control company in the US and the largest privately held company in the sector. Then in 2012, Rentokil expanded its presence on the West coast of the United States by acquiring Western Exterminator Company for US$99.6 million, making Rentokil the third-largest pest control company in the country. In December 2021, Rentokil purchased Terminix for $6.7 billion, and became the largest pest control company in the US.

Until 2013, Rentokil had no clear strategic direction. Management liked the pest control business but it remained a conglomerate with a bunch of disparate businesses. In 2013, the company announced that CEO Alan Brown would step down, and Andy Ransom, formerly the managing director of Rentokil's West region, would become CEO. Andy’s big contribution to the business was focus. Rentokil doubled down on the pest control business - which they recognized as the best business within the Rentokil portfolio with secular growth, good margins, low capex intensity and high free cash flow conversion - to a point where 80% of its revenues now come from the pest control business. Further, during his tenure as CEO, Ransom has focused on enhancing the company's service offerings, improving operational efficiency, and expanding its global footprint.

Since 2013, Rentokil has acquired approximately 300 companies to enhance its existing network in the US and expanded into new markets such as India, the Middle East, and Latin America, with a focus on cities poised for higher growth in the future.

While Rentokil typically does small tuck in acquisitions, Terminix was a big one! The integration of Terminix has been delayed. Initially expected to be completed by 2025, it is now projected to finish by 2026. As can be expected, the market does not like this and is in ‘show me the money’ mode. We think this is a tremendous opportunity to acquire a compounder business operating in an industry with secular tailwinds with opportunities for margin expansion.

We anticipate significant total returns in the coming years as we expect a resurgence in sales growth, improved margins, and an expansion in multiples, all of which could lead to substantial gains over the next 2-3 years.

Here is the composition of the business in 2023:

Out of this, geographically:

60% of EBIT is in the US

20% of EBIT is Europe

11% of EBIT is in Asia and Asia-Pacific

9% of EBIT is in UK & Africa

Out of this, segmentally:

80% of EBIT comes from Pest Control

15% of EBIT comes from Health & Hygiene

5% of EBIT comes from Workwear in France (up for sale)

Compared to its closest peer Rollins, Rentokil is more diversified geographically (Rollins is 92% US) and segmentally (Rollins is 100% pest control). It is much more of an international business that has the potential to do really well if the US dollar weakens and if the rest of the world (ROW) starts doing better than the US. We think this type of exposure has a place in the portfolio.

In this report, we will talk about industry structure, competitive advantages, organic growth, Terminix acquisition and the general path for Rentokil going forward.

Industry and Competitive Advantages

The slide below from Rentokil shows the size, segmentation and growth of the US market (esp residential which is very under-penetrated):

Pest control businesses are benefiting from several secular forces that are driving growth in the industry.

Rising urbanization and population density are increasing the demand for pest control services as more people live in close quarters, creating opportunities for pests to thrive. The US population moving to the Southern US states is a big part of the trend.

Climate change is causing shifts in pest populations and behaviors, leading to new challenges for businesses and homeowners that require professional intervention.

Additionally, heightened awareness of health and safety standards, stricter regulations and reputational risks, are motivating both residential and commercial customers to invest in regular pest control services.

Here is an example of how clients think about pest control,

In commercial pest control and even residential pest control, we all use the same product. Ecolab claims they manufacture their own, but they also sub in plenty of others. It's all about service and responsiveness. Pricing to a certain level, but pricing is not always the number one choice. For a lot of them, it's in the top three, but it's not number one. It's service, it's responsiveness. It's "Getting the information I need because I got a boss I report to in facilities or operations. I don't want to have to explain over and over why we have a pest issue in this one location and why we can't get it under control.

-Former VP at Terminix (Alphasense Transcript)

Importantly, the slide below from Rollins shows just how defensive this industry has been in the past:

Source: Rollins Investor Presentation

Revenues grew through weak economic conditions showcasing the essential nature of these services.

The other advantageous factor about the industry is that Pest control companies benefit from a recurring revenue model that provides them with a steady and predictable stream of income. Rollins and Rentokil often offer ongoing services through subscription plans, such as yearly or multi-year contracts. With these plans, these companies provide regular pest control services to customers such that pests never become a problem.

