Memo: International Investing

We scour the world for ideas, and why you should too

Welcome back! If you are new, subscribe to receive monthly deep-dive research on global stock ideas and other original investment content

Value Punks is primarily focused on international investing. So far, we have published three deep dives (Rakuten, HDFC Bank and Xiaomi) on profitable and unique enterprises that are based outside the United States. We often get asked about our focus on international investing.

Why?

Why bother with international investing when you can just buy the QQQs and go to the beach? The US market is deep and wide and an investor can spend their whole life understanding and selecting businesses listed on US exchanges. Our hero - Warren Buffett - has done just that. With a few exceptions, he has largely deployed capital only in the United States.

International investing is a lot of work. It can also be uncomfortable. Importantly, international stocks have underperformed since GFC:

It has become really hard for international mandates to justify their existence. Many allocators have made the easy decision to redeem and invest the capital back in the good old S&P 500. This decision, of course, was not taken lightly. The allocators rely on extensive analysis by the consultants.

Value Punks - having been in the trenches in international markets for over a decade - believes this is the optimal time to allocate capital to international ideas.

Let us explain.

If instead of the last 10 years we focus on the longer term history of international investing, we observe that the performance is not bad! Starting 2003, after the internet bubble, there was outperformance against the S&P 500 until about 2014 for international equities and until 2021 for emerging markets equities. Notably, the outperformance until 2008 was very significant!

In addition to the outperformance in 2000’s, international equities had periods of outperformance against their US counterparts in the 1970’s and 1980’s. The current period has been the longest period of relative underperformance for international stocks. Perhaps, international markets are due for a season of outperformance? We know no one believes in reversion to the mean anymore but with high inflation prints and record deficits in the US, perhaps there is an argument for investing a part of your assets outside the US. Right now everyone is FOMO’ing into US stocks but, as and if the cycle turns, it is probable that the same investors will FOMO into international markets.

“I skate to where the puck is going to be, not where it has been”

-Wayne Gretzy

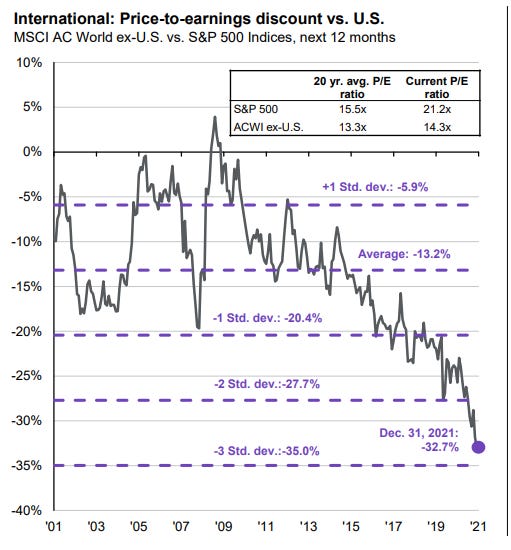

As investors, all we really control is what we buy and the price we buy it at. We know that starting valuations have a huge bearing on eventual returns. Currently, international stocks are at the cheapest compared to their US counterparts.

Ok, says you the astute reader, perhaps the valuation argument makes sense. But, we invest in high quality businesses or high growth businesses. Also, we like businesses with simple corporate governance. Oh, and by the way, - are the financials of these international stocks available in English? Queen's English?

Yes, dear reader - they are available in English! Also, we do not argue for a 100% allocation to international stocks so please keep your US stocks. We present arguments below to consider allocating a part of your portfolio to international stocks.

Diversification

“A single arrow is easily broken, but not ten in a bundle”

-Japanese proverb

We are in the business of making risk adjusted returns. International investing diversifies some of the risks that come with investing only in the United States. Moreover, international markets have some great listed businesses. We look for companies that earn sustainable superior economic returns as a result of an inherent competitive advantage. This competitive advantage can be a brand, lower cost structure, network effects, switching costs, superior intellectual property, scale or a combination thereof. There is likely a comparable ‘peer’ business in Europe or Japan to most US businesses. We also observe that Europe and Japan have largely retained their industrial bases due to which new industries associated with manufacturing, such as automation or robotics, are also likely to originate in these countries. In other cases, international markets contain unique businesses in industries such as luxury or tech/semiconductor. These businesses have the ability to do as well as some of the best US businesses.

