Deep Dive: Zebra Technologies (ZBRA)

Industrial 'picks & shovels' undergoing a cyclical hiccup

We believe shares of Zebra Technologies present an attractive opportunity to acquire a high-quality compounder - one that is momentarily out of favor - at a compelling valuation.

Historically, buying high-quality industrials during cyclical pullbacks has proven to be a dependable strategy for long-term investors. The caveat here is that they must have a strong underlying business and balance sheet to weather the cycle. High quality industrials often emerge out of the downturn even stronger.

Recently, Zebra has reported disappointing numbers for both Q2 and full-year guidance. FY23 revenue is projected to decline 20-23% year-over-year, due to the normalization of Pandemic-level demand. Weakness was especially evident among customers in the retail and logistics sectors, which are now digesting their capacities and delaying new purchases.

It's also worth noting a significant litigation settlement payment was made to competitor Honeywell, which reduced Zebra's net income by more than 40% last year. This places Zebra in an interesting spot - the company neither screens well on a trailing nor on a forward basis!

However, looking past the cyclical hiccup, we believe Zebra’s growth optionality is not being reflected in its current valuation. With America’s manufacturing construction activity at historically high levels (even after adjusting for inflation - see below chart), driven by onshoring and government stimulus, it should be a matter of time before spending trickles down to supply chain investments and new equipment purchases.

In addition, Zebra’s strategic pivot from a hardware-centric company to a solutions provider provides ample growth opportunities. Through the sales of software and automation technologies, management is laser-focused on delivering on new labor optimization solutions. Zebra has a highly capable management team with strong record of driving growth both organically and through strategic acquisitions.

All of this means that looking beyond the immediate slump, this is an attractive opportunity for patient investors. This report will delve into our conviction on Zebra’s business and management, its growth opportunities, challenges, potential disruptions, and valuation.

The Business

Zebra Technologies is the market leader in tracking and identification technology. The company has the industry-leading share (average 40%) across three core product categories: printers (barcode and RFID), scanners/data capture devices, and rugged mobile computing.

These equipment serves as the lifeblood to modern supply chains. They are primarily used for inventory management, tracking the movement of goods, as well as parts management and quality assurance in manufacturing. Other use cases includes retail checkouts and patient identification/specimen labeling in healthcare facilities, and many more.

At a high level, Zebra’s equipment helps to bridge physical and digital worlds, supporting the digitization and automation efforts for businesses. For most of its history, Zebra has primarily been known as a hardware-centric company. However, management is now focused on transforming the company to become a solution provider, integrating hardware with a growing suite of software solutions that allow customers to “see the bigger picture” of their operations.

Zebra sells to a diverse end-market. Retail & e-commerce accounts for 30%, transportation and logistics 20%, manufacturing 18%, with the balance being mostly public sector and healthcare. Zebra has a global presence with over 50% of its topline generated outside of North America.

Zebra operates two business segments:

Asset Intelligence & Tracking, or AIT (30% of revenue in FY2022)

This segment traditionally consisted of Zebra’s thermal (barcode) printer business. With the accounting reclassification in 2Q 2023, the segment now also includes Zebra’s RFID portfolio (roughly low to mid single digit percentage of total revenue).

Zebra’s printers can print on a variety of medium including labels, wristbands, tickets, receipts, and plastic cards, and the segment also includes the sales of these consumables supplies.

Enterprise Visibility & Mobility, or EVM (70% of revenue in FY2022)

This segment contains Zebra’s businesses which were mostly obtained through acquisitions, including its 2014 purchase of the enterprise product portfolio of Motorola Solutions (Zebra’s largest acquisition to date), as well as some of Zebra’s more recent acquisitions in the software and machine vision space.

Motorolla was split into two independent companies in 2011. Motorola Mobility focused on the consumer business including mobile phones, while Motorola Solutions was the enterprise/government side of the business. In 2012, Google purchased Motorola Mobility for $12.5bn. In 2014, Motorola Solutions sold a part of its enterprise portfolio, which mainly consisted of rugged mobile computing and scanning/data capture devices, to Zebra for $3.45 bn.

These mobile computing devices are purpose-built for industrial and field use. They can be dropped on concrete, left in a freezer room, have chemicals spilt on, or even run over by a fork truck, and still be expected to operate. From a hardware perspective, they might look very similar to consumer smartphones and tablets. However, the business model here is quite different from the consumer side as it requires its own specialized sales and support network.

