Deep Dive: Publicis Groupe (PUB, PUBGY)

Cockroach, not dinosaur

We want to acknowledge that this idea and content came from a friend of Value Punks - @IcemanCapital. He has prior experience covering global equities with an institutional manager in Canada. Give him a follow here!

“When times are good, you should advertise, when times are bad you MUST advertise”

- Popular industry adage

Introduction

Publicis Groupe (PUB) is one of the world's largest advertising agencies based in Paris. The company is listed on the Euronext Paris Exchange (PUB) and has a US-listed ADR with the ticker PUBGY (5 shares of ADR = 1 ordinary share).

Publicis Groupe is an industry giant, and many of its operating subsidiaries have created some of the most memorable advertisements of the past decade. Yet, for those not deeply involved in the European markets, the Group might not ring as familiar. That begs the question, what makes Publicis compelling, and why should we pay attention to it now?

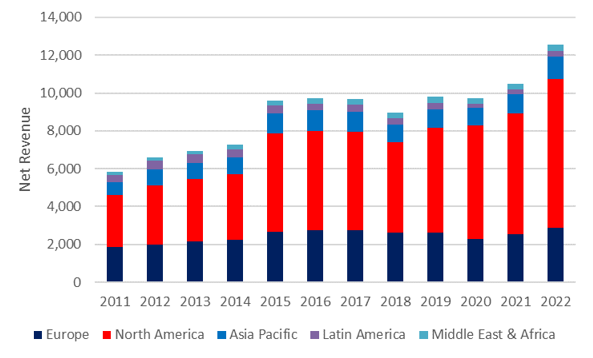

PUB is headquartered in France, but it’s not exactly a “European” company. With >62% of its revenues generated in North America, it’s one of the major players in the world's most attractive advertising market. The appeal of the US market lies in its scale, profitability, and relatively favorable data regulations (which we believe is unlikely to change meaningfully going forward)

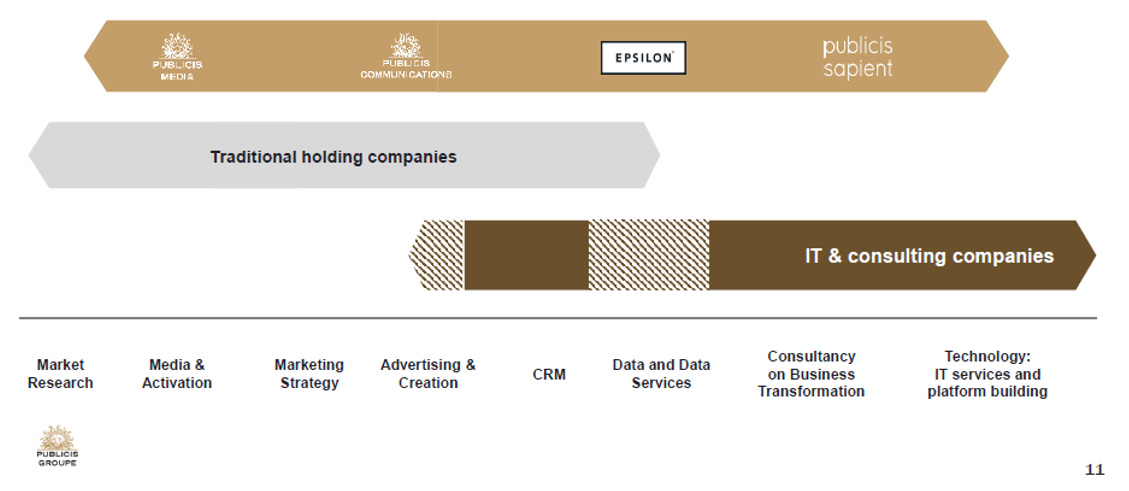

The company has made several strategic acquisitions over the past ten years that have positioned it with integrated assets across the full spectrum of the marketing value chain. PUB’s business is well split across all the different areas, with about 1/3rd exposed to creative, 1/3rd in Media Buying/Planning and another 1/3rd in hybrid data and information technology consulting. The company is favorably positioned to capture both digital business transformation and IT spending (even as creative spending potentially stagnates).

Publicis enjoys a more robust positioning today relative to previous cycles, as its reorganization and transformation activities from prior years, which we will delve into, have borne fruit. This is reflected in superior margins, growth profile, and market share gains.

The media landscape continues to evolve rapidly, creating complexity and execution challenges for advertisers. Digital advertising now accounts for the majority of global ad spending, underscored by an increasingly fragmented landscape. Search (Google) and social media (Facebook, Instagram, TikTok, Twitter) continues to dominate, but the list is far from over as options exist to advertise on eCommerce platforms (Amazon, Walmart, Kijiji, etc.), and advertising-supported streaming services (Netflix, Peacock, etc.) which are also increasingly common.

Concerns have been raised about the business models of large ad agencies - we believe claims of their demise are greatly exaggerated. A recurring theme in this evolving landscape is its complexity, with advertisers requiring partners to help them navigate efficiently. PUB is well-positioned to help its clients do so, with the strength of its capabilities increasingly becoming evident in its operating results.

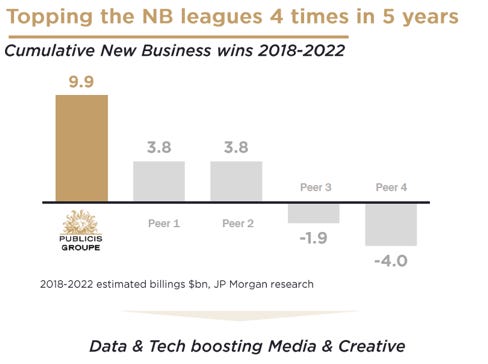

In the past year, PUB shares have hit a recent high, driven by advertising spending outpacing expectations and consistent new business wins (which PUB has led the peer group in ~five of the last six years). While shares are up, they still appear attractively valued. Despite concerns around the magnitude and timing of an impending recession, we believe PUB is the best positioned it has ever been to navigate a potential slowdown - thanks to its more robust business mix relative to previous cycles and a new integrated marketing offering which should be less exposed to spending cuts.

