AI minus the BS (Part 3)

Implications for investment research; Action plans and survival tips for buy-side analysts

If you enjoyed our mini-series on AI so far, our friend and co-author [Redacted] has started a separate Substack, where he will continue to journal his A.I. learning journey. Give him a follow!

Welcome back.

So far, we’ve looked at

Why you should take advancements in AI seriously

The bare bones of how GPT models work

What GPT models are capable of, and what its limitations are

In the last part of this series, we will discuss the implications of these technological advancements on knowledge workers, particularly focusing on those in our domain - investment professionals. For investment professionals, the question remains: How can we effectively navigate and adopt to this impending wave of innovation?

We will start with A) a list of high-probability assumptions about the near future, B) work out the key implications, and C) come up with an action plan to deal with the potential implications.

Let’s dig in.

PART A: ASSUMPTIONS

What will the near future look like? Let’s start with some basic assumptions.

Generative AI models are here to stay, and they will get more accurate, faster and more capable over time. These tools are not mere novelties; they’ve crossed the minimum utility threshold and have gained widespread adoption. At a minimum, we are likely to see cheaper & more efficient models1, models fine-tuned for specific use cases with improved accuracy and added capabilities such as web access and plugin use.

AI tools are coming. Generative AI models enable all kinds of automation that were not possible before. Now, it's important to recognize that most genuine trends have also exhibited bubble-like characteristics. There will be a plethora of tools that all do something similar and most will come with a huge amount of hype that overstates their capabilities. But amidst the sea of development, a select few will stand out as genuinely beneficial and valuable.

The impact of all of this is likely to come quickly. Historically, broad technological changes happened relatively slowly since they required either heavy infrastructure or ecosystem build-out. Factory automation took about a hundred years, and computing devices and the internet took a few decades. A.I. tools don’t require nearly as much of a build out. Datacentres, software wrappers and plug-ins will need to be built, but we are not starting from scratch as we did with PC or the Internet. The pace of change is likely to be similar to the mobile web/app build out.

PART B: IMPLICATIONS

OK - so change is happening, fast. What does it mean for us? If we can summarize the implications into one sentence, it is this: You cannot outwork a robot.

A common line of reasoning on A.I.’s impact on jobs goes as follows: Humans have been automating workflows since the dawn of time. After thousands of years of this process, we all still have jobs. Ergo, this A.I. hoopla is just a head fake. Everything will be just fine.

We beg to differ.

Yes - this is true in a way. Since the caveman days, we’ve invented tools to make our lives more efficient: machines, steam engines, electricity, internal combustion engine, computers, the interne. We’ve come a long way.

It is also true that despite all this progress, humans still have jobs - and at a macro level, everything works out in the end. But there are a few other lessons we can draw from the history of automation:

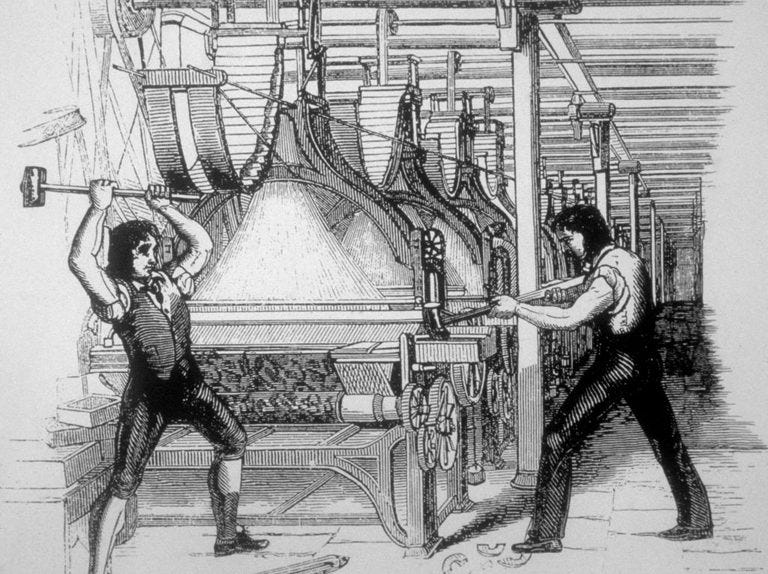

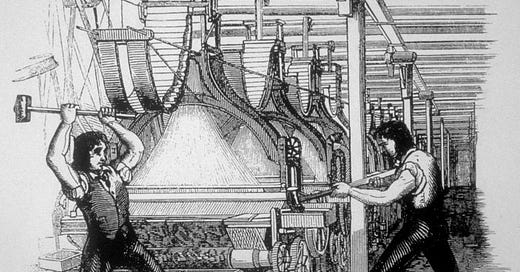

While the impact of automation varied, if you were in the direct path of automation, you often had a bad time. Textile workers, buggy drivers, punch card operators, scribes, photo lab operators, travel agents… the list goes on.

When the role survived (e.g. accountants, translators), it was due to a combination of incomplete automation, latent demand, and role expansion. Often, the role still required significant human input, and either the demand for services grew in line with increased productivity (translation), or the role shifted to “higher level” tasks (accountants)2. Importantly, survival required extensive use of new automation tools (How many accountants do you know of that use manual ledger?)

In the very end, displaced people found jobs. However, this “end” often came after years of significant pain. The Luddite movement - which sought to destroy textile factories - lasted about 5 years, caused significant destruction of property, and required military intervention.

Here is a simple math to drive the point home: for any task that can be performed with A.I. tools, the baseline just went from $10s-$100s dollars per hour, with high latency turnaround, to 0.004 cents to 0.06 cents per 750 words, with instant turnaround and infinite stamina.

In other words, if you try to go head to head against a robot, then you’re gonna have a bad time!

PART C: ACTION PLAN

Now - if you’re a knowledge worker, how do you figure out whether you’re a textile artisan or an accountant? We think this requires some self-assessment:

What are my outputs, and what steps do I take to produce them?

How much of my “production process” can be automated right now?

What will it take to automate 80%+ of my job?

Is there a lot of latent demand for my output? If everyone’s productive capacity increases by 2-10x, will there be enough demand to soak it up?

How tightly defined is my role? Can I evolve my role by focusing on the non-automated parts?

To be sure - this is a difficult and speculative exercise to go through. It also demands a high level of introspectiveness that is not easy. Like the textile artisan, we have all dedicated countless hours honing our craft. We all carry an inherent bias towards our own work, and overcoming this is no easy task.

With this in mind, we produce what a hypothetical outcome would look like for buyside investment research (a role that we are familiar with).

Degree of automation:

For a research role, a large part of the day is spent on: 1) data collection & organization, 2) general online research, and 3) writing. There’s still a fair amount of high level thinking involved, mostly around formulating questions and synthesizing conclusions, but this takes up less time.

If there is an AI tool that can grab relevant documents, extract useful takeaways from them, and furthermore output them in a structured and well-written manner, then it’s not crazy to imagine that 80% of hours can be automated. In fact, these tools should be able to be built with GPT-4, and we are starting to see them being developed. A research analyst’s work capacity is likely to increase meaningfully over the coming years.

However - to completely automate the job away, there would need to be an AI agent that can take a broad command, such as “find me a mispriced stock”, or “tell me what you think of this”, and be able to produce a fully customized report, exactly the way the team or portfolio manager wants it. This is still a long shot, and probably requires a few breakthroughs towards AGI in order for it to work properly. Until this happens, automation will be incomplete.

Latent demand:

Given that investment management is a fiercely competitive industry, it is likely that the work demands will expand to fill the capacity increase. If any analyst could cover X companies and produce Y reports per year, well, they might be expected to do 3X and 3Y with the help of A.I.!

At the same time, this may lead to an even more competitive market. The net impact of AI tool adoption may be the equivalent of growing the active manager pool by 2-5x. This may make alpha generation much harder than it is today.

