Introduction

Recruit Holdings is an internet, media, and services conglomerate headquartered in Tokyo. We consider Recruit to be a true blue-chip and one of the best managed companies in Japan. The company is listed on the Tokyo Stock Exchange (6098), and also has US-listed ADR with the ticker RCRUY (5 shares of ADR = 1 ordinary share).

Recruit is a household name for Japan-focused investors. But why should other investors care about Recruit?

Recruit is headquartered in Tokyo, but over 70% of group profit is generated outside of Japan. Most of this comes from US-based global job aggregator and portal Indeed which was acquired in 2012. Recruit should be benchmarked against US and global peers.

Marketplace businesses tends to attract investors - and for a good reason as these can turn out to be highly lucrative. In terms of scale, the jobs market is the biggest marketplace opportunity of them all. But there aren’t many high quality, scaled marketplaces in this space that are publicly listed. Through Recruit, investors can own a global champion.

Out of Recruit’s other businesses, the fast-growing “seller solutions” suite of SaaS tools for retail stores in Japan that’s benefitting from Japan’s Covid recovery is particularly attractive. It’s also worth pointing out that Recruit is a very well-managed organization. This is not a situation where investors are buying a badly managed holding company just to obtain exposure to its crown jewel (a pattern that we see quite often).

As of late, Recruit’s shares have pulled back given concerns of a cooling jobs market in the US. Cyclical risks notwithstanding, what we emphasize in this report is that Indeed is a structural grower, with significant opportunity to address a large and growing market as the global leader in HR technologies. Not only does Recruit have a long runway, it is also profitable and financially well-managed.

Recruit trades at a forward P/E of 21x and EV/adj.EBITDA of 10x. Share price is 20% lower than where the company last announced share repurchases (October 2022). Recruit has $6bn in net cash (roughly 14% of market cap), and given its strong balance sheet further repurchases are possible and could serve as near-term catalyst.

Business segments

Recruit has a long history dating back to 1960, and operates a diverse portfolio of businesses. Over the past few years, Recruit has shifted its focus to becoming an “HR Technology company” - this came as a result of the blowout success of Indeed.

Recruit operates three business segments:

HR Technology – Recruit paid $1 billion to acquire Indeed in 2012, and last fiscal year Indeed generated close to ~$3bn in adjusted EBITDA (62% of company’s total). This has to be one of the most successful overseas acquisition ever done by a Japanese company! Practically all of the profit in HR Technology segment came from Indeed, but the segment also includes US-based Glassdoor which was acquired in 2018.

Matching & Solutions – Recruit owns a large number of Japan’s leading consumer media portals and apps, including real estate, beauty, bridal, travel, dining, and classifieds. Recruit has decades of experience operating these media. In the past they used to be mainly print magazines, but Recruit has successfully transitioned them into the digital age. This segment also includes a SaaS business which offers a suite of business tools for retail stores including point-of-sale, HR/worker management, payments, and more (these are comparable to US-based Square’s seller solutions business).

Staffing – Recruit operates traditional staffing business in Japan and overseas

A deep dive on Indeed

Indeed was founded in 2004 by Rony Kahan and Paul Forster. Today it’s the largest job aggregator in the world with 300 million unique visitors per month.

It’s called a job aggregator because in the early days it mainly scraped the internet for job listings from career pages, job portals, and other websites. Job listings were highly fragmented, and Indeed had this great technology to aggregate and present them in a user-friendly way. As an aggregator, Indeed was able to amass the largest collection of job listings on the web. This was very powerful, allowing it to disrupt the traditional job portals (who remembers Monster.com?) with the aggregator model.

As Indeed became hugely popular with job seekers, employers also took notice and started to create employer accounts which allowed them to “sponsor” listings, and also to list jobs directly on Indeed. After all, employers just want to be where the applicants are. This virtuous cycle is shown below. Today, Indeed has a mixture of aggregated (third party) and direct listings, but increasingly the mix has shifted towards the latter. No longer is Indeed just a pure aggregator.