PUB trades at a forward P/E of 10.5x and EV/Adjusted EBITDA of 5.9x. Shares yield ~4% and are up 26% YTD. The company’s healthy balance sheet and FCF generation of >$1.7b should allow it to complete share repurchase or opportunistic M&A in the upcoming year.

In this report we will delve into: PUB’s business segments, transformation of the group, competitive dynamics of the advertising industry, a closer look at PUB’s Epsilon acquisition, as well as discussion of risks including generative AI, privacy and data regulations, valuation, and other topics.

Business Segments

Publicis has a long history dating back to 1926 and has survived throughout many different environments due to its ability to adapt. Longtime Publicis executive Rishad Tobaccowala believes that ad agencies “[are] like cockroaches. Everybody hates us. Nobody likes to see us. But cockroaches have outlived everyone. We scurry out of corners.” PUB’s portfolio of businesses spans the entire marketing value chain which we detail below:

Communications

Publicis’s origins are deeply embedded in its creative activities. When you think of ad agencies, you might think of Don Draper of Mad Men, and that’s a reasonably good analogy as to what happens in the segment. These agencies strive to find ideas that will resonate with consumers, balancing factors like brand reputation, history, and a client's overall marketing strategy. To deliver these creative services, Publicis utilizes a mix of production assets and the creative capabilities of its workforce. The employees are housed under several of the world’s most renowned agencies, including Leo Burnet, Saatchi & Saatchi and BBH. Below is a famous ad Saatchi put out back in the 1970s (“The Pregnant Man” - an educational campaign for contraception and pregnancy prevention), which is considered to be one of the most memorable from that era.

For readers who may be new to studying the industry, major advertising conglomerates like Publicis often encompass multiple smaller agencies or brands, typically brought together through M&As. Instead of merging them into a single, monolithic brand, Publicis maintains their distinct identities. This allows each agency to retain its unique client base, creative culture, and branding. Importantly, it also mitigates conflicts of interest between competing clients.

Media

The Media segment includes media buying, planning, eCommerce and performance management operations. Publicis Groupe’s advantage in media buying is a scale-shared model which aggregates buying power across all clients to secure better rates. A portion of these savings is passed back to customers, enhancing their return on investment. In the US alone, this buying power is significant as Publicis represents about 1/3rd of every dollar of media buying in the country (globally PUB ranks 2nd overall in total industry billings as shown below).

With all this spending going through the centralizing buying group, this also allows the company to generate insights on where ROI is improving or deteriorating, allowing it to continually optimize campaigns for customers.

Sapient

This was Publicis’s biggest move to enter digital consultancy - an area traditionally dominated by companies like Accenture. Publicis acquired Sapient in 2014 after multi-year consolidation efforts of similar businesses within the group including Digitas, Razorfish, LBi, and Rosetta, which focused on digital.

Simply stated - Sapient helps clients stay ahead in the digital domain by leveraging technology solutions (e.g. setting up robust IT infrastructure and creating custom applications) and data management strategies. This ensures clients can effectively manage and utilize data, and in turn be able to design high-value added digital products and services.

Sapient’s partnership with Spirit Airlines serves as a good example of effective digital transformation. Previously, Spirit’s app could only handle basic check-ins, and lacked the functionality of other popular airline apps (even after launching a second-generation application on its own, Spirit fell short of customer expectations). The new application created by Sapient added functionalities like transactions (paying for bags), selection of seat assignment, priority board, and personalized trip assistance. Not only has the new app resulted in higher customer satisfaction, but it also led to higher ancillary sales.

Improvements to the consumer-facing app were plenty, but they could not have been achieved without an overhaul of the back end and workflows - a strong suit of Sapient.

Health

Publicis’s Health segment is unique as it covers the full range of marketing value chain, but exclusively for healthcare companies. The most significant difference compared to all other customers is that regulations vary significantly by country. PUB’s expertise extends to setting up medical training, scientific communications, and public relations/special events.

History

The origins of Publicis Groupe goes back to 1926 when Marcel Bleustein-Blanchet founded the company. At that time, many large businesses in France saw little value in advertising activities and considered them to be of limited importance. He saw an opportunity to change this, introducing a marketing methodology and ethical framework to shift this perception over time.

The early days: Advertising in the early 1900s changed rapidly as radio stations and televisions became widely available. Initially, both media formats had limited or no advertising, but as time spent on them drifted higher, an opportunity emerged for advertisers. PUB expanded alongside the proliferation of formats during this period, eventually adding radio, cinema, and magazine expertise. After WWII, the company entered the "Golden Age of Advertising," winning several large multi-national accounts from companies like Nestle and Colgate-Palmolive. Growth remained strong, allowing the company to invest in new technology/tools like Surveys, which were not widely used in the industry until the 1950s.

Expansion: From 1960-75, advertising in France surged, allowing PUB to prosper and go public via IPO in June 1970. Reinvestment priorities shifted as the company expanded throughout Europe, reaching 23 countries by 1978. Marcel eventually passed away in April 1996, and his daughter replaced him as Chairman of the Board (she is currently Vice Chair). In the late 1990s, PUB was driven to create a complete international network of agencies and serve clients worldwide. Alongside these geographic expansions, the company also built expertise in relationship marketing, new media, media buying, public relations and healthcare communications.

