Welcome back! If you are new, subscribe to receive monthly deep-dive research on global stock ideas and other original investment content

Summary:

EPAM is a high quality IT services provider that has been compounding earnings at a high rate for the last 10 years.

The stock is currently dislocated - down more than 70% as of the date of writing. EPAM’s delivery centers are distributed throughout the world but have a major presence in Ukraine, Belarus and Russia (clients are mostly based in the US and Europe).

We have laid out a framework for analyzing IT services business. We have also performed scenario analysis on the possible future trajectory of EPAM in light of the geopolitical circumstances. In each scenario the stock price should be materially higher in 24 months.

Before we begin, we want to say that we, at Value Punks, are appalled by the human tragedy and pray for a swift end to this senseless conflict.

EPAM is a global IT services firm with presence in 40 countries and 58,800 employees. The company provides services to a diversified end-market consisting of clients in the financial services, travel, retail, software, healthcare among other industries. The company is well placed as a ‘toll booth’ between technology and corporations who increasingly need technology to transform their business.

Over its history, EPAM has been a ‘compounder’. The Company has a sticky and growing client base that it supports with its deep engineering expertise. EPAM came to the market via an IPO in 2012 (at $12/share), and since then has grown revenues and operating profits almost 10x. Due to its quality, capital allocation, increasing scale and inflecting margins, investors had awarded the company a very high (average) multiple of 50-60x LTM earnings over the last 5 years.

Recently, the stock price has declined from a high of $720 in October 2021 to ~$180 per share. Some of this is due to the rout in technology stocks but the bigger issue at hand is that about half of EPAM’s engineers are based in Ukraine, Belarus and even Russia.

Before the invasion, EPAM issued its 2022 guidance and expected revenues to increase 37% with stable operating margins. The street had its EPS doubling in three years from 2021 levels. Furthermore, EPAM has a fortress balance sheet with $1.2 bn in cash on a $11 bn market capitalization (11% of mcap). EPAM pulled this guidance a few days later and the stock cratered. The company later issued a press release supporting Ukraine and committing $100 mn for relocation of its employees in Ukraine.

Here are the historical financials ($USD millions (GAAP)):

This report will discuss the global IT services industry broadly, before diving into a discussion of EPAM’s business. We’ll also provide a way to think through the risks related to the current geopolitical situation. In doing so, we won’t be making any macro calls on geopolitics, but rather approach it from the bottom-up using scenario analysis as a way to visualize the risk-reward. Given the wide range of potential outcomes here and the fluidity of the situation, this one deserves a more nuanced treatment than a ‘simple buy’ recommendation. We hope that with this, the reader can come to an informed decision on this unique (and potentially attractive) opportunity, and decide for themselves if they find the risk-reward setup suitable.

Context

All IT services companies look the same. They all provide bodies that specialize in technology to businesses that need to either cut costs or improve processes. Under the hood, however, they are all a little different. Understanding these nuances can be the difference between a value trap and a compounder.

Drivers of IT spending

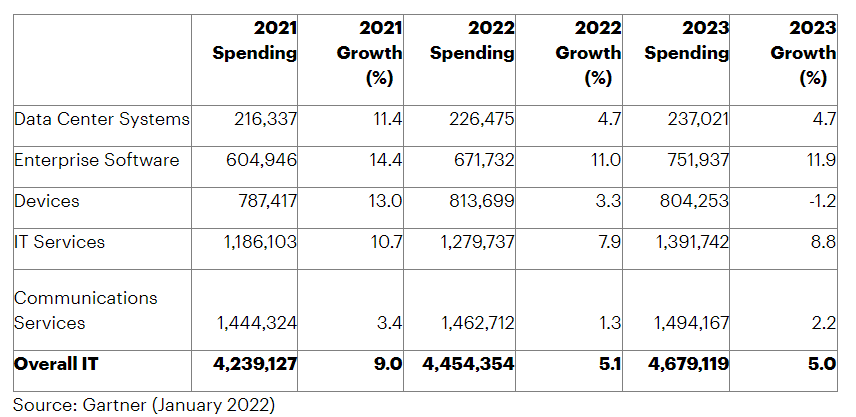

Worldwide IT spending is projected to total $4.5 trillion in 2022, an increase of 5.1% from 2021, according to the latest forecast by Gartner. This spend is divided into the following categories:

We can see above that software and IT services are the fastest growing segments of overall IT spend. The IT service providers play in these buckets and grow faster due to the following,

Increasing IT spends: These spends are typically a function of IT budgets. These budgets are typically a certain percentage of revenues. The trend is that most corporations are allocating a larger and larger part of their spends to technology - software is in fact eating the world. These spends have further tailwinds from:

Cloud computing

Cybersecurity

Work from home

Digital marketing

Increasing outsourcing: Larger businesses can afford in house technology departments but for most businesses technology is not their core expertise. It is also difficult to hire and retain good technology talent. In the past, most companies let IT companies manage their costs but increasingly IT services companies are helping businesses transform the way they do business (i.e. digital transformation).

Confirming this, Gartner mentioned that, through 2025, organizations will increase their reliance on external consultants, as the greater urgency and accelerated pace of change widen the gap between organizations’ digital business ambitions and their internal resources and capabilities. Garner also mentions that among businesses planning to boost tech spending in 2022, IT budgets are expected to grow by 26% (31% in North America vs. 21% in Europe), on average. In 2022, the top factor driving companies to increase budgets is an elevated priority on IT projects (49%), which could indicate multi-year modernization efforts that were accelerated by remote work, and a steady shift to cloud-based services have chipped away at legacy technology.

This jives with EPAM’s guidance.

IT services is not a new business. US businesses such as IBM, HP, Perot systems and the like were successful in this business for many years. Warren Buffett had been reading IBM’s annual report for 50 years before he bought the stock. He talked to Berkshire companies and reasoned that most companies do not switch their IT providers. He was absolutely right in his assessment of the industry - it is a very sticky business - but picked the wrong horse (should have bought Accenture instead!).

We digress.

Evolution of the industry

In the 1990’s there were two main tasks performed by IT services companies - infrastructure and applications. Most big companies needed someone to set up and manage servers, network and other equipment. In addition, starting with the financial institutions/banks, they also needed custom applications that could help them become more efficient.

The late 1990’s brought the rise of the Indian IT services industry. These companies could manage a corporation's back office for much less than IBM or Perot or HP. They had cheap English speaking programmers who could take over the task of developing and maintaining custom applications from India (enabled by the internet). Before packaged software, most large corporations developed their own custom software (some banks are still running applications on Cobol and Fortran). The Indians could do it for much less! They also took over the maintenance of current software. Most back offices were a mess with different custom applications which never talked to one another. The first phase of the Indian industry’s development was taking over the client’s “mess for less”.

The western IT services companies faced deflation in their core services business due to the emergence of Indian IT services providers. They then read Peter Druker and left the commoditized business and started offering more specialized services such as packaged software implementation, building and maintaining infrastructure for a fixed rate or offering technology consulting. Even then they lost a lot of business over the last 25 years, first in commoditized services, and then in more specialized services as the Indian IT services providers kept moving up the value chain.

The Indians just had a huge cost advantage. An engineer in India could be hired for 1/10th the cost! Due to this, most large Indian IT service providers had operating margins of 35-40% while their western counterparts managed with 15-20% margins. Slowly but steadily, the western companies started building delivery centers in India and the cost arbitrage started deteriorating. The margins have more or less converged.

Until 2010, most of this work was still confined to the back office. Clients, however, increasingly needed help with the revenue generating parts of the business. Software was eating the world and they did not know how to make sense of it. They needed apps, transition to cloud, data analytics and the like in order to be competitive in this very tech enabled world. In order to update their front office they also had to make changes in their back office.