Indeed is completely free for users and monetizes by charging employers. Employers can post job listings on Indeed for free but they need to pay if they want to “sponsor” their listings. The model here is very similar to Google AdWords. The only thing an employer needs to do is input their ad budget and duration of campaign, and then leave it to Indeed’s algorithm to optimize the rest.

“Their algorithm is actually really interesting, in that if you have, let's say $100 to put on a job for a week, it's not going to split that $100 evenly. It's going to put more of that money on Monday, and Tuesday, and Wednesday because they are the highest traffic days, and that's when it's most likely for people to be searching for jobs. Actually, push it then, and then you'll spend very little on days like Friday when nobody's looking for a job, or Saturday. They're very smart about their product, how it works, how to get people engaged and interested.”

– Former Indeed Senior Enterprise salesperson (Dec 2022, Stream Transcript)

Here’s roughly how it works: a $100 budget is enough to buy 100 clicks if the cost-per-click is $1. After 100 clicks is reached, the ad is taken down from sponsored listings and becomes just a regular listing. How much the $100 can buy depends on the competition for sponsored listings - so if there are many competing employers that are all trying to sponsor similar listings, then the cost-per-click might go up to, say, $2 so that $100 will only get you 50 clicks. To get 100 clicks as before, employers will need to up their budget to $200 in this case. This is how competition (a tight labor market) leads to higher earnings for Indeed.

Sponsored listings is the bread and butter for Indeed’s monetization. According to a former employee, it accounts for roughly 80% of its profit. Indeed’s other products include:

Featured Employer, which is a branding product that allows employers to make their listings more visually attractive and create employer profile pages with rich media content.

Indeed Resume is a subscription-based product which offers employers the ability to browse through over 200 million resumes and contact candidates using direct mail.

New innovative products like Indeed Hire, Indeed Hiring Platform, and Indeed Flex which we will get into later on.

As we mentioned earlier, a tight labor market benefits Indeed as employers spends more on the platform. This is precisely what the industry saw during the Covid recovery phase as employers needed to fill their positions fast and competed fiercely for hires. It also results in an environment where Indeed can more easily cross-sell its newer products in addition to sponsored listings. The fact that job shortage was especially acute for blue collar jobs, which is Indeed’s strongest area, further drove business growth during Covid recovery. All of this led to Indeed’s phenomenal growth last fiscal year as shown below.

Granted, the extremely tight conditions in 2022 was a one-off. Quarterly trends above show that Indeed reached a cyclical peak in revenue in the September 2022 quarter. Then in March, Indeed laid off 2,200 employees or 15% of its workforce.

“Last quarter, US total job openings were down 3.5% year-over-year, while sponsored job volume fell 33%. In the US, we are expecting job openings will likely decrease to pre-pandemic levels of about 7.5 million, or even lower over the next two to three years”. - Chris Hyams, CEO

This also echoes the warnings given out by ZipRecruiter, Indeed’s competitor in the US, earlier this year.

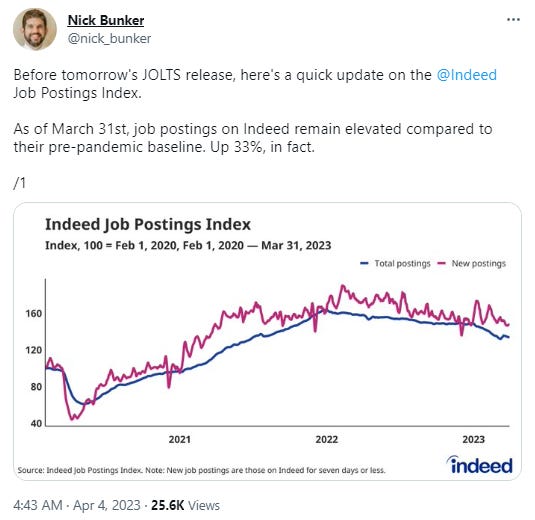

If you are interested in the economics and data, we suggest following Nick Bunker, an Economist at Indeed.

