Warner Bros. Discovery (WBD) is an interesting situation. Some investors think it is straightforward while others find it a complicated mess. The business does have all the ingredients for an absorbing story - it has streaming wars, tons of debt, key industry figures like David Zaslav and John Malone, and now, a writers strike thrown into the mix!

At the surface, the thesis is very simple:

WBD has $49 bn in debt but Zaslav is adept at finding synergies and cutting costs. While linear TV is in trouble, WBD can increase its EBITDA over the next two years due to Zaslav’s skill.

With it, it can eliminate $10-11 bn in debt and get to a more manageable 3.5-4x gross leverage ratio in 2024 from its current very high ratio of 5x.

A lot of hard pill swallowing has been done and we see that WBD took $3.8 bn in pre-tax restructuring charges in FY 2022.

Eliminated debt and streaming success de-risks the company and bumps the multiple due to which its stock can go from current $12-15 levels to more like $25-30. In fact, that may be at the lower end of the estimates as we know that Zaslav’s incentives do not kick in before the stock gets to $34 per share (he is already very rich..FYI).

This is a very lucrative return over the next 2-3 years but the following assumptions have to hold:

Zaslav has to be good at deriving synergies and cost cutting without stifling the creative talent at Warner.

Linear TV declines have to be managed.

WBD cannot lose the NBA in 2024-25

Advertising, which is cyclical, has to hold.

Max, WBD’s streaming service, has to win subscribers and show increasing profitability. Management has a $1 bn EBITDA target.

Streaming profitability has to make up for linear declines after 2024

Value investors often talk about the difficulty of investing in growing businesses as they necessitate assumptions about the future growth of the business, but then turn around and buy companies such as WBD which require making difficult assumptions on the four points mentioned above!

The difference between a growth stock and a situation like WBD comes down to valuation. WBD is trading at 7x 2023E EBITDA and 12.5x EPS which is very reasonable and if they can indeed meet expectations on deleveraging then this is a 30%+ IRR opportunity.

In this report, we delve into the underlying business factors driving these assumptions. Is the stock truly undervalued? Let’s dive in.

WBD was formed through the merger of WarnerMedia of AT&T and Discovery Inc. on April 8, 2022.

The merger was a strategic move to better position both companies in the new media landscape, creating a more diversified media company that’s better capable of competing with the likes of Netflix and Disney. Following the merger, David Zaslav who was the long-time CEO of Discovery Inc, became the CEO of WBD. Zaslav has stated that WBD would aim to spend a combined $20 billion annually on content and aim to expand their streaming services, including HBO Max, to reach 400 million global subscribers.

WBD segments the business as follows:

Studios: Warner Bros. Pictures, New Line Cinema and Warner Animation Group plus DC Studios. The Studios segment also includes Warner Bros. Games. Some of the most popular shows produced by Warner Media include Game of Thrones, Friends, The Big Bang Theory, The West Wing, The Sopranos, and Sex and the City.

Linear TV: WBD’s linear network operations include 30 U.S. general entertainment, lifestyle, and news networks, as well as a host of international networks and global and regional sports networks. The most popular of these are channels such as CNN, TNT, TBS, and Cartoon Network. WBD Sports’ U.S. portfolio includes the NBA, MLB, NCAA, NHL and USSF.

DTC: WBD’s DTC business includes their flagship streaming service that has now been branded as ‘Max’. This will be a mix of content from HBO and Discovery as well as Warner’s other assets.

Linear TV

Linear TV offers viewers access to content via subscription to cable or satellite services, or through over-the-air broadcasts. The term linear refers to the way in which viewers consume the content. They can only watch programs according to a broadcaster programming schedule. If they want to watch their favorite content, they have to tune in to a specific TV channel at a specific time. This is the broadcasting style traditional television and radio stations have used for years.

Linear TV networks make money via two sources: retransmission revenues and advertisements.

The demise of linear TV has been predicted for 15+ years and the industry has kept confounding the skeptics. The industry made lucrative deals during 2010-2012 which extended the life of the business and produced many years of lucrative free cash flows.

How did this happen?

One word: Live sports (and other live programs including live news). Okay, more than one word!