With these contracts, especially with commercial clients, pest control companies use digital sensors and monitoring devices to detect pest activity in real-time. Advanced pest control systems allow for remote monitoring of traps, baits, and sensors. These devices can alert technicians to infestations or pest presence, allowing for targeted interventions. This is both a service enhancing and a cost saving mechanism for the pest control companies. The end result is that the business becomes more defensive, higher quality, and cash management becomes much easier.

The market fully recognizes this and has awarded Rollins with very high multiples:

For those calculating, Rollins stock price has increased from $1.50 in May 2004 to $8 in May 2014 to $47 in May 2024 leading to a 19% CAGR over both the 10 and 20 year time period. A very impressive track record indeed!

In the United States, the pest control industry is dominated by a few large companies, each with a significant market share and extensive networks across the country. The most prominent of these are Rollins, Rentokil, and TruGreen, Arrow, among others. As we mentioned before, after the acquisition of Terminix, Rentokil has now become the largest pest control business in the US.

Rollins and Rentokil benefit from network/route density effects. This is an under discussed competitive advantage. Several industries benefit from route density-based competitive advantages, particularly those that involve frequent service or delivery to customers within specific geographic areas. Waste management companies, food distribution, beer distribution, etc. are prominent examples.

Route density-based competitive advantages stem from having a high concentration of customers or service points within a specific area, leading to increased efficiency and cost savings.

Shorter travel distances lower transportation costs and improve operational efficiency, while economies of scale spread fixed costs over more customers.

This market concentration and scale also helps with marketing. Scale allows buying power in digital marketing and also enhances brand visibility. When a customer has a pest infestation and ‘googles’ for service providers the biggest companies typically have the scale to buy the relevant ad words to get more than their fair share of the one off business (which can be converted into recurring revenue subscription business over time).

Serving a dense customer base in a region offers chances to gather data on local preferences and trends, providing valuable customer insights. This understanding enables businesses to tailor their strategic planning and make more informed decisions based on specific local needs.

With scale, companies can buy products at a cheaper price or dedicate some portion of revenues to R&D in order to provide better products or services to their clients. As an example, advancements in technology have led to the development of non-chemical pest control methods such as heat treatments, cold treatments, and high-frequency sound waves. These methods can target pests without using harmful chemicals.

While it is not hard to open up a pest control service, these route and density based advantages mean that the larger companies have big advantages. Due to this and other factors, we have seen the ‘roll-up’ of small and medium businesses over the last 20 years.

Terminix Acquisition

Rentokil has built its US business with M&A. The first significant acquisition occurred in 2006 when J.C. Ehrlich, then the fourth largest pest control company in the U.S., was purchased for $142 million. Nine years later, the acquisition of The Steritech Group followed, costing $425 million. In addition, there have been many tuck-in acquisitions that, over time, made Rentokil into a major player in US pest control.

In 2021, Rentokil announced the acquisition of Terminix at $6.7 billion (80% in equity and 20% in cash), equating to 19x 2021 EBITDA and 13x including synergies. When the deal closed a year later, RTO's share price had dropped by 35%, reducing the purchase price to $5 billion or 10x EBITDA multiple. The acquisition made a lot of sense for Rentokil as it complemented its strong commercial business with termite and residential business (important for long term growth as under-penetrated). Rentokil became the biggest pest control company in the US and went up to 25% residential from 12% residential in the US.

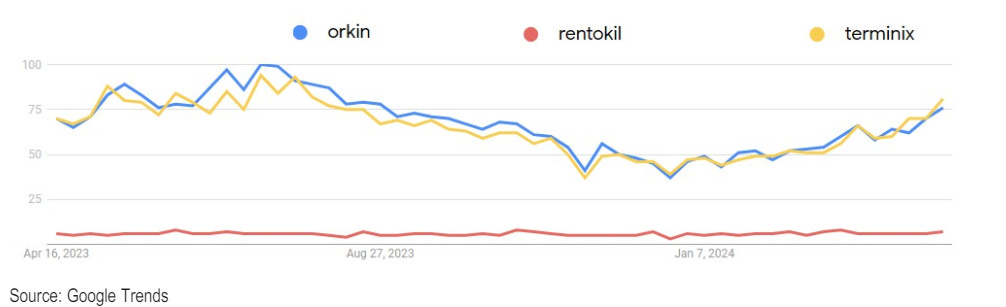

In addition, it gave it a very strong brand in Terminix which is as strong a brand as Orkin in the US.