While the cyclical trends are not great, labor market tightness has so far proved to be stickier than many had predicted. And shortages in certain areas of the economy are more structural, for example essential workers like nurses which is not sensitive to business cycles (below). Post-Covid, a new type of work-life balance became the norm, and it’s also debatable whether these human habits can be so easily reversed in just a few quarters. In our view, it’s unlikely that everything is simply going to mean-revert back to pre-pandemic conditions; rather there is probably a new normal that will be here to stay for a while.

Growth is far from over

Now let’s talk about the structural opportunities for Indeed and why we are excited about Indeed’s future if we zoom out and think about where the business could in the long term.

“As long as Indeed keeps investing heavily in new products and perfecting products, which is what they do constantly, I think they’re going to continue to grow for years to come…I don’t think Indeed is in any trouble plateauing just yet”

– former Director of Sales at Indeed (Sep 2022, Stream Transcript)

To add context to the above quote, hiring is filled with frictions and inefficiencies. According to one study done by Indeed, it takes on average 15 weeks for job seekers to get a job. And during that period, 50% of job seekers experience job search duration longer than their personal financial runway. In other words, the problem to be solved is big, and far from being saturated.

If we look at Recruit’s product strategies, they have an overarching goal which is to add value to employers and their HR departments. This falls under two categories:

Provide higher quality matches (= Indeed becoming more “intelligent” at what it does)

Going down the hiring funnel (= Indeed taking on more tasks that would otherwise be done by the HR department, helping them automate their manual tasks)

Let’s take a closer look.

Higher quality matches

“Employers don’t really care about how many people click on their jobs on Indeed site. That’s a means to an end. What they care about is the number of qualified applicants or the amount of time and energy and cost it takes to make a successful hire. Indeed’s analytic strategy has been and continues to be getting closer and closer to that actual hiring event”

– Former VP Engineering at Indeed (Sep 2022, Stream Transcript)

Traditionally, the industry operated on a cost-per-click model. While this was the industry standard, employers wanted more. Employers want to pay for applications, because that actually means something rather than clicks. To go a step further, it’s really the “qualified applicants” the employers are more interested in paying for, rather than simply just applicants. You get the point. To draw out the industry progression, it looks like the below diagram. The dollar amount paid by employers increases as you move to the right.

Indeed has been trying to shift its customers from pay-per-click to models on the right side of the diagram. The new charging models provide Indeed the opportunity to make more money, provided it can achieve higher conversion rates. This is what we meant when we said Indeed’s opportunity lies in becoming more “intelligent” at what it does.

“Just the fact that they're, what I mentioned earlier, moving their pay-per-click to pay-per-application on their flagship popular product, the job postings, that's an easy way for them to grow their revenue without changing much. It's pretty much saying, "We're increasing prices, but having a good reason behind it," helping their clients pay only for applications as opposed to clicks.”

– Indeed former Director of Sales (Sep 2022, Stream Transcript)

The ultimate destination here is “pay per hire”. If this sounds familiar, well, this is basically the model of a traditional recruitment agency which charges 30% of an applicant’s salary upon hire.

Indeed already has a product here called Indeed Hire. It’s a white-glove service, similar to a traditional recruiter, where Indeed gets paid a percentage commission upon hire. Indeed’s strategy is to undercut and disrupt traditional recruiters (10% fee vs. 20-30% at traditional recruiters) by making use of more technology and automation in the matchmaking process instead of a human agent.

At least this was the ambition. Indeed Hire was launched in 2016, but has not lived up to its promise. The problem was that the technology could not deliver, and the company ended up needing to do a lot more manual work to cover the tech shortfall. With what little they were charging (10%) they could not cover the cost. Perhaps the mistake here was that they were too early. A former employee thinks that Indeed would keep trying and the product might make a comeback one day. With significant recent advances in AI and chip technology, perhaps we are getting closer. There is no question that this is where the industry is heading, so the question is really whether Indeed does it or someone else.

“If I’m able to pay for guaranteed hires on the platform, you could charge a significant amount of money if your algorithm and skill works well enough to actually be able to forecast and deliver those hires”

– Former Director of Product Marketing (Sep 2022, Stream Transcript)

Deko, Recruit’s CEO, likes to talk about a “magical hiring button” as his long-term vision. That is, he envisions a button for job seekers that says “click and get hired” - this is shown below. Obviously, this is just aspirational more than realistic at this point, but it’s worth noting that Recruit is very ambitious. It has a desire to innovate and solve big problems.