The other important factor to consider in diversification is currencies. When one buys international stocks there are actually two trades here - one to buy the local currency and the other to buy the stock. It has generally been observed that international stocks outperform during periods when the US dollar is weak. The US dollar - represented by the DXY - underperformed 2002-2008 which led to the huge emerging markets outperformance we see on the chart above. Not only do you gain on the stock but also on the currency! As a current example, while US growth stocks have declined in a material way since November 2021, Brazilian stocks have risen 20% - led by both stock returns as well as FX. It is important to note that many international countries, especially emerging markets, did not have the option to stimulate their economies during Covid. Due to this, their fiscal and current accounts look much better than the US.

Perhaps, it's time for a turn?

Fundamentals

“Fish where the fishes are”

-Charlie Munger

By some estimates, 40% of the world’s market capitalization is outside the US. Some international markets, especially emerging markets, can have higher growth than the United States and one can invest here to benefit from this high growth. While one can pick stocks anywhere, the tailwinds of growth here means that time is on the side of the long term investor. Demographics are destiny, they say. With populations declining in most developed countries, where can you go to find some growth? Furthermore, if one is feeling slightly more adventurous then the small and mid cap securities in international markets can be especially lucrative.

Countries such as Japan, South Korea and China have businesses that have leapfrogged US businesses when it comes to technology and innovation and one can profit or at least learn from these business models. Facebook (err Meta) shareholders recently found out that they should have studied Bytedance. Well, they should not feel so bad as it took the US government all this while to realize that there is a single point of failure with all of the world’s semiconductor manufacturing taking place in a tiny island off of the coast of China. Why has Taiwan been so successful? Well, you will have to read Paul Krugman’s Nobel prize winning thesis but the short answer is ecosystems develop which leads to economies of scale not just due to capital and equipment but also due to talent. The best semiconductor engineers are in Taiwan!

A long time ago a senior portfolio manager took me aside and said, ‘Value Punk, do you know the secret to success in this business’. I must have mumbled something like ‘superior analyses’ or ‘insights’. No, he said, ‘pick the index you compete with’.

Mic drop.

A good active manager can find a lot of alpha in international markets!

Ok, sure, valuations are better and fundamentals are there and perhaps we can benefit from diversification and even outperform the index.

But, what about corporate governance?

We have CEOs in the US with fat salaries and stock options at a high % of revenues which aligns their interest to ours! Dilution, what dilution? We’ll worry about dilution in a bear market. These CEO’s also report something called adjusted EBITDA and earnings. Will these international companies follow these wonderful adjusted accounting standards?

This memo does not argue that investors invest in a state owned company or with one of the shady promoters in emerging markets. Corporate governance and culture are paramount when it comes to compounding over the long term. One can have very high standards on alignment and find them in droves in international markets. Importantly, IFRS has made things much simpler in that accounting standards (with a few minor exceptions) have been harmonized in many parts of the world.

In many cases, these international companies are run by first generation entrepreneurs or families who have retained the business for many generations and steward it with great care. Research shows that family owned businesses outperform over the long term. Of course, it is important to understand alignment of interest between the controlling and minority shareholders. We have come across our fair share of unsavory characters but that has not kept us from finding the good ones. It does not take more than an expert call or a drink with a local broker to get the downlow on the management/family.

“Corporate governance should be done through principles and not rules”

-Adi Godrej

On the positive, capitalism ‘slows down’ in international markets and decisions are made for decades not quarters. The importance of capital allocation policy to investors can hardly be overstated. In 1987, Warren Buffett observed in his letter to shareholders that, “Most bosses rise to the top because they have excelled in an area such as marketing, production, engineering, administration or, sometimes, institutional politics. Once they become CEOs, they face new responsibilities. They now must make capital allocation decisions, a critical job that they may have never tackled and that is not easily mastered.” A good business can become an excellent investment if the free cash flow generated by the business can be invested at attractive rates of returns. An entrepreneur or a family running the business intuitively understand capital allocation.

While countries such as Japan are getting better at capital allocation, emerging markets companies been very good at it as capital has historically been scarce. From a China perspective, we have already written our views on the VIE structure.

Given high valuations in the US as well as a strong US dollar, can international stocks outperform again? We believe so, and Value Punks is dedicated to helping you find and understand the most interesting international ideas!

We would love to hear from our community - If there are any companies that you would like to see us cover, let us know by commenting below!

Also, please feel free to forward this to anyone who may have an interest in international investing.

Legend holdings if you can find what it owns. No one else did that

Like this. Thanks