S&P Global estimates that US TV and streaming sports media rights payments will likely total $25.6 billion in 2023 across broadcast, cable, RSNs and streaming services. This has risen from an estimated $14.6 billion in 2015 and is expected to grow to more than $30 billion in 2025 as new deals are forged. We saw a lot of inflation in sports content costs which was passed on to cable TV subscribers and everyone lived happily ever after. Cord-cutting was balanced by pricing. You can either have a lot of subscribers at a low price point or a few subscribers at a premium price point, but what matters is total ARR. As costs are fixed, as long as ARR is increasing the business is doing well.

However, things are changing. Retransmission consent has grown to be the most important revenue stream for broadcasters, now approximately 50% of revenue, compared to 10%-20% nearly a decade ago. To date, broadcasters have been able to elude the negative impact of cord-cutting, due primarily to price escalators. Per-sub fees are now tracking toward $5 per sub per month.

How far can they go in price? Not very far from here. We have already seen retransmission revenues flip in the negative territory. At a certain point, the balance tips such that ARR starts to decline. This is when you cannot push pricing and cord-cutting is still a big headwind.

“In a couple of years is when you do your renewals with your cable company. Warner Discovery is going to go sit down with Comcast in, I don't know, whatever year it is. Comcast is going to say, "Tell me why your rates are going up, but you have no new content or very little new content. Your ratings are down and not as many people are subscribing to cable anymore. Why should I pay you more? Why should I Comcast go raise the bills on my customers to make them more upset with me and maybe drive them to somebody else? Why should I give you a rate increase?" It's a very hard conversation. I don't know when it happens, but I'm certain that it's happened at least once and probably will be happening dozens more times as the cable business continues its trends”

- Former WBD VP, Content Experiences (Jan 2023, Stream Transcript)

Another problem that TV networks face is big tech becoming a threat in live sports. YouTube beat rivals to win the rights for NFL Sunday ticket which is one of the biggest sporting events in the US. Amazon became the first company to put the NFL behind a streaming paywall, coughing up about $1 billion per year to air Thursday Night Football on Prime Video starting this season.

If one does a thought exercise and asks who has the balance sheet in 2025 or 2030 to bid for sports rights if subs keep declining and sports inflations keeps trending then one is forced to only think of big tech.

Increasing encroachment of big tech into live sports is a major step change for linear TV due to which it is likely to face increasing declines and we believe the market and investors are underestimating the effects of further declines on the bottom line. These are high operating leverage businesses where a lot of this revenue decline will disproportionately affect EBITDA and the bottom line. What will WBD look like if they lose the NBA?

“Customers are following them there…our customers are going to find alternatives to the [broadcast] networks. And even the mainstay of professional football, which is probably the one mainstay they [broadcasters] have, is readily available to a number of sources today. So the next step in retrans is down, not up… I said it about regional sports, I’m saying it now. That’s where that’s going. And it’s a shame because the local broadcasters are caught in a vice between the network and the distributors. So we have some empathy for their plight, but we cannot be their bank unless we get a return. And right now, we don’t get a return.”

- Charlie Ergen, CEO Dish TV

In response to these headwinds, Linear TV is adapting. Some linear TV channels are launching their own streaming services, such as CBS All Access and NBC's Peacock, in an effort to keep up with changing viewer habits. They are focusing further on live events, such as sports and news broadcasts. Many linear TV channels are also integrating with digital media, such as social media and streaming platforms, to reach younger viewers. For example, some TV shows have their own social media accounts and hashtags, and some channels are producing exclusive content for platforms like Snapchat and TikTok. But it is likely not enough!

Linear TV subs peaked at ~100 mn subscribers and have been declining ever since. We are currently at 61 mn subscribers and this rate has been steadily declining at a 5-7% rate. The bears will straight line extrapolate this to say that the US will have no subs left in 15 years while the bulls will say that the subs will stabilize at a 40-45 mn level due to demographics, sports, news, and inertia.

The big question mark, in our mind, will be at what ARPU?

We know that these issues are already hurting the bottom lines for the mainstream networks. The industry has responded with consolidation and cost cutting. We are in a difficult part of the cycle where deep cuts and synergies are needed to offset the declines from cord-cutting. The propensity to pay up for a cable bundle will be greatly diminished due to the demands on consumer wallets for all the other content, including networks own streaming services.

In the long history of broadcasting, the last 10-15 years seem like one last push to keep the industry relevant. We believe the playbook of the past decade may be nearing its end, and we are afraid that bulls may be overlooking the potentially significant effect of a declining retransmission revenues on the bottom line.