Role expansion:

In our view, without role expansion, buyside research in the traditional sense would become a challenged profession.

What could role expansion possibly look like?

More focus on decision making and risk management (encroach into PM territory)

Bigger role in specialty initiatives (e.g. activism and engagement)

Or perhaps we will start to see hybrid roles emerge - research/product, research/financial planning, etc.

But hold on. If you are a buyside analyst reading this - things are not as pessimistic as they look! None of us can predict what happens 5-10 years from now, but with transitions, there will be opportunities. With this in mind, we have some specific recommendations to buyside analysts.

Integrate AI into your process and workflow: In the coming years, buyside firms will be looking to formalize this, creating opportunities for investment professionals that can spearhead such initiatives. As long as we don’t get to AGI tomorrow, investment research won’t be eliminated completely, which means we’ll need to find ways to gradually integrate AI into processes and workflows.

For example, LLMs can reliably automate certain repetitive tasks, but it’s crucial to establish the degree to which they can also manage analytical and creative responsibilities.

Learn to use AI tools more effectively. The simplicity of the ChatGPT interface can be deceptive, leading users to treat it simplistically (much like a web search). Many complaints about ChatGPT trace their roots to misunderstanding or lack of effort in prompting (i.e. users expecting it to read their minds). Like any software, there is a learning curve involved. Understanding even the basics of how GPT models work can help analysts get the most out of tools.

Perhaps in the future, there will even be market distortions or mispricing caused by certain features of AI systems, as their adoption becomes significant enough. If so, you would want to know.

Keeping abreast of industry-specific AI advancements. Currently available AI tools like ChatGPT might seem too general for most professional users. But more industry-specific tools are on the horizon. These specialized tools, utilizing proprietary or targeted data sets, are fine-tuned to be able to provide deeper insight or more accurate analysis. Be on the lookout for new tools that can add value to your workflow and process.

Closing words

Over the last three articles, we've attempted to lay down some basic groundwork to help us make sense of what's going on with these new generative AI tools. We've focused on GPT models, but there are similar breakthroughs happening in other areas like text-to-image, text-to-sound, and computer vision.

We won’t pretend to be fortune tellers. Nobody knows how all of this will play out. But there's one thing we're pretty sure about: The best way to deal with uncertain change is to embrace it and figure out how to work with it.

Start incorporating AI tools into your daily life and workflow gradually. Learn to deal with their limitations. Find ways to automate tasks that once seemed impossible. Ignore the doomsayers and hype-mongers at both extremes and instead, focus on what you can control. Assess how these advancements can add value to your life and work, and position yourself to benefit from them.

Stream by AlphaSense is an expert transcript library that helps investment analysts maximize returns with access to tens of thousands of high-quality, searchable, proprietary expert transcripts covering multiple perspectives, industries, and markets. Unlike costly and time-consuming traditional expert network calls, Stream drives faster time to insight, improves ROI, and ensures critical information isn’t missed in the research process. You can sign up for a free trial by clicking here.

Note that GPT-3’s operational cost decreased by roughly 10x as its “turbo” model was developed. It’s unclear exactly how OpenAI achieved this, and how much of it will translate to GPT-4. But we are likely to see significant improvements in cost / speed. The improving cost/performance ratio of GPUs will also contribute, albeit more slowly.

the case of ATMs and bank tellers is a great example of how level of automation impacts job numbers. As ATMs grew from 100k units to 400k units between 1995 and 2010, number of tellers in US remained stable at 550k due to a combination of proliferation of branches (cheaper to operate smaller branches + deregulation), and change in role from cash handling to relationship. But, as internet banking took over, number of tellers decreased from 550k in 2010 to 340k today.

![[redacted]'s avatar](https://substackcdn.com/image/fetch/$s_!lWn2!,w_36,h_36,c_fill,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fbucketeer-e05bbc84-baa3-437e-9518-adb32be77984.s3.amazonaws.com%2Fpublic%2Fimages%2F17d07f92-f7cb-4c47-8487-c12ee130769c_3419x3021.jpeg)