The early 2000s were pivotal for PUB as it completed two significant creative deals. The first was the acquisition of Saatchi and Saatchi, a widely renowned agency for its creativity. The second was the acquisition of Zenith, which merged with its Optimedia subsidiary and created a scaled player in media buying and planning.

Inroad into digital: Starting in 2006, PUB began to expand into digital and interactive communications with the acquisition of Digitas Inc. Incremental purchases of Rosetta, a digital agency, and Big Fuel, an agency focused on Social networks, were consistent with this strategy. LBi, the largest European independent marketing and technology agency, was acquired in 2013 and combined with Digitas to create a scaled digital global network. Also, in mid-2013, PUB proposed a merger of equals with Omnicom Group. The talks broke down due to a power struggle between CFOs, a potential culture clash, and emerging tax issues. PUB then prioritized acquisitions of several digital agencies and pursued industry partnerships with companies like Adobe.

As mentioned earlier, PUB acquired Sapient in 2014, substantially expanding its arsenal to assist clients in their digital transformation journey. However, growth targets set out at the inception proved too ambitious, leading to a €1.4 billion write-down shortly after.

Reorganization and transformation: In 2016, the Group restructured its go-to-market approach, shifting to a country model where each client was assigned a Country Client Leader, which could offer the entire set of solutions (Creative, Media, Digital, and Health). This new modular approach broke down siloes. As the organization digested this, it led to several notable employee departures and lackluster organic growth in 2016-2017 of less than 1%.

The following year, PUB doubled down on the path of integration as it rolled out its “Power of One” strategy. It began with creating two decision-making entities: the executive committee responsible for the transformation and the management committee responsible for operational execution. PUB launched its "Sprint to the Future" Plans in March 2018, which aimed to deliver +4% organic growth in 2020, €450m of cost reductions, and drive 5-10% headline EPS growth in 2018-20.

Transformation efforts persisted with acquiring Epsilon, a marketing data specialist, further expanding the company’s offerings and differentiation from peers. Net revenues from data and digital business transformation sources reached >30% of the portfolio. The company's integration efforts were increasingly paying off in 2018 and 2019 when it topped league table wins for new clients.

In 2020, the impacts of COVID-19 were substantial, but partially offset by accelerating digital growth as e-commerce and DTC investment accelerated. By 2021, advertising spending had recovered rapidly, up 15.6% as economic growth recovered and stimulus activity flowed through the economy. Organic growth stayed at >10% in both 2021 and 2022 - record levels the company had not reached since 1998-1999. Growth was strong, driven by solid contributions from Epsilon, Sapient, and the Group’s businesses in the US (where its portfolio offering was most integrated).

Momentum remained strong in 2023 and is on track to deliver ~5.5-6% organic year-over-year growth. The integration efforts from prior years continues to pay off as Publicis led the peer group in new business billings. In 2023, PUB appears to be in its best form, as evident in the strong margins, growth profile, and market share gains in the industry.

Advertising Market Overview

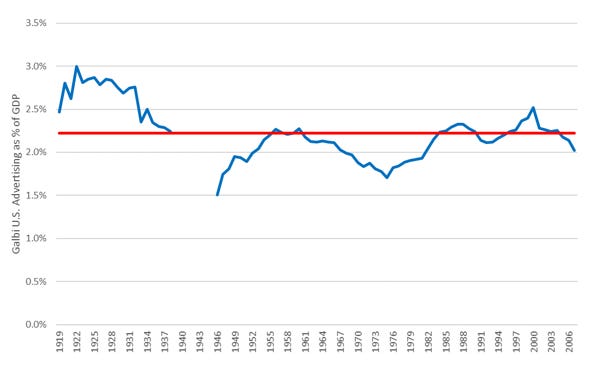

The advertising market has a long history and has continually evolved with the emergence of new mediums and technology. Here, we refer to the market broadly as “just about anything from a company’s marketing budget” - not limited to ads in the traditional sense, but also including components like direct mail, coupons, product placements, market research, event marketing, and public relations. Looking at US data from 1919 to 2007, the market fluctuated between 1-3% of GDP (shown in the first chart below, source: Galbi). Data from Magna Global indicates similar trends going back to 1980 (second chart below), but the share appears to range from 1 to 1.4% of GDP due to difference in methodology.

Regardless of definition, advertising spending peaked in 2000 as a % of GDP and decoupled further in 2009 from the onset of challenges created during the GFC Crisis. Multiple culprits drove this change:

The proliferation of digital platforms, which led to partial disintermediation of the ad agencies and lower overall spending levels. As these platforms grew in significance, the effectiveness of non-digital spending came under increasing scrutiny and cannibalization.

Many of the large clients and consumer-facing multinationals also faced a period of decelerating organic growth and weaker pricing trends, leading to internal budget constraints. In particular, 3G Capital’s approach in the FMCG sector was also increasingly impacting peers as more adopted zero-based budgets and a mindset focused on near-term profitability, which likely ate into budgets.

But if it wasn’t clear enough from the data above, advertising spending has always been cyclical and should continue to be going forward. In the past ~23 years of data, shown below, global advertising spending has grown on average at a 2.6x multiplier relative to global GDP growth. Spending relative to GDP typically falls during a recession, then accelerates to a higher proportion of GDP in the subsequent periods (i.e. peaks and troughs are both magnified) – this is evident below in 2009 and 2020. Unsurprisingly, the organic growth of the Big Four ad agencies mirrors industry trends as most spending flows through them in some fashion.

