Deep Dive: BlackRock (BLK)

Breaking down the world's largest asset manager

BlackRock is the largest asset manager in the world, and its Founder/Chairman Larry Fink arguably the most powerful person on Wall Street. Everyone has heard of BlackRock, but surprisingly few – even professionals who work in asset management – know about the business other than being a prolific asset gatherer.

But what sort of competitive advantage has the firm built to grow consistently for three and a half decades in asset management (an industry where success is often short-lived)? Why is BlackRock considered the original “Fintech”? And is BlackRock now finally too big to grow? To answer these, we draw on plenty of commentaries from interviews with BlackRock’s former employees, including Managing Directors, in this report.

BlackRock at a quick glance:

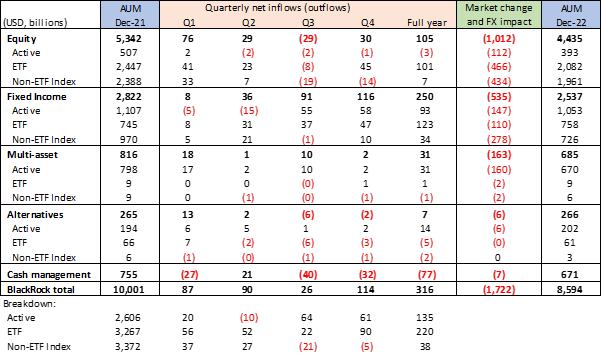

As of December 2022, BlackRock had AUM (assets under management) of $8.6tn. A year ago, it had over $10tn. Since 2012, AUM grew at a CAGR of 9%. Taking a closer look:

While BlackRock started as a fixed income house, today more than half of AUM comes from equities, fueled by the growth of equities ETF (BlackRock iShares).

But make no mistake - BlackRock is not just an ETF house. Actively managed strategies accounts for almost a third of AUM, and contributes to half of the firm’s total revenue. Importantly, BlackRock’s performance in active strategies have been good (especially 3 and 5-year returns).