Before Terminix Rentokil only made smaller tuck-in acquisitions in the US. This was a major transformative deal that made Rentokil into the largest pest services provider in the US.

Terminix, however, was a troubled asset. It had underperformed peers for many years and had gone through a lot of management changes. Rentokil has a difficult task of integrating it and uplifting its performance to the best of the breed.

I think just looking back, there was a lot of turnover at the C-suite with the presidents and CEOs that we had. In the four years I was there, there was probably at least three, if not four, maybe even five different people at the top there. As an employee, especially in management, and you see that constant change, it's definitely a little unsettling.

-Terminix Regional Manager (Alphasense Transcript)

During that time, if you went back 10 years, they (Terminix) went from part of ServiceMaster to CD&R for private equity, and then they went public. They had four or five CEOs and presidents in there and then a bunch of divisional heads in there as well. That's what's stunted the growth,

-Former VP Terminix (Alphasense Transcript)

The positives from the acquisition are scale, brand, a more balanced portfolio and synergies.

The goal at Rentokil is to derive $225 mn in synergies (up from an initial estimate of $150 mn). They will do this by consolidating branches and bring the total number of branches down to 400 from 625 current Rentokil and Terminix branches. This branch consolidation will have the direct result of increasing margins as it dramatically reduces costs.

Source: JPM

Source: JPM

Rentokil now has a better opportunity to cross sell its services across commercial and residential customers.

That's going to make it more likely that that customer is going to leave us to go to the other company, because if we can keep a customer, if we can sign up a customer with a pest control service, a termite service, and mosquito service, it's going to be extremely difficult for them to want to leave us and get a whole new company to do all those services. That was something that was always ingrained in our brains, was to keep cross-selling, working in a variety of different markets from really small in-the-middle-of-nowhere branches to a pretty major market.

-Terminix Regional Manager (Alphasense Transcript)

While we can go on and on on the integration and the acquisition, a rule of thumb in the industry is that customers like their technicians and if technicians are churning then it is likely that customers are churning. Retention or churn is one of the most important variables when it comes to subscription based businesses. In addition to impacting revenue and profitability, they are an important factor because they control intangibles such as brand - high retention rates can signal a strong market position and customer trust. In the most recent Rentokil quarterly report, they disclosed that Terminix's employee retention rate is about 69% (an improvement from the 64% in the quarter before), which still appears quite low. Rentokil's employee retention is approximately 83%, as an example. Rentokil has a plan in place to harmonize pay between the Rentokil and Terminix technicians which will actually see total pay go up for Terminix technicians.

I'll use rounder numbers right now, but we would traditionally have expectations for commercial retention right at 90% into the low 90% range. If we had a year, say that was in the mid-85%, that was a bad year for retention. Traditionally, that 90-ish, ± 3% is where we focused on our retention efforts. I would say you could see a drop of 5%-10% more in that given year (after acquisition). It also depends on how well you're going to integrate that business.

-Former VP at Terminix (Alphasense Transcript)

In residential areas, the churn rate is naturally higher. Residential is not a very high quality business unless the pest control services company can sell multiple services to the household. Typically, residential customers churn due to three reasons, (a) pricing is always a significant issue. If there's a price increase or if customers face financial constraints, pest control is often the first service to be cut, as it's viewed as an ancillary and expendable service, (b) The second issue is the service offering. Customers might leave if they don't feel they're getting value for their money or if the service doesn't meet their expectations, and (3) Thirdly, once the problem is solved, customers might not see ongoing value in the service and decide they no longer need it.

Rentokil has been a stellar long-term investment. Over the past decade, its shares have delivered total returns of 528 percent, compared to 72 percent from the FTSE All-Share Index. This success has been achieved through consistent organic growth in its pest control and hygiene businesses, supplemented by strategic bolt-on acquisitions.