Ad spend is a critical source of revenue for many business models - one that’s also very high margin. One of the oldest mediums is newspapers, which, without advertising or classified spending, would never have reached the scale of revenue it did (newspaper revenue peaked in 2007, before falling sharply thereafter due to falling circulation and declining ad spend). In fact, this pace of deterioration caught even Warren Buffett off guard, which led to lackluster returns from his roll-up strategy to consolidate select newspapers – and the eventual sale of these assets to Lee Enterprises in 2020.

“It upsets the people in the newsroom to talk that way, but the ads were the most important editorial content from the standpoint of the reader,”

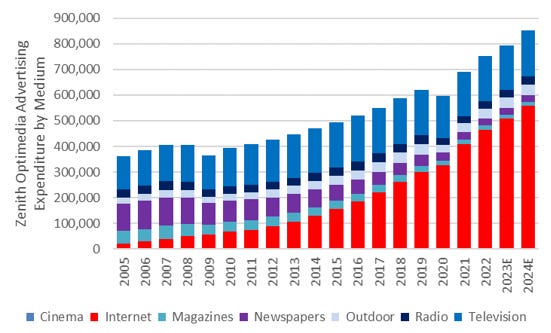

Ad spend on television and newspaper once dominated the industry, accounting for about 2/3rd of total expenditures in 2005. Since then they have secularly declined, ceding share to internet/digital which represented 2/3rd of the industry in 2022.

But why exactly did internet advertising spending increase during this period? The reason seems obvious - the proliferation of smartphones and increasing share of consumer time spent meant so did ad spending on these platforms. But importantly, advertisers started to understand over time that the internet allowed them to reach consumers more effectively. Consumers were increasingly served ads of products they wanted to see, and advertisers could become more deliberate about which consumers or audiences they were targeting.

Facebook, Google, and others achieved this by collecting user behavior data, which was subsequently analyzed and used to build user profiles. Across the industry, a more comprehensive range of businesses began to collect first, second and third-party data - each data type can help better target customers (although source, quality, and reliability vary dramatically).

The critical role of data has been driving significant changes in the digital advertising landscape. As the old adage goes 'the only constant in this industry is change.' Specifically, we highlight two areas of particular interest.

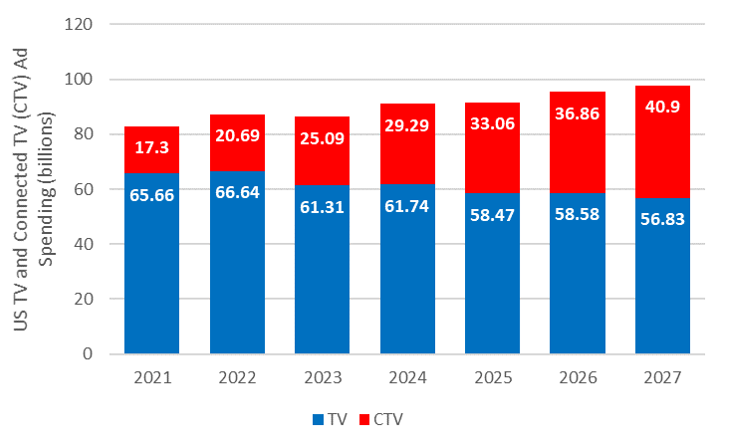

Traditional linear TV is expected to continue to decline as cord-cutting impacts more households, but Connected TV is expected to double in size, as shown below. For reference, this covers Smart TVs, Apple TVs, Chromecasts, Amazon Fire Sticks, Gaming Consoles and Roku, which are seeing penetration gains as consumers upgrade hardware at home.

The other rapidly growing area is Digital Retail media, which includes the Amazon, Walmart, and Kroger ad networks. Ads are becoming an increasingly important source of high-margin revenues for these respective companies. These networks are increasingly a popular choice by advertisers, as these retail partners have an abundance of customer data covering actual transactions, can integrate online + offline spending, and leverage valuable first-party data they have.

The size of this market is probably underappreciated by most; by 2024, eMarketers estimates it will be $68 bn which is more than 2x the level of the streaming advertising market. Martin Sorrell - industry titan and founder of WPP - predicted in 2018 that Amazon alone would generate ad revenue of $100 bn (for context Meta generated $113 bn of ad revenue in 2022). Sorrell’s prediction is aging quite well. In its latest results (Q3 2023), Amazon’s ad revenue reached $48 bn on an annualized basis and growing at 26% y/y.

The tagline from Eric Seufert best captures the expansion of this market: “Everyone’s an ad network.” Even companies like Marriot - which most would not associate with the concept of ad networks - are in the process of creating their own through industry partnerships!

All said it appears there will be many choices marketers will have to make going forward, and the media landscape, as we see it, is going to be far from simple to navigate. Many other growth avenues could emerge, like gaming advertising driven by more free-to-play launches and metaverse advertising as penetration of VR devices increases. The list is endless. Below is a good illustration that captures the complex state of the advertising industry today.

Competition

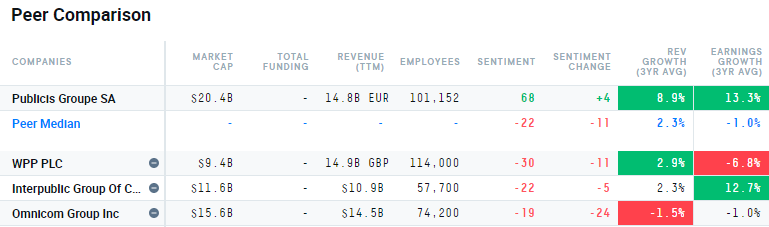

We can examine the competitive landscape from several angles. The most obvious comparison would be within the Big Four, as illustrated in the below comp table (source: AlphaSense). Clearly, Publicis has been leading the peer group in both top and bottom-line growth in recent years.

