ATS Corporation

A mini Danaher on the cheap!

The Danaher Business System (DBS) is a comprehensive framework used by Danaher Corporation to drive continuous improvement and operational excellence. It focuses on customer needs, leveraging Lean, Six Sigma, and Kaizen methodologies to enhance processes and performance. DBS emphasizes data-driven decision-making, standardized practices, and employee involvement to ensure consistent quality and efficiency. It supports growth and innovation by encouraging experimentation and optimizing operations.

DBS was largely developed and introduced under George M. Sherman, who was CEO of Danaher from 1986 to 2001. Sherman was instrumental in establishing and applying DBS, basing it on the principles of the Toyota Production System (TPS) and Lean manufacturing. These methodologies, renowned for their emphasis on efficiency, waste reduction, and ongoing improvement, served as the foundational concepts for DBS. Consequently, the initial focus of DBS was on boosting operational efficiency.

As Danaher expanded, the Danaher Business System (DBS) evolved to include more than just manufacturing processes. It came to cover a wide range of business areas, such as supply chain management, sales and marketing, and human resources.

A friend in the industry once pitched Danaher to his portfolio manager, but the manager couldn’t grasp the company’s competitive advantage or justify paying a high multiple for the stock. They eventually met with Danaher’s management at a conference and asked a series of detailed questions, but the answers kept coming back to one thing - DBS, DBS, DBS. This is, again, a series of small, continuous improvements applied across every facet of the company. While many companies are aware of this approach, the real challenge lies in embedding it deeply into the corporate culture - a task that is much harder to replicate, but one that drives Danaher's long-term success.

ATS’s current CEO, Andrew Hider, spent a decade at Danaher Corporation, where he held various positions. After joining ATS in 2007, Mr. Hider introduced the ATS Business Model (“ABM”), a business management system that enables progress through a process of disciplined, continuous improvement (“Kaizen”) at its core. The ABM focuses on achieving results in three key areas: People, Process, and Performance. This is driven by adopting a customer-first approach, implementing a performance management system, creating annual operating and capital deployment plans for each ATS division, shortening development cycles, and enhancing production efficiencies. The ABM supports ATS’s progress on eight value drivers: 1) bookings; 2) revenue; 3) EBIT margin; 4) working capital; 5) on-time delivery; 6) quality; 7) internal fill rate/hiring; and 8) employee turnover.

Sound familiar?

Since Andrew Hider took over as CEO of ATS, the stock surged from $10 per share to a peak of $48 in 2023. However, it has since dropped nearly 50%, currently trading around $26 per share. This offers tremendous value to participate in a secular growth industry run by a a team that has been successful in integrating a DBS like system into their culture.

ATS is a leading System Integrator and Original Equipment Manufacturer (OEM) that delivers comprehensive automation solutions to some of the world’s largest companies. ATS provides end-to-end offerings, including services, software, and hardware, to automate manufacturing processes across various sectors, from Pharmaceuticals to Nuclear. In the pre-automation stage, ATS assists clients with discovery and analysis, concept development, simulation, and total cost of ownership modeling to evaluate automation feasibility. During the automation phase, ATS supplies specialized equipment, which includes both its proprietary OEM products and third-party components, and offers services such as integration, engineering design, prototyping, software and manufacturing process controls, and equipment design/build. After automation, ATS supports clients with training, process optimization, preventive maintenance, emergency support, spare parts, retooling, retrofits, and equipment relocation.