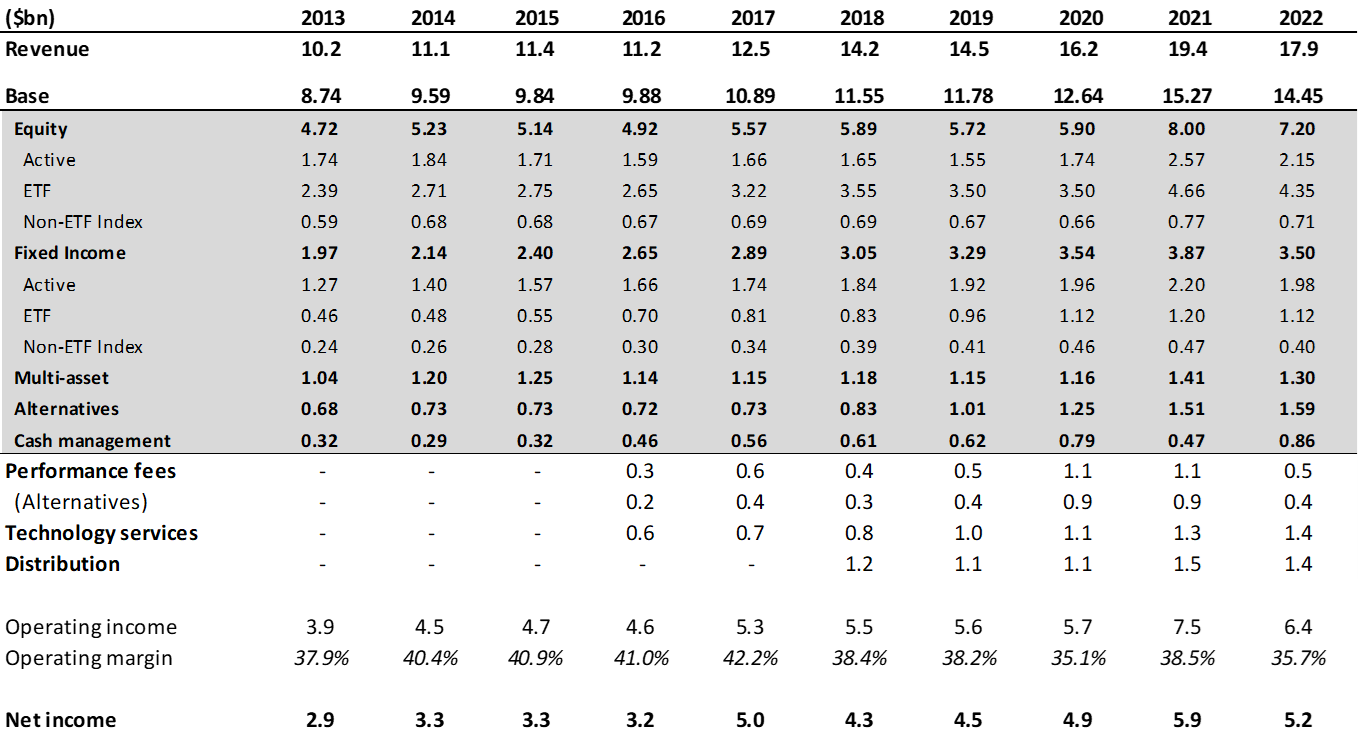

Revenue breakdown roughly mirrors that of AUM breakdown. Alternatives clearly punches above its weight contributing to 11% of revenue (13% if performance fees included) with only 3% of AUM.

Not included in the breakdown above is a separate ‘Technological Services’ segment which generated revenue of $1.4bn (7.6% of firm total). This includes external revenue from Aladdin, BlackRock’s portfolio and risk management software built in-house. But the importance of Aladdin to BlackRock is much higher than its revenue contributions suggests, and in fact so important that it deserves to be the centerpiece of this report.

Becoming BlackRock

As prominent as Larry Fink is now, perhaps lesser known is his early career. Fink had a meteoric rise as a star fixed-income trader at First Boston, becoming the company’s youngest managing director at the age of 31. Having ‘made it’ at a young age, Fink became emboldened by his success. His desk was the most profitable trading desk at First Boston. That is, until 1986, when he made a failed bet on interest rates which blew up and ended costing his desk $100 million in a few days. In Fink’s own words:

“At 31 I became the youngest managing director at First Boston, and at 34 I became an asshole” – Larry Fink

His career at First Boston never recovered. He ended up leaving the firm two years later, in 1988.

Fink attributed his failure to a lack of risk management. After leaving, he partnered with seven other co-founders and started a new asset management firm. This time around, Fink vowed to emphasize risk management at the heart of the company. So BlackRock was born.

Except, in the early days it wasn’t called BlackRock. Steven Schwarzman’s BlackStone took a 40% equity in Fink’s new venture (in exchange for a $5 million line of credit). In 1994, Fink’s firm split off from BlackStone and named itself BlackRock – paying homage to its former parent. BlackStone sold its stake in BlackRock, (then valued at $240m) to PNC Bank, a regional bank based in Pittsburgh. PNC folded its own asset management operations into BlackRock and then listed the combined entity in 1999. At the time of the IPO, BlackRock was already a giant that was managing $165bn primarily in fixed income.

While most of the AUM was in fixed income at the time, BlackRock also began to expand into equities. Notably, BlackRock grew by a series of successful M&As. Successful M&As are a rarity, but especially in asset management where it’s more about people and culture. In 2004 BlackRock acquired State Street Research & Management for $375mn, which bolstered the firm’s equities business. In 2006 it acquired the distressed assets of Merrill Lynch Investment Management. But Larry Fink’s biggest bet would be in 2009, when BlackRock acquired Barclays Global Investors – including the iShares ETF unit which was its crown jewel - in a $13.5 billion deal.

Fink astutely took advantage of the buying opportunity created after the Global Financial Crisis. iShares was the crown jewel of Barclays, but Barclays had been pressured to sell it in order to avoid a UK government bailout. This was a bold move by Fink. It was unconventional at the time to bring active and ETF businesses under the same roof - these two were different businesses with very different cultures. Fink’s foray into ETF demonstrated his long-term vision, but perhaps more impressive was his willingness to essentially disrupt itself to ensure BlackRock’s success.