Bernstein, a research house, puts it succinctly, “Digital is a unique wave as it is integrated with the entire technology stack – front end apps, back end data center/cloud, legacy apps, data sources – all need to be integrated to realize an end to end digital transformation outcome. This has also led to integration of spends which are no longer restricted to the CIOs but also the CMOs, CDOs, COOs, etc.” A bank cannot become digital if the back office is still doing batch processing (well, that's not totally true as some banks have come up with band-aid solutions!).

This led to the rise of new IT sourcing companies with very strong engineering capabilities that were ahead of their time. EPAM, Globant, Luxoft (now acquired by DXC) appeared on the scene with delivery centers based in Eastern Europe or Latin America. The legacy businesses for most traditional outsourcing companies were now experiencing deflation as clients needed to find dollars to spend on transforming their businesses. Plus there seems to be a quality differential!

The Indian companies always have lower prices than companies in Eastern Europe or in Central Europe, but the real competitive advantage for the companies that are coming out of Eastern Europe and Central Europe is that they produce quality. The total cost of a project may be lower than the total cost of a project out of India, even though the price per person is much lower in India than in Central Europe or Eastern Europe.

-EPAM ex-Global Head of Division (Aug 2020) - Stream transcript

An Accenture or an Infosys now has two very different businesses within their portfolios - a legacy business which is facing deflation and de-growing mid single digits and a new digital services business that is growing at high double digits. Net result is that these businesses grow at high single or low double digit rates. Newer IT service companies such as EPAM grow at a much faster rate because their revenues are exclusively in the digital category.

Analyzing EPAM

As we mentioned before, these businesses look the same from the outside and are black boxes for the average analyst. It is difficult to appreciate the nature of work or the stickiness of the client base. The key differences between a good and an OK business is the portfolio of clients and execution. Clients in industries with increasing IT budgets and execution to be able to deliver on budget and on time - these are not businesses a ham sandwich can run!

EPAM’s historical core competency is full lifecycle software development services including design and prototyping, product development and testing, component design and integration, product deployment, performance tuning, porting and cross-platform migration.

The competitive advantage of this business model comes from scale in both verticals and horizontals. Let us explain.

Verticals

The amount of business to be won depends on the IT intensity of that particular industry. Banking and financial services are the biggest consumer of IT services and form a large part of most IT services business including EPAM.

There is a misunderstanding amongst analysts that these are service businesses (project to project) due to which they do not deserve high multiples. This is not true. These revenues are very recurring. The financial services industry, for example, has a constant need for IT services due to complicated back offices, changing compliance requirements, mergers and acquisitions, or digitizing services. An IT service provider needs to work hard to take its fair share of the client’s IT budget but the good ones do just that. Whatever the client’s need, the IT service provider has a solution. EPAM is especially good at this!

With a company like EPAM that has such a high rate of growth, it cannot afford to lose clients. Once it gets into a client, it has to land, as they say, and expand. They have to land and expand, and then expand further, and then expand further. Their focus on stickiness, on building good relationships with clients based on quality results is a hallmark of the EPAM philosophy.

-Industry Consultant (Feb 2022) - Stream transcript

Within these verticals, a company will typically start with small projects and slowly graduate to doing more. Importantly, unless you successfully finish a $10 mn project for a client, you will not win another client that will give you a $10 mn project - chicken and egg. It is very difficult to scale! Furthermore, it is not enough to have done a $10 mn project in a different vertical - the reference needs to come from the same vertical! Even then, the decision to onboard an IT service provider is often taken at the board or management level. No one gets fired for hiring Accenture (or EPAM!).

Due to this, we see that larger companies such as Accenture grow larger (674,000 employees!) while many small and mid cap companies are unable to scale. In the cases where they scaled, they either had a big marquee client that could offer them a big project and a solid reference or bought their way into a big project. EPAM has been a bit of an anomaly in the industry and has scaled organically based on the quality of its work and its technological prowess (some M&A but mostly tuck-in).

EPAM’s verticals are as follows:

As we can see, they are in good verticals without a vertical being overwhelmingly large as a percentage of revenues.