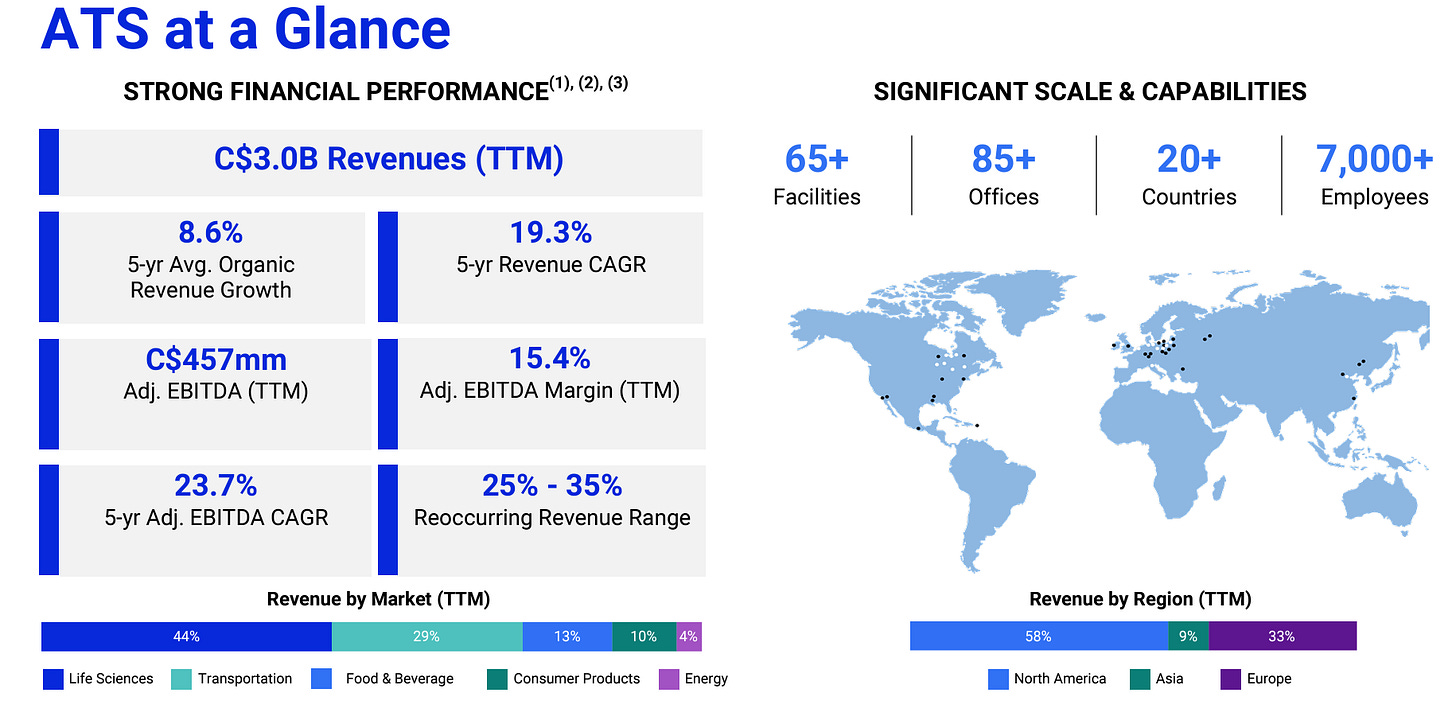

ATS employs over 7,000 people at more than 65 manufacturing facilities and over 85 offices in North America, Europe, Asia and Oceania. This gives ATS critical scale in all major geographies so that clients have confidence that their service calls will be answered and resolved in reasonable timeframes. This is not easy to replicate and is part of ATS’s moat.