The acquisition was really a case of David acquiring Goliath. The acquired portfolio of Motorola Solutions generated an annual revenue of $2.4 bn at the time of acquisition, almost twice the size of Zebra’s legacy printer business which had under $1.3 bn in sales.

Despite this massive undertaking, this was a highly successful acquisition. It gave a huge credibility boost to Zebra’s management team, led by Anders Gustafsson at the time (who recently transitioned from CEO to Executive Chair). Zebra had successfully integrated Motorolla’s people and products, and significantly improved the profitability of the acquired portfolio, growing its operating income by threefold in the eight years post-acquisition.

Today, Zebra is the market share leader across three core product categories, as shown above. The only other full-line competitor is Honeywell, while smaller competitors tends to be more focused on single categories, for example Datalogic (Italy) in data capture and Sato (Japan) in printers.

There are also some low-priced ‘ankle biters’ in the market such as Bluebird (South Korea). The emergence of these low-priced competitors have led to some degree of commoditization in hardware. This has forced the larger players like Zebra and Honeywell to increasingly emphasize a total cost and solutions-oriented approach to differentiate themselves.

Business moat

When analyzing industrial companies, a consistent pattern often emerges: they possess a robust moat surrounding their product portfolio, distribution, and aftersales. These are the foundations of a strong industrials business. They often take decades to establish, and what we also often see is that these moats tend to get stronger over time.

Product portfolio - The industry is essentially duopolistic from the vantage point that only Zebra and Honeywell are considered comprehensive providers. This matters because multi-vendor solutions are less desirable. A scanner from Company X has to read labels printed using Company Y’s machine - if this doesn’t work, is it the scanner’s fault or the printer’s fault?

Former Zebra employees have noted that customers have no shortage of choices and could mix and match hardware from competing vendors to save money at times. However, some of these customers ends up returning to Zebra to consolidate their purchases, after running into problems with their multi-vendor setups.

Distribution - Zebra has built an extensive distribution network. Roughly 20% of Zebra’s sales is made directly to enterprises, while 80% of sales goes through its network of over 10,000 ‘Channel Partners’ consisting of consultants, value-added resellers, and system integrators. These partners can range in size, scope, and sophistication, from smaller mom & pops that only provide simple device setups, to end-to-end integration providers.

“Overall, I think you have to have the right partners in the region. Basically, as I said, you can sell a product, but without the support from partners it’s very difficult for the end customer. Most of our partners in the region (APAC) have been selling Zebra for the last 10, 20 years.”

– Former Business Development Manager at Zebra Asia Pacific (Sep 2022, Stream Transcript)

Aftersales - Just about any successful industrials company needs to provide exceptional aftersales support, and Zebra is no exception. Most customers would run into serious operational disruption if their barcode reader goes down. Imagine a hospital lab that can no longer scan and identify patient samples. These must be fixed right away!

At times, it’s about mechanically fixing the hardware. Other times, it can be software related, and you might be surprised at how this works, as a customer explains below:

“What they do is, we'll tell them "It's not reading this barcode." We'll send them a sample of the barcode and it doesn't have to be the physical barcode, we can take a picture of it and send it to them. They'll take that into their lab. They'll figure out what the code change is at the firmware level that they have to make to the scanner so that it will pick it up. They send us back just the barcode and we go to the scanner scale and scan that barcode. Whatever's in contained within that barcode updates the firmware on the scanner scale. Now you can take the product that wasn't scanning and scan it. I haven't figured out how they do it. They're really good about solving those quickly.”

Zebra’s moat looks to be getting stronger over time, as the company transitions from a hardware vendor to a solutions provider, embedding itself further down customer’s operational processes.

Key to this transformation is software. In the past, Zebra’s ‘software’ focus was primarily on device software like printer management tools. For example, when replacing printers, customers often seek backward compatibility with existing print management software, so that they can be ready-to-use out of the box. This helps deter customers from choosing competitor’s hardware, which lacks compatibility and must be reconfigured from scratch.

While device software continues to be an important part helping to contribute to the stickiness of the business, the focus is evolving.

Today, ‘software’ at Zebra has expanded to encompass a more comprehensive suite of solutions in areas like workforce management, inventory management, supply chain visibility, and operational forecasting. These are not just centralized planning tools - they're edge device applications that can be integrated with Zebra's hardware products. For example, the workforce management software Reflexis, when installed on mobile computers, gives frontline workers with the ability to manage their shift schedules in real-time.