Horizontals

This refers to the type of work done by the IT services provider. Broadly, work is divided into services around hardware, software and then making it all work together. The industry names for this are application development, package implementation, infrastructure (on-prem and cloud), security, testing, data analytics, business process outsourcing, among others. Some of these such as business process outsourcing or infrastructure management have been commoditized while newer services such as application development, data analytics and other digital services are more specialized. It is important to quote several industry sources from to get a sense of EPAM’s DNA.

So a lot of data and analytics, predictive analytics, machine learning-type engagements, and automation RPA kind of wrapped around a lot of that intelligent automation. A lot of CRM projects, member experience gamification. So a lot of things -- data-driven, custom engineering, but also very good at insight. So, if it was an analytics project, they (EPAM) were good at finding the best way to kind of provide insights and help clients with accelerators and making data-driven decisions.

-Industry Consultant (Feb 2022) - Stream transcript

Just like verticals, scale matters in horizontals. Employees at an IT service provider need to be experts in whatever they are selling to the client. For this, either the company needs to hire experts or maintain a culture of learning within the organization such that employees are constantly abreast of changes in technology. This is the core expertise of an IT service provider - they know technology - but technology is always changing. Unless a company has a minimum scale of employees, it is difficult for them to offer more than a few services to the client leading to lower stickiness and lower margins.

I would say in my experience in working directly with EPAM is that they have a core engineering expertise that is top shelf. They can bring that to bear on whatever projects or programs that they're involved with. They seem to have a team of core scientific engineers that aren't necessarily dedicated to any particular project but are there to help in any fashion to accelerate or solve very difficult problems that come into play that may stall a project. Their ability to do that is pretty profound.

-EPAM Competitor (Jan 2022) - Stream transcript

The other way to get scale and capabilities is through acquisitions. Good providers do many tuck-in acquisitions to gain either expertise or clients. EPAM had done many successful acquisitions over its history and integrated them into their culture. EPAM does not pay a dividend and most free cash flow has been used in these tuck-ins. Large-scale acquisitions in this industry typically don’t succeed due to cultural differences.

When they (EPAM) identified in the past that there's a capability that's going to be in higher demand in the market, and they lack the capability internally, they did the smart thing in my estimation. Which is they went ahead and purchased one or two or several really strong players, and integrated them.

-EPAM competitor (Jan 2022) - Stream transcript

Refer below for more color on the revenue line, including geographic breakdown and customer concentration.

Needless to say, the economics of a $10 mn project are very different from a $1 mn project. The selling and marketing expenses can be amortized over a much larger base and the delivery infrastructure can be optimized to gain efficiencies. In order to manage costs the IT services providers have to maintain a ‘pyramid’ - for example - 5 junior engineers for 1 project manager for a smaller project or 10 junior engineers and 2 senior engineers along with a project manager for a higher value project. All this requires a finesse with managing a large workforce which takes some time to develop. It helps that engineers want to work for EPAM.

EPAM was the big dog in that region. People wanted to work there because they were the best name. Everybody knew them and they paid the best. I think if I was an engineer over there, and I wanted to, say, come to the U.S., EPAM would be the one to go for because they had the biggest client base and the most opportunities.

-Ex EPAM Executive (Dec 2021) - Stream Transcript

Due to the difference in project sizes as well as higher investments in S&M that a smaller IT service provider requires, margins are typically lower than their larger peers. But, over time, with scale, margins can increase faster than revenues. EPAM was just at this inflection point.

Ok - so we hope we have successfully argued that EPAM is a high quality business and has a moat due to scale on both the demand and supply sides of the business. The important thing to note is that the company is at an inflection point where it is growing the number of clients that are over $20 mn at a very fast pace. This means that EPAM is gaining recognition in the market and that growth should remain strong.

Now, where do these businesses go wrong?

As we mentioned before, managing these businesses is not easy. From time to time, we have seen businesses such as Cognizant and Wipro struggle. So what should we watch out for?