However, large acquisitions typically fail for two main reasons. First, the buyer may overpay and struggle to achieve acceptable returns on the investment. We know that they paid a full multiple. In our opinion, the deal was neither a steal nor was it very expensive. Second, the buyer may underestimate the challenges of integrating the acquired company, failing to satisfy key stakeholders such as employees and customers. The market is cautious on this integration:

My concern, and again my opinion and my opinion only, using your term, I think they're going to blow themselves up. One of the challenges is, again, customers want their technician to be accessible. If you've got three locations in a large metro area, it's often difficult to be able to handle an emergency complaint call. You may see technicians change from service to service. You may not have the availability of equipment or material and so forth, and so that can be a real challenge.

-Former Director at Terminix (Alphasense Transcript)

Scale is important in the business but after a certain point, it becomes counterproductive. Rollins, for example, splits up a branch after a branch reaches $8-10 mn in revenue as it starts affecting customer service which is the most important variable in this business.

Rentokil has the difficult task of keeping technicians happy, consolidating pay structures across Rentokil and Terminix, consolidating branches and back end systems, and reducing the number of brands in the market from 80 to about 10. In a service business where you do not want to see a lot of change - this is a lot of change! It is due to this and the volatility associated with these changes that the market is taking a dim view of the stock.

Further, we see signs of improvement. Rentokil reported a stronger-than-expected Q4, but more importantly, they addressed the issues encountered in H2 2023 and presented an action plan to resolve them. The main challenge was a decline in the acquisition of new residential, termite, and SME customers, with in-bound sales leads decreasing by 2-3%. This was due to several factors (1) Terminix merger, (2) Changes in Rentokil's marketing and sales leadership, (3) Flat sales colleague retention rates (60% at Terminix and 77% at Rentokil), (4) Branch closures, and (5) Increased digital marketing spending by competitors.

In our opinion, Rentokil is a very thoughtful acquirer and Rentokil management understands these issues. As an example, they have pushed their synergy targets 12 months forward and, while this disappoints Wall Street, slowing down this integration is probably the right approach.

We also do not believe that Rentokil needs to perform as well as Rollins in order to re-rate. We acknowledge that Rollins is a better business. In our work on Rollins, we found that it has better organic growth and a lot of this comes down to culture. The top brass at Rollins are all ‘pest’ people and they understand the business. They hire well, train well, keep the technicians happy, and executive M&A in a thoughtful manner. Further, their 92% exposure to the best growing US market helps!

For Rentokil, we do not believe it should or that it needs to perform at the same level as Rollins. We believe if organic growth rates (the ultimate metric for the health of the underlying business) improves to 4-5% the market would be content and re-rate the business.

Importantly, the prize at the end of it is worth it:

Management forecasts at least 5% organic revenue growth and 8-10% total revenue growth. They project EBIT margins to exceed 19% by 2026, up from the current 16.7%. This improvement is expected from synergy execution and operating leverage.

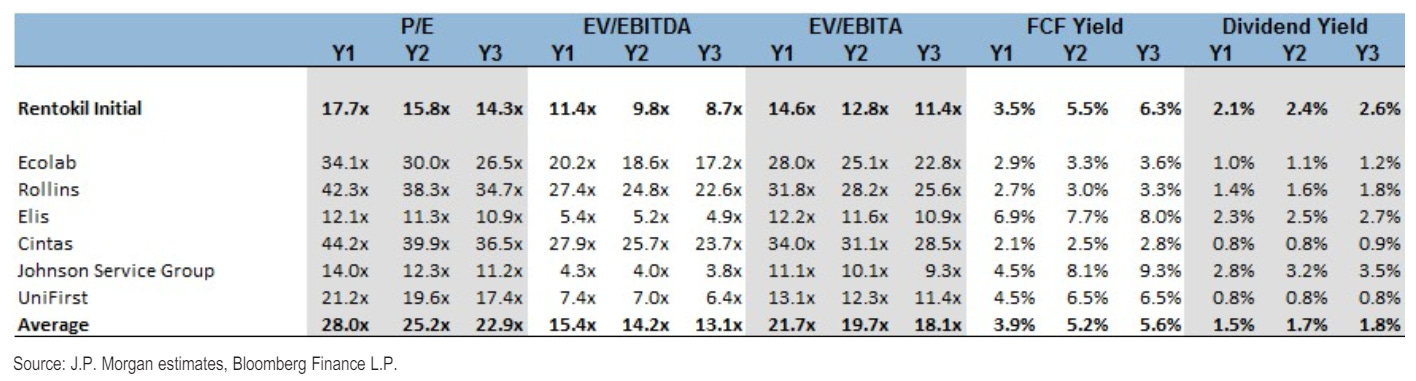

If these targets are met, the EPS in 2026E would be £0.30. Rentokil is currently trading at 14 times the 2024 P/E. It is important to remember that Rentokil typically traded at 25x P/E before the Terminix acquisition and its closest competitor Rollins trades at 40x P/E. If Rentokil were to trade back to its historical valuation then we have a stock that is 80% higher from current levels in a two year timeframe.