There are many advertising agencies worldwide, and by most accounts, they participate in the highly competitive sector. However, only the Big Four are scaled well enough to compete for the large multi-national accounts that are primary customers. Unfortunately there aren’t many clean data that’s easily obtainable, but in one chart (below), it indicates that 42.5% of the US market is held by firms outside of the Big Four.

However, competition needs to be examined more broadly:

Looking forward, it seems very possible that the large GAF platforms continue to capture - directly or indirectly - more marketing spend. This might be particularly true as AI enhances self-serve platforms and adds generative creative capabilities (more on this later).

Consulting companies like Deloitte and Accenture have expanded into advertising through several small deals focused on digital agencies. Still, they don’t seem to have had much overall success in the market.

Another challenge is that clients will attempt in-house activities, sometimes poaching talent from the Big Four to build internal capabilities. Most of these concerns are overblown, and recent results indicate PUB is the best positioned among peers due to the full scope of its offerings.

By geography, PUB has one of the highest exposures to the US market. Exposure is essential due to the US market’s scale (GDP), advertising intensity (per capita), and less limitations on the amount/type of data that can be collected about consumers. On a regional basis, the EU continues to be the first mover on data, resulting in more restricted business activities and higher compliance costs for firms with larger EU market exposure.

As shown below, PUB’s profitability has consistently ranked ahead of peers over the past cycle. We believe this is structural, owing to the company’s favorable geographic mix as mentioned, but also effective cost management, and bolstered by the benefits from the Epsilon deal in 2019. Absent a severe recession, we expect the margin profile to drift higher in the next five years as higher growth in Epsilon relative to the rest of the business drives margin accretion.

The key difference between PUB and its peers is the Group’s capabilities across the entire marketing value chain. Earlier, we touched upon the Sapient acquisition in 2015. Publicis further bolstered its offerings through the acquisition of data services business Epsilon in 2019. The most relevant alternative to Epsilon seems to be Acxiom, which competitor Interpublic Group purchased in 2018 for 11x EV/EBITDA. Basically, this deal gave IPG a smaller version of Epsilon (but excluded the identifying capabilities as they were left with LiveRamp).

Publicis CEO Arthur Sadoun explained it as:

“Acxiom is only about data. Epsilon is way more. [We] are first in CRM, with an outstanding way of putting together and building ID around first-party data. That is a business that has nothing to do with Acxiom.

“Every year they are sending 71 billion personalized emails. They can identify 225 million consumers in the US with 7,000 attributes. Last but not least, they have a platform called Conversant, which is a big part of their business, that can deliver personalized messaging at scale.”

Core to our discussions with the company was the notion that having a more comprehensive set of client offerings has been a winning feature over the past few years, and it seems likely this trend will continue. Management highlighted that with a more comprehensive offerings across the value chain, they can capture more of clients’ aggregate spending. This is illustrated below.

With so many services on offer, one question is how the bidding process and pricing are determined. Admittedly this area has always been somewhat of a black box for industry outsiders. However, two points came across as particularly important in our research:

Creative activities and media buying are priced similar to the market. However, the area where Publicis can price differently is with its data, data services, and digital business transformation offerings.

Additionally, the scaled media buying and planning operations offer financial benefits (higher aggregate dollar spent with PUB) that can be reinvested to make the overall proposition/deal stronger.

A former PUB executive sheds some light on how they have been able to consistently win relative to the large consulting competitors, despite recent efforts by these competitors to consolidate their own digital agencies.

“When it comes to a lot of the creative and experience pitches that we were up against at Publicis, we were up against the Accentures and McKinseys, or Deloittes, we would end up winning because we had a media lever to pull and media dollars to have to work with, to move money around to make the financials work too.

In the tech houses, the P&Ls and the financials are very structured and straight up because it's all about hourly rates and bodies and time and materials, and technology costs. There's not a lot of room to move money around to make deals work in that same fashion. There's a lot of tension around pitches that when the tech houses are trying to get into more of the creative and media marketing space, it's quite hard to bring the financials down in a way that makes the project affordable for clients

…but Publicis can make the financials work because there's a bigger pool of money to work with and more fluidity in the system because of the media side…

You could imagine if a tech house bought one of these media companies, how much it would unlock in terms of just not only end-to-end service but also ways that you can run the financials because of this big pool of media money that's now brought in that these tech houses don't have today.”

- Former Unit Head at Publicis Groupe (July 2023, AlphaSense Expert Insights)

Case Study: Epsilon

PUB's most significant deal in the past decade was when it acquired Epsilon from Alliance Data Systems (ADS) in 2019 for € 3.95b. The purchase price translated into an 8.2x EV/EBITDA multiple on trailing EBITDA of ~€400m.