“Let’s say Zebra’s revenue was 80% hardware, 20% software. You’re going to see a shift over the next five years of that being more of a 50/50 split…then 30/70, 30% hardware, 70% software…the reason we’re doing that is because hardware will continue to be commoditized. Those margins will continue to have pressure and they will shrink. The demand for hardware won’t go away, it’ll still be there. In order to maintain and even accelerate those growth rates, you need to get higher margin, higher value-add services in there like software that see 50%, 60%, 75% gross margin on top of that stuff. You’ll see a shift.”

- Former Regional Director at Zebra (April 2023, Stream Transcript)

Zebra’s software focus makes a lot of strategic sense, but we believe there are two obstacles the company faces:

Customer perception is difficult to change, and for many, Zebra is still regarded a hardware-centric company. When it comes to solutions, companies instinctively turn to leaders like Accenture, IBM, or Deloitte. Changing this perception to become ‘top of the funnel’ requires time and effort.

Many of Zebra's software solutions have been obtained through acquisitions. This means integrating varied tech stacks, presenting a challenge in standardization.

“I think Zebra has the most full solution. They have a full portfolio of supply chain applications way ahead of a lot of other companies. The challenge, at least from my perspective, is that to get these on a standardized platform…Salesforce had a standard platform that they started as a CRM, and then they were able to add on different modules because everything was under the same architecture. With Zebra, that’s a little bit of a challenge, is that their software solutions aren’t under the same architecture.”

– Former Solutions Engagement Manager at Zebra (June 2022, Stream Transcript)

Recent cyclical weakness

As long term investors, our focus is typically not on quarterly results. But the most recent quarter (Q2 2023) for Zebra is worthy of addressing given the surprising weakness in results and guidance which sent shares down 20% after announcement.

First, before we dig in, here’s a Smart Summary from AlphaSense highlighting some key points from the earnings call (click to zoom in). As a side note - we are genuinely impressed with the recent advancements in AI summaries, and find them quite useful as a ‘first look’ for pinpointing the main talking points.

Let’s delve deeper. The headline numbers certainly seemed alarming: Management is guiding Q3 sales to decline 30-35% yoy, with double digit declines across all primary product categories. Guidance assumes that the weak sales trajectory of Q3 persists for the rest of the year, with FY23 sales projected to be 20-23% lower.

The reasons for this downturn are clear. Weakness was seen across the board, but especially in e-commerce/retail and logistics. These industries, having ramped up investments during Covid, are now absorbing the surplus that they have built, delaying purchases of new devices.

Notably, sales of mobile computers have been particularly weak. The shift from legacy Microsoft enterprise OS to Android-based devices started around 2015-2016, and Zebra was the pioneer at leading this shift. This created a tailwind for device sales in the form of shortening hardware cycle over the 2016-2022 period.

Compared to the legacy Microsoft platform, Android has much more frequent OS and software updates. Historically, customers would use their devices until they malfunctioned, which took a decade or more. With Android, the device replacement cycle became much shorter. Although the hardware is still capable of prolonged use, companies like Zebra have capitalized on this shift by introducing ‘forced obsolescence’ onto older devices, which would no longer be supported with essential updates. This nudged customers to replace their devices.

“When we used to have, I would say, an 8 to 10-year refresh cycle, especially on the hardware side, that’s moved down into more of the 3 to 6-year refresh cycle”

- Former Regional Director at Zebra (April 2023, Stream Transcript)

While shorter replacement cycle has boosted revenue growth in the past years, it also means that now, customers are working with a young install base and have the flexibility to delay their upgrades without causing too much operational issues.

Now, does this imply a return to an era where these devices will be used for 10+ year? Management doesn’t think so. As business sentiment rebounds, they anticipate a resurgence in upgrades.

During the call, the Chief Revenue Officer had confirmed that virtually no orders or backlog was cancelled, and that there has been no customer behavioral changes that suggest a change in usage pattern. In other words, this is entirely a timing issue.

Regarding the bleak guidance, the following gives some sense on the assumptions on which the guidance was built. The bar has been set quite low, it seems.