There is more. There is a free option in Rentokil deciding to move its primary listing to the US. We have seen the multiple expansion with Ferguson and CRH with US listing and the same is possible for Rentokil as a majority of its business is now US based. If that were to happen, we would not be surprised to see Rentokil trade closer to 30x P/E for more than 100% upside in 2-3 years.

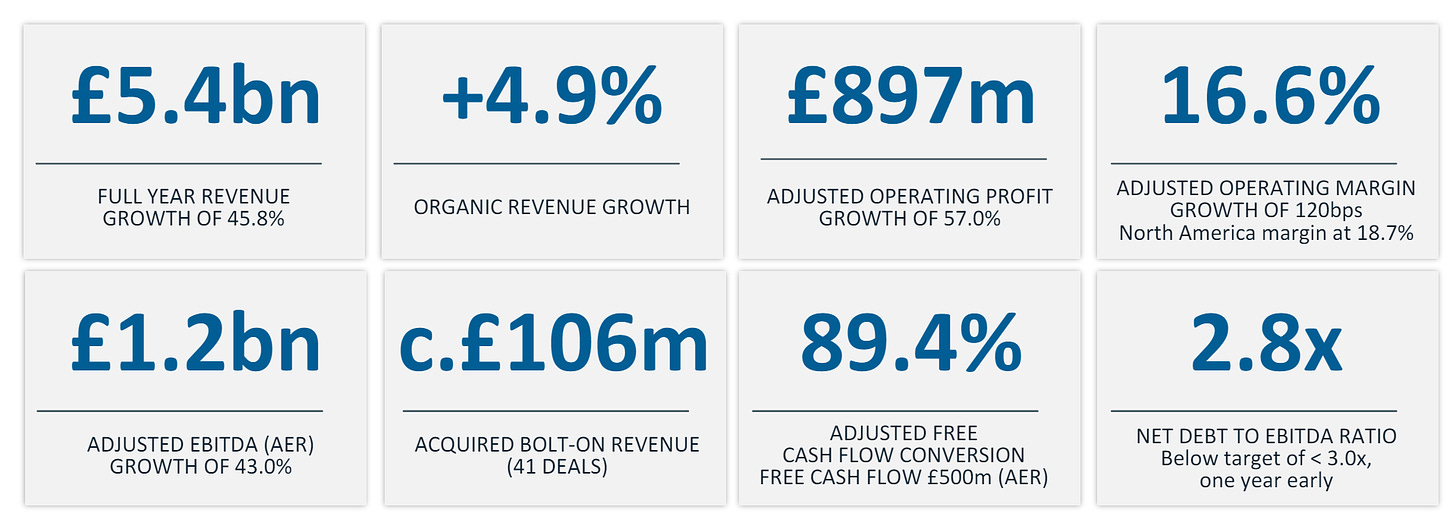

The financials are very simple:

Rentokil is a £10.2 bn market capitalization business listed in the UK with an ADR listed on the NYSE.

Revenue is a function of organic growth as well as inorganic growth from tuck in M&A. Rentokil did $5.4 bn in revenue and this revenue should grow at mid to high single digits for the foreseeable future.

Margins are depressed and should improve with the integration of Terminix and operating leverage as branches are better utilized. Rentokil made a 22.8% EBITDA margin in 2023A but this should improve to 24-25% by 2026. They have a guidance to increase their EBIT margin to 19% plus.

FCF conversion is high at 85% of EBITDA. Rentokil took on debt to buy Terminix but has been paying it down such as net debt to EBITDA is about 2.6x. Free cash flow will be used to pay down debt and to buy other smaller pest control companies in the US and internationally.

Peer multiples justify a target multiple of 25x for Rentokil:

What gives us confidence?