When asked about what his firm’s secret sauce is, Larry Fink often answers “culture”. This must sound cliché to most people. But what came as a surprise as I was going through interviews with former BlackRock employees was the sheer positivity of comments about the firm’s culture. By the time I had gone through eight interviews, I could not find anything other than the highest praise for the firm’s culture, which can pretty much be summed up as an enormous ‘sense of fiduciary duty’ and a ‘focus on risk management’.

(Keep in mind the passages below are interviews with former employees, not paid PR spokespersons!)

“I will say that the thing that I was most impressed with in my time at BlackRock is lots of organizations talk about or talk the talk about the importance of their clients. I really actually felt that every day at BlackRock. The intensity of the client relationship and your fiduciary obligation within that relationship is something that's massively impressive about BlackRock. I can give you a whole litany of things that are what I would call micro problems at BlackRock, but at a macro level. Their focus on their clients is absolutely very impressive.”

“I can’t stress enough how seriously BlackRock treats client relationships, and the business development function at large. Anywhere you go at BlackRock, literally any office in the world and you ask any person, clients always come first, and a client’s trust is sacrosanct”

“Can't say enough great things about the firm. Over 15 years, BlackRock has been very good to me and I've gotten to see all of its ins and outs in every aspect of the business. I've touched almost every possible part of the firm. I think the world of the leadership team, the people there, the infrastructure, certainly, the Aladdin backbone, we call it the central nervous system that underlies everything we do at BlackRock. I'm not there currently, but very much there in spirit and continuing to cheer it on because it's a world-class organization.”

The Original ‘Fintech’

BlackRock doesn’t call itself this, and nor do investors, but the truth is that it’s more of a fintech than most of the companies that investors consider “fintechs” out there in the market today.

BlackRock is a first-rate investment organization, but its stock picking (or bond picking) prowess alone didn’t make it into what it is today. BlackRock’s senior management considers technology their right-to-win in the industry. This is interesting as most asset managers are bad with technology!

As an analogy, if asset management is a factory, then Blackrock operates the largest, most data-driven and sophisticated factory. It’s a factory that produces not physical goods, but risk management insights. By opening up the Aladdin platform to other large asset owners like insurance companies and pension funds, BlackRock has accumulated the largest dataset in the industry. With risk models that have been crisis-tested and refined for over three decades, Aladdin is the industry leading risk-management platform.

So what’s the significance of this for an asset manager? Consider the fact that BlackRock works closely with the C-suite and the boards of the largest pension funds and endowments in the world. These key decision makers are most concerned with risk management above all - answers to questions like: “What’s going to happen to my portfolio if X happens in the world?” or “How to quantify the risk that I can’t meet my future liabilities?”. Leveraging its technology platform, BlackRock is able to provide answers and solutions to these kinds of questions. Whatever BlackRock proposes, it’s able to back them up with data. The result is that BlackRock has earned a reputation as a risk consultant to the largest asset owners globally. With technology, BlackRock has built a ‘right-to-win’ platform in asset management.

Aladdin – “Asset, Liability, Debt and Derivative Investment Network”

“To really understand BlackRock, you need to understand Aladdin”

– Rob Goldstein, COO

As we discussed, Larry Fink made it very clear from day one that risk management should lie at the heart of BlackRock. Aladdin started as BlackRock’s in-house risk management tool for fixed income. As BlackRock’s investment operations grew in scale and expanded into other asset classes, so did Aladdin. Risk management still lies at the heart of Aladdin, but it’s now hardly just a risk management software. It handles everything from pre-trade to post-trade, covering back, middle, and front office. BlackRock employs 4,500 technologists (out of a total workforce of 18,000).

“Most people that know the firm either from having been in it or following it closely, know that it is religiously disciplined and hyper-focused on downside risk mitigation which spans investment risk, credit risk, compliance risk, regulatory risk, etc. Aladdin is heavily dedicated to this”

Aladdin came out of solving BlackRock’s internal risk management needs. For about ten years it was used exclusively internally. Then in 1999, BlackRock made the big decision to open it up, and started selling subscription to external clients which were mostly other big money managers and asset owners like insurance companies and pension funds. Sounds familiar? This is much like Amazon with AWS.