“What's embedded in the guide for the second half, one, it's supported by the most recent sales velocity. If you look, we are assuming significantly lower conversion rates on our pipeline of opportunities than we've had historically used due to the continued pushouts of orders that we've discussed earlier in the call. So again, a much lower conversion rate assumption on those deals…And I think the other important assumption is we're not having -- we're not assuming there's any type of potential year-end spending or new large deployments in the fourth quarter, which we typically see as we approach the end of the year.”

- Nathan Winters (CFO), Zebra Q2 2023 call

And finally, some optimistic comments came from Bill Burns, the CEO:

“We believe, ultimately, we're seeing in the process of seeing really the bottom in Q3 and Q4 and do see an inflection point in 2024…and we expect to exit year-end with the right levels of inventory for what is the end demand that our distributors are seeing.”

- Bill Burns (CEO), Zebra Q2 2023 call

In summary, while the headline numbers were certainly alarming, we also believe that the guidance is conservative. It's also noteworthy that the management expressed some optimism regarding the forward outlook and potential inflection point starting 2024, which, for the most part, went under the radar.

Secular growth

Looking past Zebra’s cyclical challenges, we believe there are plenty of reasons to be optimistic about the company’s long-term prospects.

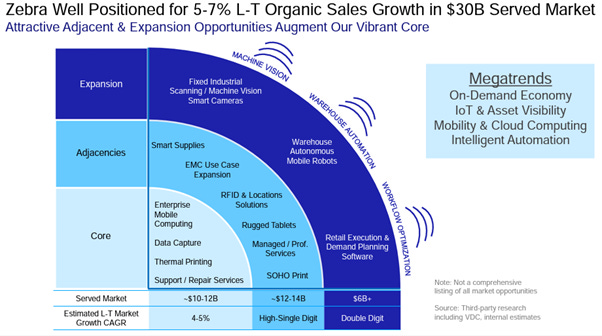

Zebra’s current annualized revenue is under $6 bn. Management assesses its own TAM at $30 bn and projects long-term revenue growth at 5-7%. This comprises growth in core product categories at a rate of 4-5%, with 'adjacencies' growing at high single-digit rates (see below).

We believe Zebra’s long-term growth will be supported by the rise in manufacturing capital spending in the United States driven by onshoring, demand for automation technology, and the expansion of new product categories.

The US is currently undergoing unprecedented levels of construction spending in the manufacturing sector. After maintaining a consistent level for decades, manufacturing construction spending (inflation adjusted) has skyrocketed. This is happening across all industries, but especially high-tech areas such as semiconductors, electronics, and industrials.

Government stimulus seems to have been a catalyst which includes ~$2 tn of direct and indirect funding from The Inflation Reduction Act and CHIPS and Science Act. In 2023 alone, the Reshoring Initiative announced over 400k new manufacturing jobs at US domestic sites.

As more manufacturing facilities start to become operational, additional supply chain investments will be required, creating a strong case for domestic demand over next several years. Historically, the US has underspent for decades in vital sectors. If the reshoring drive is real, then we are not talking about just one or two years of strong spending - perhaps we may be at a cusp of a new normal which could be sustained for many years to come.

As manufacturing returns onshore, a growing challenge for corporate America will be labor shortages and wage inflation - a risk that is still fresh in the minds of many CEOs from the Pandemic.

There should be growing focus on automation technologies and labor optimizing solutions, which Zebra is well-positioned to capitalize on. If we look at Zebra’s new product portfolio, the priority areas include RFID solutions, machine vision, and workflow management software. Immediately, we see that these products are positioned to benefit from the trend. Collectively, these three product areas represented about $500 mn in annualized sales in Q2 2023.

In machine vision, while Zebra maintained a small product portfolio in the past, the company’s real foray into the field came with the acquisition of Matrox in 2021. With this, Zebra has been able to acquire products for higher-end use cases, allowing it to better compete with industry leaders including Cognex and Keyence (see here for our previous Deep Dive on Keyence).

It's worth noting that Matrox's sales are heavily weighted towards the semiconductor industry – a sector at the heart of the reshoring initiative and poised to grow long-term. In addition, Zebra has been trying to push Matrox's product to other users including pharmaceuticals, general manufacturing, and logistics. The advantage Zebra has is its extensive distribution network, allowing it to push new products to a diverse customer base, and its brand and reputation, having done business with more than 80% of Fortunate 500 companies.

Finally, Zebra also has a significant international presence with 50% of revenue coming outside of North America. While we wouldn’t necessarily label Zebra’s presence outside of North America a ‘growth driver’, it is notable that Zebra has a strong presence in certain developing markets in Asia and LATAM. India is one such where Zebra has a 50-55% market share (~$100mn revenue in a ~$200mn market).