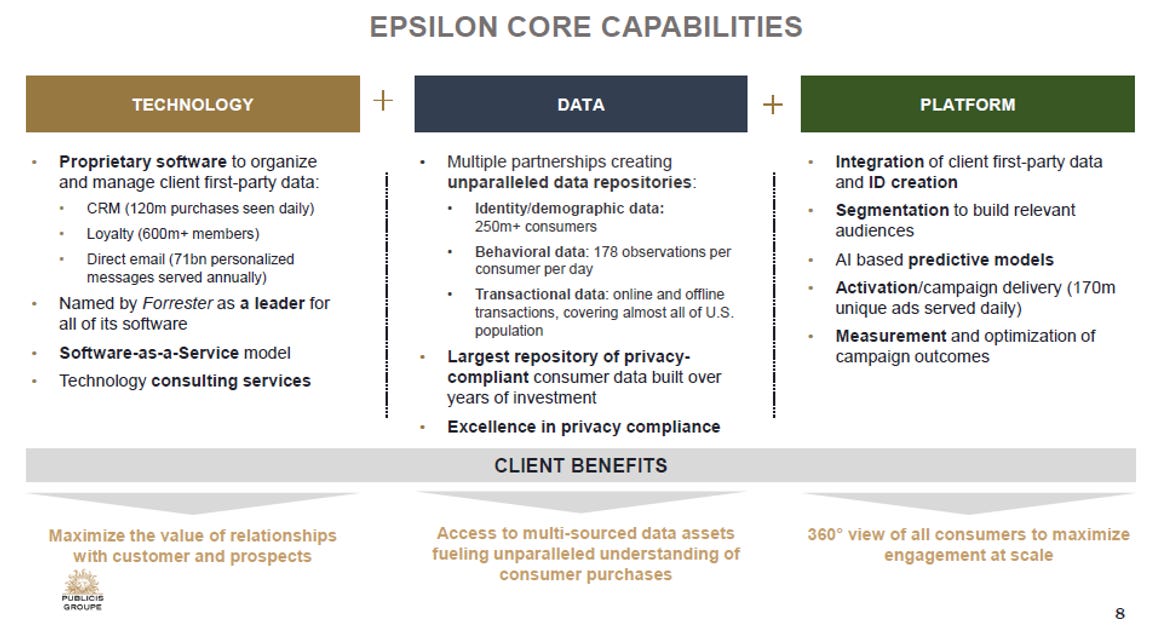

So, what exactly did they purchase? The deal included three major components: software to organize and manage client first-party data (e.g. CRM), a library to further enrich first-party data, and a platform to build profiles (IDs) and activate campaigns. The value of these combined is a lot more than meets the eye.

Epsilon enabled PUB to solve a common problem many of its clients faced – that they had lots of first-party data, but full value was not captured from it. PUB was now able to onboard, clean, and structure client data. Step two would be to enrich or upgrade it with Epsilon’s own proprietary demographic, behavioral, and transactional data repository (accumulated over years of investments and industry partnerships). The last step would be to create user profiles, build relevant audience groups, and eventually deliver effective marketing campaigns to specific groups.

A former executive explains the product positioning of Epsilon:

“Essentially, the way it was thought of strategically was you can build your own walled garden if you're a large advertiser by using Epsilon and Publicis.

Instead of allowing Google and Meta to own your data and keep it behind in the walled garden, you can control your own data and leverage it yourself using the technology and capabilities that Epsilon had. That's essentially what the offering is or the product positioning, if you will.

In Epsilon's background, I believe the reason their main data asset that they had when Publicis acquired them was that they had all the financial transaction data from, I think it was almost all the automakers in the U.S., so all the financing. They had a lot of credit card transaction data. They had a real wealth of data…consumer data that they could leverage and they would create advertising solutions through that for clients."

– Former Chief of Staff at Publicis Groupe (September 2023, AlphaSense Expert Insights)

We believe Epsilon is highly differentiated. One significant benefit of the Epsilon offering is that it could build an identifier that covers both the online and offline worlds. This ability to see consumers conduct interactions hundreds of times daily allows advertisers to adapt to a consumer's needs. This is a real-time view across devices and channels updated roughly every 5 minutes.

The closed loop and real-time updating capabilities are powerful. To demonstrate, here’s a simple example - Suppose you have just booked a vacation. You looked at some sandals online, and then purchased one at a local store in the afternoon. Instead of seeing more sandals when you read the news online at the end of the day, seeing sunglasses or car rental deals is much more likely to lead to a successful conversion.

What’s best about this technology is that it doesn’t rely on “re-targeting” technology (which can be considered the lazy man’s approach to online marketing). Retargeting is when you search for a product or interact with a brand website, but then, as you shift to new websites, this “ghost” follows you for days or weeks, with limited adaptation to any future behavior you demonstrate (Haven’t we all been shown that same ad repetitively days and even weeks after we’ve already completed our purchases?)

“Our business is focused on having a conversation with consumers over a long period of time, which is really the point that Arthur was making about personalized experiences at scale. No consumer is that interested after they visited a website to be hit with hundreds and hundreds of digital images of the product that they were looking at, which is where retargeting classically plays. Our clients are looking for a way to build brand loyalty over an extended period of time and that's the ability that we bring to the table. To reach them over that extended period of time with accuracy, with efficiency and in a way that's relevant for the consumer, which I think is the most important part.”

- Epsilon Acquisition Conference Call 2019

According to a study by Digiday which compared ID alternatives available in the marketplace, they found that Epsilon was the only solution available on the market that could incorporate and connect across nine different data types (below image - the importance of all of the items is evident). Even the second-best could integrate only five, highlighting the quality gap.

Lastly, we provide an overview of the flywheel PUB can create with its Epsilon assets. Epsilon offers one of the few end-to-end solutions for completing online digital advertisements outside of the Google, Amazon, and Facebook (GAF) Platforms. Epsilon’s ownership of proprietary library shown in red in the flowchart below stacks on top of client first-party data and helps materially with the enrichment, profile creation, and segment process. With this, PUB has positioned itself as an owner of these assets versus peers, which tend to effectively rent it from third parties like Google, Xandr, and Trade Desk. In addition, Epsilon has advantaged data access from thousands of media owners and can pool this information to help counter the scale advantages of the GAF platforms.

At the time of acquisition, Epsilon had already been highly ranked by industry publications (named a “leader” by Forrester Waves) - a position which it has consistently maintained into 2023. Through Epsilon, a differentiated offering provides PUB with pricing leverage, in addition to making its portfolio increasingly resilient and less exposed to overall advertising spending cycles.