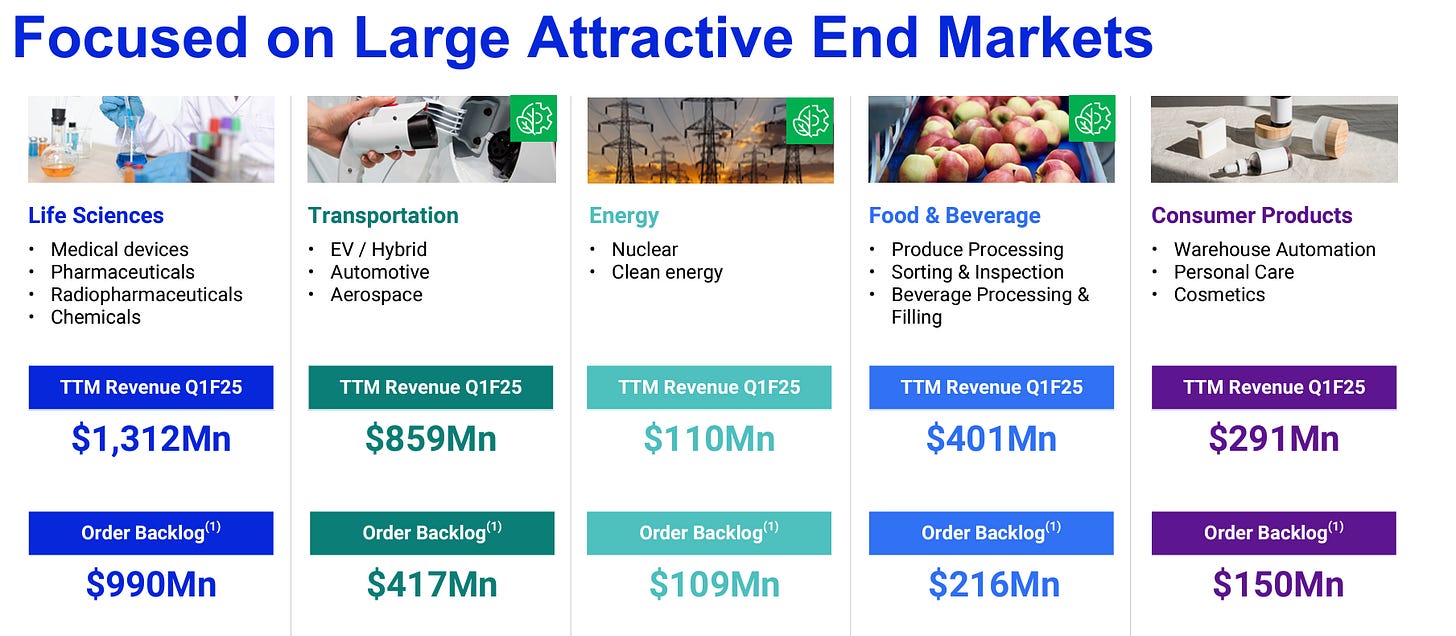

In fiscal 2009, the Automotive sector was ATS's largest end market, contributing 32% of the company’s annual revenue. This shifted in fiscal 2010 with the acquisition of Sortimat, which significantly increased ATS's presence in the Life Sciences sector. Over the following years, ATS continued to expand its footprint in Life Sciences through additional acquisitions, including Comecer, PA, and SP Industries. By fiscal 2023, Life Sciences had become ATS's largest end market, representing approximately 44% of revenue, with around 66% of that coming from Medical Devices and the rest from Pharmaceuticals, Chemicals, and Radiopharmaceuticals.

“So a company who's launching a drug, a new product they're going to come to us. And we would be -- in this particular case, we're in the Drug Delivery System of the auto-injector. And they're going to come to us. We're going to build out -- design and build their entire manufacturing process for them. We build it in our factory, we then tear down and ship it to their factories, set it up, train their operators how to use it, and then we'll service and support that equipment for the life of the equipment or the life of the product.”

-CFO at Deutsche Bank conference (2024)

This heightened exposure has been beneficial, as the significant barriers to entry in the Life Sciences market—such as stringent regulations, the need for advanced technological solutions, and the high cost of failure—help protect ATS from intense competitive pressures. Additionally, the Life Sciences market generally does not experience heavy price competition, as customers prioritize performance factors like speed, consistency, and precision, which are crucial due to the nature of the products being manufactured.

ATS entered the Food & Beverage sector with the acquisition of MARCO for approximately $57 million in fiscal 2020, further expanding its presence with the $260 million acquisition of CFT in fiscal 2021. ATS focuses on areas such as fresh produce processing, sorting and inspection, and beverage processing and filling. Key factors driving demand in this market include strict government regulations on food processing, the need for high-quality produce, and demographic shifts influencing consumer preferences.