People - As John Malone would say, your assets go up and down the elevator every day. The productive asset of an IT services company are its people, and a good culture where people have opportunities to learn and grow is essential. Every company in the sector reports attrition which gives one indication of quality. Infosys, for example, had attrition of 20% for a few quarters when it was going through management changes. It is difficult to expect projects to be done on time and on budget under these circumstances. EPAM has one of the lowest attrition rates in the industry at ~10%.

Technology - Technology keeps changing and all IT services providers need to evolve with these changes. Some IT services companies such as Cognizant relied a bit too much on their historical success and did not change with time. This leaves room for competitors to enter a client and then expand their offerings. EPAM’s niche is technology and its value proposition is that it is on the forefront/right side of technology, so it has lower risk of being disrupted.

Vertical focus - Some companies have a very large portion of their revenue come from one or two verticals. In these cases, their fortunes are then tied to IT budgets of that industry. Tech Mahindra, for example, derives a large proportion of revenues from the telecommunications vertical. It experiences faster growth when there is a step change in technology in that industry (3G to 4G) and de-growth in between. EPAM, as shown above, is well spread out and booms or busts in one industry are unlikely to affect its overall trajectory.

Leverage - Continuity is important. Clients do not want to give work to a highly leveraged provider due to the uncertainty of that provider to be able to complete the assignment in a volatile economic environment (DXC…..). EPAM has $1.2 bn in net cash on the balance sheet.

Strategic distraction - This can be said for any corporation but an IT services provider needs to know their core strengths. The TAM is so large and client demands are so high that it is easy to be distracted. Infosys, for example, tried to be a consulting company for many years while TCS, its local peer, was steadfast in the belief that it is an engineering company and did much better.

Management - Management is key in this business. Culture is of paramount importance. If the CEO is distracted -> the executive branch is distracted -> project managers are distracted -> engineers are distracted → no work gets done. The opposite is true when everything works as a well oiled machine and clients are delighted.

We believe that EPAM is a superior business and is shielded from the common problems in the industry.

Current situation

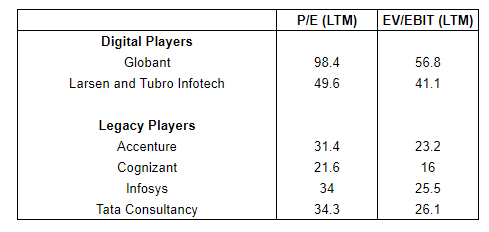

Due to strong business growth, increasing margins and high FCF conversion, investors were willing to give it very high multiples. The stock regularly traded at over 50-60x LTM EPS (peaked at 85x LTM EPS). Even after the current rout in technology stocks and de-rating of multiples, this sector trades at high relative multiples :

With Russia’s invasion of Ukraine, the stock has fallen from $550 to $180 and de-rated to 21.5x LTM EPS. It is interesting to observe that during the depth of the Covid crisis, EPAM never traded below 35x LTM EPS. While the absolute stock price is higher than the Covid lows - the de-rating in the stock has been enormous.

Whether EPAM is a bargain or not depends on your risk appetite. We will present a few scenarios on how one can think about this.

EPAM Scenarios

At present, EPAM has 58,000 employees out of which 14,000 employees are in Ukraine and 9,000 each in Belarus and Russia.

EPAM is not a stranger to conflict in the region. It faced some disruptions in 2014 during the then skirmishes. Since then, it accelerated hiring in other countries in Eastern Europe and built and bought delivery centers in India and Latam.

EPAM has moved into the different locations…they've moved out of, for example, Minsk. They have big centers in Ukraine. They have centers in Russia. They're looking at Armenia. They have Poland, and they have Bulgaria, and they have Spain. They're very concerned about making sure that they have delivery centers worldwide that can support their growth. In Guadalajara and in India and in China, they have delivery centers. They're very aware of the fact that they need to locate delivery centers not just in Eastern Europe and Central Europe, but in other parts of the world and they're actively doing that.