Given the current momentum at home in the US, the international segment might seem less important in comparison. A significant portion of Zebra’s international clientele comprises of US multinationals, and in an era of onshoring, we might not see their international footprint grow at the rate we have seen historically. Nonetheless, Zebra has the strongest international presence among its competitors, and this should bode well if growth outside of the US surprises on the upside.

Technological changes

The main technological debate today surrounds RFID - the next generation technology for identification and tracking. It raises questions about the potential impact on barcode scanning in the long run.

Unlike barcodes which need to be optically scanned, RFID operates using radio frequency waves to transfer data from an in-built chip. This offers several advantages:

More potential for automation: With RFID, there's no need for direct line of sight. As long as the RFID tag is within proximity (distance up to 10 meters), it can be read. The scanning of irregularly shaped items can be automated, without the need for a human worker to manually locate and scan the tags.

Faster: Barcodes are typically scanned one at a time, but RFID allows for simultaneous scanning of up to 1,000 tags per second, enabling much greater throughput.

More ‘intelligent’: They can store more data than barcodes. Also, in contrast to barcode which can only be read, RFID tags have both read and write capabilities, allowing for real-time data modifications.

The apparel industry is currently the largest user of RFID tags, accounting for an estimated 70% of usage. The dominance of fast fashion brands like Zara, Uniqlo, H&M, and others have significantly contributed to RFID adoption.

RFID is perfectly suited for their needs - these brands deal with high inventory volume and velocity. They have to adjust quickly to fluctuating demand, rapid product cycles, and manage high rates of product returns. There's a need for real-time inventory management on the SKUs (e.g. color, size) to ensure timely replenishment of inventory. Moreover, RFID aids in deterring product theft.

Zebra entered RFID in the early 2000s. On the hardware side, the competitive landscape is quite similar to the barcode space - Zebra competes with familiar rivals such as Honeywell and Sato. Zebra boasts the broadest RFID portfolio in the industry, and the concern here isn't that Zebra will become irrelevant in RFID or cede share to its competitors.

Instead, the risk stems more from shifting use cases which can potentially lead to the cannibalization of other (barcode) hardware sales. For instance, if a single RFID reader is able to capture everything entering a warehouse, it would render manual barcode scanning obsolete. This could replace a dozen workers with handheld barcode scanners, leading to lower hardware revenue overall.

While RFID has been used primarily in apparel until now, it is now starting to gain more traction in general merchandise and logistics industries:

“We look forward to expanding the use of RAIN RFID into more categories to further improve inventory accuracy across the business, provide a better in-store shopping experience for customers, and drive more online and pick-up-in-store capabilities.”

- Walmart, Senior Director Operations Acceleration & Support (Source: Impinj)

“As it relates to RFID technology, it will eliminate all the manual scans done by our pre-loaders. If that doesn’t drive productivity, I don’t know what will”

- Carol Tome, CEO of UPS (Source: Impinj)

Another example of a disruptive use case is in retail. The image below shows Uniqlo’s RFID self-checkout stations which are now outfitted at most of its stores. Shoppers can place all of their items into the checkout box (with no sorting required), and the machine will automatically populate the items, enabling a one-click checkout.

Perhaps in the future, we won’t even need checkout stations, as new concept stores could allow customers to simply pick up items and exit the store. Will barcodes be a thing of the past?

Another question concerns value capture. The difference with barcoding is that more value lies on the consumables side with RFID, given the microchips and more complex process of label making. Zebra operates primarily on the hardware side of RFID (printers and scanners). The bulk of the consumables side is captured by microchip makers (e.g. Impinj, NXP) and label makers (Avery Dennison, Alien Technology), which in turn supplies to Zebra.

Therefore, even though RFID unit prices are higher and the technology has a potentially large TAM in the future, the value is split among several key players in the supply chain. Whether Zebra would benefit, if hypothetically barcodes were to be completely replaced by RFID, is uncertain.

What has been Zebra’s response? Management stresses that RFID is “additive but not cannibalizing barcode technology”. They envision a scenario where both technologies can grow.

Cost is still the biggest issue for RFID. There are various estimates but most of them places the cost of barcodes at one cent or less per label, while RFID tags have a cost range between 5 to 25 cents and beyond.