So Aladdin is valuable to BlackRock as both an internal tool (with BlackRock itself as the largest and most sophisticated user of Aladdin) and an external revenue-generating SaaS business. And these two are closely related. For example, BlackRock, as the largest and most sophisticated asset manager, is the main driver of innovations and new features on Aladdin. As one former employee has said,

“Anything Blackrock wants, most likely every other client’s going to want that a couple months down the road”

Let’s talk about why Aladdin is appealing to external customers. Aladdin’s key value proposition is “one company, one platform, one data set”.

“It’s a framework that supports the entire asset management lifecycle from risk management through portfolio construction, through, if you will, client statements and regulatory, and it supports all of the various instrument types. The key thing about Aladdin is, it’s a single database where all of the applications run off of the same data sets, which is what its real power is”

– Former Director, Aladdin Product Group (Sep 2022, Stream Transcript)

Most financial services firms juggle software from multiple vendors. The alternative to Aladdin would be to use different software for different parts of the business – for example Charles River for trading, Geneva for portfolio accounting, another one for regulatory reporting, and yet another one perhaps for portfolio construction. Some may be internally developed as well. The problem is that all of these software work off of different datasets and are not designed to talk to one another. Firms have tried to stitch up products from different vendors, but the more integration work involved, the more process risk that’s created. Siloed risk management can turn into disasters for organizations, not to mention the cost and burden on the IT department for having to manage multiple vendors. Aladdin provides an all-in-one seamless solution.

BlackRock has been a major driver for this single vendor model which has been gaining popularity. Others have followed – State Street acquired Charles River Development in 2018 which combined Charles River’s front-office software with State Street’s back and middle office, essentially validating the single platform/vendor model. There are three major players today (BlackRock, SimCorp, State Street) offering end-to-end solutions. While the precise market share breakdown is not known, BlackRock is believed to be the largest. An MD of SimCorp North America said he sees SimCorp’s Dimension platform and BlackRock’s Aladdin as “the only game in town”. Another competitor says BlackRock is in the lead and “it will be hard to catch them unless they lose their focus”.

How powerful and significant is Aladdin?

“One of the greatest examples of the power of Aladdin was, in the 2008 Financial Crisis on Saturday and Sunday when Lehman Brothers went under, all of Aladdin investment management clients had a report on their desk on Monday morning showing their exposure to Lehman across all of their holdings, whether it was Lehman as broker, they had Lehman investments, etc., and it was the only firm that had a true handle on what people held and where it was, which is why the Federal Reserve and a lot of countries came to BlackRock to help them manage themselves out of the financial crisis.”

– Former Director, Aladdin Product Group (Sep 2022, Stream transcript)

“(after 2008 financial crisis) We were called in by the Federal Reserve Bank of New York to facilitate the rescue operations of Bear Stearns and AIG…we were among the only advisors in the world who could make sense of these assets, provide actionable advice to our clients, and also possessed the trading infrastructure to execute on behalf of our clients when asked”

The power of Aladdin is evident. But if it’s so good, why does BlackRock not keep Aladdin proprietary?

Now this is where it gets even more interesting. Risk models benefits from having more data. And one way BlackRock can obtain the most complete dataset in the industry is by allowing others, including even its competitors, to use its software. It’s been reported as of 2020 that $21.6tn in assets sits on Aladdin, and this comes from just a third of Aladdin’s 240 largest clients.

Bigger datasets mean better visibility into systemic risks, allowing it to create better models. This is a moat that’s growing over time as Aladdin reaches more users, and as risk models get tested through market crisis and are continuously refined and improved upon. If Aladdin is the dominant risk management platform today, I would wager that in ten years there will be even less competition.

At this point, astute readers may ask: isn’t there a conflict of interest? Why would users of Aladdin, some of which are BlackRock’s competitors, trust BlackRock with their own data? This is certainly a valid concern that is shared by some users. To mitigate this issue, there is a “Chinese wall” within BlackRock that makes sure that while client data can be used for the purpose of refining Aladdin’s models by the technology group, it can’t be used by Blackrock’s investment department to trade against their client positions.

“There’s really strict protection in terms of who can see what. Honestly, even just the permissions of who has access to certain pages and so far they (BlackRock) haven’t messed up, so they’ve got a pretty good track record on that. It’s something that they’re just upfront about. For the most part, pretty big asset management firms that I worked with through Blackrock have been okay with that. Their lawyers have been okay with that.”