The second source of revenue for linear TV is advertising. Advertising is cyclical but very lucrative. Here are some statistics.

Total Ad revenues (United States):

Ad revenues by medium:

Globally, Magna expects media owners’ advertising revenues will grow by +5% in 2023 to reach approx. $830 billion. This is a slowdown from +7% in 2022 and +23% in 2021. S&P has similar forecasts to above and predicts that total TV ad revenue will fall 8.2% in 2023, with network TV down 5.7% and cable down 3.5%. Local TV, including political advertising, is expected to drop 18.9% in a non-election year. By contrast, digital advertising is expected to grow by 9%.

Linear TV continues to suffer from the long-term erosion of linear reach and live viewing as seen above. However, linear TV has two things going for it:

Resilient pricing where TV CPM inflation hits double-digits in 2021-22 and will continue to grow by an average 10% in 2023. We believe TV remains one of the preferred ways for advertisers to build a brand; and

The rise of brand safety and media responsibility in marketers’ priorities that has led some brands to slow down digital diversification.

While this will slow the declines, the math on advertising works the same:

Fewer subscribers = less advertising revenues.

More recently, all broadcasters have talked about macro factors affecting advertising revenues. We know that advertising is cyclical and can decline substantially in a recession.

A cyclical business that’s structurally declining in the long term and will never get high multiples. The networks will provide the necessary cash flow needed for firms like WBD and Paramount to de-lever and to re-invest in their streaming services. However, if the streaming services cannot match the free cash flow profiles of these legacy cash cows then the enterprise value of these businesses will likely decline over time.

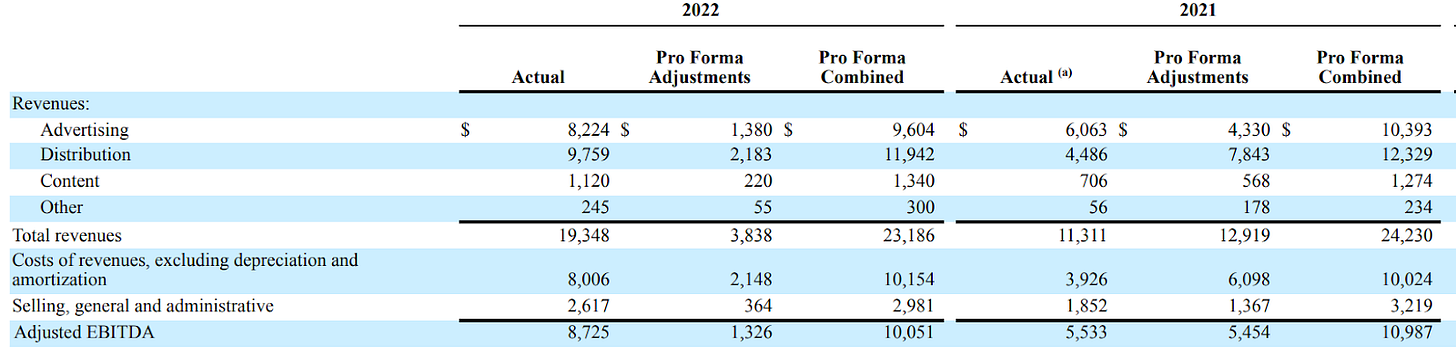

Here are how the financials shake out for the networks division:

There were a lot of restructuring costs below the line. In 2023 and 2024, we will likely see the dividends from these restructuring efforts in the form of permanent synergies and cost cuts. Earlier we have argued that these revenues are at risk due to cord-cutting which, if in excess of price increases (which will likely be the case) will have a big impact on the bottom line.

Unlike guidance and consensus that projects EBITDA to rise in both 2023 and 2024, our assumption is more conservative. We predict EBITDA will grow to $11 bn in 2023, but will stabilize at the $10 bn level a few years after that, followed by a gradual decline. It is anyone’s guess at the pace, but we would not be surprised if it is at ~5-7% annually for many years. We hold this view in spite of our bearish cord-cutting and pricing assumptions, as we trust that management will continually cut costs to safeguard profitability.

Still, $10 bn per year is a significant level of profitability which if it converts to FCF at 40-50% level will produce $4-5 bn in FCF for WBD and it keeps the de-leveraging thesis in play. If WBD does nothing else, it can be a debt free company in less than 10 years!