Going down the HR funnel

Based on what we’ve discussed, some readers may be asking: “is this a technology-leap-of-faith that I need to be betting on?” The good news is that Indeed also has a way to slowly and surely grow in a more predictable fashion. This is the second pillar of growth strategy - to capture more value by expanding down the HR funnel.

Indeed Hiring Platform automates the recruiting process, and according to Indeed, takes over 70% of recruiting steps that were traditionally done manually by the HR department. The platform allows employers to screen candidates, schedule and conduct interviews all through an integrated platform without leaving Indeed. This is a cost saver for HR departments. But not only that - it also speeds up the time-to-hire. For example, resumes can be scanned instantaneously for job requirements like certifications using AI. There will also no longer be time-consuming back and forth emails between jobseekers and the HR department to schedule interviews.

This product received a big push during Covid, as organizations switched to doing virtual interviews. A former employee believes Indeed’s Hiring Platform is a highly unique product in the market that few competitors possess, again demonstrating Indeed as an innovator in the space.

“I think that the product (Indeed Hiring Platform) from what I’m hearing, since I left is actually doing really well. They are monetizing it significantly. It’s hard for me to say that is the revenue amount but I’m guessing, this is probably the third biggest revenue generating product for Indeed right now”

– Former Director of Product Marketing (Sep 2022, Stream Transcript)

A very important point worth noting is that by expanding down the HR funnel, Indeed obtains more access to useful data. Job portals often receive little data other than the job listings that candidates have clicked on. But by becoming involved deeper in the hiring funnel, Indeed can gain insights into whether a candidate has been given an interview after applying, or how many have actually passed the interview. Traditionally, these were things that Indeed had to rely on the kindness of employers to provide manual feedbacks on.

Indeed would then have access to a complete picture of candidate success, which is key to improving the quality of matchmaking. A former VP of Engineering describes this very succinctly:

“The phrase used within Indeed is getting closer to the hire. That’s both a product strategy, but also an analytic strategy”

– Former VP Engineering at Indeed (Sep 2022, Stream Transcript)

In FY2021, 2 million virtual interviews between job seekers and employers happened directly on Indeed. This is a tremendous asset.

Over time, Indeed could take over more HR functions, such as background checks, reference checks, and skill assessments. Typically HR departments work with different third-party vendors for these areas. For example, third party vendors help test a candidate’s fluency of Spanish and grade the candidate from 1 to 10 in fluency and then report back to the HR. If Indeed can provide solutions in all of these areas in-house, it would be further value-add for HR departments.

Indeed Flex

Indeed Flex is a product that deserves a brief mention on its own. It’s a new product that doesn’t belong to any of the categories we discussed above. And that’s because Indeex Flex is a whole new platform with a different niche and product philosophy.

Indeed Flex was founded in 2015 in the UK and formerly known as Syft. It was acquired in 2019, and in April 2021 rebranded as Indeed Flex (the product is currently available in the UK and in select markets in US).

It’s essentially a staffing service for gig workers that’s differentiated by being 1.) highly gig-worker centric, and 2.) providing entirely mobile-native experience (like Uber). Compared to Indeed, there are some nuances. Flex truly prioritizes the needs of the gig workers (rather than employers). Whereas Indeed is more of an employer-centric platform, Flex became a separate platform because of this difference in philosophy. It aims to be the most flexible, easy-to-use, worker-centric platform for gig workers.

Recruit has made Flex a priority and has been investing significantly. Management has disclosed that Flex will contribute 2-3% of HR Tech revenue this fiscal year. It’s not material yet, but it’s worth paying attention to.

HR Tech: Industry and competition

The annual TAM for the global HR matching market is US$236 bn in 2021, according to Recruit’s estimates which is shown below.