Pest control is a secular growth business and even with mis-steps, we believe Rentokil cannot help but grow

Before the Terminix acquisition, the EPS growth at Rentokil and Rollins was very similar. This means that the company was doing well executing on the pest control strategy.

Everything we have read about Andy Newsome or the interviews we have seen or heard assures us that this is a management with their head and, importantly, incentives at the right place.

Rentokil has completed over 200 acquisitions since 2015—and has spent an average of GBP 310 million on mergers and acquisitions annually over 2018-22 - focusing on acquisition targets that build geographic density of its customers. This is not its first rodeo.

The company is running a lot of pilots - little experiments - to try to identify best practices for its network, and it is likely that mistakes will be made and lessons learned. As another example, they divide the US into 7 regions. They want to go slowly in the first region and depending on the results will integrate other regions.

We acknowledge that Rentokil has not done an acquisition as big as Terminix in the past and this brings its own set of challenges. While the company encountered some problems last year, we see that they already have a plan to fix things to get organic growth back to trend.

We'll take a cautious approach and we'll be measuring everything, measuring everything that we do in that integration to make sure that it's not having a deleterious effect on growth or customer experience or colleague experience. And if we see anything, we'll pivot. That's what we do. So we'll try and see if there's anything that causes any concern to customers, if it is, we'll adjust and address.

-Andy Ransom Q1 call

Termite Claims

A part of the bear case also rests on termite claims.