Even with this kind of potential conflict of interest, the fact that BlackRock’s competitors are still using Aladdin is a testament to the importance of the software and the software’s lead over other competing solutions. For example, Vanguard, BlackRock’s biggest competitor in the ETF space, is an Aladdin user. Importantly, it also shows the kind of reputation and trust that BlackRock has built in the industry.

Growing Aladdin

External sales of Aladdin have grown at 15% CAGR over the last five years, and accounted for 7.6% of BlackRock’s total revenue in 2022. In 2022, Aladdin’s headline growth was only 7%, but this was due to headwinds from 1) currency on non-USD revenue, and 2) AUM decline of assets managed on Aladdin (AUM is one pricing component of Aladdin). Beyond 2023, management still expects long-term growth rate of low to mid teens.

The core customers of Aladdin are major financial services companies such as large asset managers, banks, and insurance companies. As of 2020 it had 268 clients. Management believes its TAM is roughly $10bn (Aladdin has $1.4bn of revenue so it has captured about 14%).

Aladdin has already captured a large share of its core customer base of large asset managers/owners. The main growth going forward would come from smaller users, such as Aladdin Wealth (launched 2017) which provides a slimmed down version of the software for the advisor channel at a lower price point. BlackRock is well positioned here as advisors are already familiar with the BlackRock brand through iShares ETFs. BlackRock’s value proposition is to deliver them institutional quality portfolio construction, modelling, and risk management tools that are not available through competitors’ software. For BlackRock, expanding its software usage among advisors is also highly strategic in that it gives the firm an even stronger foothold in the channel for distribution of funds and ETFs.

In 2019, BlackRock paid $2 bn to acquire software company eFront, bolstering Aladdin’s capability in private assets such as PE. By integrating eFront into Aladdin, BlackRock brought public and private asset classes together. For the first time, clients can cover all asset classes under a single risk management platform.

But there are still plenty of white spaces remaining. For example, one area which Aladdin hasn’t addressed well yet is the exotics space where strategies can get fairly complicated. Another area is treasury solutions. BlackRock may also try to expand in the advisor channel through adjacent offerings such as financial planning, client portals, billing etc. BlackRock may continue to acquire competing software to add capabilities to its own platform in one or more of these areas.

“(Rob Goldstein, BlackRock COO and head of BlackRock Solutions) wants Aladdin in some way, shape, or form being run by most investment firms on the planet. That doesn’t just mean asset managers, insurance companies, or banks. That means every firm that has anything to do with investments”

– Former Aladdin Implementation Associate (Feb 2022, Stream Transcript)

A former VP believes there is still quite a lot of runway:

“Yeah, I think there's still quite a bit of runway. I think there's still potential to steal share from some of the competitors like a Charles River or a FactSet. I think there's still penetration in the asset management space or enter any Fortune 500 company space. At the end of the day, they're going to be managing money too. I think there is definitely still penetration to be had when you think of pensions, endowments, any of those retirement funds. I know they've got definitely some space in that market. I think there is a lot of room to grow.”

In 2016 Larry Fink gave a goal of 30% as Aladdin’s sales contribution to total company revenue. However, since then there has been little to no mention of the quantitative target. One reason is that it may have been too aspirational. If this is achieved, Aladdin would be generating more than $5bn in annual sales (half of the $10bn TAM). But another reason is perhaps a fear of regulatory scrutiny. Already, Aladdin has a huge share among large institutions and maybe regulators are right to start asking some questions. The debate focuses around whether it’s prudent to let a single risk management software become so systemically important. If everyone is using the same risk management software - even if it’s the best one - does that increase or reduce risk?

This has also fomented a speculation of potential spin-off of Aladdin. Management hasn’t confirmed nor denied this, but there are reasons to believe it’s a viable option in the future. Management may be pressured by regulators to curb BlackRock’s influence. But there are also good business reasons for doing so –separation from BlackRock can possibly allow Aladdin to better grow as a standalone entity, for example by alleviating concerns that its competitors may have that it’s owned by BlackRock. Aladdin might also be able to better execute growth strategies such as pursuing asset management software roll-ups independently. Finally, shareholders could benefit if Aladdin gets valued based on standalone growth software multiples. If BlackRock does this it won’t be the first time in the industry. In 2018 Brevan Howard, a macro hedge fund, spun off its internally developed trading infrastructure in 2018 and renamed it Coremont.