For Indeed, the relevant category is the first one on the chart - Job Advertising and Talent Sourcing which is a $26bn sub-segment (this further breaks down into $24 for online ads and $2bn for offline ads). Using this, Indeed would have a ~30% market share (assuming it only operated in this segment of the market). But as we’ve discussed earlier, through new businesses such as Indeed Hiring Platform and Indeed Flex, they have been expanding their own TAM into new areas.

Competition

Many online job platforms exists around the world, but only two are scaled global players - Indeed and Linkedin. The chart below compares Indeed with three companies that we consider are the most direct comps.

Without a doubt, Linkedin is the strongest competitor.

It’s worth noting that the two are not competing for the exact same pie because Linkedin has historically dominated the white collar/high salary segment while Indeed’s strength has been blue collar segment. Linkedin is the place for “careers” while Indeed is the place for “jobs”.

Linkedin is a social media; most users are not actively looking for new jobs (although they may be interested and open to one). The vast majority of Indeed users are actively looking for a job which they can start immediately, so there is a difference in the degree of motivation for users

An interesting angle I’ve heard is that Linkedin is the only platform offering employers access to “latent” job seekers. This is valuable during times when labor force participation is low, as there is a lot of value in being able to interact with the latent population to try and convert them into real job seekers.

Linkedin is also very strong when it comes to enterprise sales (understandably, owned by Microsoft).

ZipRecruiter:

More comparable to Indeed given its focus on blue-collar roles/”jobs” and SME employers.

Think of ZipRecruiter as a smaller and more commoditized Indeed, operating only in North America, with less job listings and users, and less innovation. Given the difference in scale (ZipRecruiter has only one-tenth the users and revenue of Indeed) it’s hard to see ZipRecruiter being a threat.

Google:

Google for Jobs launched in 2017. Initially, Google was a highly feared entrant but have turned out to be a hollow threat so far.

Google operates largely a self-serve model with limited support for customers (much like its other B2B businesses). This is a major disadvantage compared to Indeed and Linkedin which have massive in-house sales and “customer success” teams.

But it’s hard to exactly call Google a “failure” here, because chances are that it wasn’t even a priority for Google. It’s too small to matter. One industry expert also believed Google might be intentionally treading lightly here to avoid further regulatory scrutiny.

The point on customer support deserves further elaboration. Indeed has more than 10k employees and the majority of them are in customer facing roles. Indeed has a very strong onboarding team for employers. And once they are converted to paying customers, they are followed up by the customer success team that provide handholding and support to minimize churn. In fact, Indeed employees would go as far as directly helping clients manage their recruitment campaigns. According to a former salesperson, he would call clients with recommended changes, and with the client’s consent, implement them to optimize the client’s campaign.

“I had something, and this is a common thing at Indeed, where you would make up a product called Indeed Managed Campaigns…what we used to say is we eat, sleep and breathe Indeed all day, so we know how the system works and our recommendation is going to be the best of our ability”

- Former Indeed Senior Enterprise salesperson (Dec 2022, Stream Transcript)

HR departments are not marketing departments. They are usually not knowledgeable about running ads. Clients may have a large ad budget, but that means little if after a few days they don’t see results and decides to pull out in frustration. Industry leaders like Indeed and Linkedin have invested a lot into customer support which ensures churn is minimized.

Fiscally prudent

Indeed is an ambitious company that is not afraid of pushing the boundaries when it comes to new product innovation. But at the same time, the company has always been financially well-managed.

“I think Indeed was also fiscally as a company managed well. Indeed was a frugal company up until the last few years I was there. Even then they weren’t splashing out huge amounts of money for the most part…Indeed was actually profitable in 2008, possibly before that, but definitely in 2008, which was my first financial year that I was an employee, and it was profitable consistently every single year after”

– Former Indeed VP of Engineering (Sep 2022, Stream Transcript)

Management is innovative, but they are also disciplined and can be trusted to strike the right balance between generating profit and investing in the future.

Glassdoor

Recruit paid $1.2bn to acquire Glassdoor in 2018, and at the time of acquisition it had $170mn in revenue and a net loss of $22mn. Recruit doesn’t disclose its current financials but even if we assume Glassdoor’s revenue has doubled or even tripled since then, it still would only account for a single digit percentage of HR Technologies segment revenue.