Transportation was once a major market for ATS, accounting for 32% of its revenue in fiscal 2009, but this share declined to 14% by fiscal 2022 before increasing to 29% currently. Over the years, ATS has gradually moved away from the Internal Combustion Engine (ICE) sector and shifted its focus toward Electric Vehicles (EVs) and aerospace which provided a lot of growth (and is the cause of current overhang on the stock). The majority of ATS's revenue in this market now comes from EV-related projects, particularly in battery assembly, where the company has delivered over 70 EV battery assembly systems to customers worldwide. The EV business has slowed down but we believe the market has overly punished the stock at this point.

Other segments like Energy and Consumer are small parts of the business but important for the long term growth of ATS as both are in attractive secularly growing sectors.

Within these segments, the revenues can further be divided by the type of work performed by ATS.

ATS supports customers at various stages of their automation projects. In the pre-automation phase, ATS offers services like concept development, simulation, and cost modeling to assess feasibility and set production goals.

For automation projects, ATS provides specialized equipment, engineering design, software development, equipment manufacturing, and system installation. It also offers duplicate systems for efficiency and handles complex equipment production and build-to-print manufacturing.

Post-automation services include training, process optimization, maintenance, emergency support, and spare parts. ATS also provides digital solutions for real-time performance monitoring and efficiency improvements.

Contracts for automation systems typically exceed $1 million, with larger projects surpassing $10 million. Project durations vary from six to 24 months, depending on the complexity.

At any given time across various segments, ATS’s recurring revenue typically ranges between 25% and 35%. When we talk about recurring revenue, there are several dynamics to consider between recurring and reoccurring, with services being a key component of that.

Over the last 8 years, Mr. Hider has led significant transformations not just including the introduction of the ATS Business Model but also a strategic shift away from highly cyclical systems integration work, reducing its contribution to revenue from approximately 70% in fiscal 2017 to about 40% in fiscal 2023, while simultaneously expanding higher-margin after-sales services. It also helps that ATS now has an increased focus on more stable sectors, such as Life Sciences and Food & Beverage.

ATS is at the early stages of its growth trajectory, with ample opportunities for further expansion—both organically and through acquisitions—as well as for improving margins.

ATS has traditionally reported that around 90% of its clients are repeat customers, with many of these relationships lasting a decade or more. This has led to a robust foundation of recurring revenue for the company. We believe the enduring nature of these customer relationships is largely because System Integrators and OEMs maintain ownership of these connections. Once a Systems Integrator completes a project for a client, their established familiarity and experience with the client's operations positions them favorably for subsequent or repeat work.

While a loyal customer base is advantageous, it can also be challenging, as competitors may have similar long-term relationships with their clients. Attracting customers from established peers may be difficult unless those peers fail to meet expectations. Consequently, despite ATS’s strong position in growing markets and solid organic growth, M&A is likely to remain a key component of its long-term growth strategy.

ATS currently has an installed base of over 26,000 projects, encompassing automation systems designed, manufactured, assembled, and serviced by the company. As this base continues to grow and the customer base expands, ATS should boost its after-sales services revenue.

Industrial Automation

The history of industrial automation spans from early mechanical devices like waterwheels and the Jacquard loom to the advanced digital systems of today. During the First Industrial Revolution, steam power and machine tools began mechanizing processes, setting the stage for automation. The Second Industrial Revolution introduced electrification and the assembly line, greatly enhancing production efficiency. By the mid-20th century, digital electronics and the invention of Programmable Logic Controllers (PLCs) enabled more sophisticated automation, while the introduction of industrial robots further revolutionized manufacturing. The current era, known as Industry 4.0, integrates physical and digital technologies such as AI, IoT, and cyber-physical systems, leading to smart factories with unprecedented levels of efficiency and flexibility. The future of industrial automation is poised to see even greater advances with AI-driven automation and human-robot collaboration, blending precision with human creativity.

The global factory automation market is projected to grow significantly, driven by the need for increased efficiency and resilience in manufacturing. At the end of 2023, the market was USD 140.5 billion, and it is forecasted to grow to USD 281.9 billion by 2030, registering a CAGR of 9.1% during the forecast period 2022-2030.

One of the key features of Industry 4.0 is its ability to create a seamless communication flow between machines, systems, and humans. IoT devices enable machines to communicate with one another and with central systems, providing continuous data streams that allow for predictive maintenance, reduced downtime, and more efficient resource allocation. AI and machine learning algorithms can then process this data to identify patterns, optimize production schedules, and even predict future trends.