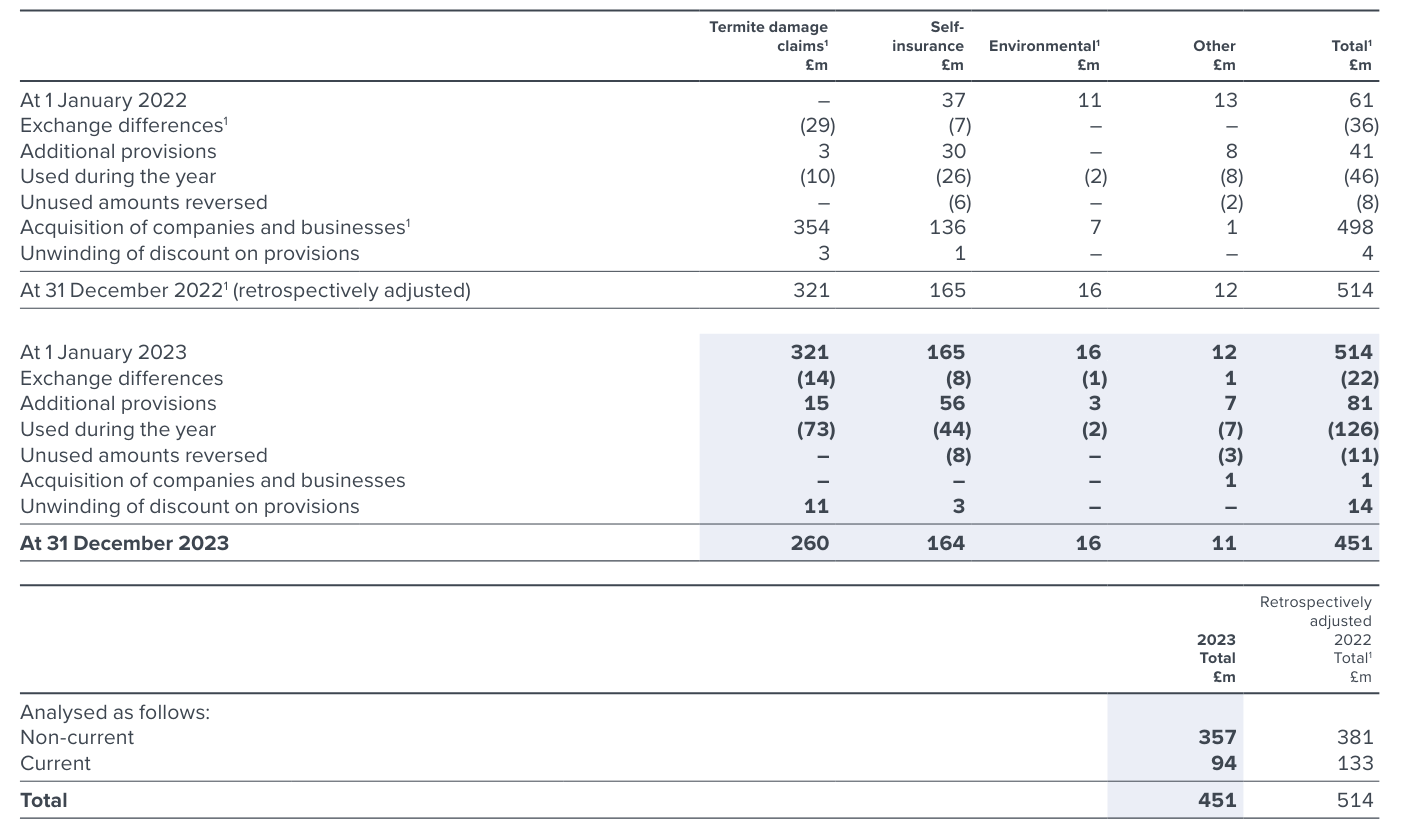

Many pest control companies offer termite treatment contracts that include guarantees or warranties. If termites cause damage while under contract, the company may be liable for repairs, leading to claims. Furthermore, if a pest control company's treatment fails to eliminate the termite infestation or prevent future infestations, customers may file claims for damages. As part of the acquisition of Terminix in October 2022, Rentokil recognised a significant provision for future termite damage claims whose liability existed at the acquisition date. The provision amounted to £260m at 31 December 2023. It is important to note that the number of warranty claims is steadily coming down and Rentokil reported large year over year declines as it is quickly trying to resolve these claims and put the issue behind it.

Source: Company filings

Rentokil has also changed its policy and while legacy policies have had unlimited cover, whereas new policies have been capped at $250,000 of claims.

It is important to note that these claims are only for pre-existing customers and once they fall away from the contractual relationship then the liability is gone. Due to this, cash conversion will be affected by 5-7% in 2024, before returning to 90% in 2025. Overall, the claims seem reasonable but there is always a risk as these are best estimates based on a variety of factors.

In summary,

Rentokil remains a robust business with significant growth opportunities. As a global leader with a strong brand and solid underlying profitability, it warrants a high valuation. Its consistent track record of delivering for investors further reinforces its appeal.

All I can is back to how we run our business; we have these very methodical machines engaging people, delivering good service. If you deliver good service, you can get price increases in line with inflation; nothing more than that. So there is an opportunity there. If you can get one or two percentage points on customer retention because you've been delivering good service, that adds quite a bit to organic growth. If you can up sell and cross sell additional services, which, of course is the Terminix plan, even before we turned up, and they’ve explained that, and there's the opportunity. Leads really come from two places. They come from online, the web, which is about organic search and paid search. There's a real opportunity to invest in the Terminix brand, and to push more leads through the web. But they also come from frontline technicians, and that's an area that I would say Rentokil has got real skills over the years of driving frontline lead technicians. So, not an easy thing to do. It won’t be overnight, but our playbook, their colleagues, working together, we think we can deliver really nice levels of organic growth. We’ll increase colleague retention, we’ll increase customer retention, and that who flywheel effect that I talked about earlier, will start to move, and we’ll start to move, we believe quite quickly, but we’ve got to get to the other side of the finish line before we can bring our tools and experience to bear, and to work with their teams.

-Andy Ranson during the Terminix M&A Call

Rentokil is the global leader in pest control, securing the number one position in the US after acquiring Terminix. Pest control now accounts for 80% of the group's revenue and operating profit, with Hygiene & Wellbeing contributing about 15%, and French Workwear making up around 5% of revenue. We have not talked about the latter two divisions as the hygiene division is very similar to Diversey and the workwear division is for sale. The pest control market has attractive growth characteristics, averaging around 5% growth through economic cycles. In the medium term, we expect Rentokil to achieve low- to mid-single-digit organic growth and low double digits operating earnings growth led by margin expansion.

We believe that the current multiples are very reasonable for a compounder company that is Rentokil. Once organic growth comes back to track, we believe investors will see light at the end of the tunnel and re-rate the shares.

Disclosure: The author and the accounts managed by the author hold shares in Rentokil. This article is for informational purposes only. We may be wrong in our analysis and encourage all readers to come to their own conclusions.