Ex-EPAM executive (Nov 2020) - Stream Transcript

All IT service providers are linear growers meaning they need to add bodies to grow. Due to this, we can calculate revenue per employee and EBIT per employee and use these numbers to design scenarios and forecast future years. Here are the three scenarios we can come up with:

In all these scenarios, we have made assumptions based on,

Revenue per employee increasing a bit in scenarios 2 and 3 as EPAM focuses on its highest priority clients and highest valued projects

Op Income per employee decreasing due to dis-economies of scale and expenses in increased effort on hiring and paying Ukrainian employees. Due to this Op margin declines.

EPAM’s ability to hire 4,400 people per quarter in 2022 (EPAM IR) scaling to 5,000 in 2023.

Most IT companies report utilization as not all employees are productive all the time. Some employees are traveling/in-between projects/in-training etc. We will ignore this for this analysis (to be conservative) even though EPAM could pull this lever.

Some clients will leave. Due to the proportional nature of demand and supply in this business, as long as EPAM can reallocate resources, the above assumptions should still hold.

Scenario 1: Bull Case

Assumptions:

Ceasefire tomorrow and things go back to normal.

EPAM, in this scenario, will likely come close to meeting the lower end of its guidance.

Guidance for 2022 was as follows:

Revenue growth 37% (out of which inorganic growth of 6%)

GAAP operating income margin of 13.5%-14.5%

GAAP EPS of 10.43-10.76 for the full year

After this, EPAM should compound EPS at 20-25% rate for the foreseeable future which will add to IRR for longer investment periods.

If this stock were to trade at 40x 2023E EPS, then it's worth $500 per share in 24 months - 2.8x upside.

Scenario 2: Base Case

Assumptions:

As per IR, 2/3rd of employees in Ukraine are in Kiev and West of Kiev and 1/3rd are in Kharkiv and South. In 2022, we assume that half of EPAM’s Ukraine workforce cannot work so a loss of 7,000 people (out of total 14,000). EPAM is still paying these employees and has committed $100 mn for relocation and restoration.

EPAM has contingency plans and has stepped up hiring efforts in other parts of the world. They have a capacity to do 4,400 net new hires per quarter.

Also, as part of the contingency plans, work is being distributed to other geographies and employees are being asked to step up.

Delivery centers in Belarus and Russia remain open. EPAM IR clarified that they are following all sanctions and are able to pay and retain these people. We still assume that EPAM lays off 2,000 employees in Russia (and 500 in Belarus) that were working on Russian clients - business that EPAM has discontinued.

At an expected EPS of $8.11 in 2022 and $10.34 in 2023E the stock is available at 22x 2022E and 17x 2023E EPS.

If this stock were to trade at 35x 2023E EPS, then it's worth $350 per share in 24 months - 1.9x upside.

In order to triangulate the valuation (and get away from multiples), we also ran a DCF based on this scenario (key assumptions were - 15% CAGR growth in FCF for 8 years after 2023; 15x FCF terminal multiple; and 10% discount rate) and this yielded an intrinsic value for the company of $330 per share.

Scenario 3: Bear Case

Assumptions

As in scenario 2, lose 7,000 employees in Ukraine

Sanctions increase or client pressure forces EPAM to close its delivery centers in Belarus and Russia. This is a total of 18,349 employees at the end of December 2021.

At an expected EPS of $5.8 in 2022 and $7.98 in 2023E the stock is available at 31x 2022E and 22.6x 2023E EPS. Even in this worse case scenario, the business will survive and produce an EPS in 2023E at a similar level as in 2021.

If this stock were to trade at 30x 2023E EPS, then it's worth $240 per share in 24 months - 33% higher compared to the current market price followed by ~20% increase in EPS for many years.

In all the above scenarios, we aim to be roughly right and not precise. For example, to be conservative, we have not factored in the $25 per share in cash on the balance sheet in any scenario.

There are three key questions that remain:

Will EPAM be able to replicate the quality of work from other centers?

Will clients be OK with a workforce based in Russia and Belarus?

What happens if there is a recession between now and then?

Quality

We believe that EPAM will be able to maintain quality. They have been diversifying since 2014. In India, for example, EPAM entered with an acquisition (Alliance). They acquired a team of 1,000 engineers and let go of half the team. Hereon, they built the team from the ground up with EPAM employees traveling to India to inculcate the EPAM culture.