“I'll start with labor. And this is really one that's kind of a general theme across. And whether you're onshore and reshoring, you're doing supply chain derisking or your labor costs are increasing. This is a real challenge and a real opportunity for ATS.”

-CEO at Citi Conference (2024)

“They (a customer who was nearshoring) went from 2,000 operators to roughly 200 for the same output. And that was all done through automation. They use all our core technologies, our linear motion, our software platform, our vision systems. And the punchline of the story is the gross margin on their product went from 45% into their facility in China to 65% at their automated factory in North America. So that's a meaningful and companies who are thinking about reshoring or derisking there's a lot of benefits.”

-CFO at Deutsche Bank conference (2024)

The common thread between each revolution has been the increasing reliance on automation to enhance manufacturing productivity, whereby businesses have been able to leverage new technology to improve performance by reducing errors and enhancing quality/speed.

RBC estimates that system Integrators have a 31% share of implementing automation systems in the U.S., behind end-users’ internal teams at 37% and manufacturers who have forward integrated like Rockwell or Siemens at 13%.

The Industrial Automation sector is highly fragmented, and ATS competes with several public companies, most of which are based in Europe. Some of its major public competitors include GEA, KION, and Dürr. It is interesting to note that all these competitors have margins in the single digits. ATS has really differentiated itself with its ABM system along with a business mix that focuses on critical industries and higher margin businesses such as after sales supper and spare parts.

Growth and Margins

ATS has been growing organically at a 9-10% rate while the overall reported growth has been helped by the steady stream of M&A. Management has a target or growing above the industry plus M&A.

ATS has a target leverage range of 2-3x Net Debt/EBITDA and is willing to exceed this in the short term for the right opportunity. The important thing is that ATS has maintained a ROIC in the 13-14% range even with this torrid pace of M&A showing that it is adding value and not overpaying. Having said that, current leverage at 2.7x is at the higher end of the range meaning that ATS will probably not be doing M&A in the near future.

Currently, ATS has EBIT margins of 13.1% but the management has a 15% EBIT margin target over time. ATS is actively pursuing several strategies to drive this growth, including expanding its higher-margin after-sales service business (which currently contributes a mid- to high-teens percentage of revenue), optimizing global supply chain operations, increasing the adoption of standardized platforms and technologies, and continuously improving processes through ABM initiatives.

ATS' software and Internet of Things (IoT) solutions have also played a key role in driving revenue growth independently of workforce expansion.

Further, enterprise-level programs - projects that extend beyond basic machine assembly and delivery to include a wider range of services like planning, custom design, manufacturing, and system integration - present a more favorable margin potential.

M&A

Approximately $1.8 billion of capital deployed towards M&A since fiscal 2018 for 23 acquired companies. These have added differentiated capabilities and exposure to end markets.

M&A is critical for growth in the automation industry, largely due to strong customer loyalty, which makes it challenging to replace existing providers and secure new contracts. Since Mr. Hider's appointment, ATS has executed a clear M&A strategy, resulting in improved margins and steady ROIC.

“We're not looking for other automation integrators or companies. We're looking for companies that have unique technology, unique capabilities, things that we don't have. And then -- with these very deep strategic relationships we have with customers, we're able to take this broader capability and bring them a more holistic solution”

-CFO at Deutsche Bank conference (2024)

There are strong parallels between ATS' M&A approach and that of Danaher. Danaher identifies acquisition targets at the business unit level, and ATS appears to follow a similar strategy, with input from business unit leaders playing a key role in identifying and nurturing potential acquisitions. Both companies focus on fragmented markets with strong long-term growth potential and significant barriers to entry. When evaluating deals, Danaher prioritizes return on invested capital (with a threshold of over 10% by year five for larger acquisitions) and looks for opportunities to apply its DBS framework - a method ATS replicates as well.