Risks

In-housing concerns

One concern widely cited by bears on ad agencies is that more and more of their large clients are pulling creative activities in-house. ANA (Association of National Advertisers) surveys seem to indicate in-housing trends reached an all-time high in 2023. The most significant benefit to clients is that it can reduce costs. But, we are skeptical that with a relatively small-scale staff and vertical expertise that is increasingly important, this is always the right move for clients in the long-term.

It seems like activities like creative, where the industry suffers from overcapacity, are likely to drift in-house. Still, areas like Media Buying/Planning haven’t shown as much of a clear indication of being pulled in-house – as the scale benefits of the Big Four cannot be easily disintermediated. This is an area where PUB has differentiated scale and strength.

We have witnessed times when companies become too oriented on short-term cost efficiency and miss the bigger picture of building a brand and growing sales. The best example of this in recent years is Adidas, which has focused too much on attribution models, short-term sales trends, and ROI metrics during the last few years. This led to internal reflection and re-assessment, where management determined investment was too heavily skewed towards performance marketing and starved in brand-building activities, including TV, outdoor, and cinema media. This led to limited growth from first-time buyers of its products, creating topline challenges for the business, illustrating the potential downfalls. In-housing trends are likely to continue in some fashion in the future, but we believe that it’s a trend that has already played out to a large extent.

Generative AI

This is a challenging area to analyze, but it wouldn’t be a fully-fledged thesis in 2023 if we didn’t at least touch on the potential impact of Generative AI! Starting with the areas that are most obvious – for creative, the ability to create more output easily with the help of genAI tools should support per-worker productivity trends. AI software can scale, but services can’t without headcount additions so that we could see some trend improvement at the margin. Below, we show the historical relationship between employee cost and output - it turns out the relationship has been quite linear.

However, creative operations of the industry are already plagued with excess capacity - would AI matter? For the Media Planning and Buying operations, there shouldn’t be much of an impact either (or at least neutral amongst the Big Four). PUB’s IT consulting capabilities may benefit as they get a chance to build AI capabilities into a client's systems (which they will then be relied upon to manage and update the tools). The biggest knock on impacts will be that it could create more demand for both Sapient/Epsilon solutions. A former Sapient executive shares his views:

“I think the cross-selling of existing services or new solutions is definitely something that will happen. I think you're starting to see that. The work that I've done, I've helped organizations build out new digital products on top of their existing portfolio of products. For example, I worked with an automotive company to build out new connected vehicle software use cases.

If the vehicle is connected to the Internet, what are the different types of services you could provide that are more software-enabled or providing over-the-air updates on performance enhancements or vehicle upgrades? That even opens up the door to new pricing models. You can have a pay-as-you-go heated seats driven by just a simple subscription to a software through the vehicle.

There's a lot of new use cases that are being unlocked and new value that could be created by developing these new software products in more traditional industries. On the digital marketing side, obviously, that creates a huge opportunity to upsell or cross-sell customers because you now know their journeys, their behaviors, what interests them, and therefore, you can create much more targeted marketing campaigns.”

- Former Senior Principal at Sapient (January 2023, AlphaSense Expert Insights)

Emerging Privacy and Data Restrictions

In recent years, there has been an emergence of several privacy regulations from regions like the GDPR (EU) or CCPA (California). Even Google is in the process of depreciating the Google advertising ID and phasing out cookies on Chrome by mid-2024. Perceived privacy-oriented companies like Apple are taking steps to bolster their advertising network at the expense of competing alternatives. The mechanics of all of these potential changes are all different. Still, the net effect is the same: a lower quality ability to target consumers, higher customer acquisition costs, and more noise in performance marketing measurement.

This leaves marketers with a few areas to pivot towards as they navigate these changes. The first option is further bolstering the collection of first-party or zero-party data, which on a competitive basis is the most robust (peers won’t have access to this data). The second is to create partnerships in the industry leveraging second-party data, which is another company’s first-party data (sometimes peers can access the same/similar data). However, this approach is only favorable to larger companies who can afford to pay. The last bucket is contextual advertising, or interest-based advertising, which is still in the earlier stages of development and a solution where there is uncertainty, relatively speaking, on whether it will help marketers.

So, how does PUB fit into helping customers navigate these changes? Regulation changes aren’t expected to limit PUB’s customer's ability to collect first-party data, and its solutions (Epsilon) here should become more valuable as a differentiator. The company’s identifier IDs should also be less impacted as they are built on more different types of data than peer offerings, so the loss of an individual type should be less material for its targeting capabilities. Former CEO of Liveramp explains the dynamic well: “The more connected a data set is to other data elements, the more valuable it is.”

The simplest way to see how PUB’s portfolio is winning in today’s market is the net winnings across the industry as more of these privacy/data restrictions have been put into play. GDPR was first implemented in 2016, and a few privacy-oriented regulations have been enacted in different regions. Looking at win-rate data from JPM from 2018 to 2022, PUB has captured more than 2.5x more new media billings than peers. On a group basis, performance has also outpaced peers with a 4-year stacked reported revenue growth of 43% vs. the -7% to +12% levels of peers. Even YTD trends remained robust, outperforming the industry by >500 bps.

Given the momentum, the first question that could come to mind is how sustainable these drivers are. CEO Sadoun addressed this on the Q3 2023 conference call:

“We are combining two things that no one else is combining at our scale. On one side, we are the leader in media, particularly in the U.S. We have the most scale and scale matter in this business. Second, media operations have been transformed by Dave Penski and his team in such a way that today, we are able to connect them with the first-party data of Epsilon that is again leading the market in third parties. What does it mean? It means that every time we get into a pitch, we are leading what clients are looking for, which is personalization at scale. Scale, thanks to Publicis Media, personalization, thanks to Epsilon, all of this connected, thanks to our business model.