Streaming

WBD’s service, HBO, has already been successful in the streaming market with its platform, HBO Max, which has gained a significant number of subscribers since its launch in 2020.

“Obviously, HBO is probably the gold standard in TV production content. If you think about all the biggest shows of the year and what gets people talking, the Game of Thrones spinoff, Succession, The White Lotus, all these shows actually have really good crossover on social media. You see people making fun of The White Lotus theme song, for example. That just shows the cultural and cultural importance of something like HBO.”

- Former Analyst, Corporate Strategy and Business Development at Disney (Feb 2023, Stream Transcript)

HBO has a reputation for producing high-quality content, and many of its shows have a dedicated fan base. By offering its content through a streaming service, HBO can reach a wider audience and provide more flexible viewing options for its customers. WBD recently announced that their new platform, dubbed just ‘Max’ (we’ll let the reader form their own opinion on this branding exercise), set to launch May 23 (to replace HBO Max), will include three different tiers: $9.99/month for the ad-supported version, $15.99/month for the ad-free option, and a new "ultimate" ad-free tier for $19.99/month that allows four concurrent streams and 4K streaming options.

In fact, we have some numbers on HBO when it was part of AT&T. We know that HBO was always in demand and was producing subscription revenues much before ad-free premium programing became profitable. HBO provided a premium subscription channel on top of the cable bundle. Its brand was always at the premium end of TV and occupied subscribers at 9 pm every Sunday evening.

In its present avatar, HBO Max (along with HBO and Discovery+) had 96.1 million subscribers globally in Q4 2022, with 54.6 million coming from the US. Max will merge the content libraries of HBO and Discovery/Scripps, and through this one-stop shop proposition, management hopes this will help users stay on the service and reduce churn.

Among the many streaming services, we believe that Max has the ‘right to win’. As John Malone said, WBD will succeed if CEO David Zaslav ‘makes the good stuff’. WBD has a target to produce $1 bn in EBITDA from Max in 2023. This may be pushed out a little due to the writers strike and also because the international launch of Max has been delayed to fall of 2023.

The accounting of streaming businesses warrants some consideration.

There has been a big debate between Netflix believers and non-believers and it has centered around earnings and free cash flow. While Netflix produces very good EBITDA and earnings, its free cash flow profile leaves much to be desired. The core of this is accounting for content. Here is the stated policy:

“For produced content, the Company capitalizes costs associated with the production, including development costs, direct costs and production overhead. Participations and residuals are expensed in line with the amortization of production costs. On average, over 90% of a licensed or produced content asset is expected to be amortized within four years after its month of first availability”.

In essence, if Netflix produces a show for $100 then it recognizes $22.5 per year as cost for this show for 4 years leading to $90 in amortized costs over 4 years. This leads to a big difference between accounting earnings and free cash flow (to Netflix’s credit, it actually produced a presentation on this accounting policy). While Netflix is available for 25x EPS, its cash flow yield is much much lower. Due to this, while Max has mentioned that they will produce $1 bn in EBITDA in 2023 and that they are already ‘profitable’, we believe that actual cash will take a long time to materialize. The risk here is that free cash flow conversion happens at the lower end of management’s 33-50% range.

The accounting for revenue here is very simple: At 100 mn subs at an average of $12-15 per sub per month will mean revenues close to $15-18 bn in revenues. It is the accounting for content and content costs that is difficult and due to this it is very difficult to say (a) streaming is a good business, and (b) importantly, if streaming can make up for some of the lost profits of the broadcasting business.

We know that Netflix came into the industry with a big bang and caused tremendous inflation in the cost of content. They had a pipeline of content to fill as some of their licensed deals were expiring and had to show growth to the market but this has brought the market to a place where the consumers are not yet ready to pay top dollar for streaming services but talent demanded top dollar due to streaming wars.

The other problem with streaming is the existence of non-economic players. Apple and Amazon now produce content but do not expect their streaming service to generate a profit. It is an ecosystem play which makes them non-economic players who happen to have very strong balance sheets - always a tough proportion if you are looking for pricing power in the industry. Apple, for example, is the closest competitor to HBO as it is focusing on very high quality content to maintain its premium brand image.

It is not a unique insight, but we do believe that further consolidation is needed for the industry to generate meaningful profits. That time will come but that time is not now. Due to this, it is more likely than not that these streaming services will operate at sub-par economics in the near future.