BlackRock as a software house isn’t yet a growth narrative that’s being widely recognized by investors. With a long term horizon, this may be a potential area for alpha generation. At the very least, this is an area which management can fall back on in a situation where the asset management side proves to be tougher to grow due to market environment. If this turns out to be the case, it is fairly conceivable that management would make a bigger push to grow the software side. It’s an optionality for shareholders and a strong value proposition for owning BlackRock over the long run.

Asset Management

BlackRock’s long-term AUM trend is shown below:

2022 aside, the market environment of the past decade has done wonders for most asset managers. As you would expect, BlackRock rode the market nicely and its AUM grew almost every year. Then 2022 came. The question now is how has BlackRock fared during 2022?

The results might surprise you. BlackRock’s total AUM declined to $8.6tn from $10tn a year earlier. But during 2022, BlackRock enjoyed net inflows of over $300bn. In fact, inflows were net positive for every single quarter during the year. This means all of the AUM decline was due to market change. This deserves to be repeated - during 2022, BlackRock had no net outflows in any of the quarters!

The full flows picture of 2022 is shown below:

Upon closer examination:

Every asset class, with the only exception of cash management (money market), recorded positive net inflows during the year.

ETFs contributed strongly to inflows (organic inflow of $220 bn or 7%).

However, strong inflows wasn’t just limited to ETFs. Active strategies were also quite strong (organic inflow of $135bn or 5%).

Active equity was one of the worst asset classes and yet only recorded $3bn of net outflow for full year (out of total $507bn AUM, less than a percent).

Active fixed income suffered net outflows in Q1 and Q2, but more than offset this with extremely strong Q3 and Q4, putting up strong full year numbers. Fixed income is now regarded as a growth area - for the first time in years clients can earn attractive returns without taking much duration or credit risk.

BlackRock has good investment performance in active strategies and should be well positioned relative to competition (see below). For example, 62-80% of its actively managed equities strategies are above benchmark or peer median over three and five year periods.

Alternatives is in a more nuanced situation. It’s basically reverse of the other asset classes in that flows were weaker during the year, but there has been little change in market impact (marks). As a result, AUM was flat. How can alternatives not suffer market impact when the market values for all other assets have collapsed? We come back to this a little later.

Overall BlackRock’s performance during 2022 has been extremely impressive and its business resilience has been demonstrated. Notably, BlackRock took market share even in a down year.

“We estimate BlackRock captured over 1/3rd of long term industry flows in 2022…Over the past 5 years BlackRock has delivered an aggregate 1.8tn in net inflows, or 5% average organic asset growth compared to flat or negative industry flows”

– Larry Fink

Now, let’s focus on the structural opportunities.

Some people say BlackRock is already too big to grow. Larry Fink’s response is that BlackRock manages about 3% of global capital market assets. Many financial services firms have higher market shares – for example investment banks like Goldman Sachs and JP Morgan have 7-8% global share. Is there anything to say that the largest asset manager can’t end up managing, say 10%, of global capital market assets? Especially when categories like ETFs, which benefits from scale advantages, are included.

Since being introduced in the 1990s, ETFs have grown significantly thanks to its numerous advantages including cost, trading flexibility, transparency, and tax friendliness over traditional fund structures. The shift in the retail advisor channel to fee-based platforms (from commission based) also played a role in the ETF adoption. No longer were advisors making money based on individual trades and there was more alignment and incentives to lower client expenses. ETFs also reflects increasing customer choices and product selection (e.g. thematic and sustainability), and rise of new platforms like roboadvisors that have gained share.