RFID also has its share of tech issues, such as interference with electronic devices, metals, or liquids.

There are applications where RFID and barcodes are used in a complementary way. In a supply chain scenario, an RFID tag might be used for pallet-level tracking, while individual items on the pallet might still have barcodes for manual point-of-sale scanning. In fact, barcodes are so cheap that they are often used together with RFID tags simply as backup in case one fails.

RFID currently accounts for low-to-mid single digit percentage of Zebra’s total revenue. While it will certainly continue to grow, we feel that the notion of a ‘barcode-less society’ is still farfetched. Nonetheless, it’s important to pay close attention to Zebra’s RFID strategy, especially with regards to how management plans to optimize value capture in areas including software and the consumables side of the business.

Zebra’s financials

Topline growth has been healthy, although the endpoint matters here. 6-year CAGR is 8.3% using FY2022 as the endpoint. FY2023 guidance is 20% lower. If we take the midpoint between the two as “mid-cycle”, CAGR goes down to 5.5%.

The margin trend tells two different stories:

Gross margin decline is quite visible in the AIT segment. Management attributes the recent decline to higher premium freight and component costs. However, one has to wonder why the company was not able to pass on the inflation to customers. As some industry experts have mentioned, ‘commoditization of hardware’ seems to be playing a role here, perhaps.

On the other hand, EVM segment has shown impressive margin improvement, reflecting operating leverage and improving mix. When Zebra acquired Motorola Solutions portfolio in 2014, EVM segment actually had less profit than AIT, but over the years EVM profit has almost tripled.

R&D spending has consistently averaged about 10% of net sales ($570m in 2022).

It’s worth noting that net income in 2022 was affected by $372m in settlement and related expenses to resolve patent litigations with competitor Honeywell. Adding this back (‘adjusted net income’), net income was roughly flat year over year.

The settlement was one-off and should not impact Zebra’s business going forward:

“Agreed to a mutual general release from all past claims and entered into a covenant not to sue for patent infringement, according to a securities filing…The two companies also entered into a royalty-free cross-license with respect to each side's existing patent portfolio for the lives of the licensed patents, according to the filing. The agreement also provides for Zebra and Honeywell to dismiss all pending intellectual property litigation in U.S. district courts, the U.S. International Trade Commission and courts outside the U.S., according to the filing.”

- Dow Jones Newswire

Zebra largely outsources its manufacturing and therefore has very small capex requirement.

The company has maintained a very high tangible ROIC ranging from 57% to over 100% in recent years.

Factoring acquisitions, with goodwill and intangibles added to the denominator, ROIC becomes mid-teens which is still quite decent.

Strong cash flow generation with free cash flow averaging above 100% of net profit. Management has a target of 100% net income conversion over a cycle, and this is a metric included in the assessment of management comp.

Capital allocation priorities are debt repayment, M&A, and repurchase of own shares. Zebra has never paid a dividend in its history, and does not anticipate paying any in the future.

The company repurchased a record amount of shares in 2022, following its share price collapse. Recently, it has repurchased its own shares at roughly $260 per share. Management seems to have conviction in repurchases at this level. Investors can buy at below this today.

M&A

Acquisitions have played a key role in Zebra’s growth.

In its early days, when Zebra was primarily focused on thermal printing (barcodes), the company acquired many smaller printing companies. This allowed Zebra to expand its product lineup to different form factors and printing mediums, such as cards and wristbands, diversifying its product range. With this, Zebra eventually emerged as the market leader in thermal printing.

A landmark acquisition happened with the 2014 acquisition of the Motorola Solutions portfolio, as we detailed earlier in this report. This proved to be a game changer.

Zebra’s capital allocation priorities continues to evolve, as evident from the table below (generated using AlphaSense) showing all of Zebra’s acquisitions over the past decade.

Today, Zebra's focus is unmistakably centered on software and automation, towards achieving its vision of becoming a comprehensive solutions provider.

Acquisitions have been a key part of Zebra’s growth in the past, and will likely be so going forward. We believe management has earned the benefit of the doubt when it comes to their ability to acquire and integrate businesses. The acquisition of Motorolla Solutions portfolio offers a case study of Zebra’s culture and leadership approach which have made it successful:

“They had identified right from the get-go that, "You know what? This is not just you guys come in and you're going to do it our way," which is what typically an acquisition ends up in. They had spent over a year on understanding the different cultures. Immediately, a lot of that legacy Motorola enterprise people really felt for the first time in a long time, that we were going to be part of the bigger picture. They promoted teamwork, they promoted, "Let's start listening to each other's ideas." This was one thing that really did knock down the barriers of us versus them. I have to say, this was the first time that I ever experienced this in any acquisition. I've been through probably four of them at this point in time. It was a breath of fresh air.”