We do believe that unlike pure streaming players, it is possible for studio owners such as Warner Bros and Paramount to derive superior economics from their content. As an example, the studios can release big name movies in the theaters and then launch them on their streaming platforms. This will likely better the economics of this content which can be monetized on multiple platforms unlike Netflix which launches multi-hundred million properties just onto their streaming platform.

We also don’t know if subscribers will, in the end, subscribe to one or two or three streaming subscriptions but it is likely to not be five. The most probable scenario is that they will have a few ‘core’ subscriptions and then a few ‘non-core’ subscriptions that they will turn on and off depending on content. This core and non-core classification can be the difference between profitability of the various platforms as this affects churn.

“If you can buy a sports event exclusively you can always gain users. But given marketing costs and churn, in the long run the service with the best bundle and the lowest costs will be the most profitable,”

- John Malone

Research shows that churn can be reduced with children’s content. Parents need their shows but they also need content that can safely entertain the kids and provide a pseudo ‘baby-sitter’ for the little ones. As a parent myself, I can attest to this and believe that Netflix is a core streaming service due to their comprehensive children’s content.

“I think one of the stickiest things we've seen from Disney is if you get the kids, then you really lock into service then it becomes you can't cancel if the kids watch it. HBO Max is maybe a little bit disappointing in that and the kids offering is a little bit weaker than maybe some other services and hasn't had it seems like its legacy and Cartoon Network but I feel like the kids content isn't as developed as it could be.”

WBD’s strategy is to insert Discovery and Scripps content in order to keep churn low. Will this succeed? We will say that for all the accolades David Zaslov gets, they have essentially bastardized the content on their channels in order to keep content costs low and make a fat margin. When did we last watch history on the history channel?

Experts are very divided on this:

“You get to the unscripted side, which is actually the most profitable thing in television. These shows will capture a lot of viewers. You can, once again, go to Middle America and ask them what 90 Day Fiancé is and a lot of people know exactly what that show is”

- Former Analyst, Corporate Strategy and Business Development at Disney (Feb 2023, Stream Transcript)

“I don't believe that someone who is used to watching HBO programs is all of a sudden going to turn on Property Brothers and be like, "Oh, this is fine."”

“Good narrative-driven shows, high level, high production level, etc., but it's still not consistent enough. That's why, to your point, I'm not surprised that their churn rate is higher because they subscribe, binge watch the show, and since there is nothing else on the platform that is coming for them. Netflix, I don't think people once they watch a show that they like, bounce, and just unsubscribe and wait for the other one. They keep their subscription on because there's always content dropping, always new content, always something different. I think HBO lack of variety in the content and consistency in great content. It's tricky.”

- Former VP, Content Marketing & Partnerships at WBD (Jan 2023, Stream Transcript)

Unlike Netflix, which releases its episodes all at once, HBO captures viewers on Sunday night with very premium content. This content, if not watched in real time, means that you are a pariah when it comes to the watercooler conversation the next day. I remember the Monday conversations after each episode of Game of Thrones or Twitter spats on Monday after Succession episodes. While nothing stops a subscriber to subscribe for a month and binge watch all premium content for the last six months, we believe this ‘social’ factor will also reduce churn.

The other ace up their sleeve is news and sports. Management has talked about integrating these services into Max which can also reduce churn and increase the profitability of this segment.

A lot of this is to be decided!

Management and Culture

The heart of any broadcaster or streaming service is content. No one can deny that between Warner Bros and HBO, WDB has some of the best libraries in the world. In this modern world, however, this is not enough. One has to be able to monetize this content in the smartest way possible.

It is not clear to us that WBD will be able to execute on this. For all their competence, Zaslav and Co are not creatives. They are financial engineers who can take out costs from an operation and maximize free cash flow. With Discovery and Scripps, the content was not the challenge. With non-scripted content, it was throwing something at the wall and making season after season if it sticks. They are in the big leagues now. Will Zaslav’s methods be as effective?

This is further complicated by the fact that Warner Bros has gone through tremendous change in the last few years. It was a division of AT&T with a very siloed culture and now it is a part of Discovery where Zaslav and Co have taken an ax to the cost structure. While totally necessary, it is difficult to know without hindsight if one has cut too deep. If you have worked in a big organization then you know the pressure and culture of a place when people around you are let go and you have to take on more and more work. Not the best place to be!