The most notable acquisitions since Mr. Hider was appointed CEO include acquisitions of: 1) Comecer for $172 million, representing ATS’ entry into the Radiopharmaceuticals space; 2) CFT for $260 million, ATS’ “platform” acquisition in the Food & Beverage market; 3) BioDot for $106 million, a significant Life Sciences acquisition; and, 4) SP Industries for $550 million, a major Life Sciences acquisition and the largest acquisition in ATS’ history; 5) Avidity Science for $195 mn which is a global provider of automated water purification equipment, services, consumables and software for the life sciences industry, including biomedical research.

Considering the fragmented nature of ATS' target markets and its successful history of capital deployment, we expect the company to continue allocating the majority of its earnings and free cash flow toward mergers and acquisitions in the future.

Recent Weakness & Valuation

ATS’s recent weakness stems from its automotive division. As their current EV projects near completion ATS announced plans to restructure their EV operations and align the cost structure.

“What's happened in the last little while is consumer demand (in EV) has been weaker. And I think that's given clients opportunity to pause some of that capacity expansion and focus on technology, making sure they have their products where they want them, getting that design stabilized. And so we expect over the midterm, there's going to be continued investment. Again, those long-term targets are there, whether it's company consumer-driven or regulation-driven. There's still a lot of capacity that has to be built.”

-CFO at Deutsche Bank conference (2024)

ATS reported Q1 Net Bookings of $783.0 million, resulting in a book-to-bill ratio of approximately 1.1x. In Life Sciences, bookings rose, driven by organic growth and $28.6 million in contributions from recent acquisitions, including $24.2 million from Avidity. Bookings in Transportation declined as customers adopted a more cautious approach to Electric Vehicle investments in response to shifting market conditions. Net bookings in Food & Beverage and Energy also saw decreases, while Consumer Products experienced an uptick due to the timing of customer projects.

ATS does have exposure to macro weakness, but overall, the business is in decent shape. ATS dramatic stock decline is more likely a function of its shareholder base than the underlying business. The company listed in the US and attracted a lot of fast money and growth investors. Now, at the sign of volatility, these growth investors have exited the stock creating an opportunity to buy into ATS at 10x NTM EV/EBITDA and 15x NTM EPS.

This is a very reasonable multiple for a company that,

Operates in a secularly growing industry with tailwinds such as increased labor costs and nearshoring

Operates efficiently in a A+ management team that is focused on innovating, increasing margins and bettering the quality of the business

Runs a M&A strategy that actually works

It is always difficult to ascertain the multiple one pays for an industrial business as all industrial business have some inherent cyclicality. In this case, we have seen a few disappointing quarters already and while it is difficult to forecast the short term, it is reasonable to expect a much bigger and better business in the long term that would be demanding of a premium multiple.

Conclusion

“I would say our aspirational peers are going to be decentralized businesses and I can write off a few off like IDEXX or AMETEK. I mean they've done a really nice job. We're building the ATS model. And I would say the fortunate thing in these conversations is we've made nice progress, but we're early in this journey. The shift to the products and standard machines and that capability on integration, and now what we can do in digital, it's the business of course, there's going to be bumps in the road. We can't predict markets, but we are very laser-focused on areas over long periods of time that we know we can out-execute and we built the team. We have the culture aligned and we're constant driver for execution.”

-CEO Hilder at Citi Conference (2024)

Since Andrew Hider became CEO in February 2017, ATS has undergone significant operational and strategic transformations, driving strong performance in recent years. This includes solid organic revenue growth, averaging around 8.9% annually from FY2018 to FY2023, and notable margin improvements, with an EBIT margin of 13.1% in FY2023 compared to 9.6% in FY2017. ATS has also effectively reinvested capital, primarily through acquisitions, yielding attractive returns and improving its ROIC from 10.0% in FY2016 to 12.6% in FY2023. All this can continue - just like it did for Danaher - for many years to come.

The end result is not only higher revenue growth and better margins but also a business with much better business quality with exposure to stable end markets and recurring revenue streams.

Disclosure: The author and the accounts managed by the hold shares in ATS. This article is for informational purposes only. We may be wrong in our analysis and encourage all readers to come to their own conclusions.