We are also not considering immigration or M&A. Will IT engineers move out of Russia and Belarus into other countries to work with EPAM? Perhaps. Will IT engineers temporary locate to their delivery centers in Eastern Europe or Latam? Some will. Importantly, EPAM has a net cash balance sheet ($1.2 bn in cash on a $11 bn mcap) and is able to acquire revenues or employees in other locations.

When Covid hit, many analysts questioned the ability of the industry to survive as IT employees would not be able to travel to client offices or go into their delivery centers. The industry surprised its most ardent skeptics by not only surviving but thriving in that environment. With remote work, it is possible to be anywhere in the world and deliver transformational outcomes for clients.

The case against being able to ramp up hiring is that this is one of the tightest labor markets for technology employees. We’ll see.

Clients

The founder of EPAM, Arkadiy Dobkin, was born in and went to university in Belarus but lives in the US. For all intents and purposes, EPAM is a US company. The CEO as a good reputation among the business circles in Ukraine as well as the US. His stake is about 3% of shares outstanding or $300 mn at today’s market price. He initially did not take a tough stance on Russia and faced some frustration from employees. Now, EPAM has committed to supporting its employees that have been displaced because of the war. They have also condemned the attack and pulled out of servicing clients in Russia. IR confirmed 1that client conversations are encouraging and clients are giving them some leeway given the circumstances.

The fact that we are in a tight labor market also helps with client retention. Will clients easily be able to replace EPAM?

Still - it is possible that some clients will leave. But, client growth and employee growth is interrelated. In scenario 2 and 3, we are assuming lower growth due to fewer able employees but that also means fewer clients or less client work.

Economic cycles

IT service providers are dependent on IT budgets which are then dependent on revenues. If there is a downturn in the economy and revenues come down - that will affect IT budgets. In past cycles, these businesses have proven themselves to be fairly resilient as penetration kept increasing as clients were behind on their IT spends. That is still the case today but more so with digital services than with legacy services. There is healthy competition in the industry but price competition is higher on the legacy side of the business than the digital side. Economic deterioration will affect EPAM’s revenues but its balance sheet is net cash and it should maintain positive Op income and should come out on the other side relatively unscathed.

Conclusion

EPAM is a high quality business that has been dislocated due to a geopolitical event. On the demand side, it has sticky and growing client base which is diversified by industry. On the supply side, it has a culture that focuses on complicated engineering problems which are difficult to disrupt.

The situation is fluid and risks are heightened. There can be unknown-unknowns (or known unknowns) that we may not have considered in the above analysis. Flows can be erratic as portfolio managers shoot first and ask questions later. Cybersecurity attacks can increase due to which EPAM is not able to deliver services. Due to this, we are not putting a recommendation on this stock but presenting a thorough analysis and letting the reader come to a conclusion. Our stance is in the disclosure.

Disclosure: The author and his clients have a small (1/3th of a full position) long position in EPAM.

Stream by Alphasense is an expert interview transcript library that has been integral to our research process. The quotes we used in this research were sourced from Stream. They are a fast growing expert network with over 10,000 transcripts on a wide variety of industries (TMT, consumers, industrials, real estate and more). We recommend Stream for its high quality transcript library (70% of experts are found exclusively on Stream) and easy-to-use interface. You can sign up for a free trial by clicking here.

Great write-up Balkar/Daye. My main concern is on structural impairment of future growth. The infrastructure they built with universities across Belarus/Ukraine/Russia was crucial in their talent hiring process, which is the key revenue driver given the supply-constrained IT service industry.

if the war doesn't end in the next 2-3yrs, don't you think that future near/mid-term growth will be capped? Especially if you look at other "engineering-focused" service providers like Globant, where many of their "bulk" hiring are geographically-focused (despite most of them doing offshore work). I assume the shift will take a significant amount of time

Awesome research, explanation, and analysis. Thank you.