“I do know that there's a lot of people that have been laid off or left or retired, but not necessarily being replaced, which caused a lot of friction and disorganization because the people that stay there had to do double work or triple work with the same amount of work or even more.”

- Former VP, Content Marketing & Partnerships at WBD (Jan 2023, Stream Transcript)

A real example of this is DC Studios. Disney has done a marvelous job with its Marvel franchise while WBD has struggled with DC. They have the characters and out of these they can create wonderful content but they have, so far, not succeeded. We know that there has been tremendous turnover at the upper levels at DC studios. We attribute the lack of Marvel-like content from WBD’s DC Studios to culture. What else is affected? We will only likely know after the fact.

There is another ace up their sleeve with the gaming division but here is what one expert has to say about that:

“I always see Warner as a story of missed opportunities. They have a lot of great stuff, which is great content, great IPs. They're never able to maximize it. Game is the symbol of this to me. You sit on a goldmine because you have iconic franchise that you can create so much different type of games or application of it. It was the case at the beginning of the game division, but it was never, to me, strategic enough to push for more investment and acquisition of studios etc.”

- Former VP, Content Marketing & Partnerships at WBD (Jan 2023, Stream Transcript)

We get the impression that things have been tough. It takes a lot to produce wonderful content and WBD has lacked in this regard. While investors take Zaslav at the helm and the backing of Malone to up their odds of success at WBD, we think one needs to handicap the culture to get a fuller picture.

Valuation

At $12.15 per share, WBD has a market cap of $29.8 bn, net debt of $46 bn and an EV of $77 bn. This is not a complicated company to value. The debt load is large but not a problem as it is well termed out and was taken at a time when interest rates were much lower.

Base case valuation:

On this EV, in 2023, it is expected to produce revenues of $46.5 bn and EBITDA of $11.2 bn which we believe is very realistic.

It should also be noted that it will likely convert 35-50% of this EBITDA into free cash flow and use this to deleverage the balance sheet. In two years, it can likely pay down $8-10 bn in debt which will bring net debt at 3.5x.

If its multiple sustains at 7x of EBITDA, then just with this debt paydown, the share price will increase to $16.5 per share - a 38% increase from present levels in two years which is an attractive IRR.

Bull case valuation:

Most investors, however, are doing a SOTP to separate the value of the declining legacy business from the growing streaming business.

We believe that these two businesses are joined at the hip and separate valuations are not appropriate but will indulge.

We can value the Linear business’s $10 bn in EBITDA capitalized at 7x = $70 bn and$15 bn in streaming Revenues at 3x = $45 bn. This is lower than Netflix’s 5x revenues multiple but we believe this is deserved due to its lower scale and likely lower profitability.

We get to an EV of $115 and if we assume $10 bn in debt paydown then equity value comes to $80 bn or $32 per share in equity value in two years. You can triple your money with this math. Other businesses, including games, for free.

The big risk to valuation and the thesis is that FCF conversion gets worse over time due to prolonged streaming wars and WBD’s low multiple declines further. We have seen enough value situations where this is the standard course.

Conclusion

WBD is a tricky one, and perhaps one that might not sit comfortably with investors subscribing to Warren Buffett’s proverbial “one foot pole” philosophy.

On one hand, it appears to be a bargain. The math works out and it seems difficult for investors to lose money here in the long term.

However, there are some undeniable challenges ahead for the business as we’ve discussed. We caution that the bull case will be bumpy and may take longer than one expects. WBD operates in an industry notorious for its rapid evolution. It’s also got a lot of debt, and slight deviations from the bull path will likely produce a lot of volatility in the stock price with it.

We’ll be keeping a close eye on the company, but we think it’s a perfectly reasonable decision to place it into the “too hard pile” for now. And for investors that are inclined to believe the bull case, we think it’s worthwhile to manage position size and keep a close eye on the core business assumptions to ensure that they remain valid over the investment period.

Stream by AlphaSense is an expert transcript library that helps investment analysts maximize returns with access to tens of thousands of high-quality, searchable, proprietary expert transcripts covering multiple perspectives, industries, and markets. Unlike costly and time-consuming traditional expert network calls, Stream drives faster time to insight, improves ROI, and ensures critical information isn’t missed in the research process. You can sign up for a free trial by clicking here.