Glassdoor is not financially material to the group, but we do note that it’s quite a unique asset. As the leader in company reviews and salary information, it boasts a significant user base (55 million visitors per month). It is our knowledge that Recruit has been running Glassdoor largely separately from Indeed since acquisition. But recently, Indeed employees have mentioned that Recruit has started to introduce cross-selling incentives between the two. For example, Indeed sales reps are visiting customers together with Glassdoor reps. It would be interesting to see if and how Glassdoor will be further integrated into the group.

Recruit’s other businesses

Matching and Solutions

Recruit was founded in 1960 and its first business was a campus recruiting magazine. According to a Harvard Business School case study on Recruit, “at the time, large Japanese companies sent recruiting material to top university career centers and candidates took a written exam for companies they were interested in. However, smaller companies weren’t able to host exams and students who were not at top universities were left out of the recruitment”.

Recruit helped fill this gap, allowing smaller companies to place recruitment ads directly to students. This became successful, and over time Recruit replicated this model to many different consumer niches, connecting consumers with small businesses through ads. Today, Recruit’s media empire spans a large domain (below).

“Life Event” - High ticket items with low frequency of purchase, including real estate (Suumo), Bridal (Zexy), and job hunting (Rikunavi, Townwork).

“Lifestyle” - more frequent/everyday purchases including salons (Hot Pepper Beauty), restaurant guide (Hot Pepper Gourmet), and travel OTA (Jalan).

Recruit is usually a top 3 player in most of these niches. Their coverage is so wide that it’s actually hard to find individuals or small businesses in Japan that have never dealt with any of Recruit’s media in some way, shape, or form.

At the heart of all of this is Recruit’s elite sales force. Recruit has one of Japan’s largest and most competent direct sales force targeting SMEs (as we’ve also seen with Indeed, strong sales culture seems to run through the group). Historically, the sales team specialized in selling advertisements. In 2013 Recruit expanded into software, sensing that many of its ad buying customers were also trying to digitize their store operations. Recruit developed a suite of SaaS business tools, and its sales force started cross-selling them. This propelled Recruit to becoming one of the largest vendors of software to Japanese SMEs.

Recruit’s SaaS tools includes includes AirREGI, their first product which is a smartphone/tablet-based POS system offering inventory management and sales analysis. The company later introduced AirPAY (cashless payment terminal), AirWORK (HR and hiring), and more.

With this, Recruit has become somewhat of a total solutions provider for SMEs. Let’s take restaurants as an example. Restaurants can place ads and take online reservations through listings on Recruit’s restaurant media Hot Pepper Gourmet (basically the OpenTable of Japan). They can use AirREGI as their main ordering system which allows diners to view menu and scan QR codes to order food. They can use AirSHIFT for managing worker shift and then take payments using AirPAY.

The three largest products are currently AirREGI, AirWORK, and AirPAY. AirPAY and AirWORK are newer products and they have grown rapidly - AirPAY has reached 359k accounts (growing at 38%) and AirWORK ATS 594k (growing 90%).

AirWORK has been highly popular. Think of it as basically a “Shopify” for HR departments. It allows employers to create their own customized hiring pages using preselected templates. Once companies create their hiring page and enter their job listings, the listings are automatically posted on other popular job search platforms including Indeed, Google, and other relevant sites, and allows employers to manage everything through one platform. This saves employers time.

The service is currently free to use, and is being monetized mainly through the sales of optional bundles that includes sponsored listings on Indeed. That is, AirWORK doesn’t seem to be monetized as a standalone platform, but rather serves as a top-of-the-funnel capture for cross-selling Indeed products. A competitor in Japan, En-Japan, has a competing platform called Engage, which has a roughly similar scale (490k locations). En-Japan is losing money on Engage due to heavy investments. Recruit’s advantage here is its distribution advantage and ownership of Indeed, allowing it to capture all of the client’s ad spend within the group (Engage incurs higher COGS to place ads on third party platforms like Indeed).