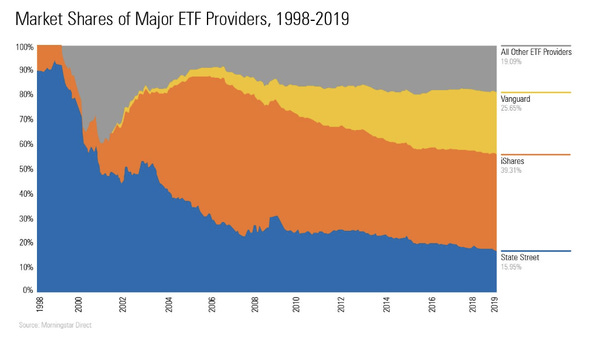

John Bogle, the founder of Vanguard, pointed out that the index business is a game of scale. The more assets, the lower the cost for investors. The largest index providers have advantages in cost, product liquidity, breadth of offering (BlackRock offers 1100+ ETFs), and distribution. The three top players in ETF (BlackRock, Vanguard, State Street) own about 80% of the market. Vanguard has been taking market share as the disruptive player with the lowest fees. State Street has been losing share while BlackRock has held its share steady.

ETFs still only accounts for 3% of global capital market assets (5% of equity and 1% of bond). Penetration is lowest outside of the US (5% in the US vs. 2% for EMEA and 1% for APAC). Of the three major players, BlackRock is the most well-positioned to grow internationally. Currently 25% and 8% of BlackRock’s AUM is from EMEA and APAC respectively.

Fixed income ETFs is seen as the next big opportunity:

“We believe this is the beginning of a major expansion of bond ETFs as component of entire bond market, and we believe this is going to simplify investing, it’s going to make investing in bonds easier, with more liquidity, and it’s going to be cheaper. I believe it’s only the beginning…we are seeing this with every active bond investor. Every active bond investor is using ETFs as component of their active expression of exposures”

– Larry Fink

BlackRock sees tripling of fixed income ETF market over five years, and doubling of the total ETF market (from $8tn to $15tn) in the next three years.

“Index funds provide investors with the most effective stock-market strategy of all time: buy American business and hold it forever, and do so at rock-bottom cost”

– John Bogle, founder of Vanguard

While ETFs have become the centerpiece at BlackRock, it’s important to point out the firm’s overarching strategy is not in any particular asset class or product category. The strategy is to build out a solutions platform leveraging Aladdin at the core. BlackRock’s expansions into the product areas like ETFs and alternatives is part of building out the storefront. And while BlackRock is often regarded as being too big, management still calls BlackRock a growth company.

“The traditional 60/40 portfolio has been challenged, and right now they (clients) need a partner to re-think their allocations…we find they are turning to BlackRock more and more for both insights and solutions. Three areas that are more common are inflation protection, income, and private markets. We have built over the years a platform that is allowing us to address these client needs both in good markets and in bad ones”

– Rob Kapito (President of BlackRock)

“Think about your sovereign wealth fund or a pension fund in Latin America with limited capabilities, and you want to get some international exposure to private debt and public equities, you find a BlackRock and they can give you everything you want with a reputation that you’re not screwing up if you pick BlackRock. No one’s going to fire you if you pick this massive beast versus fund XYZ that was just founded two years ago and hasn’t proven itself”

– MD, Infrastructure Investments at Brookfield Asset Management (Dec 2022, Stream Transcript)

Challenges and risks to monitor:

Fee compression

There is only one trend for asset management fees and that is down. Not surprisingly, ETFs have led the decline in fees. Active management has suffered too but alternatives has been the most resilient to fee pressure.

Fee pressure will no doubt continue, but it’s hard to know how the magnitude of fee declines will be compared to the past decade. If capital market returns remain weak over the coming years, that is likely to create more fee pressure as investors focus on cutting cost. However, this may also accelerate the growth of the ETF business due to its cost advantages.

Regulation

Over the years, ETF providers have amassed influence over voting of listed equities. BlackRock, Vanguard, and State Street combined have on average about 20% ownership of S&P500 equities. Bernie Sanders said “these companies own everything”. This is not technically true as these firms are not owners – however, they have considerable influence on voting which in most cases they do on behalf of the asset owners. There are bipartisan calls to stem the influence of the ETF firms.

Larry Fink has deflected the mounting criticism, saying that BlackRock has no interest in acting in any capacity other than being a fiduciary, and that his firm is working to democratize voting by giving back votes under its Voting Choice program.

BlackRock has been expanding the list of eligible investors under its Voting Choice program, and now most of large institutional holders of BlackRock funds are eligible to decide how they want to vote. BlackRock plans to eventually roll this program out to cover individual holders of funds too. Recently, it rolled out a pilot for individual fund holders in the UK. This is an industry-wide movement with Schwab and Vanguard having announced similar initiatives to “give back” votes recently as well.

