Coupang

Outside vs. Inside view

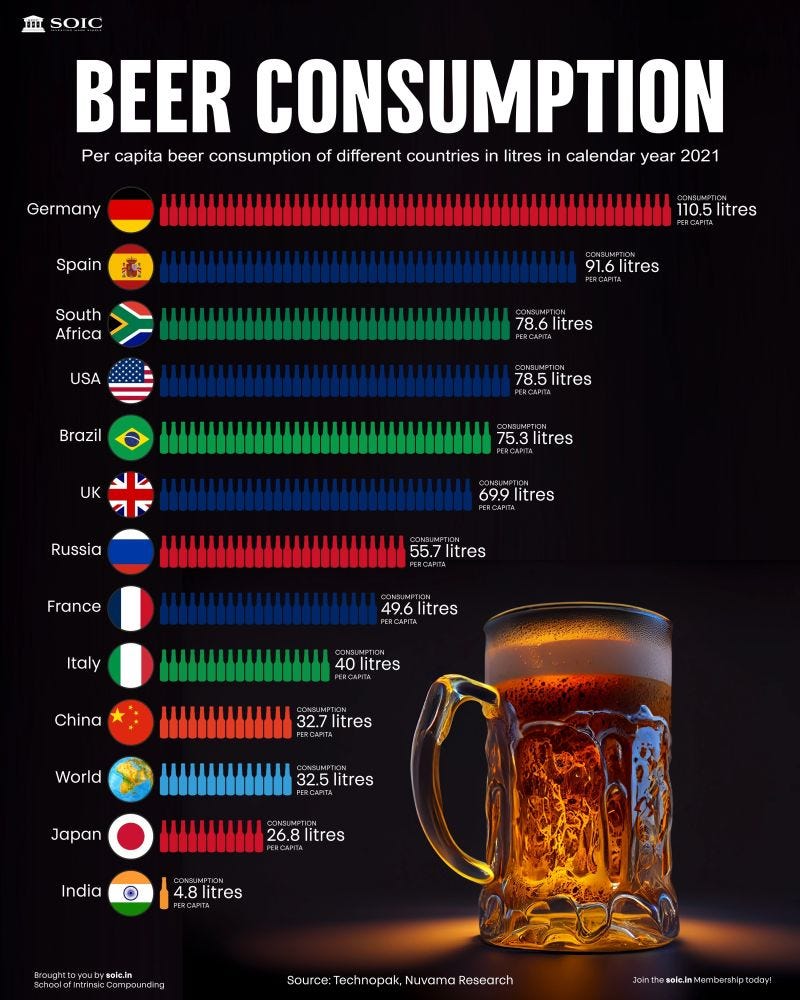

United Breweries is a beer business known for its Kingfisher beer, which is one of the most recognizable beer brands in India and internationally. The company was established in 1915 and is headquartered in Bangalore, India. Now controlled by Heineken, it is one of the largest beer producers in India and has a significant market share (>50%) in the Indian beer industry. India has a relatively low beer consumption compared to the rest of the world:

Further India has 1.3 bn people where the median age is 28 years old. This should mean that the beer consumption must be growing gangbusters! It only consumes 4.8 liters per capita compared to 32.7 liters in China or 75 liters in Brazil. This is a market that has a potential to be 5-10x its current size.

A foreign investor looking at these statistics may find the Indian beer sector very compelling. Further, United Breweries may seem like a perfect bet with a high market share, ubiquitous brand, and governance overseen by Heineken.

However, these are United Breweries financials over the last 10 years:

Source: Koyfin (82 INR is one USD)

It is only when you spend some time in India and understand its alcohol industry, history, taxes, state control, consumer preferences etc. that you realize that it actually makes sense.

Similarly, Bill Miller IV wrote a blog post on Coupang which can be found here. He makes a compelling case for Coupang and ended with the discussion on valuation:

“Shares appear relatively inexpensive versus e-commerce peers (AMZN, MELI, BABA, ETSY, EBAY, SE, JD, and Naver) given CPNG’s superior growth profile, as analysts are forecasting CPNG to grow Earnings Before Income, Taxes, Depreciation, and Amortization (EBITDA) at a 35.1% CAGR from 2023-2026, more than double the peer group median’s expected growth. CPNG trades at a forward (FY25 consensus) Enterprise Value/Sales (EV/Sales) multiple of 1.0x, a 55% discount to the peer group median multiple, and a level that historically marked a bottom for Amazon.”

-Miller Value Funds

This is in stark contrast to Daye Deng who lives in Korea and thinks that investors are underestimating the competitive and political risks in Coupang. He is cautious due to the following four factors:

Chinese platforms pose a genuine threat, resulting in fundamental changes to the Korean e-commerce landscape.

The Chinese are also more strategic than investors might think (particularly AliExpress) and have long-term ambitions in the Korean market.

The bullish case for Coupang today requires government intervention that’s strong enough to stifle the Chinese players. But here, I remain somewhat skeptical.

In my view, Coupang is almost certain to face significant domestic political risks in the long term.

Daye now writes at the East Asia Stock Insights and provides a compelling case to be cautious:

Give it a read and decide for yourself!

Disclosure: The author or the editor have no position in Tourmaline at this time. The above is for informational purposes only. We may be wrong in our analysis and we encourage all readers to come to their own conclusions.