Japanese SMEs have historically underspent on IT, and digitization spending has significant room to grow. Recruit helps solve the biggest problem that small businesses in Japan face now which is labor shortage. Against the backdrop of Covid recovery, there will be more pressing need for small stores to keep investing in IT. For example, crowded and understaffed restaurants need better automated ordering and reservation management systems. Japan’s tourism is booming, and more tourists from overseas will pressure stores to invest in digital payments solutions, moving away from being a cash-based society to accepting a wide variety of digital payments options.

The Matching & Solutions segment suffered significantly during Covid due to its exposure to physical stores. Adjusted EBITDA in this segment fell from 183bn pre-Covid to 103bn in FY2021. But we believe this segment has seen a cyclical bottom and will likely see a strong rebound going forward. Profit of this segment reaching pre-Covid levels alone would boost consolidated profit by roughly 80bn yen or up 16% from current levels.

Staffing

Staffing segment contributes a large amount to Recruit’s topline (48% of total), but this is mostly pass-through of staff salary. The profit contribution is much smaller (18%). Recruit’s margins in staffing is decent: Japan at 9-10% and overseas at 5-6% (adj. EBITDA margin). This is roughly in line with global peers. Roughly 60% of revenue comes from outside of Japan. Recruit owns CSI Companies and Staffmark in the US, RGF Staffing in Europe, and Chandler Macleod in Australia, all of which were acquired since 2011.

Staffing used to be a more important part of the Recruit’s strategy under the previous CEO Minegishi who oversaw these M&As. Current CEO Idekoba has shifted the organizational focus towards HR Technologies, and mentions of staffing have gone down. Recruit will continue to focus on operational improvements in its staffing business to lift margins, but it’s unlikely that they will make meaningful new investments in this segment.

Management

Throughout the company’s 60+ years history, Recruit has made two notable business transitions: 1.) from print to digital media, and 2.) from traditional staffing to HR technologies. In both cases, it involved the the company disrupting its own business. This is never easy, and Recruit did this not just once, but twice!!

What made it possible for Recruit? We think the company’s unique company culture is key to understanding this.

Culture of embracing change: At Recruit, there is a culture where employees are not dissuaded from leaving the organization. Many employees leave to start their own firms or move on to do something different, and this is celebrated within the firm. Recruit even encourages early retirement for senior employees with generous packages. This is done deliberately to keep the organization fresh and young, and to avoid falling into what management calls “large company disease”.

Culture that truly values diversity: At Recruit, these are not just words on a company credo. Recruit values hiring creative and passionate minds rather than just academic high achievers. Diversity ensures that organizational norms are constantly being challenged at Recruit.

“Recruit was particularly famous for turning its employees into highly sought after candidates on the job market after they worked at the firm. Its alumni were spread across the top echelons of government, business, and media, and included an Olympic medalist” - Harvard Business School case

Reviews by former employees (source: OpenWork)

Translation: “Employees are brilliant. A company that has this many young, brilliant staff who come to work with an owner’s mindset everyday is a rarity even across all of Japan. Like the acquisition of Indeed shows, the company is not afraid of disrupting itself in the creation of new value. I think it’s a company that will continue to survive future changes.” (Date of review: July 2020)

Translation: “It’s all about the culture. The company attracts brilliant employees, and has the systems and culture in place to bring out more than 100% out of their people. I think every organization should have something to learn from Recruit’s culture” (Date of review: June 2020)

Recruit is a professionally run company – the original founder resigned in 1988, sold all of his shares, and have not been involved in the business since then. The founder was in fact implicated in an infamous political scandal at the time, leading to his resignation. We won’t go off on a tangent about it here, but interested readers can check out the Wikipedia summary. What’s important is that there have been 5 CEOs ever since the founder stepped down. Recruit’s culture is deeply entrenched organizationally, and not dependent on who is at the top.

Current CEO Hisayuki Idekoba (“Deko”) joined by firm in 1999. Deko spearheaded the acquisition of Indeed in 2012 and became the CEO of Indeed from 2013. In 2021 he was given the top job at Recruit Holdings, deservedly given what he was able to accomplish with Indeed. Deko’s main focus will continue to be HR Technologies.