– Former Sr. Director, QA Engineering (July 2022, Stream Transcript)

When the new leadership team was formed at the combined company, it wasn’t just Zebra management - Senior Motorola personnel were placed at the highest levels, with real cross-pollination between the two organization. This sent a good and clear message to the Motorola employees knowing that they were regarded as an important part in the new organization.

Our impression, from interviews with former Zebra employees, is that this is a company that deals fairly with all of its stakeholders, and has upheld a high standard of corporate citizenship. In turn, it has won over the respect and loyalty of its employees.

“Zebra is a really, really good company with their employees as well as their customers. I think they try to partner with great companies on a win-win relationship”

There has been a leadership transition this year. Anders Gustaffson, the respected long-time CEO, transitioned to Executive Chair on March 1, 2023 while Bill Burns became the new CEO. Bill has seven years of senior leadership experience at Zebra, including five years as Chief Product & Solutions Officer, credited with the strategy and growth of the EVM segment.

It’s notable that throughout Zebra’s 50+ years of history as a company, it had only two CEOs. Gustaffson was the second CEO after the Co-founder, Ed Kaplan, ran the company for 35 years. While Zebra is not led by a founder today, we believe it resembles a founder-led company in its emphasis on corporate culture as well as its selective approach to leadership and succession planning.

“Zebra was a great company. They were building the foundation as to what they wanted to be for the next 50 years or so”

- Former Regional Director at Zebra (April 2023, Stream Transcript)

Returns expectations

At $12 bn market cap, Zebra is trading at roughly 18 times ‘normalized’ earnings, which we derive as follows:

Take the average of FY2022 revenue and FY2023 guidance (20-23% yoy decline) as mid-cycle topline

Operating margin of 16% and an effective tax rate of 20%

Peers in this space trades at following multiples:

Smaller hardware-centric competitors: Sato (12.5x forward earnings), Datalogic (11.8x)

RFID players: Avery Dennison (19.7x), Impinj (5.5x price to sales)

Machine vision and automation: Cognex (51.1x), Keyence (37.2x)

Zebra’s business essentially represents a cross-section of the above. It deserves a premium to smaller competitors like Sato and Datalogic, due to its stronger business moat and ability to expand into solutions and adjacent categories. If Zebra is able to successfully grow its share in the automation and software space over time, then it’s not unreasonable to expect margin expansion from current levels.

Starting from our normalized base, over the next 5 years, we model in net income growth of 8-9% annually comprising of topline growth of 5% per annum and 3 ppt operating margin expansion (16% to 19%) over the period.

Note that Zebra’s recent cost cutting initiative (FY23) has resulted in $65 mn of incremental annualized expense reduction not yet reflected on the income statement. Going forward, this creates ~1.5 ppt of yoy margin improvement on the operating line.

Overall, we expect Zebra to generate $6.6 bn in topline and over $1 bn of net income by FY2027. With some multiple expansion (18x to 22x), reflecting an improving product mix shifting towards software and automation, this results in $22 bn market cap, or 5-year CAGR of 13% from Zebra’s current share price.

Now, a 5% annual revenue growth lies at the low-end of management’s guidance for LT growth and we view this as conservative. For instance, if the boom in manufacturing spending starts to materialize then it’s likely to be much higher. In a bull-case scenario we adjust our growth rate assumption from 5 to 10%, and holding all other assumptions constant, this would yield a 5-year CAGR of 18%.

Conclusion: Shares of Zebra Technologies presents an attractive opportunity to acquire a high-quality compounder - one that is momentarily out of favor - at a compelling valuation.

Disclosure: The author(s) holds a long-position in Zebra Technologies

Stream by AlphaSense is an expert transcript library that helps investment analysts maximize returns with access to tens of thousands of high-quality, searchable, proprietary expert transcripts covering nearly every industry and market. Unlike costly and time-consuming traditional expert network calls, Stream drives faster time to insight, improves ROI, and ensures critical information isn’t missed in the research process. You can sign up for a free trial by clicking here.