Alternatives

Alternatives is positioned as a growth driver for BlackRock but flows during the past year have slowed considerably. Most of BlackRock’s AUM in alternatives is in illiquid assets (real assets, private equity, and illiquid credit) as shown below.

A lot has been written recently on the cracks that are beginning to appear in the private market. For example, it’s reported that BlackRock has recently curbed redemptions from its real estate funds in the UK after a surge in redemption requests (Blackstone has done similarly too). Private equity has also been drawing investor scrutiny over financial engineering and overleveraged funding structure.

Rising interest rates, questionable marks (performance smoothing), and high fees have prompted investor re-think on the asset class. Is the party over? We are watching closely but suffice to say the days of easy growth seems to be over.

Financials and valuation

The long-term revenue trend is shown below. Again, the message is that BlackRock has been quite resilient considering the market rout of 2022 - historic in the sense that there was no safety in any asset class.

When it comes to growth, asset managers are advantaged businesses due to the natural long term growth in the stock market. A physical business needs to produce more widgets or hire more people but if markets return 8-10% over the long term (which has been the historic average) then Blackrock will grow at those levels. In addition, as we discussed above, it is gaining share of flows which will add a few hundred basis points to growth. Historically, this has been tempered by fee compression but we see in the data that fee compression for Blackrock is abating - the rate of change on passive products has declined substantially and the share of higher fee active products and alternatives has increased.

BlackRock’s costs have grown faster than revenue in the past decade leading to decline in operating margin from 42% down to 36%. Mostly these are due to new investments into technology and new product offerings (ESG and sustainable investment options). The strong market has allowed BlackRock to invest very proactively. In January, BlackRock announced that it’s reducing headcount by 500. While only 3% of workforce, the cutback signals the reduction in the pace of investments. Assuming topline holds steady, margins are likely to have bottomed.

With this, BlackRock becomes a company that can grow earnings at low double digits for a long period of time. We can count on Larry and Rob to do the right things when it comes to capital allocation and you have a vehicle that can compound.

How much might BlackRock’s technology business be valued at? It’s hard to say given the lack of disclosure, but there are some reference points:

SimCorp is probably the closest publicly listed comp. It has EUR 500 mn in revenue, 27% operating margin, and 22% net income margin. Market cap is EUR 2.6 bn = 5x revenue or 24x income.

Charles River Development was acquired by State Street for $2.6 bn in 2018, while it had $300 mn of revenue in 2017 = 8-9x revenue.

Now, BlackRock is much bigger than both of these with $1.4 bn in topline from essentially a single product line (Aladdin), with a customer base of mostly large users. We would wager that Aladdin’s margins are higher than SimCorp’s (probably much higher), and also probably higher than BlackRock’s consolidated (30% net income margin).

Assuming 30% net income margin at 30x p/e gets us to $13 bn in valuation. BlackRock doesn’t disclose margins in this segment and we guess that’s because it’s very high. On a standalone basis we wouldn’t be surprised if the technology segment could be valued at even higher.

Overall, BlackRock historically traded between 16-20x P/E. Today it’s 21x. BlackRock has consistently traded at a premium to its asset management peers, both in the public market (chart 1) and private markets (chart 2). However, there are times when BlackRock is available at a discount; most recently in October 2022. Fortunately or unfortunately, these prices don’t last very long so the strategy here should be to build conviction in the thesis and use a market drawdown to initiate a position.

BlackRock has tremendous business strength (ETFs, Aladdin, fund performance) and industry leadership in AUM and fee growth. Its technology offering is also something that none of its peers have making BlackRock unique. In summary we see BlackRock as a high quality compounder currently trading around fair value, which warrants accumulating on market sell-offs.

If you are looking for an expert network to get up to speed on industries and companies, then we highly recommend Stream by Alphasense.

Stream by Alphasense is an expert interview transcript library that has been integral to our research process. They are a fast growing expert network with over 20,000 transcripts on a wide variety of industries (TMT, consumers, industrials, real estate and more). We recommend Stream for its high quality transcript library (70% of experts are found exclusively on Stream) and easy-to-use interface. You can sign up for a free trial by clicking here.