In FY2021, CEO was paid 575mn yen in total compensation, comprising 100mn in base salary, 128mn in short-term cash incentive, 230mn in long-term stock incentives, and 117mn in long-term stock options. Variable comps are mostly linked to the growth of adjusted EBITDA. CEO Deko holds 234,000 shares (~819mn yen) and Chairman Minegishi (the previous CEO) holds one million shares (~3.5bn yen).

Valuation

Recruit has a market cap of 6tn and enterprise value of 5.2 tn (after deducing net cash of roughly 0.8 tn), trading at P/E of 21x and EV/adj. EBITDA of 10x (forward).

HR Technologies

ZipRecruiter trades at 9x forward adj. EBITDA. One could easily argue that Indeed deserves a higher multiple.

Linkedin was acquired by Microsoft in 2016 for $26 bn. At the time, Linkedin was guiding for a $3.6bn revenue and adj. EBITDA of $950-970 mn (7.2x rev and 27x adj. EBITDA). Currently Indeed makes 3x more profit than Linkedin did at the time it was acquired.

If we take these multiples as lower/upper bound, then HR Technologies is valued at a range of 3-9 tn yen. It shouldn’t be hard to make the case that HR Technology segment alone is probably worth the entire or a substantial portion of Recruit’s enterprise value.

Matching & Solutions

We can separate the segment into consumer media and SaaS tools.

For the former, the relevant comps are Yelp (1.5x rev, 7x EBITDA), Bookings.com (5x rev, 15x adj EBITDA), and Kakaku.com (5.8x rev, 13x EBITDA).

For the latter, peer comps are much more aggressive - Smaregi (8.8x revenue, 65x EBITDA) or Block (33x adj. EBITDA).

Using pre-Covid adj. EBITDA of 150-180 bn with multiples of 10-20x, we get 1.5 - 3.6 tn for this segment.

Staffing

Global peers (Adecco, Randstad, Manpower, Robert Half, etc.) generally trades at 6-8x EBITDA which values this segment at 0.5-0.7 tn.

To summarize the above sum-of-the-parts:

The multiple compression can be attributed to the market’s belief that Indeed is cyclically overearning. And the market is right - there is no denying that this business is cyclical and that we are in midst of a labor market downturn. With any business where the profit can go up 4-5x in one year, it’s helpful to keep in mind that operating leverage also works in reverse!

Having said this, it’s probably not right to anchor ourselves entirely on pre-pandemic numbers either. The company has made substantial progress on the product side and has become much more entrenched in the hiring market during this time. In addition, there are structural gaps in the labor market that will be difficult to resolve, as we’ve noted previously.

If we assume a 50% decline to Indeed’s profit, then we would be looking at roughly P/E of 30x and EV/adj. EBITDA of 14x, which is a lot less cheap.

It’s worth noting that this doesn’t assume a recovery in Recruit’s Matching & Solutions business in Japan, which we think is on the recovery track now and will likely help to offset to some extent the headwind in the US labor market.

Historically, Recruit has done a lot of M&As but under the new CEO priority seems to have shifted to organic growth. This gives the company more capital to return to shareholders. Previously, Recruit announced share repurchases of 150 bn yen in October 2022 at a price that’s roughly 20% above current levels. Recruit continues to generate cash and with a strong balance sheet we think further repurchases are likely if share price continues to languish.

In summary we view Recruit as an exceptionally well-managed blue chip with solid position in the global HR technologies market. It’s among the best managed companies in Japan, and today, it can be bought at a historically low price.

If you are looking for an expert network to get up to speed on industries and companies, then we highly recommend Stream by Alphasense.

Stream by Alphasense is an expert interview transcript library that has been integral to our research process. They are a fast growing expert network with over 25,000 transcripts on a wide variety of industries (TMT, consumers, industrials, real estate and more). We recommend Stream for its high quality transcript library (70% of experts are found exclusively on Stream) and easy-to-use interface. You can sign up for a free trial by clicking here.