The second reason why we are confident in the growth of Publicis Media is not only that we are gaining market share with new clients or with existing clients that we are extending is that, we are leading the two major areas of growth for Media in the future, that’s our retail media and connected TV. And the reason why we are leading in those two areas are the same which is we have the first-party data, even Google is starting to do first-party data. We have the first-party data, and we have the scale in media that allow us to actually lead in an area like retail media, where we see that our client will spend more money there than in linear TV very soon. So a source of growth for us, but also in everything that has to do with connected TV because the future of advertising when it comes to TV is personalized, it’s our ability through a single identity to deliver a message that can be scaled on TV, okay? And we have, of course, a favorite place with the media owner on the other and the technology on the other.”

Management

Arthur Sadoun is only the 3rd CEO since the firm's inception in 1926, and was handpicked by Maurice Levy, the prior CEO, who remains on the Board. From a strategic perspective, we believe Sadoun has focused on the right pillars to improve the business's competitive position in the future. His most significant decision has been to acquire Epsilon. Collectively, the changes have improved the value proposition for PUB’s customer base, and even peers/partners are increasingly trying to replicate its strengths in first party data arena.

“I have to admit that when we decided with Maurice Levy to make this acquisition four, five years ago now, we knew it was absolutely critical to have a leading position in data, and this is why we made this big investment at the time that has been, of course, a disruption that we had to integrate. But I can tell you that we were anticipating how strategic will be first-party data for the entire market and how much clients will realize that not having a direct contact with their customers will be a strategic issue. And again, when you see Google that now is trying to appeal to clients through first-party data, you understand, hopefully why this is so core and important to our model.”

- Q3 2023 Conference Call

Founder Marcel Bleustein-Blanchet's ownership was passed down to his daughter, Elisabeth Badinter, and she still owns ~6.6% of the business today. She held the Chairman role from 2000 to 2017 and has since shifted to a Co-Chairman position, which she retains today. Her son, Simon Badinter, has also built a career in the industry and has been on the board since late 2000.

In most cases, our view is that family or anchor shareholder ownerships are generally positive as they incentivize a longer-term orientation on capital allocation and strategy development. We don’t have any reasons to think otherwise for Publicis. The Badinter family’s ongoing involvement on the board acts like a bumper to avoid any materially dilutive deals or aggressive bets that could have the potential to endanger the firm's long-term viability.

Let's take a quick look at the compensation structure for management. The short-term compensation policy is well structured, with varying allocations on organic growth, operating margins, and cost management, and the balance is tied to CSR initiatives. Longer-term incentives are still tied to organic growth and margin targets but include TSR, cash flow, debt management, and integration progress (All in One). Employee Share ownership is minimal – not ideal. We came across some anecdotes of abnormally high levels of employee retention at Digitas, one of its agencies, but it’s unclear how widespread this dynamic is across the entire organization. Rounding it all out, the incentive structure is reasonable enough.

Valuation

Publicis has a market cap of €18.6b and an enterprise value of €19.3b. The stock trades at 10.5x P/E, about in-line with peers after considerable de-rating from prior decade highs. On EV/EBITDA multiples, the stock trades at 5.9x, a discount from both OMC and IPG. PUB deserves a premium to peers given its track record or superior growth, competitive product positioning with its data/tech assets, and a robust balance sheet.

Below we show the IRR (and sensitivities) based on FY25 consensus EPS and P/E multiple of 12x.

Below, a “reverse implied” DCF analysis makes the valuation look very punitive to the company, especially in light of the company’s fundamentals and long-term history (recall - these organizations have been described as cockroaches!) It suggests a considerable implosion in revenue over the next few years and barely any recovery in the subsequent decade. In other words, shares are pricing in substantial disintermediation or disruption by future technology that eliminates growth altogether. These are not high hurdles to underwrite. Even if we have a recession next year, consider that organic growth for PUB in prior downturns only fell by low double digits in a single calendar year.

One last piece of insight - could the Big Four themselves be targets of acquisition? Former executive believes that as PUB increasingly competes with the large consulting groups, this could potentially result in an acquisition at some point:

“You have to wonder if some of these smaller agencies are being built to be bought. Again, it's a very striking thing to think about. The top three holding companies in the world combined are the same revenue as one Accenture, one McKinsey, one Deloitte. If those guys are getting into the same space and the paths are starting to cross, if you think about the concentric circles, and the best way I describe these things is that the McKinseys, the Accenture, the Deloittes are tech houses trying to be creative houses. Publicis is a creative house trying to be a tech house.

If you think about the concentric circles and the Venn diagram, they're pushing together more and more. Eventually, there's going to be enough overlap that someone's going to make a move whether or not politically or ego-wise Arthur (CEO) is going to let that happen, who knows, but Arthur might want that from a Publicis perspective because it's a feather in his cap to be acquired by a big tech house and it gives him credibility that he brought a lot of the tech into the Publicis system to begin with.”

- Former Unit Head at Publicis Groupe (July 2023, AlphaSense Expert Insights)

Fundamentals are strong, expectations are not high, and valuation cuts a few different ways suggest healthy return potential going forward. PUB looks well-positioned to navigate an increasingly complex environment and generate attractive shareholder returns.

If you enjoyed this post, please share it!

AlphaSense Expert Insights is an expert transcript library that helps investment analysts maximize returns with access to tens of thousands of high-quality, searchable, proprietary expert transcripts covering multiple perspectives, industries, and markets. Unlike costly and time-consuming traditional expert network calls, AlphaSense drives faster time to insight, improves ROI, and ensures critical information isn’t missed in the research process. You can sign up for a free trial by clicking here.